Professional Documents

Culture Documents

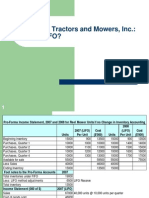

Merrimack Tractors and Mowers, Inc.: Lifo or Fifo ?: Assumptions Preparing Income Statement

Uploaded by

Dinman Gupta0 ratings0% found this document useful (0 votes)

288 views3 pagesOriginal Title

dinman_40013

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

288 views3 pagesMerrimack Tractors and Mowers, Inc.: Lifo or Fifo ?: Assumptions Preparing Income Statement

Uploaded by

Dinman GuptaCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 3

MERRIMACK TRACTORS AND MOWERS, I

CALCULATION OF BALANCE ANS SALESCALCULATION

AS PER LIFO METHOD

OF INVENTORY BALANCE

PARTICULARS

AVAILABLE SALES

UNITS

RATE

AMOUNT

BEGINNING

15000

900 13500000

QUARTER 1

10000

1400 14000000

QUARTER 2

10000

1500 15000000

QUARTER 3

10000

1600 16000000

QUARTER 4

10000

1700 17000000

TOTAL

55000

75500000

CALCULATION OF INVENTORY BALANCE

PARTICULARS

AVAILABLE SALES

UNITS

RATE

AMOUNT

BEGINNING

15000

900 13500000

QUARTER 1

10000

1400 14000000

QUARTER 2

10000

1500 15000000

QUARTER 3

10000

1600 16000000

QUARTER 4

10000

1700 17000000

TOTAL

55000

75500000

INCOME STATEMENT FOR THE YEAR (2008)

ASSUMPTIONS PREPARING INCOM

PARTICULARS

LIFO

FIFO

SALES

73700000

73700000

1 THERE IS A 10% INCREASE IN THE

COGS

62000000

50500000

2 SELLING AND DISTRIBUTION EXPEN

GROSS MARGIN

11700000

23200000

S & D EXPENCES

10000000

10000000

INCOME BEFORE TAX

1700000

13200000 CONCLUSION:- THE COMPANY IS MAKING MORE PRO

LESS -TAX (35%)

595000

4620000

NET INCOME

1105000

8580000

PROFIT MARGIN(%)

1.5

11.64

S AND MOWERS, INC.: LIFO OR FIFO ?

INVENTORY BALANCE ANS SALES AS PER LIFO METHOD (2008)

ISSUE

SALES

BALANCE

UNITS

RATE

AMOUNT

UNITS

RATE

AMOUNT

10000

1700 17000000

10000

1600 16000000

10000

1500 15000000

10000

1400 14000000

15000

900 13500000

40000

62000000

15000

900 13500000

F INVENTORY BALANCE ANS SALES AS PER FIFO METHOD(2008)

SALES

BALANCE

UNITS

RATE

AMOUNT

UNITS

RATE

AMOUNT

15000

900 13500000

10000

1400 14000000

10000

1500 15000000

5000

1600 8000000

5000

1600 8000000

10000

1700 17000000

40000

50500000

15000

3300 25000000

ONS PREPARING INCOME STATEMENT

A 10% INCREASE IN THE SALES PER YEAR

ND DISTRIBUTION EXPENSES REMAINS THE SAME

Y IS MAKING MORE PROFIT USING FIFO METHOD SO IT SHOULD OPT FOR THE FIFO METHOD OF INVENTORY EVALUATION.

NTORY EVALUATION.

You might also like

- Northboro Machine Tools CorporationDocument9 pagesNorthboro Machine Tools Corporationsheersha kkNo ratings yet

- Wilkerson Company Case Numerical Approach SolutionDocument3 pagesWilkerson Company Case Numerical Approach SolutionAbdul Rauf JamroNo ratings yet

- Case Study 2 - ChandpurDocument11 pagesCase Study 2 - Chandpurpriyaa03100% (3)

- C1 - Rosemont MANAC SolutionDocument13 pagesC1 - Rosemont MANAC Solutionkaushal dhapare100% (1)

- Mid-Term Question Paper Set - 1Document17 pagesMid-Term Question Paper Set - 1Archisha Srivastava0% (1)

- WorkingGroup - A1 - Ingersoll Rand (A)Document5 pagesWorkingGroup - A1 - Ingersoll Rand (A)Apoorva SharmaNo ratings yet

- Case Analysis Rosemont Hill Health Center V3 PDFDocument8 pagesCase Analysis Rosemont Hill Health Center V3 PDFPoorvi SinghalNo ratings yet

- Rosemont Health Center Rev01Document7 pagesRosemont Health Center Rev01Amit VishwakarmaNo ratings yet

- The Power of Direct Sales Growth Through Motivation and TrainingDocument8 pagesThe Power of Direct Sales Growth Through Motivation and TrainingSaurabh PalNo ratings yet

- Had On The $158,000 Profit of First Six Months of 2004? AnswerDocument3 pagesHad On The $158,000 Profit of First Six Months of 2004? AnswerRamalu Dinesh ReddyNo ratings yet

- Chapter 5Document30 pagesChapter 5فاطمه حسينNo ratings yet

- Case Study 2: Blanchard Importing and Distributing Co., IncDocument3 pagesCase Study 2: Blanchard Importing and Distributing Co., IncMansi MundhraNo ratings yet

- Davey MukullDocument6 pagesDavey MukullMukul Kumar SinghNo ratings yet

- Autumn 2011 - Midterm Assessment (25089)Document8 pagesAutumn 2011 - Midterm Assessment (25089)Marwa Nabil Shouman0% (1)

- Group 10 - Sec BDocument10 pagesGroup 10 - Sec BAshishKushwahaNo ratings yet

- VNFPPDocument1 pageVNFPPSiddharth100% (1)

- Project Rosemont Hill Health CenterDocument9 pagesProject Rosemont Hill Health CenterSANDEEP AGRAWALNo ratings yet

- SecB Group7 ODD CaseDocument2 pagesSecB Group7 ODD CaseKanuNo ratings yet

- PRICING EXERCISES ANALYSISDocument14 pagesPRICING EXERCISES ANALYSISvineel kumarNo ratings yet

- JHT's SuperMud Four Year System Project Financial AnalysisDocument4 pagesJHT's SuperMud Four Year System Project Financial Analysisanup akasheNo ratings yet

- Ingersoll Rand Case AnalysisDocument7 pagesIngersoll Rand Case AnalysisSrikanth Kumar Konduri0% (2)

- Exhibit 10 (Reliance Baking Soda) : Manufacturer's Price Per CaseDocument2 pagesExhibit 10 (Reliance Baking Soda) : Manufacturer's Price Per Casehope 23No ratings yet

- Problem Set 2Document2 pagesProblem Set 2Rithesh KNo ratings yet

- CVPDocument3 pagesCVPRajShekarReddyNo ratings yet

- 3M: in India For India: Group 02Document5 pages3M: in India For India: Group 02PRATIK RUNGTANo ratings yet

- Case Analysis - Nitish@Solutions Unlimited 1Document5 pagesCase Analysis - Nitish@Solutions Unlimited 1Piyush SahaNo ratings yet

- LIFO vs FIFO Impact on Merrimack TractorsDocument3 pagesLIFO vs FIFO Impact on Merrimack TractorsstudvabzNo ratings yet

- Iim Case StudyDocument12 pagesIim Case StudySANDEEP SINGHNo ratings yet

- Case Problem 3 Textile Mill SchedulingDocument4 pagesCase Problem 3 Textile Mill SchedulingSomething ChicNo ratings yet

- Hospital SupplyDocument3 pagesHospital SupplyJeanne Madrona100% (1)

- Nview SolnDocument6 pagesNview SolnShashikant SagarNo ratings yet

- Q3 Management AccountingDocument2 pagesQ3 Management AccountingSHREYA UNNIKRISHNAN PGP 2019-21 BatchNo ratings yet

- Micorsoft TransformationDocument7 pagesMicorsoft Transformationlena lesley urusaroNo ratings yet

- Boston CreameryDocument11 pagesBoston CreameryJelline Gaza100% (3)

- MM II - Section A - Group #6Document9 pagesMM II - Section A - Group #6Rajat RanjanNo ratings yet

- EX 1 - WilkersonDocument8 pagesEX 1 - WilkersonDror PazNo ratings yet

- Financial Accounting and Reporting: The Game of Financial RatiosDocument8 pagesFinancial Accounting and Reporting: The Game of Financial RatiosANANTHA BHAIRAVI MNo ratings yet

- This Study Resource Was: Forner CarpetDocument4 pagesThis Study Resource Was: Forner CarpetLi CarinaNo ratings yet

- Advanced C1 - Mobonik-CaseDocument7 pagesAdvanced C1 - Mobonik-CaseKshitij chaudharyNo ratings yet

- Solman 12 Second EdDocument23 pagesSolman 12 Second Edferozesheriff50% (2)

- Classic PenDocument15 pagesClassic PenAnkur MittalNo ratings yet

- Case Problem 1 - Product MixDocument7 pagesCase Problem 1 - Product Mixgorgory_30% (1)

- Boston CreameryDocument5 pagesBoston CreameryTheeraphog Phonchuai100% (1)

- Sec-A - Group 8 - SecureNowDocument7 pagesSec-A - Group 8 - SecureNowPuneet GargNo ratings yet

- Catawba Industrial Company-Case QuestionsDocument1 pageCatawba Industrial Company-Case QuestionsSumit Kulkarni0% (3)

- Group - 9 - Sec - B - IQDM - Merton - Truck - CompanyDocument8 pagesGroup - 9 - Sec - B - IQDM - Merton - Truck - CompanyMANVENDRA SINGH PGP 2019-21 BatchNo ratings yet

- Steel Frame FurnitureDocument17 pagesSteel Frame FurnitureDev AnandNo ratings yet

- OTISLINE PresentationDocument5 pagesOTISLINE PresentationAseem SharmaNo ratings yet

- Software Associates Case AnalysisDocument8 pagesSoftware Associates Case AnalysisMuhammad AsifNo ratings yet

- IPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr IssueDocument4 pagesIPO Note: Devyani International Limited's Rs. 1,776-1,838 Cr Issuechinna rao100% (1)

- Case-American Connector CompanyDocument9 pagesCase-American Connector CompanyDIVYAM BHADORIANo ratings yet

- Lesson 5 Income Tax On CorporationDocument20 pagesLesson 5 Income Tax On CorporationReino CabitacNo ratings yet

- Assignment Number 2Document5 pagesAssignment Number 2Caspian PrinceNo ratings yet

- Interim-and-segment-reporting-2Document3 pagesInterim-and-segment-reporting-2JuvilynNo ratings yet

- Merrimack Tractors LIFO or FIFODocument13 pagesMerrimack Tractors LIFO or FIFODevyani SinghNo ratings yet

- Merrimack Tractors and Movers IncDocument2 pagesMerrimack Tractors and Movers IncPranav MehtaNo ratings yet

- تمارين +الحل اداريةDocument14 pagesتمارين +الحل اداريةaec216320136No ratings yet

- Growth in Assets (Rs. in Crores) : Number of SchemesDocument6 pagesGrowth in Assets (Rs. in Crores) : Number of SchemessatyamehtaNo ratings yet

- Management Accounting 12Document4 pagesManagement Accounting 12subba1995333333No ratings yet

- Management Accounting Assignment Question I & IIDocument3 pagesManagement Accounting Assignment Question I & IIAbdul LathifNo ratings yet

- JeevikaDocument4 pagesJeevikaDinman GuptaNo ratings yet

- Your Portable Empire Book ReviewDocument10 pagesYour Portable Empire Book ReviewDinman GuptaNo ratings yet

- Meaning of The Brand From Consumer's PerspectiveDocument18 pagesMeaning of The Brand From Consumer's PerspectiveDinman GuptaNo ratings yet

- Learning Summary (KPL Case)Document6 pagesLearning Summary (KPL Case)Dinman GuptaNo ratings yet

- Meaning of The Brand From Consumer'S Perspective: Group No: 8Document19 pagesMeaning of The Brand From Consumer'S Perspective: Group No: 8Shalini KumariNo ratings yet

- Merrimack Tractors and Mowers, Inc.: Lifo or Fifo?Document5 pagesMerrimack Tractors and Mowers, Inc.: Lifo or Fifo?Dinman GuptaNo ratings yet

- MM 2Document9 pagesMM 2Dinman GuptaNo ratings yet

- Chak deDocument9 pagesChak deDinman GuptaNo ratings yet