Professional Documents

Culture Documents

Daily Morning Update 21 Oct 2011

Daily Morning Update 21 Oct 2011

Uploaded by

Mitesh ThackerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Morning Update 21 Oct 2011

Daily Morning Update 21 Oct 2011

Uploaded by

Mitesh ThackerCopyright:

Available Formats

DAILY TRADING HIGHLIGHTS & OUTLOOK

21 Oct, 11

S&P CNX NIFTY

OPEN HIGH 5086 5099

LOW CLOSE

5034 5092

Change(pts) Change (%)

(-47) (-0.92)

Advanc/Decline Total Turnover (` in cr.)

2:3 4582

MARKET OUTLOOK The Nifty opened the session on a bearish note on the back of negative cues from its global peers and then traded in a narrow range for most part of the day. The nifty recorded a low of 5034, before staging a comeback to move up to a high of 5099. The nifty eventually closed the day at 5092 with a loss of 47 points. The index has been trading in a range of 5000-5170 in the last few sessions. As long as index remains in this range, we are likely to witness a volatile and choppy trading sessions. On the upside the index has immediate resistance at 5170 (recent swing top) above which it is likely to test the level of 5230 (Negative Gap resistance (level). In case the nifty fails to get past 5170, it would keep facing supply pressure and could re test the support of 5060/5020 levels. Sustenance above the 5230 level could see the index filling up its negative gap and the index could head towards the level of 5270 / 5330 in a short span of time.

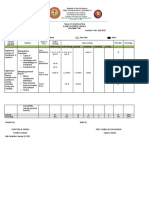

Key Levels & Averages

INDEX NIFTY BANK NIFTY Close Support-1 Support-2 Resistance-1 Resistance-2 8 DMA 34 DMA 200 DMA

5092 9746

5060 9619

5020 9490

5170 9865

5200 9972

5067 9609

5032 9584

5431 10629

DAILY TRADING HIGHLIGHTS & OUTLOOK

21 Oct, 11

TRADING RECOMMENDATIONS

State Bank of India CMP - ` 1933.90 Technical Outlook & Trading Strategy:The share price of SBI has seen a sharp fall from the highs of `2529.7 on 26th July 2011 to the lows of `1710 Levels. The stock has since then pulled back and has managed to close above its cluster of moving averages. The momentum indicator on the daily chart is also in a bullish zone suggesting more upside in the stock. We recommend traders to buy in the range of `1930`41938 levels with a stop loss placed below `1878.8 levels for targets of `1994 / `2036levels.

Reliance Industries Limited CMP` 840.40 Technical Outlook & Trading Strategy:The price of Reliance Ind has remained under selling pressure for last few weeks. But, the key observation to be made is that the price of Reliance Ind appears to be forming an inverted head and shoulder pattern on its daily charts. The inverted head and shoulder price pattern is a bullish price pattern and has positive implications on the future price movements of a stock. The price of Reliance Ind is also trading above its key moving averages and the momentum indicators are firmly placed in buy mode. We recommend traders to buy in the range of `838 `841 levels with a stop loss placed below `820.8 levels for targets of `864 `880 levels, expected to be achieved in coming few Sessions.

Disclaimer

The views expressed are based purely on Technical studies. The calls made herein are for information purpose only. The information and views presented here are prepared by Matrix Solutions and his associates. The information contained herein is based on their analysis of the Charts and up on sources that are considered reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended on this Website may not be suitable for all investors. Past performance may not be indicative of future performance. Some of the securities/commodities presented herein should be considered speculative with a high degree of volatility and risk. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. You specifically agree to consult with a registered investment advisor, which we are not, prior to making any trading decision of any kind. While acting upon any information or analysis mentioned on this website, investors may please note that neither Matrix Solutions nor any person connected with him accepts any liability arising from the use of this information and views mentioned herein. Matrix Solutions and his affiliates may hold long or short positions in the securities/commodities discussed herein from time to time the services are intended for a restricted audience and we are not soliciting any action based on it. Neither the information nor any opinion expressed herein constitutes an offer or an invitation to make an offer, to buy or sell any securities/commodities, or any options, futures or other derivatives related to such securities/commodities. Part of this website may contain advertising and other material submitted to us by third parties. We do not accept liability in respect of any advertisements. You acknowledge that any warranty that is provided in connection with any of the products or services advertised on this website described herein is provided solely by the owner, advertiser, manufacturer or supplier of that product and/or service, and not by us. We do not warrant that your access to the Website and/or related services will be uninterrupted or error-free, that defects will be corrected, or that this site or the server that makes it available is free of viruses or other harmful components. Subscribers are advised to understand that the services can fail due to failure of hardware, software, and Internet connection. Access to and use of this site and the information is at your risk and we do not undertake any accountability for any irregularities, viruses or damage to any computer or Mobiles that results from accessing, availing or downloading of any information from this site. We do not warrant or make any representations regarding the use or the results of the use of any product and/or service purchased in terms of its compatibility, correctness, accuracy, reliability or otherwise. You assume total responsibility and risk for your use of this site and site-related services. A possibility exists that the site could include inaccuracies or errors. Additionally, a possibility exists that unauthorized additions, deletions or alterations could be made by third parties to the site. Although we attempt to ensure the integrity, correctness and authenticity of the site, it makes no guarantees whatsoever as to its completeness, correctness or accuracy. In the event that such an inaccuracy arises, please inform our staff so that it can be corrected. Price and availability of products and services offered on the site are subject to change without prior notice. To the extent we provide information on the availability of products or services you should not rely on such information. We will not be liable for any lack of availability of products and services you may order through the site. Transactions shall be governed by and construed in accordance with the laws of India, without regard to the laws regarding conflicts of law. Any litigation or any action at law or in equity arising out of or relating to these agreement or transaction shall be subject to Mumbai jurisdiction only and the customer hereby agrees consents and submits to the jurisdiction of such courts for the purpose of litigating any such action. A CALL ON SMS is a service given only to members with the sole intention to aid their information means. We do not guarantee any accuracy of generation, databases, delivery timings etc. while giving this facility. Depending on your location, service provider, medium of communication and delivery, the service may be at times slow or not there at all. We do not guarantee completion of delivery. We shall in no way be responsible for delays in receiving SMS on the mobile caused due to delivery methods chosen by the Service Provider, rush on the Service Providers Servers or any other reason whatsoever that may cause such a delay. Use of this website and its services constitutes acceptance of Disclaimer, Privacy Policy and Terms of Use.

You might also like

- Jean Keating Prison TreatiseDocument34 pagesJean Keating Prison TreatiseSharif 912100% (6)

- Zanzibar Investment ReportDocument87 pagesZanzibar Investment Reportmomo177sasa100% (2)

- Doug Casey CRSurvivingCrisisHandbook PDFDocument149 pagesDoug Casey CRSurvivingCrisisHandbook PDFJuan Manuel AlmarazNo ratings yet

- DR Complete Guide To Money PDFDocument366 pagesDR Complete Guide To Money PDFRobert LindseyNo ratings yet

- Airports UBSDocument89 pagesAirports UBSWeileWUNo ratings yet

- Free Ebook IncognitoDocument53 pagesFree Ebook IncognitoAnderson Bragagnolo100% (4)

- Fundamentals of Financial Management Concise Edition 9th Edition by Brigham Houston ISBN Test BankDocument16 pagesFundamentals of Financial Management Concise Edition 9th Edition by Brigham Houston ISBN Test Bankmichelle100% (26)

- Chapter 7-Risk, Return, and The Capital Asset Pricing ModelDocument18 pagesChapter 7-Risk, Return, and The Capital Asset Pricing Modelbaha146100% (1)

- Bug StrategyDocument13 pagesBug StrategySooraj Suresh100% (5)

- How to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!From EverandHow to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!Rating: 3.5 out of 5 stars3.5/5 (7)

- Joint Arrangements Straight ProblemsDocument3 pagesJoint Arrangements Straight ProblemsAi Fe100% (4)

- Seminar in Finance - Case Study Northwest CompanyDocument4 pagesSeminar in Finance - Case Study Northwest CompanyNell Mizuno100% (1)

- Managing Transaction Exposure - Dalina DumitrescuDocument9 pagesManaging Transaction Exposure - Dalina DumitrescuJoan BubestNo ratings yet

- A Study On Investors Preferences Towards Mutual FundsDocument64 pagesA Study On Investors Preferences Towards Mutual FundsVini SreeNo ratings yet

- Daily Morning Update 27sept 2011Document2 pagesDaily Morning Update 27sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 24 Oct 2011Document2 pagesDaily Morning Update 24 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 9dec 2011Document3 pagesDaily Morning Update 9dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 7dec 2011Document3 pagesDaily Morning Update 7dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 12dec 2011Document3 pagesDaily Morning Update 12dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 26 Sept 2011Document2 pagesDaily Morning Update 26 Sept 2011Mitesh ThackerNo ratings yet

- Daily Morning Update 26 Oct 2011Document2 pagesDaily Morning Update 26 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 8dec 2011Document3 pagesDaily Morning Update 8dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 18 Oct 2011Document2 pagesDaily Morning Update 18 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 14 Oct 2011Document2 pagesDaily Morning Update 14 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 19 Dec 2011Document3 pagesDaily Morning Update 19 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 20 Oct 2011Document2 pagesDaily Morning Update 20 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 22 Sept 2011Document2 pagesDaily Morning Update 22 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 30 Dec 2011Document2 pagesDaily Morning Update 30 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 13 Dec 2011Document3 pagesDaily Morning Update 13 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 09 Sept 2011Document2 pagesDaily Morning Update 09 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 12 Oct 2011Document2 pagesDaily Morning Update 12 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 15 Dec 2011Document3 pagesDaily Morning Update 15 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 2dec 2011Document2 pagesDaily Morning Update 2dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 16 Dec 2011Document3 pagesDaily Morning Update 16 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 Sept 2011Document3 pagesDaily Morning Update 28 Sept 2011Devang Visaria100% (1)

- Daily Morning Update 28 Sept 2011Document2 pagesDaily Morning Update 28 Sept 2011Mitesh ThackerNo ratings yet

- Daily Morning Update 03 Oct 2011Document2 pagesDaily Morning Update 03 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 11 Oct 2011Document2 pagesDaily Morning Update 11 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 10 Oct 2011Document2 pagesDaily Morning Update 10 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 20 Dec 2011Document3 pagesDaily Morning Update 20 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 21 Sept 2011Document2 pagesDaily Morning Update 21 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 16 Sept 2011Document2 pagesDaily Morning Update 16 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 2 Jan 2012Document2 pagesDaily Morning Update 2 Jan 2012Devang VisariaNo ratings yet

- Daily Morning Update 14 Dec 2011Document2 pagesDaily Morning Update 14 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 07 Oct 2011Document2 pagesDaily Morning Update 07 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 Nov 2011Document2 pagesDaily Morning Update 28 Nov 2011Devang VisariaNo ratings yet

- Daily Morning Update 29 Sept 2011Document2 pagesDaily Morning Update 29 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 21 Dec 2011Document2 pagesDaily Morning Update 21 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 1dec 2011Document3 pagesDaily Morning Update 1dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 29 Dec 2011Document2 pagesDaily Morning Update 29 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 Dec 2011Document2 pagesDaily Morning Update 28 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 13 Oct 2011Document2 pagesDaily Morning Update 13 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 29 Nov 2011Document2 pagesDaily Morning Update 29 Nov 2011Devang VisariaNo ratings yet

- Daily Morning Update 30 Sept 2011Document2 pagesDaily Morning Update 30 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 23 Sept 2011Document2 pagesDaily Morning Update 23 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 5dec 2011Document3 pagesDaily Morning Update 5dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 04 Oct 2011Document2 pagesDaily Morning Update 04 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 25 Oct 2011Document2 pagesDaily Morning Update 25 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 July 2011 From MatrixDocument2 pagesDaily Morning Update 28 July 2011 From MatrixDevang VisariaNo ratings yet

- Commodity Outlook 30.09.11Document3 pagesCommodity Outlook 30.09.11Devang VisariaNo ratings yet

- Daily Morning Update 22 Dec 2011Document3 pagesDaily Morning Update 22 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 30nov 2011Document2 pagesDaily Morning Update 30nov 2011Devang VisariaNo ratings yet

- Daily Morning Update 23 Dec 2011Document2 pagesDaily Morning Update 23 Dec 2011Devang VisariaNo ratings yet

- Commodity Outlook 03.10.11Document3 pagesCommodity Outlook 03.10.11Devang VisariaNo ratings yet

- Daily Morning Update 31st Oct 2011Document2 pagesDaily Morning Update 31st Oct 2011Devang VisariaNo ratings yet

- Daily Trading Note Commodity Outlook 28.07.11 From MatrixDocument2 pagesDaily Trading Note Commodity Outlook 28.07.11 From MatrixMitesh Thacker100% (1)

- Commodity Outlook 25.10.11Document3 pagesCommodity Outlook 25.10.11Devang VisariaNo ratings yet

- Daily Morning Update 05 Oct 2011Document2 pagesDaily Morning Update 05 Oct 2011Devang VisariaNo ratings yet

- Commodity Outlook 23.09.11Document3 pagesCommodity Outlook 23.09.11Devang VisariaNo ratings yet

- Daily Morning Update 17 Oct 2011Document3 pagesDaily Morning Update 17 Oct 2011Devang VisariaNo ratings yet

- Commodity Outlook 16.09.11Document2 pagesCommodity Outlook 16.09.11Devang VisariaNo ratings yet

- Commodity Outlook 11.10Document3 pagesCommodity Outlook 11.10Devang VisariaNo ratings yet

- Commodity Outlook 04.10.11Document3 pagesCommodity Outlook 04.10.11Devang VisariaNo ratings yet

- Weekly Update 31 Dec 2011Document5 pagesWeekly Update 31 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 2 Jan 2012Document2 pagesDaily Morning Update 2 Jan 2012Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 30 Dec 2011Document2 pagesDaily Morning Update 30 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 23 Dec 2011Document2 pagesDaily Morning Update 23 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument5 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 28 Dec 2011Document2 pagesDaily Morning Update 28 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 22 Dec 2011Document3 pagesDaily Morning Update 22 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 29 Dec 2011Document2 pagesDaily Morning Update 29 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 21 Dec 2011Document2 pagesDaily Morning Update 21 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Commodity Update 20-12-2011Document6 pagesDaily Commodity Update 20-12-2011Devang VisariaNo ratings yet

- Daily Morning Update 20 Dec 2011Document3 pagesDaily Morning Update 20 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 15 Dec 2011Document3 pagesDaily Morning Update 15 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 19 Dec 2011Document3 pagesDaily Morning Update 19 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Weekly Update 17th Dec 2011Document6 pagesWeekly Update 17th Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 16 Dec 2011Document3 pagesDaily Morning Update 16 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 14 Dec 2011Document2 pagesDaily Morning Update 14 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 13 Dec 2011Document3 pagesDaily Morning Update 13 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Weekly Update 10nd Dec 2011Document5 pagesWeekly Update 10nd Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 8dec 2011Document3 pagesDaily Morning Update 8dec 2011Devang VisariaNo ratings yet

- Leveraged Buyouts: An Overview ofDocument15 pagesLeveraged Buyouts: An Overview ofle LENo ratings yet

- Barth, M. E., Cram, D, P., & Nelson, K. K. 2001. Accruals and The Prediction of Future Cash Flow. The Accounting Review, 7 (1), 27-58Document33 pagesBarth, M. E., Cram, D, P., & Nelson, K. K. 2001. Accruals and The Prediction of Future Cash Flow. The Accounting Review, 7 (1), 27-58Febiola YuliNo ratings yet

- Chapter 5Document30 pagesChapter 5Krupa ShahNo ratings yet

- FOREX Day Trading..Document3 pagesFOREX Day Trading..Ahmed NabilNo ratings yet

- Definition of SukukDocument16 pagesDefinition of SukukNahidul Islam IUNo ratings yet

- Capital Budgeting - FinmarDocument3 pagesCapital Budgeting - FinmarnerieroseNo ratings yet

- Bank of Rajasthan LTDDocument2 pagesBank of Rajasthan LTDProfessor Sameer Kulkarni100% (1)

- What Is Debt MarketDocument1 pageWhat Is Debt MarketVenkatesh PothamNo ratings yet

- Nabm2 Tos Final TermDocument2 pagesNabm2 Tos Final TermKathleen Anne Bataluna RebanalNo ratings yet

- Shankarlal Agrawal College OF Management Studies, GondiaDocument40 pagesShankarlal Agrawal College OF Management Studies, GondiaRavi JoshiNo ratings yet

- 7 2006 Dec QDocument6 pages7 2006 Dec Qapi-19836745No ratings yet

- 5984 17474 1 PBDocument13 pages5984 17474 1 PBTiarannisaaNo ratings yet

- Karla Company P-WPS OfficeDocument14 pagesKarla Company P-WPS OfficeKris Van HalenNo ratings yet

- D - Feuille - Formules - Final - Et - Table - Loi - Normale - Anglo - HEC - Futures and Options FinalDocument4 pagesD - Feuille - Formules - Final - Et - Table - Loi - Normale - Anglo - HEC - Futures and Options FinalZiyo WangNo ratings yet

- Handouts 169Document15 pagesHandouts 169Rio Cyrel CelleroNo ratings yet

- Interim Report Q4 2012 EngDocument25 pagesInterim Report Q4 2012 Engyamisen_kenNo ratings yet

- Final Exam Revision: Short Answer QuestionsDocument32 pagesFinal Exam Revision: Short Answer QuestionsUyển Nhi TrầnNo ratings yet