Professional Documents

Culture Documents

Statement of Operations For The Fiscal Year Ended January 2, 2011 Revenues

Uploaded by

Vasantha ShetkarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Statement of Operations For The Fiscal Year Ended January 2, 2011 Revenues

Uploaded by

Vasantha ShetkarCopyright:

Available Formats

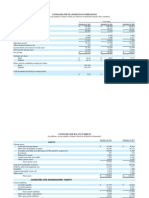

Statement of Operations for the Fiscal Year Ended January 2, 2011 Revenues: Rental revenues $ 1,816.

0 Merchandise sales 296.4 Other revenues 44.1 2,156.5 Cost of sales: Cost of rental revenues 655.9 Cost of merchandise sold 228.9 884.8 Gross profit 1,271.7 Operating expenses: General and administrative 1,233.1 Advertising 50.6 Depreciation and intangible amortization 85.0 Impairment of long-lived assets 22.2 1,390.9 Operating income (loss) (119.2) Interest (expense) income, net (93.5) Other items, net (3.1) Income (loss) before reorganization items and income taxes (215.8) Reorganization items, net (9.7) Provision for income taxes (2.2)

Equity in income (loss) of non-Debtor subsidiaries, net of tax (20.9) Income (loss) from continuing operations (248.6) Income (loss) from discontinued operations, net of tax (19.4) Net income (loss) $ (268.0)

53

Table of Contents Balance Sheet as of January 2, 2011 Assets Current assets: Cash and cash equivalents $ Receivables, net 35.6 Amounts due from non-Debtor subsidiaries, net 31.3 Merchandise inventories 100.3 Rental library, net 188.8 Prepaid and other current assets 84.3 Total current assets 506.5 Property and equipment, net 118.4 Deferred income taxes 77.0 Investments in non-Debtor subsidiaries 276.2 Intangibles, net 4.8 Restricted cash 34.2 Other assets 37.9 $ 1,055.0 Liabilities and Stockholders Equity (Deficit) Current liabilities: Accounts payable $ Accrued expenses 194.4 Deferred income taxes 77.1 149.5 66.2

Total current liabilities 421.0 Other liabilities 12.1 Liabilities subject to compromise 1,147.2 Liabilities to non-Debtor subsidiaries subject to compromise 27.6 1,607.9 Total stockholders equity (deficit) (552.9) $ 1,055.0

54

Table of Contents Statement of Cash Flows for the Fiscal Year Ended January 2, 2011 Net cash provided by (used in) operating activities $ (31.3) Investing activities: Capital expenditures (18.5) Change in restricted cash 23.8 Other investing activities 1.3 Net cash provided by (used in) investing activities 6.6 Financing activities: Proceeds from DIP Credit Agreement 93.8 Repayments on DIP Credit Agreement (93.8) Repayments on senior secured notes (45.0) Debt financing costs (4.6) Capital lease payments (4.7) Intercompany loans 18.9 Net cash provided by (used in) financing activities (35.4) Net decrease in cash and cash equivalents (60.1) Cash and cash equivalents at beginning of year 126.3 Cash and cash equivalents at end of year $ 66.2

You might also like

- Leucadia 2012 Q3 ReportDocument43 pagesLeucadia 2012 Q3 Reportofb1No ratings yet

- Trend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio AnalysisDocument4 pagesTrend Analysis, Horizontal Analysis, Vertical Analysis, Balance Sheet, Income Statement, Ratio Analysisnaimenim100% (1)

- Financial Statements PDFDocument91 pagesFinancial Statements PDFHolmes MusclesFanNo ratings yet

- AESCorporation 10Q 20130808Document86 pagesAESCorporation 10Q 20130808Ashish SinghalNo ratings yet

- Worldcom Financials 2000 2002 ADocument5 pagesWorldcom Financials 2000 2002 AmominNo ratings yet

- Home Depot in The New MillenniumDocument3 pagesHome Depot in The New MillenniumElaineKongNo ratings yet

- Verizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsDocument9 pagesVerizon Communications Inc. Condensed Consolidated Statements of Income Before Special ItemsvenkeeeeeNo ratings yet

- Five Year Record: Shareholder InformationDocument4 pagesFive Year Record: Shareholder InformationSalim Abdulrahim BafadhilNo ratings yet

- Consolidated Statements of Cash Flows: Years Ended March 31Document8 pagesConsolidated Statements of Cash Flows: Years Ended March 31Edielson SantanaNo ratings yet

- Net Sales: January 28, 2012 January 29, 2011Document9 pagesNet Sales: January 28, 2012 January 29, 2011장대헌No ratings yet

- Actavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)Document3 pagesActavis, Inc. Consolidated Statements of Operations: (In Millions, Except Per Share Amounts)macocha1No ratings yet

- Consolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Document5 pagesConsolidated Statements of Operations: Years Ended September 29, 2012 September 24, 2011 September 25, 2010Basit Ali ChaudhryNo ratings yet

- Wassim Zhani Cheesecake Factory Practice Problem SolutionDocument7 pagesWassim Zhani Cheesecake Factory Practice Problem Solutionwassim zhaniNo ratings yet

- Macy's 10-K AnalysisDocument39 pagesMacy's 10-K Analysisapb5223No ratings yet

- Consolidated Profit & Loss Account For Continuing OperationsDocument13 pagesConsolidated Profit & Loss Account For Continuing OperationsAlok JainNo ratings yet

- Ratio Analysis Berger Asian PaintsDocument11 pagesRatio Analysis Berger Asian PaintsHEM BANSALNo ratings yet

- TCS Ifrs Q3 13 Usd PDFDocument23 pagesTCS Ifrs Q3 13 Usd PDFSubhasish GoswamiNo ratings yet

- 3Q14 Financial StatementsDocument58 pages3Q14 Financial StatementsFibriaRINo ratings yet

- Fsap Template in EnglishDocument34 pagesFsap Template in EnglishDo Hoang HungNo ratings yet

- MCB Consolidated For Year Ended Dec 2011Document87 pagesMCB Consolidated For Year Ended Dec 2011shoaibjeeNo ratings yet

- Reformulated Profit Loss Statements 2018-2017Document10 pagesReformulated Profit Loss Statements 2018-2017Tushar KumarNo ratings yet

- Finals Output-AgadDocument16 pagesFinals Output-AgadClarito, Trisha Kareen F.No ratings yet

- Att Ar 2012 ManagementDocument35 pagesAtt Ar 2012 ManagementDevandro MahendraNo ratings yet

- FSA Hw2Document13 pagesFSA Hw2Mohammad DaulehNo ratings yet

- 2014 IFRS Financial Statements Def CarrefourDocument80 pages2014 IFRS Financial Statements Def CarrefourawangNo ratings yet

- Balance Coca-Cola 2011Document4 pagesBalance Coca-Cola 2011AinMoraNo ratings yet

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Hindalco Industries FY19-20 Financial ReportDocument14 pagesHindalco Industries FY19-20 Financial ReportJaydeep SolankiNo ratings yet

- TableDocument1 pageTableparasshah90No ratings yet

- Westfield WDC 2011 FY RESULTS Presentation&Appendix 4EDocument78 pagesWestfield WDC 2011 FY RESULTS Presentation&Appendix 4EAbhimanyu PuriNo ratings yet

- HPCL profit and loss analysis for FY20 and FY19Document10 pagesHPCL profit and loss analysis for FY20 and FY19riyaNo ratings yet

- Ejemplo Balance GeneralDocument10 pagesEjemplo Balance GeneralAndreaNo ratings yet

- Condensed Consolidated Statements of IncomeDocument7 pagesCondensed Consolidated Statements of IncomevenkeeeeeNo ratings yet

- Att-Ar-2012-Financials Cut PDFDocument5 pagesAtt-Ar-2012-Financials Cut PDFDevandro MahendraNo ratings yet

- Siemens Report4You FY2022Document64 pagesSiemens Report4You FY2022Vibhore KanoongoNo ratings yet

- Apple Inc: FORM 10-QDocument76 pagesApple Inc: FORM 10-Qwill2222No ratings yet

- Four Year Financial Performance ReviewDocument15 pagesFour Year Financial Performance ReviewRahmati RahmatullahNo ratings yet

- Financial ReportDocument35 pagesFinancial ReportDaniela Denisse Anthawer LunaNo ratings yet

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- CNXX JV 2012 Verkort 5CDocument77 pagesCNXX JV 2012 Verkort 5CgalihNo ratings yet

- Pt11. Equity AnalysisDocument20 pagesPt11. Equity AnalysisANASTASIA AMEILIANo ratings yet

- Marchex 10Q 20121108Document60 pagesMarchex 10Q 20121108shamapant7955No ratings yet

- USD $ in MillionsDocument8 pagesUSD $ in MillionsAnkita ShettyNo ratings yet

- Analysis of Shareholders' Equity StatementsDocument8 pagesAnalysis of Shareholders' Equity StatementsKaran VermaNo ratings yet

- Fundamentals of Corporate Finance Income StatementDocument9 pagesFundamentals of Corporate Finance Income StatementAltamish AyyazNo ratings yet

- Notes: AssetsDocument13 pagesNotes: AssetsChaitanya BhujadeNo ratings yet

- FM Assignment (Shilpa Kathuroju-48)Document37 pagesFM Assignment (Shilpa Kathuroju-48)shilpaNo ratings yet

- June 2013 Q3 QuarterDocument49 pagesJune 2013 Q3 Quartergrkyiasou33No ratings yet

- TSAU - Financiero - ENGDocument167 pagesTSAU - Financiero - ENGMonica EscribaNo ratings yet

- Tata Steel Balance Sheet and Profit & Loss AnalysisDocument6 pagesTata Steel Balance Sheet and Profit & Loss AnalysisNeel GaralaNo ratings yet

- Nestle and Alcon - The Value of ADocument33 pagesNestle and Alcon - The Value of Akjpcs120% (1)

- Presentation of M.S &SDocument22 pagesPresentation of M.S &SArun SanalNo ratings yet

- SMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011Document18 pagesSMRT Corporation LTD: Unaudited Financial Statements For The Second Quarter and Half-Year Ended 30 September 2011nicholasyeoNo ratings yet

- Section 2 Group 6 FADMDocument77 pagesSection 2 Group 6 FADMRavi KumarNo ratings yet

- 70 XTO Financial StatementsDocument5 pages70 XTO Financial Statementsredraider4404No ratings yet

- MU PLC Annual Report 2002 Financial StatementsDocument21 pagesMU PLC Annual Report 2002 Financial StatementsNurlisaAlnyNo ratings yet

- HKSE Announcement of 2011 ResultsDocument29 pagesHKSE Announcement of 2011 ResultsHenry KwongNo ratings yet

- Life Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-QDocument33 pagesLife Time Fitness, Inc.: United States Securities and Exchange Commission Washington, D.C. 20549 FORM 10-Qpeterlee100No ratings yet

- IT TopicsDocument1 pageIT TopicsVasantha ShetkarNo ratings yet

- Video Rental Industry - NotesDocument5 pagesVideo Rental Industry - NotesVasantha ShetkarNo ratings yet

- Southwest Airlines 2002 challenges and recommendationsDocument2 pagesSouthwest Airlines 2002 challenges and recommendationsVasantha ShetkarNo ratings yet

- IKEADocument1 pageIKEAVasantha Shetkar100% (1)