Professional Documents

Culture Documents

Proffessional Tax

Proffessional Tax

Uploaded by

Jayesh Bheda0 ratings0% found this document useful (0 votes)

11 views18 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views18 pagesProffessional Tax

Proffessional Tax

Uploaded by

Jayesh BhedaCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 18

aad —a

(ai Ras ¥(4))

meverdid wd svar ous

MI ARA MHA WA,

wea ifs

suites treat

(Rous)

aveell

suis AlayeAzi ud wARsz/aud.a.ceRory Bys

ula,

Maga aad,

RABMaAsar 10,

alsa, ween Sead,

atiuayal, rilara—ses,

Rua: wd aise 860 wd Anaw sua

Gualsd AMA sued auuar wea idl sed enue

ud Lisnisice, al.19/10/14) uw rigdari yourad 3,

axed,

Mgtia, % WAS au wd DAA ara d.

FY saapor

Attr 19/10/14 WA

widla ygrue wd 1

Berd y alu ued youaard 3 an wd ada wa AAMard grad ayo aaa

4a) oan ura add dla dar raauell eaizt cuaany dai area soften 8.

aay Gurr Rela ay ada dla di Asta avid ard la Baad vier

au vid alsrdled, rine—se9 9 alla 42 eisai.

wee Ze. was aa,

DARIGHT TO INFORMATATION ACTL-120D-9 doe

As AUR

aidan ewes.

adit i. asu9s

Gujarat State Tax on

Professions, Tr ades,

Callings and

Employme nts

(Amendment) Act,

2008.

NOTIFICATION

FINAN CE DEP ARTMENT

Sachivalaya, Gandhinagar.

Dated the 31° March, 2008.

‘No.(GHN-8)PET -2008-S.1(2)-TH:- In exercise of the

powers conferred by sub-section (2) of section 1 of the

Gujarat State Tax on Professions, Trades, Callings and

Employments (Amendment) Act, 2008 (Guj. 10 of 2008),

the Government of Gujarat hereby appoints the 1 April,

2008 as the date on which the said Act shall come into

force.

By order and in the-name of the Governor of Gujarat,

M. A. Bhatt,

Additional Secretary to Government

Gujarat State Tax on.

Professions, Trades,

Callings and

Employments Act,

1976,

No. (GHN-10)PFT-2008-8.3(2)(3)-TH :-

NOTIFICATION

FINANCE DEPAR TMENT

Sachivalaya, Gandhinagar

Dated the Ist April, 2008.

In exercise of the powers conferred by the

third proviso to sub-section (2) of section 3 o fthe Gujarat State Tax on Pr ofessions, Trades,

Callings and Eroployments Act, 1976 (President’s Act No.11 of 1976), the Government of

Gujarat hereby specifies the rates in column 3, 4 and 5 of the Schedule appended hereto, as

‘minimum rates which shall be levied by the respective Designated Authorities, forthe class

of persons specified in column 2 of the said Schedule,

SCHEDULE

Entry No.

of

Sch edule 1

to the Act.

Class of Persons

Minimum Rate of Tax per annum

(in Rs)

District

‘Munieipa lity

Manicipa

Corp oration

(ear

2

Panchayat |

3

4

3

2:

@

&)

©

@

©

®

@)

Legal Practitioners

including Solicitors and

Notaries Public.

Medical Practitioners

including Medical

Consultants and

Dentists.

Technical and

professional

consultants, including

Architects, Engineers,

RCC Consultants, Tax

Consultants, » Chartered

Accountants, Actuaries

and Management

Consultants.

Chief Agents, Principal

Agents, Special A gents,

Insurance Agents and

Surveyors or Loss

Assessors, registered or

licenced under the

Insurance Act, 1938 (4

of 1938).

All Contractors other

than building

contractors.

Commission’ Agents,

Dalals and Brokers

other than Estate

Brokers.

Automobile Brokers.

500

500

‘s00/-

500/-

500/-

00/-

500/-

7,000

1,000/-

1,000/-

1,000/-

1,000/-

1,000/-

1000/-

20007. +

2,000/-

2,000-

2,000/-

2,000/-

2,000/-

2,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Outstate Farmer Gujarat High Court JudgmentDocument36 pagesOutstate Farmer Gujarat High Court JudgmentJayesh Bheda100% (4)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Application For Issuance of Certificate of Practice Under Bar Council of India Rules, 2014Document2 pagesApplication For Issuance of Certificate of Practice Under Bar Council of India Rules, 2014Jayesh BhedaNo ratings yet

- Civil Servants Cannot Function On The Basis of Verbal or Oral Instructions, Orders, Suggestions, Proposals (Full Judgment)Document21 pagesCivil Servants Cannot Function On The Basis of Verbal or Oral Instructions, Orders, Suggestions, Proposals (Full Judgment)Jayesh BhedaNo ratings yet

- Not Necessary To Declare Religion On FormDocument11 pagesNot Necessary To Declare Religion On FormJayesh BhedaNo ratings yet

- Negotiable Instruments (Amendment) Ordinance, 2015Document3 pagesNegotiable Instruments (Amendment) Ordinance, 2015Latest Laws Team100% (1)

- Gujarat High Court Case Flow Management (Subordinate Courts) Rules, 2016Document14 pagesGujarat High Court Case Flow Management (Subordinate Courts) Rules, 2016Jayesh Bheda0% (1)

- Photography Club of Gandhidham - Trip Report - Palar DhunaDocument13 pagesPhotography Club of Gandhidham - Trip Report - Palar DhunaJayesh Bheda100% (1)

- Photography Club of Gandhidham - Modvadar - Trip ReportDocument14 pagesPhotography Club of Gandhidham - Modvadar - Trip ReportJayesh BhedaNo ratings yet

- Gujarat Municipality Act, Chapter 13 in Gujarati LanguageDocument5 pagesGujarat Municipality Act, Chapter 13 in Gujarati LanguageJayesh Bheda100% (4)

- Only One Motilal C. Setalvad, Never A Second Again - R.K. GargDocument23 pagesOnly One Motilal C. Setalvad, Never A Second Again - R.K. GargJayesh BhedaNo ratings yet

- Photography Club of Gandhidham - Bhimasar Trip ReportDocument11 pagesPhotography Club of Gandhidham - Bhimasar Trip ReportJayesh BhedaNo ratings yet

- Gujarat BJP Manifesto For Assembly Election 2012 in Gujarati LanguageDocument14 pagesGujarat BJP Manifesto For Assembly Election 2012 in Gujarati LanguageJayesh BhedaNo ratings yet

- RTI Notification For Senior Citizen and Physically ChallengedDocument1 pageRTI Notification For Senior Citizen and Physically ChallengedJayesh BhedaNo ratings yet

- Supreme Court On Justice, Courts and DelaysDocument17 pagesSupreme Court On Justice, Courts and DelaysJayesh BhedaNo ratings yet

- Manifesto of Gujarat BJP For Assembly Election 2012 in English Language.Document9 pagesManifesto of Gujarat BJP For Assembly Election 2012 in English Language.Jayesh Bheda100% (1)

- Birds-Animals Have Fundamental Right To Live FreelyDocument8 pagesBirds-Animals Have Fundamental Right To Live FreelyJayesh BhedaNo ratings yet

- State of Gujarat Versus Gaurang Mathurbhai LeuvaDocument7 pagesState of Gujarat Versus Gaurang Mathurbhai LeuvaJayesh BhedaNo ratings yet

- Ground Rent of Gandhidham - Notification of TAMP - 2012Document22 pagesGround Rent of Gandhidham - Notification of TAMP - 2012Jayesh BhedaNo ratings yet

- H.M.Maharao Shri Madansinhji Saheb of Kutch Versus State of GujaratDocument8 pagesH.M.Maharao Shri Madansinhji Saheb of Kutch Versus State of GujaratJayesh BhedaNo ratings yet

- Public Purpose Plots Allotted To Gandhidham Municipality by SRCDocument2 pagesPublic Purpose Plots Allotted To Gandhidham Municipality by SRCJayesh BhedaNo ratings yet

- Lessons From Penalties Imposed On PIO by Central Information Commission Under RTIDocument9 pagesLessons From Penalties Imposed On PIO by Central Information Commission Under RTIJayesh BhedaNo ratings yet

- RTI Blank Form-English-gujaratiDocument2 pagesRTI Blank Form-English-gujaratiJayesh Bheda100% (12)

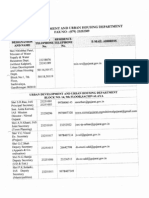

- Contact Details of GUDCDocument5 pagesContact Details of GUDCJayesh BhedaNo ratings yet