Professional Documents

Culture Documents

M&M BCG Matrix

Uploaded by

Sidrah AhsanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

M&M BCG Matrix

Uploaded by

Sidrah AhsanCopyright:

Available Formats

M&m Bcg Matrix.

Docx

M&m Bcg Matrix.Docx

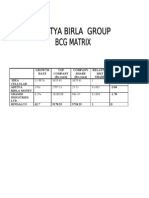

| GROWTH RATE | TOP COMPANY(Rs crore) | COMPANY SHARE(Rs crore) | RELATIVE MKT SHARE | LOG | IDEA CELLULAR | 11.00 % | 3629.61 | 3629.61 | 1 | 0 | ADITYA BIRLA MONEY | 15% | 2797.13 | 25.51 | 0.1402 | -2.04 | GRASIM INDUSTRIES LTD. | 6.2% | 58288.00 | 964.47 | 0.1898 | -1.78 | HINDALCO | 62.7 | 5178.25 | 5718.25 | 1 | 0 |

Cash Cows Dogs Star Question Mark

BCG matrix has 2 dimensions: market share and market growth while divided in Four categories. Placing products in the BCG matrix results in 4 categories in a portfolio of a company: 1. Stars (=high growth, high market share) - use large amounts of cash and are leaders in the business so they should also generate large amounts of cash. - frequently roughly in balance on net cash flow. However if needed any attempt should be made to hold share, because the rewards will be a cash cow if market share is kept. 2. Cash Cows (=low growth, high market share) - profits and cash generation should be high , and because of the low growth, investments needed should be low. Keep profits high

- Foundation of a company 3. Dogs (=low growth, low market share) - avoid and minimize the number of dogs in a company. - beware of expensive turn around plans. - deliver cash, otherwise liquidate 4. Question Marks (= high growth, low market share) - have the worst cash characteristics of all, because high demands and low returns due to low market share - if nothing is done to change the market share, question marks will simply absorb great amounts of cash and later, as the growth stops, a dog. - either invest heavily or sell off or invest nothing and generate whatever cash it can. Increase market share or deliver cash

Limitations are:

* The assumption that cash flow will be determined by a products position on the matrix is weak. Some stars will show a healthy positive cash flow as will some dogs in markets where competitive activity is low. * Treating market growth rate as proxy...

You might also like

- Portfolio AnalysisDocument36 pagesPortfolio Analysissalman200867100% (2)

- The BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementFrom EverandThe BCG Growth-Share Matrix: Theory and Applications: The key to portfolio managementRating: 2 out of 5 stars2/5 (1)

- How to Make Money in Stocks and Become a Successful Investor (TABLET--EBOOK)From EverandHow to Make Money in Stocks and Become a Successful Investor (TABLET--EBOOK)No ratings yet

- M&M BCG MatrixDocument3 pagesM&M BCG MatrixPrince38No ratings yet

- Stars ( High Growth, High Market Share) : Product Life CycleDocument3 pagesStars ( High Growth, High Market Share) : Product Life Cycle2771683No ratings yet

- BCG MatrixDocument2 pagesBCG MatrixKusum VayaNo ratings yet

- BCG Growth Share Matrix: Shubham Nagar Bba 6 SEM 02911401718Document11 pagesBCG Growth Share Matrix: Shubham Nagar Bba 6 SEM 02911401718shubNo ratings yet

- Boston Consulting Group Matrix: Bhumika More SIES Nerul College of ASCDocument27 pagesBoston Consulting Group Matrix: Bhumika More SIES Nerul College of ASCLatika RathaurNo ratings yet

- Stars ( High Growth, High Market Share)Document2 pagesStars ( High Growth, High Market Share)Kamlesh TarachandaniNo ratings yet

- BCG Matrix: Product Life CycleDocument10 pagesBCG Matrix: Product Life CycleiamgyanuNo ratings yet

- BCG MatrixDocument12 pagesBCG MatrixA.Rahman SalahNo ratings yet

- BCG MatrixDocument8 pagesBCG MatrixuzairrafeeNo ratings yet

- BCG MatrixDocument14 pagesBCG MatrixNidhi GuptaNo ratings yet

- BCG ItcDocument92 pagesBCG Itcprachii09No ratings yet

- CHAPTER 5 Strategic Analysis of Diversified CompaniesDocument40 pagesCHAPTER 5 Strategic Analysis of Diversified CompaniesBekam BekeeNo ratings yet

- MM Ansoff & BCG MatrixDocument31 pagesMM Ansoff & BCG MatrixAshirbad NayakNo ratings yet

- The BCG MatrixDocument3 pagesThe BCG MatrixfaranawNo ratings yet

- SM Chapter 2Document34 pagesSM Chapter 2Masood khanNo ratings yet

- BCG MatrixDocument17 pagesBCG MatrixGowri J BabuNo ratings yet

- Boston Consulting Group MatrixDocument20 pagesBoston Consulting Group MatrixReema Mamtani100% (1)

- BCG Matrix and GE 9 Cell PlaningDocument5 pagesBCG Matrix and GE 9 Cell PlaningAmit Vasantbhai50% (2)

- BCG MatrixDocument14 pagesBCG MatrixloganathprasannaNo ratings yet

- UNIT-4-Choice of Business Strategies: Understanding The ToolDocument12 pagesUNIT-4-Choice of Business Strategies: Understanding The ToolNishath NawazNo ratings yet

- Portfolio AnalysisDocument40 pagesPortfolio AnalysisAryan GuptaNo ratings yet

- Bruce Henderson: Boston Consulting Group (BCG) MATRIX Is Developed by Consulting Group in The Early 1970'sDocument14 pagesBruce Henderson: Boston Consulting Group (BCG) MATRIX Is Developed by Consulting Group in The Early 1970'sShakshi Arvind GuptaNo ratings yet

- BCG Notes FinalDocument10 pagesBCG Notes FinalHarsora UrvilNo ratings yet

- The BCG Growth-Share MatrixDocument10 pagesThe BCG Growth-Share MatrixPuNeet ShaRmaNo ratings yet

- BCG MatrixDocument3 pagesBCG MatrixSiddhi Tande AdhavNo ratings yet

- The BCG GrowthDocument6 pagesThe BCG GrowthAkhilesh ShawNo ratings yet

- BCG MatrixDocument6 pagesBCG Matrixsonuka100% (1)

- BCG Matrix Assignment 1Document7 pagesBCG Matrix Assignment 1Raja AbdullahNo ratings yet

- BCG MatrixDocument15 pagesBCG MatrixManpreet Singh BhatiaNo ratings yet

- Presented By, Sanjay ParmarDocument15 pagesPresented By, Sanjay ParmarRahul ChandiramaniNo ratings yet

- BCG Matrix: Presented byDocument10 pagesBCG Matrix: Presented by2285 Rishika VaidyaNo ratings yet

- BCG MatrixDocument19 pagesBCG MatrixRishab MehtaNo ratings yet

- Boston Consulting Group Matrix: Presented byDocument12 pagesBoston Consulting Group Matrix: Presented byBrandon ThomasNo ratings yet

- 06 - Business PortfolioDocument4 pages06 - Business PortfolioKateřina SabelováNo ratings yet

- Black Book SMDocument37 pagesBlack Book SMamitpandey6592No ratings yet

- The BCG GrowthDocument3 pagesThe BCG GrowthKhuram ShahzadNo ratings yet

- BCG SMDocument15 pagesBCG SMshivaprabhuNo ratings yet

- Meaning of CommunicationDocument4 pagesMeaning of CommunicationAMALA ANo ratings yet

- Bruce Henderson: Boston Consulting Group (BCG) MATRIX Is Developed by Consulting Group in The Early 1970'SDocument17 pagesBruce Henderson: Boston Consulting Group (BCG) MATRIX Is Developed by Consulting Group in The Early 1970'SfahadfiazNo ratings yet

- BCG MatrixDocument2 pagesBCG Matrixpallav86No ratings yet

- BCG MatrixDocument4 pagesBCG MatrixRahul AgarwalNo ratings yet

- Lecture 2 BCG MatrixDocument26 pagesLecture 2 BCG MatrixAnant MishraNo ratings yet

- BCG Growth-Share MatrixDocument2 pagesBCG Growth-Share Matrixmanojdiman943No ratings yet

- BCG Matrix: Portfolio Management Based On Market Share and Market Growth. Explanation of BCG Matrix. ('70)Document4 pagesBCG Matrix: Portfolio Management Based On Market Share and Market Growth. Explanation of BCG Matrix. ('70)Ramu NagatiNo ratings yet

- 7s Model-BCG ModelDocument17 pages7s Model-BCG Modelsurya100% (1)

- Understanding The BCG Model Limitations / Problems of BCG ModelDocument13 pagesUnderstanding The BCG Model Limitations / Problems of BCG Modelshovit singhNo ratings yet

- BCG Matrix ClassDocument12 pagesBCG Matrix Classanita_028818No ratings yet

- BCG Matrix: Surya.H 121901042 Strategic ManagementDocument3 pagesBCG Matrix: Surya.H 121901042 Strategic ManagementCrazy MechonsNo ratings yet

- Boston Consulting Group (BCG) MatrixDocument11 pagesBoston Consulting Group (BCG) MatrixAnjali AnjaliNo ratings yet

- Boston Consulting Group (BCG) MatrixDocument14 pagesBoston Consulting Group (BCG) MatrixMutahar Hayat100% (1)

- Product StrategyDocument19 pagesProduct Strategyshivam sharmaNo ratings yet

- Reliance BCG Matrix EmmanuelDocument24 pagesReliance BCG Matrix Emmanuelsubhojitkarmakar10100% (1)

- Final Theory - Marketing STRGDocument81 pagesFinal Theory - Marketing STRGkartkgala123No ratings yet

- How to Make Money in Stocks: A Successful Strategy for Prosperous and Challenging TimesFrom EverandHow to Make Money in Stocks: A Successful Strategy for Prosperous and Challenging TimesNo ratings yet

- The Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)From EverandThe Profit Zone (Review and Analysis of Slywotzky and Morrison's Book)No ratings yet

- Top Stocks 2016: A Sharebuyer's Guide to Leading Australian CompaniesFrom EverandTop Stocks 2016: A Sharebuyer's Guide to Leading Australian CompaniesNo ratings yet

- Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingFrom EverandDividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingNo ratings yet