Professional Documents

Culture Documents

CH 11

Uploaded by

Anissa RahmawatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CH 11

Uploaded by

Anissa RahmawatiCopyright:

Available Formats

1

Chapter 11

APPLIED COMPETITIVE

ANALYSIS

Copyright 2005 by South-Western, a division of Thomson Learning. All rights reserved.

2

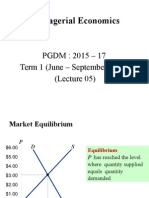

Economic Efficiency and

Welfare Analysis

The area between the demand and the

supply curve represents the sum of

consumer and producer surplus

measures the total additional value

obtained by market participants by being

able to make market transactions

This area is maximized at the

competitive market equilibrium

3

Economic Efficiency and

Welfare Analysis

Quantity

Price

P

*

Q

*

S

D

Consumer surplus is the

area above price and below

demand

Producer surplus is the

area below price and

above supply

4

At output Q

1

, total surplus

will be smaller

Economic Efficiency and

Welfare Analysis

Quantity

Price

P

*

Q

*

S

D

Q

1

At outputs between Q

1

and

Q*, demanders would value

an additional unit more than

it would cost suppliers to

produce

5

Economic Efficiency and

Welfare Analysis

Mathematically, we wish to maximize

consumer surplus + producer surplus =

} }

= +

Q Q

dQ Q P Q U dQ Q P PQ PQ Q U

0 0

) ( ) ( ] ) ( [ ] ) ( [

In long-run equilibria along the long-run

supply curve, P(Q) = AC = MC

6

Economic Efficiency and

Welfare Analysis

Maximizing total surplus with respect to

Q yields

U(Q) = P(Q) = AC = MC

maximization occurs where the marginal

value of Q to the representative consumer

is equal to market price

the market equilibrium

7

Welfare Loss Computations

Use of consumer and producer surplus

notions makes possible the explicit

calculation of welfare losses caused by

restrictions on voluntary transactions

in the case of linear demand and supply

curves, the calculation is simple because

the areas of loss are often triangular

8

Welfare Loss Computations

Suppose that the demand is given by

Q

D

= 10 - P

and supply is given by

Q

S

= P - 2

Market equilibrium occurs where P* = 6

and Q* = 4

9

Welfare Loss Computations

Restriction of output to Q

0

= 3 would

create a gap between what demanders

are willing to pay (P

D

) and what

suppliers require (P

S

)

P

D

= 10 - 3 = 7

P

S

= 2 + 3 = 5

10

The welfare loss from restricting output

to 3 is the area of a triangle

Welfare Loss Computations

Quantity

Price

S

D

6

4

7

5

3

The loss = (0.5)(2)(1) = 1

11

Welfare Loss Computations

The welfare loss will be shared by

producers and consumers

In general, it will depend on the price

elasticity of demand and the price

elasticity of supply to determine who

bears the larger portion of the loss

the side of the market with the smallest

price elasticity (in absolute value)

12

Price Controls and Shortages

Sometimes governments may seek to

control prices at below equilibrium

levels

this will lead to a shortage

We can look at the changes in producer

and consumer surplus from this policy

to analyze its impact on welfare

13

Price Controls and Shortages

Quantity

Price

SS

D

LS

P

1

Q

1

Initially, the market is

in long-run equilibrium

at P

1

, Q

1

Demand increases to D

D

14

Price Controls and Shortages

Quantity

Price

SS

D

LS

P

1

Q

1

D

Firms would begin to

enter the industry

In the short run, price

rises to P

2

P

2

The price would end

up at P

3

P

3

15

Price Controls and Shortages

Quantity

Price

SS

D

LS

P

1

Q

1

D

P

3

There will be a

shortage equal to

Q

2

- Q

1

Q

2

Suppose that the

government imposes

a price ceiling at P

1

16

This gain in consumer

surplus is the shaded

rectangle

Price Controls and Shortages

Quantity

Price

SS

D

LS

P

1

Q

1

D

P

3

Q

2

Some buyers will gain

because they can

purchase the good for

a lower price

17

The shaded rectangle

therefore represents a

pure transfer from

producers to consumers

Price Controls and Shortages

Quantity

Price

D

P

1

Q

1

D

SS

LS

P

3

Q

2

The gain to consumers

is also a loss to

producers who now

receive a lower price

No welfare loss there

18

This shaded triangle

represents the value

of additional

consumer surplus

that would have

been attained

without the price

control

Price Controls and Shortages

Quantity

Price

SS

D

LS

P

1

Q

1

D

P

3

Q

2

19

This shaded triangle

represents the value

of additional

producer surplus

that would have

been attained

without the price

control

Price Controls and Shortages

Quantity

Price

SS

D

LS

P

1

Q

1

D

P

3

Q

2

20

This shaded area

represents the total

value of mutually

beneficial transactions

that are prevented by

the government

Price Controls and Shortages

Quantity

Price

SS

D

LS

P

1

Q

1

D

P

3

Q

2

This is a measure of

the pure welfare

costs of this policy

21

Disequilibrium Behavior

Assuming that observed market

outcomes are generated by

Q(P

1

) = min [Q

D

(P

1

),Q

S

(P

1

)],

suppliers will be content with the

outcome but demanders will not

This could lead to a black market

22

Tax Incidence

To discuss the effects of a per-unit tax

(t), we need to make a distinction

between the price paid by buyers (P

D

)

and the price received by sellers (P

S

)

P

D

- P

S

= t

In terms of small price changes, we

wish to examine

dP

D

- dP

S

= dt

23

Tax Incidence

Maintenance of equilibrium in the

market requires

dQ

D

= dQ

S

or

D

P

dP

D

= S

P

dP

S

Substituting, we get

D

P

dP

D

= S

P

dP

S

= S

P

(dP

D

- dt)

24

Tax Incidence

We can now solve for the effect of the

tax on P

D

:

D S

S

P P

P D

e e

e

D S

S

dt

dP

=

Similarly,

D S

D

P P

P S

e e

e

D S

D

dt

dP

=

25

Tax Incidence

Because e

D

s 0 and e

S

> 0, dP

D

/dt > 0

and dP

S

/dt s 0

If demand is perfectly inelastic (e

D

= 0),

the per-unit tax is completely paid by

demanders

If demand is perfectly elastic (e

D

= ), the

per-unit tax is completely paid by

suppliers

26

Tax Incidence

In general, the actor with the less elastic

responses (in absolute value) will

experience most of the price change

caused by the tax

S

D

D

S

e

e

dt dP

dt dP

=

/

/

27

Tax Incidence

Quantity

Price

S

D

P*

Q*

P

D

P

S

A per-unit tax creates a

wedge between the price

that buyers pay (P

D

) and

the price that sellers

receive (P

S

)

t

Q**

28

Buyers incur a welfare loss

equal to the shaded area

Tax Incidence

Quantity

Price

S

D

P*

Q*

P

D

P

S

Q**

But some of this loss goes

to the government in the

form of tax revenue

29

Sellers also incur a welfare

loss equal to the shaded area

Tax Incidence

Quantity

Price

S

D

P*

Q*

P

D

P

S

Q**

But some of this loss goes

to the government in the

form of tax revenue

30

Therefore, this is the dead-

weight loss from the tax

Tax Incidence

Quantity

Price

S

D

P*

Q*

P

D

P

S

Q**

31

Deadweight Loss and

Elasticity

All nonlump-sum taxes involve

deadweight losses

the size of the losses will depend on the

elasticities of supply and demand

A linear approximation to the deadweight

loss accompanying a small tax, dt, is

given by

DW = -0.5(dt)(dQ)

32

Deadweight Loss and

Elasticity

From the definition of elasticity, we know

that

dQ = e

D

dP

D

Q

0

/P

0

This implies that

dQ = e

D

[e

S

/(e

S

-

e

D

)]

dt

Q

0

/P

0

Substituting, we get

0 0

2

0

5 0 Q P e e e e

P

dt

DW

D S S D

)] /( [ .

|

|

.

|

\

|

=

33

Deadweight Loss and

Elasticity

Deadweight losses are zero if either e

D

or e

S

are zero

the tax does not alter the quantity of the

good that is traded

Deadweight losses are smaller in

situations where e

D

or e

S

are small

34

Transactions Costs

Transactions costs can also create a

wedge between the price the buyer pays

and the price the seller receives

real estate agent fees

broker fees for the sale of stocks

If the transactions costs are on a per-unit

basis, these costs will be shared by the

buyer and seller

depends on the specific elasticities involved

35

Gains from International Trade

Quantity

Price

S

D

Q*

P*

In the absence of

international trade,

the domestic

equilibrium price

would be P* and

the domestic

equilibrium quantity

would be Q*

36

Gains from International Trade

Quantity

Price

Q*

P*

S

D

Quantity demanded will

rise to Q

1

and quantity

supplied will fall to Q

2

Q

1

Q

2

If the world price (P

W

)

is less than the domestic

price, the price will fall

to P

W

P

W

Imports = Q

1

- Q

2

imports

37

Consumer surplus rises

Producer surplus falls

There is an unambiguous

welfare gain

Gains from International Trade

Quantity

Price

Q*

P*

S

D

Q

2

Q

1

P

W

38

Effects of a Tariff

Quantity

Price

S

D

Q

1

Q

2

P

W

Quantity demanded falls

to Q

3

and quantity supplied

rises to Q

4

Q

4

Q

3

Suppose that the government

creates a tariff that raises

the price to P

R

P

R

Imports are now Q

3

-

Q

4

imports

39

Consumer surplus falls

Producer surplus rises

These two triangles

represent deadweight loss

The government gets

tariff revenue

Effects of a Tariff

Quantity

Price

S

D

Q

1

Q

2

P

W

Q

4

Q

3

P

R

40

Quantitative Estimates of

Deadweight Losses

Estimates of the sizes of the welfare

loss triangle can be calculated

Because P

R

= (1+t)P

W

, the proportional

change in quantity demanded is

D D

W

W R

te e

P

P P

Q

Q Q

=

1

1 3

41

The areas of these two

triangles are

Quantitative Estimates of

Deadweight Losses

Quantity

Price

S

D

Q

1

Q

2

P

W

Q

4

Q

3

P

R

) )( ( .

3 1 1

5 0 Q Q P P DW

W R

=

1

2

1

5 0 Q P e t DW

W D

. =

) )( ( .

2 4 2

5 0 Q Q P P DW

W R

=

2

2

2

5 0 Q P e t DW

W S

. =

42

Other Trade Restrictions

A quota that limits imports to Q

3

-

Q

4

would have effects that are similar to

those for the tariff

same decline in consumer surplus

same increase in producer surplus

One big difference is that the quota

does not give the government any tariff

revenue

the deadweight loss will be larger

43

Trade and Tariffs

If the market demand curve is

Q

D

= 200P

-1.2

and the market supply curve is

Q

S

= 1.3P,

the domestic long-run equilibrium will

occur where P* = 9.87 and Q* = 12.8

44

Trade and Tariffs

If the world price was P

W

= 9, Q

D

would

be 14.3 and Q

S

would be 11.7

imports will be 2.6

If the government placed a tariff of 0.5

on each unit sold, the world price will be

P

W

= 9.5

imports will fall to 1.0

45

Trade and Tariffs

The welfare effect of the tariff can be

calculated

DW

1

= 0.5(0.5)(14.3 - 13.4) = 0.225

DW

2

= 0.5(0.5)(12.4 - 11.7) = 0.175

Thus, total deadweight loss from the

tariff is 0.225 + 0.175 = 0.4

46

Important Points to Note:

The concepts of consumer and producer

surplus provide useful ways of analyzing

the effects of economic changes on the

welfare of market participants

changes in consumer surplus represent

changes in the overall utility consumers

receive from consuming a particular good

changes in long-run producer surplus

represent changes in the returns product

inputs receive

47

Important Points to Note:

Price controls involve both transfers

between producers and consumers and

losses of transactions that could benefit

both consumers and producers

48

Important Points to Note:

Tax incidence analysis concerns the

determination of which economic actor

ultimately bears the burden of a tax

this incidence will fall mainly on the actors

who exhibit inelastic responses to price

changes

taxes also involve deadweight losses that

constitute an excess burden in addition to

the burden imposed by the actual tax

revenues collected

49

Important Points to Note:

Transaction costs can sometimes be

modeled as taxes

both taxes and transaction costs may affect

the attributes of transactions depending on

the basis on which the costs are incurred

50

Important Points to Note:

Trade restrictions such as tariffs or

quotas create transfers between

consumers and producers and

deadweight losses of economic welfare

the effects of many types of trade

restrictions can be modeled as being

equivalent to a per-unit tariff

You might also like

- Consumer Choice, Demand Curves, and ElasticityDocument2 pagesConsumer Choice, Demand Curves, and ElasticityhanifakihNo ratings yet

- AP Microecon GraphsDocument12 pagesAP Microecon GraphsQizhen Su100% (1)

- Microeconomics Graphs GuideDocument12 pagesMicroeconomics Graphs GuideSayed Tehmeed AbbasNo ratings yet

- Producer and Consumer SurplusDocument28 pagesProducer and Consumer SurplusSyedNo ratings yet

- Market Equilibrium and Consumer Producer SurplusDocument20 pagesMarket Equilibrium and Consumer Producer SurplussachinremaNo ratings yet

- Scarcity, Choices and Economic AnalysisDocument4 pagesScarcity, Choices and Economic AnalysisAndrew Halpern100% (1)

- The Instruments of Trade PolicyDocument43 pagesThe Instruments of Trade PolicyHarika HarikaNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Distortionary Taxes and Subsidies: Solutions For Microeconomics: An IntuitiveDocument25 pagesDistortionary Taxes and Subsidies: Solutions For Microeconomics: An IntuitiveKarolina KaczmarekNo ratings yet

- Policy The Perfectly Competitive Model: Consumer Producer SurplusDocument88 pagesPolicy The Perfectly Competitive Model: Consumer Producer SurplusPraveen SharmaNo ratings yet

- Policy & The PerfectlyDocument48 pagesPolicy & The PerfectlyRajan RanjanNo ratings yet

- CH 14Document77 pagesCH 14hartinahNo ratings yet

- Demand, Supply, and Market Equilibrium Concepts ExplainedDocument35 pagesDemand, Supply, and Market Equilibrium Concepts ExplainedRobert AxelssonNo ratings yet

- Analysis of Competitive MarketsDocument84 pagesAnalysis of Competitive Marketsmamogobomighty1231No ratings yet

- CH 17Document67 pagesCH 17Costi CalapodNo ratings yet

- PGP-Micro (Session-9 & 10)Document41 pagesPGP-Micro (Session-9 & 10)Akash DeepNo ratings yet

- Milo FileDocument29 pagesMilo Filesiewpeiting0% (1)

- Section 2 Section 2 Intervention in Markets Intervention in MarketsDocument18 pagesSection 2 Section 2 Intervention in Markets Intervention in MarketssittmoNo ratings yet

- Supply and Demand Together: - Three Steps To Analyzing Changes in EquilibriumDocument10 pagesSupply and Demand Together: - Three Steps To Analyzing Changes in Equilibriumlinh leNo ratings yet

- Economics: Submitted To: Ma'Am Samina Submitted By: FiashaDocument6 pagesEconomics: Submitted To: Ma'Am Samina Submitted By: FiashaNajeeba Medical2No ratings yet

- Lecture 5 - Market Equlibrium and Concept of Elasticity of Demand and Its ApplicationDocument80 pagesLecture 5 - Market Equlibrium and Concept of Elasticity of Demand and Its ApplicationnivecNo ratings yet

- Capital: Microeconomic TheoryDocument67 pagesCapital: Microeconomic TheoryJennifer Gabrielle IrawanNo ratings yet

- Business 62Document4 pagesBusiness 62Ansherina SilvestreNo ratings yet

- Government Intervention: Evaluating the Gains and Losses from Price Controls, Supports and SubsidiesDocument42 pagesGovernment Intervention: Evaluating the Gains and Losses from Price Controls, Supports and SubsidiesAnyone SomeoneNo ratings yet

- Async GovtinterventionDocument42 pagesAsync Govtinterventionzipzab26No ratings yet

- Analyzing Gains and Losses from Government Policies Using Consumer and Producer SurplusDocument29 pagesAnalyzing Gains and Losses from Government Policies Using Consumer and Producer SurplusCristina Cascón MartínNo ratings yet

- Price Elasticity and Demand EstimationDocument35 pagesPrice Elasticity and Demand Estimationlucien_luNo ratings yet

- 12 Key Diagrams For As EconomicsDocument13 pages12 Key Diagrams For As EconomicsAmaan RashidNo ratings yet

- BIE201 Handout05Document14 pagesBIE201 Handout05andersonmapfirakupaNo ratings yet

- Summary F 13 PRTDocument56 pagesSummary F 13 PRTюрий локтионовNo ratings yet

- UQ Lecture 6 Introductory Microeconomics Econ1010Document41 pagesUQ Lecture 6 Introductory Microeconomics Econ1010ThomasNo ratings yet

- Managerial Economics CompleteDocument18 pagesManagerial Economics CompleteAmlan BhowmikNo ratings yet

- Understanding Marginal Rate of Substitution and Total RevenueDocument6 pagesUnderstanding Marginal Rate of Substitution and Total RevenueashishNo ratings yet

- Competitive Markets and Market EquilibriumDocument33 pagesCompetitive Markets and Market EquilibriumRajeev SinghNo ratings yet

- Supply meets demand: Market equilibrium and welfare effectsDocument24 pagesSupply meets demand: Market equilibrium and welfare effectsbobdownloadsNo ratings yet

- Managerial Economics 2.: Demand, Supply and Market EquilibriumDocument36 pagesManagerial Economics 2.: Demand, Supply and Market EquilibriumhenNo ratings yet

- Econ 24 CH1 To CH3Document18 pagesEcon 24 CH1 To CH3Muyano, Mira Joy M.No ratings yet

- Pasar Persaingan SempurnaDocument38 pagesPasar Persaingan SempurnaCandri Rahma MaharaniNo ratings yet

- Ch4 Part2 HandoutsDocument9 pagesCh4 Part2 HandoutsFernando FlorinioNo ratings yet

- Cba 1104 - Theory of Price DeterminationDocument46 pagesCba 1104 - Theory of Price DeterminationPhainos Simon GwariNo ratings yet

- tariffs (2)Document4 pagestariffs (2)ahmedgalalabdalbaath2003No ratings yet

- Effects of Tariffs on Trade PolicyDocument55 pagesEffects of Tariffs on Trade PolicyMadalina RaceaNo ratings yet

- Welfare EconomicsDocument37 pagesWelfare EconomicsRohan SolomonNo ratings yet

- Ch02 PindyckDocument71 pagesCh02 Pindyckpjs_canNo ratings yet

- Govt InterventionsDocument14 pagesGovt InterventionsHARSHALI KATKARNo ratings yet

- Chapter 2Document10 pagesChapter 2罗JackyNo ratings yet

- The Impact of Supply and Demand Factors on the Equilibrium Price and Quantity of Hot ChocolateDocument98 pagesThe Impact of Supply and Demand Factors on the Equilibrium Price and Quantity of Hot ChocolateKiran DatarNo ratings yet

- Ch05.Competition & MonopolyDocument61 pagesCh05.Competition & MonopolyLâm ĐoànNo ratings yet

- Law Of Demand Explained: Factors Affecting Demand And Types Of Demand CurvesDocument19 pagesLaw Of Demand Explained: Factors Affecting Demand And Types Of Demand CurvesanilpritiNo ratings yet

- Competitive Equilibrium and Economic Efficiency: Dr. Gong JieDocument48 pagesCompetitive Equilibrium and Economic Efficiency: Dr. Gong Jiejoeltan111No ratings yet

- Review of Econ 203Document73 pagesReview of Econ 203api-235832666No ratings yet

- Cal86 Definite Integrals Applications To EconomicsDocument6 pagesCal86 Definite Integrals Applications To Economicsmarchelo_chelo100% (1)

- Definitions A-Z in Earm1Document7 pagesDefinitions A-Z in Earm1Mehul KhareNo ratings yet

- Chopra4 PPT ch06Document37 pagesChopra4 PPT ch06Tia MejiaNo ratings yet

- Chapter 4: Negative Externalities and Policy SolutionsDocument36 pagesChapter 4: Negative Externalities and Policy SolutionsSurya SrinivasanNo ratings yet

- Economics 102 Lecture 8 Ways To Measure Utility RevDocument40 pagesEconomics 102 Lecture 8 Ways To Measure Utility RevNoirAddictNo ratings yet

- Chapter 3 - The Analysis of Competitive MarketsDocument14 pagesChapter 3 - The Analysis of Competitive MarketsJiedan HuangNo ratings yet

- Micro Eco 2Document31 pagesMicro Eco 2AMBWANI NAREN MAHESHNo ratings yet