Professional Documents

Culture Documents

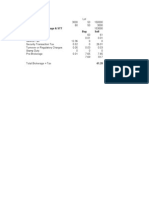

Net of Current: Service Tax: STT: Stamp Charges: Turn Over Charges: DP Charges: Edu Cess: Hedu Cess: Net Amount Due To Us

Uploaded by

akhilbittu0071Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Net of Current: Service Tax: STT: Stamp Charges: Turn Over Charges: DP Charges: Edu Cess: Hedu Cess: Net Amount Due To Us

Uploaded by

akhilbittu0071Copyright:

Available Formats

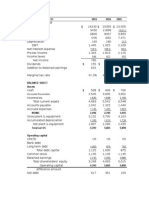

Net of Current : Service Tax: STT : Stamp Charges: Turn Over Charges: DP Charges: Edu Cess: HEdu Cess:

Net Amount Due to us:

2385.1 0.66 0.02767 3.56 0.14926 0.32 0.22 0 0.01 0.01 2389.88

3785.47 3.74 0.098799 12.28 4.731838 1.4 1.6 6.47 0.07 0.0748 0.04 0.0374 -3759.87

Delivery Buy 10.3 0.125 0.01 0.0035

The Transaction Charges are :NATURE OF TRANSACTION - RATE OF STT (Charged on Traded Value) Delivery based transaction in equity - Buyer and seller each to pay 0.125% Non-delivery based transaction in equity - Seller to pay 0.025% Stamp Duty 0.010% for delivery based trades and 0.002% for intra-day trades. Service Tax 10.30% on Brokerage + Transaction Charges ( 10% Service Tax + Education Cess 2% of Service Tax Turnover Tax 0.0035% of traded value ( cash segment )

Delivery Sell 10.3 0.125 0.01 0.0035

Intrday Buy Sell 10.3 10.3 0.025 0.002 0.002 0.0035 0.0035

Base Brokerage Value Value Traded Value

ax + Education Cess 2% of Service Tax + Higher Education Cess 1% of Service Tax )

Derivatives ( Futures ) - Seller to pay 0.017% Derivatives ( Options ) - 0.017% only on sell side if Squared off. (on premium) 0.125% to be paid by purchaser if Exercised. (on settlement value) Stamp Duty - Derivatives (F&O) : 0.002% for Futures on actual price and 0.002% for options on premium. Turnover tax and 0.0023% for Futures on actual rate and 0.0513% on premium.

% for options on premium.

You might also like

- Brokerage Calculator For Zerodha, RK, EDEL WEISS-2007 FormatDocument9 pagesBrokerage Calculator For Zerodha, RK, EDEL WEISS-2007 FormatwritetoevvNo ratings yet

- Multi Tech Case AnalysisDocument4 pagesMulti Tech Case AnalysissimplymesmNo ratings yet

- PlanDocument4 pagesPlanrajritesNo ratings yet

- Tariff Sheet (Trading) : Fixed Brokerage PlanDocument5 pagesTariff Sheet (Trading) : Fixed Brokerage Planakhilsahu2004No ratings yet

- Brokerage in CashDocument7 pagesBrokerage in Cashrajp2099No ratings yet

- Stock Option Trading Calculations Including Brokerage and Taxes ForDocument6 pagesStock Option Trading Calculations Including Brokerage and Taxes Formerc2No ratings yet

- Stock Options CalculationsDocument6 pagesStock Options CalculationsamyeoleNo ratings yet

- Adam Sugar LTD Financial AnalysisDocument20 pagesAdam Sugar LTD Financial AnalysiswamiqrasheedNo ratings yet

- Brokerage CalculatorDocument9 pagesBrokerage CalculatorMrugen ShahNo ratings yet

- Square Pharma Valuation ExcelDocument43 pagesSquare Pharma Valuation ExcelFaraz SjNo ratings yet

- Brokerage CalculatorDocument12 pagesBrokerage Calculatorirap1981No ratings yet

- CVMA PracticeDocument14 pagesCVMA PracticeRandhir ShahNo ratings yet

- Mobikwik Cash Out To Bank A/c - 96% Paytm Cash Out To Bank A/c 4%Document13 pagesMobikwik Cash Out To Bank A/c - 96% Paytm Cash Out To Bank A/c 4%Satya PrakashNo ratings yet

- Tms Buy RatesDocument1 pageTms Buy Ratesapi-257017808No ratings yet

- Financial RatiosDocument1 pageFinancial RatiosAbhishek RampalNo ratings yet

- Goods & Service Tax CompleteDocument76 pagesGoods & Service Tax CompleteAyesha khanNo ratings yet

- There Is No Such Thing As 'SST'Document1 pageThere Is No Such Thing As 'SST'hfdghdhNo ratings yet

- Assets Non Current AssetsDocument15 pagesAssets Non Current AssetsBushraKhanNo ratings yet

- Maple Leaf Cement: Horizontal Analysis: Balance SheetDocument9 pagesMaple Leaf Cement: Horizontal Analysis: Balance SheetkilleroffNo ratings yet

- Ratio AnalysisDocument13 pagesRatio AnalysisGaurav PoddarNo ratings yet

- VATDocument11 pagesVATSaurav KumarNo ratings yet

- ZAAD Charging ProposalDocument28 pagesZAAD Charging ProposalHoyaalay67% (3)

- Introduction To TheDocument11 pagesIntroduction To The9211420420No ratings yet

- VAT Guide 2023Document46 pagesVAT Guide 2023ELIJAHNo ratings yet

- GST GuidelinesDocument61 pagesGST GuidelinesSandip JadavNo ratings yet

- Brokerage CalculatorDocument20 pagesBrokerage Calculatorpvr09No ratings yet

- NaseerDocument1 pageNaseernaseer_sattiNo ratings yet

- Fiscal Year Is January-December. All Values USD Millions.: AssetsDocument29 pagesFiscal Year Is January-December. All Values USD Millions.: AssetsHubert Luis Madariaga ManyaNo ratings yet

- 8100 (Birla Corporation)Document61 pages8100 (Birla Corporation)Viz PrezNo ratings yet

- VAT GuideZRADocument56 pagesVAT GuideZRADaniel Glen-WilliamsonNo ratings yet

- Income Statement 2002 2003 2004 2005: ForecastDocument3 pagesIncome Statement 2002 2003 2004 2005: Forecastmehar noorNo ratings yet

- Financial Reporting & Analysis Mock Test For Mid Term ExaminationDocument6 pagesFinancial Reporting & Analysis Mock Test For Mid Term ExaminationTanuj AroraNo ratings yet

- ChargesDocument1 pageChargessbpathiNo ratings yet

- TaxInvoice PDFDocument1 pageTaxInvoice PDFponiteNo ratings yet

- GST Impact On The Supply ChainDocument8 pagesGST Impact On The Supply ChainAamiTataiNo ratings yet

- 3757 155121Document130 pages3757 155121Mahesh Nadarajan100% (1)

- Adjusted Present ValueDocument14 pagesAdjusted Present ValueGoGoJoJo100% (1)

- GST RoadmapDocument14 pagesGST Roadmapsiddhumesh1No ratings yet

- Role of Digital Signature Certificate in GSTDocument13 pagesRole of Digital Signature Certificate in GSTreginlu tayangNo ratings yet

- AssignmentDocument4 pagesAssignmentshanushashaNo ratings yet

- Reliance OptoinDocument3 pagesReliance OptoinSanthosh KumarNo ratings yet

- Pert 2Document4 pagesPert 2Natya NindyagitayaNo ratings yet

- VAT Guide 2021Document56 pagesVAT Guide 2021C ChamaNo ratings yet

- GST Guidelines Infodrive IndiaDocument64 pagesGST Guidelines Infodrive IndiaVipul VipulNo ratings yet

- Value Added TaxDocument26 pagesValue Added TaxMohit KumarNo ratings yet

- Electricity Consumption Bill For LT Consumers Only: 06-06-2015 DHMP3837078854 Success 143.00Document1 pageElectricity Consumption Bill For LT Consumers Only: 06-06-2015 DHMP3837078854 Success 143.00kohinoor_roy5447No ratings yet

- Financial Status Sesa Goa 2011-12Document13 pagesFinancial Status Sesa Goa 2011-12Roshankumar S PimpalkarNo ratings yet

- Tirecity ClassworkDocument6 pagesTirecity ClassworkAkshay MehtaNo ratings yet

- Vat 1Document77 pagesVat 1Shajid HassanNo ratings yet

- Descriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsDocument15 pagesDescriptio N Amount (Rs. Million) : Type Period Ending No. of MonthsVALLIAPPAN.PNo ratings yet

- July 2013: Current, Call and Savings AccountsDocument1 pageJuly 2013: Current, Call and Savings AccountsBala MNo ratings yet

- Rose Ltd.'s Income Tax Computation - Year of Assessment 2013Document2 pagesRose Ltd.'s Income Tax Computation - Year of Assessment 2013rachna357No ratings yet

- Vat Vs GST FinalDocument35 pagesVat Vs GST FinalJatin GoyalNo ratings yet

- 7179226899VAT Deduction at Sources 2015-2016Document16 pages7179226899VAT Deduction at Sources 2015-2016Saiful IslamNo ratings yet

- Business EnvironmentDocument12 pagesBusiness EnvironmentArpit JainNo ratings yet

- Goods and Services Tax " Future in India": by - Joe Suhas Thambi Rahul Aurade MET Institute of Management, NasikDocument33 pagesGoods and Services Tax " Future in India": by - Joe Suhas Thambi Rahul Aurade MET Institute of Management, NasikJOEMEETSMONUNo ratings yet

- Calculation of Weight of Equity and Debt: 2012Document13 pagesCalculation of Weight of Equity and Debt: 2012একজন নিশাচরNo ratings yet

- Scrip Symbol Company Name Quantity Avg Buy Price TotalDocument16 pagesScrip Symbol Company Name Quantity Avg Buy Price TotalanimekingdbsNo ratings yet