Professional Documents

Culture Documents

Case 1: Ali Farhoomand

Uploaded by

Kamran AhmedOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Case 1: Ali Farhoomand

Uploaded by

Kamran AhmedCopyright:

Available Formats

CASE 1

Alibaba.com

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Ali Farhoomand

University of Hong Kong

China is a place where miracles are made. Jack Ma had made it his aim to make the Alibaba Group

Jack Ma, founder and chairman of Alibaba one of three largest Internet companies in the world and

Group1 a Fortune 500 company.7 Could the IPO be the first step

to Alibaba.com’s global market dominance, or would it

On November 6, 2007, Alibaba.com debuted on the be overtaken just as quickly as it rose to regional pre-

Hong Kong Stock Exchange, raising US$1.5 billion to eminence?

become the world’s biggest Internet stock offering since

Google’s initial public offering (IPO) in 2004. On the

first trading day, frenzied purchases of the stock pushed Internet and E-Commerce

prices up by 193 percent, the fourth-largest first-day in China

gain in Hong Kong’s stock exchange in three years. The

closing price of US$5.092 per share gave Alibaba.com a The world’s most populous nation had 162 million

value of about US$25.6 billion, making it the fifth-most- Internet users as of June 2007.8 Although the Chinese

valuable Internet company and the largest in Asia outside Internet-using population was second only to that of

Japan. It also made the company’s stock among the most the United States,9 China’s Internet penetration rate

expensive on the Hong Kong exchange,3 trading at 306 of 12.3 percent significantly trailed those of the United

times its projected 2007 earnings of US$83.6 million.4 In States, Japan, and South Korea, whose penetration

contrast, Yahoo!, a globally recognized “dot-com” brand rates were all more than 65 percent.10 Nevertheless,

that held a 39 percent stake in pre-IPO Alibaba.com, and with the penetration rate growing at around three

Japan’s SoftBank, which owned 29.3 percent of Alibaba. percentage points annually (see Exhibit 1), China was

com prior to the IPO, traded at only around 60 times their expected to experience even more rapid growth in the

projected earnings. In other words, shareholders had dis- scale of penetration, having crossed the critical thresh-

played extreme optimism about Alibaba.com’s prospective old of 10 percent and heading into the steep phase of

earnings by paying a significant premium to own the the S-curve.11

company’s shares. Similarly, e-commerce was still in its infancy in

Barely a week after the IPO, Alibaba.com was already China. Official figures estimated that only 25.5 percent of

reported to be in talks with SoftBank to set up a joint Internet users in China had engaged in online shopping,

venture in early 2008 in Japan. Although the Japanese whereas the figure was 71 percent in the United States.

telecom giant disclosed no details regarding the proposed The utilization rate of online sales and marketing was also

venture, it was likely that Alibaba.com would expand its very low—a mere 4.3 percent compared to 15 percent in

service to mobile users in Japan, a market that had been the United States. The only exception to the trend was the

impenetrable to the Chinese e-commerce company.5 On its rate of online stock transactions, which was 14.1 percent,

home turf, parent company Alibaba Group had already narrowly beating the U.S. rate of 13 percent. The official

proven its mettle by topping EachNet, an older rival explanation was the frenzy over the financial markets in

backed by global leader eBay.6 Founder and Chairman China that started around 2006.12

Ricky Lai prepared this case under the supervision of Professor Ali Farhoom and for class discussion. This case is not intended to show effective or ineffective

handling of decision or business processes.

© 2008 by The Asia Case Research Centre, The University of Hong Kong. No part of this publication may be reproduced or transmitted in any form or by any

means—electronic, mechanical, photocopying, recording, or otherwise (including the Internet)—without the permission of The University of Hong Kong.

CHE-HITT-09-0102-Case-001.indd 1 10/5/09 8:49:15 PM

2

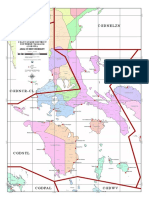

Exhibit 1 China’s Internet Penetration Rate

Case 1: Alibaba.com

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

14.0%

12.3%

12.0%

10.0% 10.5%

9.4%

8.0% 8.5%

7.9%

7.3%

6.0% 6.7%

6.2%

5.3%

4.0% 4.6%

3.6%

2.0%

0.0%

2

7

2

6

‘0

‘0

‘0

‘0

‘0

‘0

‘0

‘0

‘0

‘0

‘0

n

n

ec

ec

ec

ec

ec

Ju

Ju

Ju

Ju

Ju

Ju

D

D

Source: China Internet Network Information Center, 2007, The 20th CNNIC Statistical Survey Report on the Internet Development in China, http://www.cnnic.

net.cn/download/2007/20thCNNICreport-en.pdf (accessed November 19, 2007).

Chinese Internet media market researcher, third-party B2B e-commerce platforms. With the

iResearch Consulting Group, valued the Chinese online Chinese government’s “11th Five-Year Planning for

shopping market at US$1.5 billion in the first quarter the Development of E-Commerce” encouraging SMEs

of 2007. The online shopping market comprised the to use third-party e-commerce platforms, however,

customer-to-customer and business-to-customer the numbers were expected to rise to 41 million and

segments, with the former accounting for US$1.3 82 percent, respectively, in 2012 (see Exhibit 5).17 The

billion, or 89.7 percent of the market in China. Overall, implication was that e-commerce had plenty of room

the Chinese online shopping market recorded a 14.8 for growth in China, at least among SMEs, where the

percent rise in the first quarter of 2007 compared to market was expected to almost quadruple between 2007

the preceding quarter and a massive 64.1 percent jump and 2012.

over the previous year (see Exhibit 2).13 By comparison, The rising popularity of e-commerce among SMEs

the online business-to-business (B2B) market was in China was fueled by several challenges in the tradi-

much bigger, valued at US$65.7 billion in the second tional trade environment, including:

quarter of 2007, increasing 10.4 percent quarter-on- • Limited geographic presence restricting SMEs’ abil-

quarter and a staggering 69.8 percent year-on-year (see ity to develop customer and supplier relationships

Exhibit 3).14 beyond their immediate vicinity

• Fragmentation of suppliers and buyers, which made

it difficult to find and communicate with suitable

SMEs in China trading partners

Small and medium-sized enterprises (SMEs) have been • Limited communication channels and informa-

a key driving force in the booming Chinese economy. tion sources through which to market and promote

In 2004, SMEs contributed 68.8 percent to the nation’s products and services or to find new markets and

gross industrial output (in current prices).15 iResearch suppliers

estimated that the number of SMEs in China would • A relatively small scale of operation, limiting SMEs’

rise from 31.5 million in 2006 to 50 million in 2012 resources for sales and marketing

(see Exhibit 4).16 Out of these 31.5 million Chinese • Absence of efficient mechanisms for evaluating the

SMEs, a mere 8.8 million, or 28 percent, utilized trustworthiness of trading partners18

CHE-HITT-09-0102-Case-001.indd 2 10/5/09 8:49:16 PM

3

Exhibit 2 Growth of the Chinese Online Shopping Market

Case 1: Alibaba.com

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

19.1%

1.8 20%

1.5 17%

14.8%

1.2 14%

12.0%

Growth (%)

US$ billion

0.9 11%

7.2%

0.6 8%

0.3 0.9 1.0 1.1 1.3 1.5 5%

0.0 2%

2006 Q1 2006 Q2 2006 Q3 2006 Q4 2007 Q1

Transaction value (US$ billion) Growth

Source: iResearch Inc., 2007, China’s online shopping market worth RMB 10.8 billion in Q1 of 2007, http://www.iresearchgroup.com.cn/html/Consulting/Online_

Shopping/DetailNews_id_65929.html, June 18 (accessed November 20, 2007).

Exhibit 3 Growth of the Chinese B2B E-Commerce Market

70.0 21%

18.3%

60.0 18%

16.5%

50.0 15%

11.7%

10.9%

Growth (%)

40.0 12%

US$ billion

10.4%

30.0 9%

34.9 38.7 45.1 53.3 59.5 65.7

20.0 6%

10.0 3%

0.0 0%

2006 Q1 2006 Q2 2006 Q3 2006 Q4 2007 Q1 2007 Q2

China’s B2B e-commerce market transaction value (US$ billion) Growth

Source: iResearch Inc., 2007, China’s B2B e-commerce market reached RMB 489.1 billion in Q2 of 2007, http://www.iresearchgroup.com.cn/html/consulting/

B2B/DetailNews_id_72299.html, November 5 (accessed November 20, 2007).

CHE-HITT-09-0102-Case-001.indd 3 10/5/09 8:49:16 PM

4

Exhibit 4 Growth of Chinese SMEs

Case 1: Alibaba.com

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

60 12%

11.2%

10.9%

50 9.1% 10%

8.4%

8.4%

8.0%

7.3% 7.7%

40 7.4% 7.3% 8%

Growth (%)

Million

30 6%

20 4%

22.0 23.6 26.2 28.4 31.5 34.4 37.3 40.3 43.4 46.6 50.0

10 2%

0 0%

2002 2003 2004 2005 2006 2007E 2008E 2009E 2010E 2011E 2012E

Number of SMEs in China Growth

Source: iResearch Inc., 2007, China SME number to reach 50 million in 2012, http://www.iresearchgroup.com.cn/Consulting/others/DetailNews.asp?id=65361,

June 6 (accessed November 22, 2007).

Exhibit 5 Usage of Third-Party E-Commerce among Chinese SMEs

50 100%

90.0%

82%

78%

40 66.4% 72.0% 80%

71%

63.8%

55%

30 60%

Rate (%)

Million

43%

34% 37.5% 39.1%

20 40%

28%

36.8%

19% 32.6%

18.8%

10 12% 20%

4.5% 7% 12.8%

1.0

3.1 5.4 8.8 11.7 16.0 22.0 30.6 36.3 41.0

1.6

0 0%

2002 2003 2004 2005 2006 2007E 2008E 2009E 2010E 2011E 2012E

Number of Chinese SMEs using third-party e-commerce

Percentage of total SMEs

Growth

Source: iResearch Inc., 2007, B2B e-commerce should start with interest of SMEs, http://www.iresearchgroup.com.cn/html/Consulting/B2B/DetailNews_

id_67225.html, July 12 (accessed November 22, 2007).

CHE-HITT-09-0102-Case-001.indd 4 10/5/09 8:49:17 PM

5

Alibaba.com Supplier membership service for Chinese exporters,

Case 1: Alibaba.com

followed in August 2001 by the launch of International

History TrustPass, a membership service catering to exporters

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Alibaba’s first online marketplace was launched as outside of China. China TrustPass was launched in

Alibaba Online in December 1998. Originally, the March 2002 to serve SMEs engaged in domestic trade.

China-based Web site operated as a bulletin board In September 2006, to facilitate the IPO of its B2B

service for businesses to post, buy, and sell trade leads. business, Alibaba underwent a restructuring of its B2B

In June 1999, Jack Ma and 18 other founders formed the arm, Alibaba.com (see Exhibit 6). The principal company

parent company, Alibaba Group, inaugurating its Web emerging from the restructuring, Alibaba.com Limited,

site in simplified Chinese to serve the Chinese mainland became 17 percent–owned by public shareholders, with

market. Three months later, a major operating subsidiary the remaining shares of the company held by the parent

in China, Alibaba China, was established to carry out company, employees, and consultants.

the business of operating B2B marketplaces. Within

months, three more sites were launched: an English site Jack Ma

for international users, a Korean site for Korean users, Lead founder and chairman of Alibaba Group, Jack Ma is a

and a traditional Chinese site for Chinese users outside native of Hangzhou, located about 100 miles southwest of

of China. In October 2000, Alibaba launched the Gold Shanghai, where the company’s headquarters are located.

Exhibit 6 Corporate Structure of Alibaba.com Before and After Restructuring

Before Restructuring:

Alibaba.com

Corporation

(Cayman Islands)

100% 100% 100% 100%

Alibaba.com Alibaba.com Allpay

Hong Kong Alibaba.com Inc Taiwan Holding E-Commerce

Limited (Delaware, USA) Limited Corp.*

(Hong Kong) (BVI) (Cayman islands)

100% 100% 100% 100%

Alibaba.com Alibaba.com Alibaba.com

Alibaba.com

Japan Investment China Japan

Limited

Holding Limited Limited Limited

(Cayman islands)

(Cayman Islands) (Hong Kong) (BVI)

100%

Alibaba.com

Investment

Holding Limited

(BVI)

100%

100%

Inter Network

Technology Alibaba.com

Limited China

(BVI) Limited

(Hong Kong)

Offshore

PRC

100% 100% 100% 100%

Alibaba (China) Alibaba Bejing Sinya

Alibaba (China)

Technology (Shanghai) Online Information

Software Co. Ltd

Co. Ltd Technology Co. Technology Co.

(PRC)

(PRC) Ltd (PRC) Ltd (PRC)

Zhejiang Alibaba

E-Commerce

Co. Ltd (PRC)

(Continued)

CHE-HITT-09-0102-Case-001.indd 5 10/5/09 8:49:17 PM

6

Exhibit 6 Corporate Structure of Alibaba.com Before and After Restructuring (Continued)

Case 1: Alibaba.com

After Restructuring:

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Employees and

Alibaba.com

Consultants of Other Public

Corporation

Alibaba.com and Shareholders

(Cayman Islands)

Alibaba Group

75% 8% 17%

Alibaba.com

Limited

(Cayman Islands)

100%

Alibaba.com

Investment

Holding Limited

(BVI)

100% 100% 100% 100% 100%

Alibaba.com Alibaba.com Alibaba.com Alibaba.com Inc. Alibaba.com

Japan Investment Hong Kong China (Delaware, USA) Taiwan Holding

Holding Limited Limited Limited Limited

(Cayman Islands) (Hong kong) (Hong kong) (BVI)

100% 100%

Alibaba.com Inter Network

Japan Technology

Holding Limited Limited

(BVI) (BVI)

Offshore

PRC

100% 100% 100% 100%

Alibaba (China) Alibaba (China) Alibaba (Shanghai) Bejing Sinya

Technology Software Co. Ltd Technology Co. Ltd Online information

Co. Ltd (PRC) (PRC) Technology Co.

(PRC) Ltd (PRC)

Hangzhou Alibaba

Advertising

Co. Ltd (PRC)

Notes:

________ Denotes equity ownership

_ _ _ _ _ Denotes contractual relationship

* Formerly known as Alibaba.com E-Commerce Corp.

Source: Alibaba.com, 2007, Global Offering Prospectus, 63–64.

CHE-HITT-09-0102-Case-001.indd 6 10/5/09 8:49:17 PM

7

Growing up during China’s Cultural Revolution, Ma their English-language Web site, Alibaba.com, which

Case 1: Alibaba.com

became interested in learning English. Starting at age 12, focused on global importers and exporters. The Chinese

and for the next 8 years, he rode his bicycle 40 minutes marketplace was served by their Chinese-language inter-

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

every morning to a hotel near the West Lake and worked face, Alibaba.com.cn, which focused on suppliers and

on his English by giving free tours to foreigners. In spite of buyers trading domestically in China.

this effort, he failed his university entrance examinations The two B2B marketplaces provided a platform to

twice before being accepted to a teachers’ university.19 The facilitate e-commerce between business sellers, whom

low-paying teaching job he was offered after graduation did Alibaba.com referred to as “suppliers,” and wholesale buy-

not interest Ma, and in 1995 he found himself employed ers (see Exhibit 7 for Alibaba. com’s value proposition).

by the Chinese government to settle a dispute between a Suppliers and buyers used the marketplaces to establish

Chinese firm and its U.S. partner. Purportedly, Ma was their presence online, identify potential trading partners,

held captive by the U.S. partner at gunpoint for two days and conduct business with each other. Suppliers and some

before he regained his freedom by agreeing to become a buyers used the marketplaces to host their company pro-

partner in an Internet startup in China, even though he files and catalogues in standardized formats known as

had no concept of the Internet at all.20 “storefronts” and post “listings” such as products, services,

Although he never carried out his end of the deal, and trade leads. Users could view storefronts and listings

Ma came into his first contact with a computer and the in over 30 industry categories and nearly 5,000 product

Internet in Seattle, Washington, and was surprised to categories by either searching for keywords or browsing

find nothing when he searched for “beer” and “China.” through the online industry directory (see Exhibit 8 for a

He then returned to China, borrowed US$2,000, and typical trading process). For many suppliers, their store-

started a company and Web site called China Pages. front or listing was their only presence on the Internet. As

The Web site shared a strikingly similar ideology with of June 30, 2007, there were more than 2.4 million store-

Alibaba.com: to list Chinese companies on the Internet fronts. In the first half of 2007, users posted a monthly

and help foreigners find their Web sites. Eventually, average of 2.9 million new listings on the marketplaces.

China Telecom would buy out Ma’s stake and he would Through active listings, inquiry exchanges, instant

end up returning to civil service to promote e-commerce. messaging, discussion forums, and other user-friendly

Always looking for a chance to fulfill his dream of setting community features, suppliers and buyers formed large,

up his own e-commerce company, Ma stepped out of the interactive online communities on Alibaba.com’s market-

civil service again in 1998 and resumed work on his vision places. In June 2007, Alibaba.com registered more than

to connect Chinese companies to the world through the 540,000 peak simultaneous online users of TradeManager,

Internet. This vision was realized in December of that an instant messaging tool for trade communications. The

year with the launch of Alibaba Online. two marketplaces collectively hosted more than 200 online

forums and more than 4.2 million registered users.

Business Model To enhance the breadth and depth of the market-

By the second quarter of 2007, Alibaba.com was the larg- places, Alibaba.com offered basic features and services to

est online B2B e-commerce company in China, based all registered users free of charge. Revenue was generated

on the number of registered users and market share by from suppliers who purchased services, primarily

revenue.21 The international marketplace was served by membership packages that provided priority placement

Exhibit 7 Alibaba.com’s Value Proposition

Suppliers Buyers

• Access to active global buyer • Access to active global supplier

community community

• Targeted marketing to reach • Broad selection of listings

buyers

• Customer service and training Alibaba.com • Access to high-quality, organized

information

• Easy-to-use interface

• Always online • Convenient, real-time medium

• Budget certainty through a fixed • Authentication and trust profiles

subscription fee model of suppliers

Source: Alibaba.com, 2007, Global Offering Prospectus, 78.

CHE-HITT-09-0102-Case-001.indd 7 10/5/09 8:49:17 PM

8

Exhibit 8 Typical Trading Process in the Alibaba.com Marketplace

Case 1: Alibaba.com

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Suppliers post

product and Suppliers Finalise

service listings Search and buyers Suppliers negotiation,

listings for make trade and buyers place

potential enquiries negotiate orders,

suppliers and transaction arrange

or buyers exchange terms delivery and

information payment

Buyers post

listings to buy

Suppliers and

buyers use

Alibaba.com’s tools

to manage customer

relationships and

trade information

Source: Alibaba.com, 2007, Global Offering Prospectus, 83.

of storefronts and listings in the industry directory United States, followed by 8.7 percent from the European

and search results. These paying members generated Union (excluding the United Kingdom), 8.2 percent

additional revenue by subscribing to value-added from India, 6.2 percent from the United Kingdom, and

services, including purchases of additional keywords to 2.7 percent from Canada.

improve their rankings in search results and premium For the Chinese marketplace, as of the end of June

placement on Alibaba.com’s Web pages for enhanced 2007, Guangdong led in the regional breakdown of regis-

exposure and visibility. tered users with a 21.5 percent share, followed by Zhejiang

with 8.5 percent, Jiangsu with 6.6 percent, Shandong with

Results 5.3 percent, and Shanghai with 4.6 percent.

Alibaba.com experienced significant growth in the number Revenue increased at a staggering cumulative annual

of registered users (Table 1) and in the number of paying growth rate of 94.8 percent from US$48.3 million at the

members (Table 2) from 2004 to mid-2007.22 end of 2004 to US$183.2 million at the end of 2006.

For the international marketplace, as of the end of According to Alibaba.com’s detailed financial data

June 2007, about 17.7 percent of users were based in the (see Exhibit 9), the international marketplace had been

Table 1 Growth in the Number of Alibaba.com’s Registered Users

End of 2004 End of 2005 Year-on-Year End of 2006 Year-on-Year

Total registered users 6.0 million 11.0 million +82.6% 19.8 million +80.2%

International marketplace 1.2 million 1.9 million +67.2% 3.1 million +59.8%

Chinese marketplace 4.8 million 9.0 million +86.3% 16.6 million +84.6%

CHE-HITT-09-0102-Case-001.indd 8 10/5/09 8:49:17 PM

9

Table 2 Growth in the Number of Alibaba.com’s Paying Members

Case 1: Alibaba.com

End of 2004 End of 2005 Year-on-Year End of 2006 Year-on-Year

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Total paying members 77,922 141,614 +81.7% 219,098 +54.7%

International marketplace 11,450 19,983 +74.5% 29,525 +47.8%

Chinese marketplace 66,472 121,631 +83.0% 189,573 +55.9%

Exhibit 9 Alibaba.com Financial Data, 2004–2007

Year ending 31 December Six months ending 30 June

2004 2005 2006 2006 2007

Amount % of Amount % of Amount % of Amount % of Amount % of

revenue revenue revenue revenue revenue

(unaudited)

(in thousands of Rmb, except percentages)

Revenue

International 254,765 70.9 527,227 71.4 991,869 72.7 431,481 72.7 695,398 72.6

marketplace

China 104,670 29.1 211,070 28.6 371,993 27.3 162,156 27.3 260,965 27.3

marketplace

Others — — — — — — — — 1,353 0.1

Total 359,435 100.0 738,297 100.0 1,363,862 100.0 593,637 100.0 957,716 100.0

(1)

Cost of revenue (62,569) (17.4) (126,509) (17.1) (237,625) (17.4) (109,131) (18.4) (122,717) (12.8)

Gross profit 296,866 82.6 611,788 82.9 1,126,237 82.6 484,506 81.6 834,999 87.2

Sales & marketing (194,773) (54.2) (393,950) (53.4) (610,198) (44.8) (299,034) (50.3) (307,428) (32.1)

expenses(1)(2)

Product develop- (19,151) (5.4) (35,678) (4.8) (105,486) (7.7) (47,256) (8.0) (58,278) (6.1)

ment expenses(1)(2)

General and admin- (57,639) (16.0) (101,082) (13.7) (159,969) (11.7) (59,820) (10.1) (88,432) (9.2)

istrative expenses(1)(2)

Other operating (426) (0.1) 14,465 1.9 17,645 1.3 800 0.1 1,190 0.1

(loss) income, net

Profit from opera- 24,877 6.9 95,543 12.9 268,229 19.7 79,196 13.3 382,051 39.9

tion

Interest income 3,591 1.0 7,876 1.1 23,159 1.7 10,340 1.7 17,699 1.8

Profit before 28,468 7.9 103,419 14.0 291,388 21.4 89,596 15.1 399,705 41.7

income taxes

Income tax credits 45,393 12.6 (32,965) (4.5) (71,450) (5.3) (28,253) (4.8) (104,543) (10.9)

(charges)

Profit for the year/ 73,861 20.5 70,454 9.5 219,938 16.1 61,283 10.3 295,207 30.8

period attributable

to equity owners

Notes:

(1) Includes share-based compensation expenses, which are allocated as follows:

(Continued)

CHE-HITT-09-0102-Case-001.indd 9 10/5/09 8:49:18 PM

10

Exhibit 9 Alibaba.com Financial Data, 2004,2007 (Continued)

Case 1: Alibaba.com

Year ending 31 December Six months ending 30 June

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

2004 2005 2006 2006 2007

Amount % of Amount % of Amount % of Amount % of Amount % of

revenue revenue revenue revenue revenue

(unaudited)

(in thousands of Rmb, except percentages)

Cost of 1,936 0.5 8,766 1.2 23,335 1.7 13,258 2.2 6,207 0.7

revenue

Sales & 5,259 1.5 26,920 3.6 50,068 3.7 21,975 3.7 21,517 2.2

marketing

expenses

Product 1,382 0.4 5,126 0.7 16,344 1.2 7,727 1.3 6,582 0.7

development

expenses

General and 2,838 0.8 8,079 1.1 24,157 1.8 10,442 1.8 20,183 2.1

administrative

expenses

Total share- 11,415 3.2 48,891 6.6 113,904 8.4 53,402 9.0 54,489 5.7

based

compensation

expenses

(2) Includes expenses of Alibaba Group not related to the B2B business as follows:

Year ending 31 December Six months ending 30 June

2004 2005 2006 2006 2007

Amount % of Amount % of Amount % of Amount % of Amount % of

revenue revenue revenue revenue revenue

(unaudited)

(in thousands of Rmb, except percentages)

Sales & — — 35,959 4.9 83,186 6.1 58,661 9.9 — —

marketing

expenses

Product — — 1,414 0.2 6,748 0.5 3,705 0.6 — —

development

expenses

General and 9,594 2.7 29,972 4.0 47,573 3.5 18,818 3.2 — —

administrative

expenses

Total 9,594 2.7 67,345 9.1 137,507 10.1 81,184 13,7 — —

Source: Alibaba. Com, 2007, Globl Offering Prospectus, 102–103.

CHE-HITT-09-0102-Case-001.indd 10 10/5/09 8:49:18 PM

11

steadily contributing slightly more than 70 percent of closely met customers’ needs. For example, a number of

Case 1: Alibaba.com

revenue, while the Chinese marketplace brought in just services available to Alibaba.com users, such as e-mail

short of 30 percent. Specifically, Alibaba.com derived and instant messaging, had initially been proposed by

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

around 71 percent of its revenue from Gold Supplier customers and later developed by Alibaba.com.

members of the international marketplace, who paid

at least US$5,373.60 per year for a standard package

and US$8,060.40 for a premium package. Alibaba.com Strategy

indicated that it would merge the two tiers of membership Alibaba.com’s mission was to make it easy to do

beginning November 2007, with the new rate starting at business anywhere.25 To accomplish this mission,

US$6,717.00 per year.23 Alibaba.com set forth a multi-pronged strategy to make

its online marketplaces more effective for SMEs around

Strengths the world.

Alibaba.com believed that it had certain competi- First, Alibaba.com tried to increase the size of its

tive strengths to merit such moves as the membership marketplaces through the expansion of its user base

merger, which would effectively produce more revenue. and active listings. The company believed that the

First, Alibaba.com had built a premier brand in the breadth and quality of users and listings were criti-

e-commerce domain, boasting the highest traffic among cal to the success of the marketplaces. To that end,

all online B2B marketplaces. According to Internet sta- Alibaba.com continued to leverage the networking

tistics compiler Alexa.com, Alibaba.com was the most aspect of its online marketplaces, its leading market

visited site in the e-commerce and international busi- position, and the “Alibaba” brand name to increase its

ness and trade categories,24 in addition to being the larg- user base worldwide. It also planned to conduct targeted

est online B2B company in China. Alibaba.com attracted marketing to potential users in specific industries and

suppliers on the strength of the large number of potential geographic locations.

buyers that used the marketplaces, which in turn attracted Second, Alibaba.com planned to enhance community

more buyers to sign up with Alibaba.com. Alibaba.com’s experiences to further improve user loyalty and activity

breadth and depth in its marketplaces were difficult to through continued development and introduction

replicate, thus creating an effective barrier to new entrants of new features and tools. Specifically, it planned to

and a virtually insurmountable lead over competitors. invest further in the existing instant messaging service,

Second, Alibaba.com focused exclusively on the online forums, and other communication services.

highly lucrative SME sector. Providing tools and solu- Alibaba.com also planned to continue organizing regular

tions tailored to SMEs, Alibaba.com was confident meetings, training, and offline events for registered

in the value proposition of its service offerings. For users and paying members to further build the sense of

example, Alibaba.com provided trust ratings for suppli- community.

ers and buyers, thus facilitating the process of selecting Third, Alibaba.com was keen to monetize its user

potential trading partners. The fixed subscription fee base after providing years of free service to the majority

model also gave budget certainty to SMEs, which were of its members. The company would strive not only to

often budget-sensitive and averse to ad-hoc expendi- convert more users into paying members, but also to

tures. Users and subscribers had responded positively, generate more revenue from existing paying members

leading to the formation of interactive communities at through sales of value-added services, such as addi-

the online marketplaces. Alibaba.com had also installed tional keyword listing and premium listing placement.

staff dedicated to enhancing the community experience Fourth, Alibaba.com planned to selectively expand its

of users to build up loyalty to and trust in the brand. sales and customer service capabilities into international

Third, Alibaba.com was confident about its sales force markets, either directly or through third-party agents,

and customer service support in attracting and retaining to acquire more paying members and sell premium

users, especially those who paid for subscriptions. As services outside China. The company had already taken

of mid-2007, Alibaba.com maintained more than 1,900 the first step by offering Gold Supplier membership

full-time field salespeople in 30 cities across China, more packages to Hong Kong suppliers in 2007. Alibaba.com

than 800 telephone salespeople, and more than 400 full- was already in talks with Japanese telecommunications

time customer-service employees, all of whom were giant SoftBank about a joint venture to tap the

grouped into teams in direct, daily contact with current Japanese market, for which significant upgrades to

and prospective customers. The customer service arm Alibaba.com’s Japanese language Web site were already

provided customer feedback to the sales force which, in the pipeline.

in turn, made use of the findings and worked with the Fifth, Alibaba.com believed that its online market-

product development team to deliver services that more place platform could be extended beyond pure trade

CHE-HITT-09-0102-Case-001.indd 11 10/5/09 8:49:18 PM

12

marketing to address users’ daily business processes, directory was bolstered by the many other B2B services it

Case 1: Alibaba.com

such as customer relationship management and internal offered, such as print business directories and exhibitions.

operations. It aimed to enhance the loyalty of its users by Founded in Hong Kong in 1971 as a monthly trade

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

providing business applications through the marketplace magazine for consumer products made in Asia for export

platform and becoming an integral part of users’ busi- to Western markets, Global Sources claimed to have a

ness operations. For example, it launched an Internet- community of over 647,000 buyers and 160,000 suppli-

based business management application called Alisoft ers as of the end of September 2007.26 Global Sources

Export Edition, developed by sister company Alisoft, for also boasted the following:

users based in China.

Finally, Alibaba.com was set to expand its business • It enabled suppliers to sell to hard-to-reach buyers in

through acquisitions, investments, licensing arrange- over 230 countries.

ments, and partnerships. The underlying objectives • It delivered information on 2 million products

would be to expand its user and revenue base, widen annually.

geographic coverage, enhance content and service • It operated 14 online marketplaces that delivered

offerings, advance its technology, and strengthen its more than 23 million sales leads annually.

talent pool. Alibaba.com also considered leveraging • It published 13 monthly magazines and over 100

its relationship with parent company Alibaba Group sourcing research reports per year.

to seek cross-selling, cross-marketing, and licensing • It organized 9-specific exhibitions that ran 22 times

arrangements and other opportunities. a year across seven cities.

In mainland China, Global Sources had over 2,000

staff members in 44 locations and a community of

Competition from Global Sources over one million registered online users and magazine

Despite Alibaba.com’s dominance in the online B2B readers of its Chinese-language media.

market in China, the company was not immune to Global Sources clearly posed a threat to Alibaba.com

competition from both domestic and international because it was earning more and more of its revenue

competitors (see Exhibit 10). Chief among Alibaba’s online, as evidenced by its 2006 annual report demon-

competitors in the international marketplace was strating that its online businesses generated more than

international B2B giant Global Sources, whose online 40 percent of its total revenue (Table 3).

Exhibit 10 Market Share of China’s Online E-Commerce Market, by Revenue

Others

ChinaChemNet 1.4%

3.8%

HC360.com

9.7%

Made-in-China.com

14%

Alibaba.com

50.0%

Global Sources

21.2%

Source: iResearch Inc., 2007, China’s B2B e-commerce market reached RMB 489.1 Billion in Q2 of 2007, http://www.iresearchgroup.com.cn/html/consulting/

B2B/DetailNews it 72299 html, November 5 (accessed November 20, 2007).

CHE-HITT-09-0102-Case-001.indd 12 10/5/09 8:49:18 PM

13

Table 3 Contributors to Global Sources’s 2006 Revenue27 Other Competition

Case 1: Alibaba.com

Revenue (US$ million) % of total and Constraints

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

Competitors in Alibaba.com’s Chinese marketplace

Online 64.4 41.2

include domestic B2B e-commerce platforms such as

Print 48.7 31.1 HC360.com, the Web site operated by HC International.

As a generalized e-commerce platform, Alibaba.com

Exhibitions 42.1 26.9

also had to contend with specialized platforms that

Miscellaneous 1.3 0.8 focused on vertical coverage of specific industries, such

as ChinaChemNet, which catered to the chemical indus-

Total 156.5

try in China. Because Alibaba.com founded its success

on the breadth of its horizontal coverage of industries,

The growth strategy of Global Sources was built it would be tremendously difficult for it to pursue ver-

around four key foundations:28 tical coverage of a specific industry without upsetting

its basic business model. In addition, there was indirect

• Market penetration through increasing revenue competition from other marketing service providers,

from exhibitions by selling more booths and increas- such as Internet search engines and traditional trading

ing the average revenue per booth; cross-selling to channels, including exhibitions, trade magazines, classi-

clients not using online, print, or shows, particularly fied advertisements, and outdoor advertising.

the large number of new clients patronizing only As Alibaba.com served mostly Chinese SMEs, it was

exhibitions; and expanding the online customer base also captive to the same problems that impeded offline

by offering new services and pricing packages for the commerce, ranging from China’s credit and foreign

new Global Sources Online 2.0. exchange controls to the deficient national distribution

• New product development: Global Sources actively network. Many procedures involved in a successful

increased its online marketplaces, magazines, and business deal, such as financing and shipping, were simply

exhibitions. In 2007, it added 11 new online market- beyond Alibaba.com’s scope. Alibaba.com also faced

places, monthly publications, and trade shows and other issues with online commerce, such as fears about

announced eight new exhibitions to be launched in fraud, privacy, and trust that discouraged businesses

2008 and 2009. from adopting the Internet as a medium of commerce.

• Expansion into China’s domestic B2B market: domes- Internally, Alibaba.com’s executives regarded their

tic trade in China was an attractive growth market charismatic and visionary founder and chairman Jack

and was synergistic with Global Sources’s existing Ma as the company’s cornerstone. However, Ma has

media serving China’s export and import sectors. indicated that his plan is to eventually exit to make room

Global Sources launched new exhibitions in China in for the next generation of leadership. Despite the fact

the hopes of attracting volume buyers as attendees. that many senior executives and potential future lead-

To complement these exhibitions and other vertical, ers of Alibaba.com were handpicked by Ma, questions

industry-focused markets, the company launched remained over the issue of succession, especially with

China Global Sources Online to enable international Ma’s departure looming on the horizon.

suppliers to sell to China’s domestic B2B market. At the end of 2007, Alibaba.com experienced a reshuf-

• Acquisitions and alliances: Global Sources, like fling of its senior management, with several executives

Alibaba.com, was on the lookout for complemen- going on study sabbaticals outside of China. Some indus-

tary businesses, technologies, and products that try watchers believed the move was a precursor to tak-

would help it to achieve and maintain leading posi- ing the company global by equipping its Chinese execu-

tions in the markets it served. In 2007, in support tives with international experience. Such speculation was

of its plans to expand online business within China, heightened by reports that Alibaba.com had encountered

Global Sources acquired the business and Web site difficulties in recruiting international business talent.29

assets of a Beijing-based online media company,

Blue Bamboo China Ventures.

The Way Forward

Given the similarities between the current position- Four months into a record-breaking IPO that significantly

ing and growth strategies of Alibaba.com and Global raised both the capital and profile of the company,

Sources, competition between the two companies for the Alibaba.com’s share price had slipped to around half

vast and growing Chinese market is bound to intensify. of the launch value. Could investor optimism about

CHE-HITT-09-0102-Case-001.indd 13 10/5/09 8:49:18 PM

14

Alibaba.com be slipping? How could Alibaba.com best and mature into an international conglomerate? Would

Case 1: Alibaba.com

utilize the proceeds from the IPO to scale new heights in Alibaba.com thrive under a rising Chinese economy, or

the B2B e-commerce industry and beyond?30 Would it be would its success only last for “One Thousand and One

# 2010 Cengage Learning. All Rights Reserved. May not be scanned, copied or duplicated, or posted to a publicly accessible website, in whole or in part.

able to emerge from the shadows of its totemic founder Nights”?

NOTES

1. R. Kwong & T. Mitchell, 2007, Alibaba shares soar on first day of 15. National Statistics Bureau of China, 2006, China Statistical

trading, Financial Times (Asia Edition), November 7. Yearbook, Chapter 14–1.

2. US$1 = HK$7.76425 on November 6, 2007. 16. iResearch Inc., 2007, China SME number to reach 50 million in

3. R. Kwong & T. Mitchell, 2007, Alibaba shares soar on first day of 2012, http://www.iresearchgroup.com.cn/Consulting/others/

trading, Financial Times (Asia Edition), November 7. DetailNews.asp?id=65361, June 6 (accessed November 22, 2007).

4. US$1 = RMB 7.4638 on November 6, 2007. 17. iResearch Inc., 2007, B2B e-commerce should start with interest of

5. R. Kwong, 2007, SoftBank and Alibaba in Talks, Financial Times SMEs, http://www.iresearchgroup.com.cn/html/Consulting/B2B/

(Asia Edition), November 14. DetailNews_id_67225.html, July 12 (accessed November 22, 2007).

6. B. Liu, 2007, US Giant eBay Loses Ground to Taobao, China Daily, 18. Alibaba.com, 2007 Global Offering Prospectus, 74–75.

April 17. 19. R. Fannin, 2008, How I did it—Jack Ma, Alibaba.com, Inc., 30(1): 105.

7. J. Macartney, 2007, Workaholic’s road to fortune “like riding on a 20. C. Chandler, 2007, China’s Web king, Fortune, December 10, 172.

blind tiger,” The Times, London, November 7. 21. iResearch Inc., 2007, Alibaba IPO Financial Research Report,

8. China Internet Network Information Center, 2007, The latest http://www.iresearchgroup.com.cn/html/Consulting/B2B/Free _

statistics, http://www.cnnic.net.cn/en/index/0O/index.htm (accessed classi__id _1076.html, November 5 (accessed December 11, 2007).

November 19, 2007). 22. Alibaba.com, 2007, Global Offering Prospectus, 102.

9. CIA, 2007, The World Fact Book, https://www.cia.gov/library/ 23. Alibaba.com, 2007, Global Offering Prospectus, 24.

publications/the-world-factbook/rankorder/2153rank.html (accessed 24. Alexa.com, 2008, Browse: E-Commerce, http://www.alexa.com/

November 19, 2007). browse?&CategoryID=298214; Alexa.com, 2008, Browse:

10. China Internet Network Information Center, 2007, The 20th CNNIC International business and trade, http://www.alexa.com/

statistical survey report on the Internet development in China, browse?&CategoryID=42647 (accessed January 2, 2008).

http://www.cnnic.net.cn/download/2007/20thCNNICreport-en.pdf 25. Alibaba. com, 2007, Global Offering Prospectus, 80.

(accessed November 19, 2007). 26. Global Sources, 2007, Investor Relations Factsheet, http://www

11. China Internet Network Information Center, 2007, The 20th CNNIC .corporate.globalsources.com/IRS/IRFACT.HTM (accessed January

statistical survey report on the Internet development in China, 22, 2008).

http://www.cnnic.net.cn/download/2007/20thCNNICreport-en.pdf 27. Global Sources, 2006, Annual Report, 24–25.

(accessed November 19, 2007). 28. Global Sources, 2007, Investor Relations Factsheet, http://www

12. China Internet Network Information Center, 2007, The 20th CNNIC .corporate.globalsources.Com/IRS/IRFACT.HTM (accessed January

statistical survey report on the Internet development in China, 22, 2008).

http://www.cnnic.net.cn/download/2007/20thCNNICreport-en.pdf 29. S. So, 2008, Alibaba reshuffle a precursor to global expansion,

(accessed November 19, 2007). South China Morning Post, January 29.

13. iResearch Inc., 18 June 2007, China’s Online Shopping Market 30. Alibaba.com stated its intention to allocate the net proceeds

Worth Rmb 10.8 Billion in Q1 of 2007, http://www.iresearchgroup from the IPO as follows: 60 percent for strategic acquisitions

.com.cn/html/Consulting/Online_Shopping/DetailNews_id_65929 and business development initiatives, 20 percent to increase the

.html (accessed 20 November 2007). existing businesses both in China and internationally, 10 percent

14. iResearch Inc., 2007, China’s B2B e-commerce market reached to purchase computer equipment and development of new

RMB 489.1 billion in Q2 of 2007, http://www.iresearchgroup.com. technologies, and 10 percent to fund working capital and for

cn/html/consulting/B2B/DetailNews_id_72299.html, November 5 general corporate purposes. Source: Alibaba.com, 2007, Global

(accessed November 20, 2007). Offering Prospectus, 130.

CHE-HITT-09-0102-Case-001.indd 14 10/5/09 8:49:18 PM

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5807)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Statutes Replaced With International Law Public Notice/Public RecordDocument5 pagesStatutes Replaced With International Law Public Notice/Public Recordin1or100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Proof of InsuranceDocument1 pageProof of Insuranceapi-307567061No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Read The Affidavit On The Mar-A-Lago WarrantDocument38 pagesRead The Affidavit On The Mar-A-Lago WarrantNewsdayNo ratings yet

- BIS Admit CardDocument2 pagesBIS Admit CardsantoshNo ratings yet

- Tsering Shakya-Dragon in The Land of SnowsDocument683 pagesTsering Shakya-Dragon in The Land of Snowslazy100% (1)

- Der SturmerDocument2 pagesDer Sturmerapi-552570985No ratings yet

- Political ScienceDocument25 pagesPolitical Scienceashutosh307100% (2)

- Napolcom History and OrgDocument5 pagesNapolcom History and OrgRandy F BabaoNo ratings yet

- 089 Aznar v. DuncanDocument4 pages089 Aznar v. DuncanPatricia Kaye O. SevillaNo ratings yet

- Labour'S Future: Why Labour Lost in 2015 and How It Can Win AgainDocument50 pagesLabour'S Future: Why Labour Lost in 2015 and How It Can Win Againonenationregister100% (4)

- Case VI-B (Yap vs. Paras)Document1 pageCase VI-B (Yap vs. Paras)Lilibeth Dee GabuteroNo ratings yet

- Sesbreno V AglubgubDocument3 pagesSesbreno V AglubgubVampire CatNo ratings yet

- Iloilo City Regulation Ordinance 2006-010Document4 pagesIloilo City Regulation Ordinance 2006-010Iloilo City CouncilNo ratings yet

- Aklanon PeopleDocument5 pagesAklanon PeopleAngielo Gabriel Saagundo100% (1)

- Objects of National Consciousness II: 1. The Coat of ArmsDocument4 pagesObjects of National Consciousness II: 1. The Coat of ArmsEkemini-Abasi50% (2)

- Parliamentary & Presidential Govt.Document14 pagesParliamentary & Presidential Govt.Royal Raj Alig100% (1)

- Statesman Delhi 05 July 2020Document12 pagesStatesman Delhi 05 July 2020Usri PalchaudhuriNo ratings yet

- CH 16 QuizDocument4 pagesCH 16 QuizSamantha MckenzieNo ratings yet

- Contract Award NoticeDocument4 pagesContract Award Noticet1kerscherNo ratings yet

- Brief - Sky Walker AppealDocument48 pagesBrief - Sky Walker AppealEdibles Magazine100% (1)

- Internal Audit in The States and Local Government of MalaysiaDocument33 pagesInternal Audit in The States and Local Government of MalaysiaUmmu ZubairNo ratings yet

- 1985 Pakistani General Election - WikipediaDocument5 pages1985 Pakistani General Election - WikipediaNoor e IlmNo ratings yet

- (ADMIN) (Republic v. Pilipinas Shell Petroleum Corp.)Document2 pages(ADMIN) (Republic v. Pilipinas Shell Petroleum Corp.)Alyanna Apacible67% (3)

- Wesley Pharmacal Co (LG)Document3 pagesWesley Pharmacal Co (LG)James LindonNo ratings yet

- Imperial Japan Pt. 1Document7 pagesImperial Japan Pt. 1Genry ConsulNo ratings yet

- If You Consider Yourself A Liberal : We're Already in AgreementDocument47 pagesIf You Consider Yourself A Liberal : We're Already in AgreementDenisMacEoinNo ratings yet

- Cgdnelzn CGDNWLZN: Coast Guard District Southern Tagalog (CGDSTL)Document1 pageCgdnelzn CGDNWLZN: Coast Guard District Southern Tagalog (CGDSTL)cgacNo ratings yet

- Concept of Government and Its OrgansDocument6 pagesConcept of Government and Its Organszaya sarwarNo ratings yet

- NHD Process PaperDocument2 pagesNHD Process Paperapi-122116050No ratings yet

- Govt To Disburse Compensation Cess Worth Rs 20K CR Announces: SitharamanDocument8 pagesGovt To Disburse Compensation Cess Worth Rs 20K CR Announces: SitharamankhushNo ratings yet