Professional Documents

Culture Documents

Form No. 27A: (In Case Return / Statement Has Been Filed Earlier)

Uploaded by

Rishi SrivastavaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form No. 27A: (In Case Return / Statement Has Been Filed Earlier)

Uploaded by

Rishi SrivastavaCopyright:

Available Formats

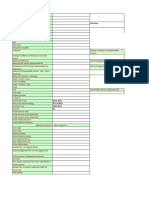

FORM NO.

27A

Form for furnishing information with the statement of deduction / collection of tax at Source (tick whichever is applicable) filed on Computer Media for the period From _________________ To _________________ (dd/mm/yyyy)# 1. (a) Tax Deduction Account No. (b) Permanent Account No. (c) Form No. : : : (d) Financial Year (e) Assessment Year (f) Previous Receipt number : : :

(In case return / statement has been filed earlier)

2.

Particulars of the Deductor / Collector (a) Name (b) Type of Deductor * (c) Branch / Division (if any) (d) Address Flat No. Name of the premises / building Road / Street / Lane Area / Location Town / City / District State Pin code Telephone No. E-mail : : : : : : : : : : : :

3.

Particulars of the Person Responsible for Deduction / Collection of Tax (A) Name (B) Address Flat No. Name of the Premises / Building Road / Street / Lane Area / Location Town / City / District State Pin code Telephone No. E-mail : : : : : : : : : :

4.

Control Totals. Sr. No. No. of Deductee / Party Records Amount Paid Rs. Tax Deducted / Collection Rs. Tax Deposited (Total Challan Amount) Rs.

5. 6.

Total Number of Annexures enclosed : Other Information : VERIFICATION

I, Place Date : :

, hereby certify that all the particulars furnished above are correct and complete. Signature of person responsible for deducting / collecting tax at source Name and designation of person responsible for deducting / collecting tax at source

* Mention type of deductor - Government or Others # dd/mm/yy : date/month/year

You might also like

- Bar Review Companion: Taxation: Anvil Law Books Series, #4From EverandBar Review Companion: Taxation: Anvil Law Books Series, #4No ratings yet

- Disbursement Voucher FormDocument9 pagesDisbursement Voucher FormRandy Sioson71% (7)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Form SCE-C StatementDocument6 pagesForm SCE-C StatementSonia Bea L. Wee-Lozada76% (71)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- SOCE Lang PDFDocument11 pagesSOCE Lang PDFJay Ronwaldo Talan JuliaNo ratings yet

- Form SCE-P StatementDocument5 pagesForm SCE-P StatementSonia Bea L. Wee-Lozada100% (4)

- 27a Blrm16408a 26Q Q1 201112Document1 page27a Blrm16408a 26Q Q1 201112Daksh Jai BajajNo ratings yet

- Printed From Taxmann's Income Tax Rules On CD Page 1 of 3Document3 pagesPrinted From Taxmann's Income Tax Rules On CD Page 1 of 3Akshay SinghNo ratings yet

- Form No. 27ADocument1 pageForm No. 27Akaturi3689No ratings yet

- Form No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer MediaDocument2 pagesForm No. 27A (See Rule 37B) Form For Furnishing Information With The Return or Statement of Deduction of Tax at Source Filed On Computer Mediabestperson86No ratings yet

- Form ST1 - Registration or CorrectionDocument4 pagesForm ST1 - Registration or Correctionkavi_soniiNo ratings yet

- PDF Editor: Form No. 15GDocument2 pagesPDF Editor: Form No. 15GImissYouNo ratings yet

- New Form No 15GDocument4 pagesNew Form No 15GDevang PatelNo ratings yet

- FORM-15G DECLARATIONDocument4 pagesFORM-15G DECLARATIONKayam BalajiNo ratings yet

- 27a Agri10144b 26Q Q1 201617Document1 page27a Agri10144b 26Q Q1 201617Amit TiwariNo ratings yet

- FORM 26Q TDSDocument3 pagesFORM 26Q TDSAmit TiwariNo ratings yet

- CPV CHECK LISTDocument2 pagesCPV CHECK LISTG N Harish Kumar YadavNo ratings yet

- 27a JDHC01825F 24Q Q3 201415Document1 page27a JDHC01825F 24Q Q3 201415shaileshNo ratings yet

- Service Tax NoDocument4 pagesService Tax NoTushar GawandeNo ratings yet

- 27a Q3 ItipannaDocument1 page27a Q3 ItipannaAnimesh MishraNo ratings yet

- Form No. 27B: (In Case Return Has Been Filed Earleer)Document1 pageForm No. 27B: (In Case Return Has Been Filed Earleer)anon-418665100% (1)

- 27a VPND00761F 24Q Q3 201415Document1 page27a VPND00761F 24Q Q3 201415Paul DaughertyNo ratings yet

- Formst 1Document3 pagesFormst 1arulantonyNo ratings yet

- RGD Revised Form A 002Document8 pagesRGD Revised Form A 002Brew-sam ABNo ratings yet

- (Original) Major Head 0044 Service Tax: Form Tr-6 For Payment of Service Tax (Challan)Document5 pages(Original) Major Head 0044 Service Tax: Form Tr-6 For Payment of Service Tax (Challan)biko137No ratings yet

- (Application Form For Registration Under Section 69 of The Finance Act, 1994 (32 of 1994) )Document6 pages(Application Form For Registration Under Section 69 of The Finance Act, 1994 (32 of 1994) )Chandan TiwariNo ratings yet

- Form 15G/15H ReceiptsDocument6 pagesForm 15G/15H ReceiptspriyaradhiNo ratings yet

- 27a Mumt13163d 26Q Q2 201314Document1 page27a Mumt13163d 26Q Q2 201314siaam123No ratings yet

- Form 15g NewDocument4 pagesForm 15g NewnazirsayyedNo ratings yet

- Service Tax Form-1Document4 pagesService Tax Form-1Ravi AroraNo ratings yet

- E5900Form027 England enDocument3 pagesE5900Form027 England enSimon MarshNo ratings yet

- 27a Mumr17831c 26Q Q4 201415Document1 page27a Mumr17831c 26Q Q4 201415ashwin shahNo ratings yet

- 2551QDocument2 pages2551QCris David Moreno79% (14)

- Form No 15HDocument3 pagesForm No 15HsaymtrNo ratings yet

- Form 27A Tax Deduction StatementDocument1 pageForm 27A Tax Deduction Statementkrashi123No ratings yet

- Service Requisition Form-OriginalDocument11 pagesService Requisition Form-OriginalsksarvananNo ratings yet

- (See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NDocument6 pages(See Sections 192A, 193, 194, 194A, 194B, 194BB, 194C, 194D, 194DA, 194EE, 194F, 194G, 194H, 194-I, 194J, 194K, 194LA, 194LBA, 194LBB, 194LBC, 194NRavi PrakashNo ratings yet

- Payment Request August 31 2012 InvoiceDocument28 pagesPayment Request August 31 2012 InvoiceRecordTrac - City of OaklandNo ratings yet

- March 8 2013Document28 pagesMarch 8 2013RecordTrac - City of OaklandNo ratings yet

- Web New 24 QDocument2 pagesWeb New 24 QSurendar SurendarNo ratings yet

- Payment Request July 2012 InvoiceDocument28 pagesPayment Request July 2012 InvoiceRecordTrac - City of OaklandNo ratings yet

- May 3 2013Document28 pagesMay 3 2013RecordTrac - City of OaklandNo ratings yet

- Payment Request August 1 2012 InvoiceDocument28 pagesPayment Request August 1 2012 InvoiceRecordTrac - City of OaklandNo ratings yet

- Individual Tax Residency Self-Certification FormDocument2 pagesIndividual Tax Residency Self-Certification FormEmadNo ratings yet

- Annual Return of Deduction of Tax Under Section 206 of I.T. Act, 1961 in Respect of All Payments Other Than "Salaries" For The Year Ending 31st March.............Document3 pagesAnnual Return of Deduction of Tax Under Section 206 of I.T. Act, 1961 in Respect of All Payments Other Than "Salaries" For The Year Ending 31st March.............Astro Shalleneder GoyalNo ratings yet

- Form ST-1 ApplicationDocument5 pagesForm ST-1 ApplicationVivekanandNo ratings yet

- Indian Income Tax Return Verification FormDocument1 pageIndian Income Tax Return Verification FormSanjeev BansalNo ratings yet

- DecemberDocument28 pagesDecemberRecordTrac - City of OaklandNo ratings yet

- March 8 2013Document28 pagesMarch 8 2013RecordTrac - City of OaklandNo ratings yet

- As Approved by Income Tax DepartmentDocument5 pagesAs Approved by Income Tax DepartmentRicha JoshiNo ratings yet

- "Form No. 15H: Area Code Range Code AO No. AO TypeDocument2 pages"Form No. 15H: Area Code Range Code AO No. AO Typepkw007No ratings yet

- Tarea 5Document9 pagesTarea 5josefaNo ratings yet

- BIR Form 2000 Documentary Stamp Tax ReturnDocument4 pagesBIR Form 2000 Documentary Stamp Tax ReturntoofuuNo ratings yet

- November Direct Payment RequestDocument28 pagesNovember Direct Payment RequestRecordTrac - City of OaklandNo ratings yet

- EMPLOYEES' CLAIM FORMDocument4 pagesEMPLOYEES' CLAIM FORMMadhaw KumarNo ratings yet

- FORM 15G DECLARATIONDocument2 pagesFORM 15G DECLARATIONgrover.jatinNo ratings yet

- 1701qjuly2008 (ENCS)Document6 pages1701qjuly2008 (ENCS)alvie_budNo ratings yet