Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

5 viewsRibbons and Bows

Ribbons and Bows

Uploaded by

studyshah123Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You might also like

- Waltham Oil Lube Centre Inc - FinalDocument10 pagesWaltham Oil Lube Centre Inc - Finalerarun2267% (3)

- Group 04 Case 03Document3 pagesGroup 04 Case 03Saranya VsNo ratings yet

- Solution Manual For Accounting Text andDocument17 pagesSolution Manual For Accounting Text andanon_995783707No ratings yet

- Accounting Text & Cases Ed 13th Case 6-3Document1 pageAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNo ratings yet

- Accounting Case 2Document3 pagesAccounting Case 2ayushishahNo ratings yet

- Cash Flow CH 11Document2 pagesCash Flow CH 11ayush sharma75% (4)

- Lone Pine CafeDocument4 pagesLone Pine CafeRahul TiwariNo ratings yet

- Accounting:Text and Cases 2-1 & 2-3Document3 pagesAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- ACCOUNTING STERN CORPORATION (A) AnswerDocument4 pagesACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNo ratings yet

- Inventories BemDocument62 pagesInventories BemRosedel Rosas100% (2)

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Chemalite BDocument12 pagesChemalite BTatsat Pandey100% (2)

- Import Distributors, Inc. : Case 26-1Document2 pagesImport Distributors, Inc. : Case 26-1NishaNo ratings yet

- Baldwin Bicycle Company Case PresntationDocument24 pagesBaldwin Bicycle Company Case Presntationrajwansh_aran100% (4)

- Case Report - Grenell FarmDocument5 pagesCase Report - Grenell Farmajsibal100% (1)

- Chemalite SolutionHBSDocument10 pagesChemalite SolutionHBSManoj Singh0% (1)

- 01 Ribbons N' Bows - SolutionDocument4 pages01 Ribbons N' Bows - SolutionShivam Kanojia100% (2)

- AHM13e Chapter 05 Solution To Problems and Key To CasesDocument21 pagesAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Waltham Oil and Lube CentreDocument5 pagesWaltham Oil and Lube CentreAnirudh Singh0% (2)

- Accounting-Lone Pine Cafe CaseDocument28 pagesAccounting-Lone Pine Cafe CaseMuadz Akbar100% (1)

- Problem 3-1Document2 pagesProblem 3-1Omar CirunayNo ratings yet

- Save Mart and Copies Express CaseDocument7 pagesSave Mart and Copies Express CaseanushaNo ratings yet

- 7-2 John Holtz (C) Case Study SolutionsDocument14 pages7-2 John Holtz (C) Case Study SolutionsAashima Grover100% (1)

- Case 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalDocument5 pagesCase 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalCyd Marie VictorianoNo ratings yet

- Chap 011Document8 pagesChap 011Neetu RajaramanNo ratings yet

- Maria Hernandez and AssociatesDocument9 pagesMaria Hernandez and AssociatesMalik Fahad YounasNo ratings yet

- 3-The Accounting Information SystemDocument98 pages3-The Accounting Information Systemtibip12345100% (1)

- Chapter 11 Balance SheetDocument12 pagesChapter 11 Balance SheetSha HussainNo ratings yet

- Chapter 3Document17 pagesChapter 3Phan Anh HaoNo ratings yet

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDocument19 pagesBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- anthonyIM 06Document18 pagesanthonyIM 06Jigar ShahNo ratings yet

- Solution For Lone Pine Cafe CaseDocument5 pagesSolution For Lone Pine Cafe CaseShammika Krishna75% (4)

- Waltham Oil and Lube WorkingsDocument5 pagesWaltham Oil and Lube WorkingsGaurav Sahu100% (1)

- Lone Pine CafeDocument13 pagesLone Pine CafeCynthia Anggi Maulina100% (1)

- Case 2-3 Lone Pine Café (A)Document15 pagesCase 2-3 Lone Pine Café (A)Cynthia Anggi Maulina100% (1)

- Bill French Case Study SolutionsDocument8 pagesBill French Case Study SolutionsMurat Kalender100% (1)

- Revenue and Monetary Assets: Changes From Eleventh EditionDocument22 pagesRevenue and Monetary Assets: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- Lone Pine Cafe SolutionDocument5 pagesLone Pine Cafe SolutionRitu ChhipaNo ratings yet

- Chapter 7 (Case) : Joan HoltzDocument2 pagesChapter 7 (Case) : Joan Holtzjenice joy100% (1)

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case Summary WalthamDocument2 pagesCase Summary WalthamAnurag ChatarkarNo ratings yet

- anthonyIM 09Document17 pagesanthonyIM 09Ki Umbara100% (1)

- Chema LiteDocument8 pagesChema LiteHàMềmNo ratings yet

- Basic Concepts of Accounting (Balance Sheet)Document12 pagesBasic Concepts of Accounting (Balance Sheet)badtzmaru0506No ratings yet

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Lori Crump Accounting Case StudyDocument1 pageLori Crump Accounting Case StudyHarsh Anchalia100% (1)

- 4a. Ribbons An' Bows Inc Case & TNDocument7 pages4a. Ribbons An' Bows Inc Case & TNnikhilNo ratings yet

- Ribons and Bows Case Study AccountingDocument6 pagesRibons and Bows Case Study Accountingsalva89830% (1)

- Economie HomeworkDocument6 pagesEconomie HomeworkEdith Muñoz LunaNo ratings yet

- ACCT212 - Financial Accounting - Mid Term AnswersDocument5 pagesACCT212 - Financial Accounting - Mid Term AnswerslowluderNo ratings yet

- ACCA F3 Jan 2014 Examiner ReportDocument4 pagesACCA F3 Jan 2014 Examiner Reportolofamojo2No ratings yet

- FMA - Ethical Case A, RevisedDocument12 pagesFMA - Ethical Case A, RevisedYezena Tegegne75% (4)

- IMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Document3 pagesIMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Ambrish (gYpr.in)No ratings yet

- 6120 - Rana Mahmoud Abd El-Moneim DerbalaDocument4 pages6120 - Rana Mahmoud Abd El-Moneim DerbalaRana MahmoudNo ratings yet

- Lesson 2. Chapter 3. Journal Entries and Prepare Trial BalanceDocument14 pagesLesson 2. Chapter 3. Journal Entries and Prepare Trial BalanceColleen GuimbalNo ratings yet

- CH 1Document52 pagesCH 1Jakaria UzzalNo ratings yet

- Chap 3 Accounting For ManagersDocument19 pagesChap 3 Accounting For ManagersBitan BanerjeeNo ratings yet

Ribbons and Bows

Ribbons and Bows

Uploaded by

studyshah1230 ratings0% found this document useful (0 votes)

5 views20 pagesCopyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views20 pagesRibbons and Bows

Ribbons and Bows

Uploaded by

studyshah123Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 20

Bus 22 Do. Mors

Note: This is a new case for the Twelfth Edition.

Approach

This is an introductory case and it should be taught as an introductory case. There will be

plenty of time in the course for the students to leam the correct form of financial statements and

details of accounting standards. In short, the instructor should be prepared to allow a variety of

formats for the financial statements and tolerate some “not quite correct” accounting.

The instructor may want to have students discuss Carmen's March 31 statement, but the

bulk of the class should focus on the three case questions. Any discussion of the March 31

statement should deal with the nature of the various accounts (ie. prepaid rent is rent paid in

advance of using the property and it is an asset because it has future economic benefits for the

company, ete), rather than the format of the statement, It is better to leave the beginning of the

course’s instruction in financial statement formats to the assigned case question discussions.

Comments on Information Gathered and Carmen’s Concerns

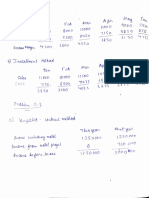

1. The three month sales total is the sum of the cash sales ($7,400) and credit sales ($320).

2. Cost of sales is derived from the following equation

Beginning merchandise inventory

Plus Purchases

Equals Total available merchandise

Less Ending merchandise inventory

Equals Cost of sales

3. Rent expense is $1,800 of $600 per month times three months. Paid in cash,

4, Part-time employee expenses ($1600) is the sum of cash paid ($1510) plus amount owed

($90).

5. Supplies expense ($80) is beginning supplies inventory ($100) less supplies inventory on

hand on March 31 ($20),

6. The prepaid advertising ($150) was run by the local paper on April 2, The benefit of the

asset expired so the asset became an expense,

7. The commercial sewing machine purchase led to an $1800 asset being recorded (a future

benefit), The asset’s benefit was partly consumed during May and June resulting in a $60

depreciation charge ($1800/ 5 years/ 12 months x 2 months ~ straight line depreciation.)

8. Some of the future benefits of the computer and related software asset were consumed

during the three month period. A $250 depreciation charge must be recognized ($2000/

2/ 12/ x 3 - straight line depreciation.)

9. Cash balance at the end of period lower than beginning balance. See Question |

discussion.

10. Four month’s interest must be recorded on the cousins’ $10,000 loan. ($10,000 x .06 x 4/

12). Carmen has “rented” the cousins’ money for four months, (She forgot to include the

March rent in her March 31 balance sheet.)

11. No depreciation is recorded on the cash register loaned by the local credit-card charge

processor and the furniture left by the former tenant, These “assets” were not recognized

on the financial statement because they were neither donated nor acquired in business

transactions.

12, The uncle’s legal work is neither an asset nor an expense of the business. It did not result

in a business transaction.

13. Carmen’s potential salary payment in July is neither an expense nor a liability as of

March 31. The company does not have an obligation on March 31 to pay her any

compensation,

Question 1

Exhibit 1 presents the company’s initial three month income statement. It does not

contain a provision for taxes, since Carmen at this early date did not know if income taxes

would be due on the annual results,

The principal reasons why the cash balance declined during the three month profitable

operating period are:

1. The commercial sewing machine purchase reduced cash by $1,800 while the

related depreciation charge only reduced income by $90,

2. Ending inventory was higher than beginning inventory and the increase was paid

for with cash, That is, more inventory was bought for cash ($2,900) than the cost

of goods sold ($2,100),

Exhibit 2 present a cash flow analysis for the three month operating period

Question 2

Exhibit 3 presents the company’s June 30 balance sheet.

Question 3

ess is off to a good start, but it will have to do better over the rest of the

.gful compensations and repay the cousins’ loan at

Carmen's bu

year if Carmen plans to pay herself any meani

the end of the year.

When discussing Question 3 some students believe that Carmen should include a

consideration of an imputed compensation expense in deciding how well she has done. Students

accept the non recognition of her compensation in the income statement, but believe she should

recognize that personally she has incurred an opportunity cost for lost wages (at least four

months x $1300).

In addition, students believe Carmen’s nonrecognition of any cost associated with using

the abandoned counters and display equipment overstates how well she is doing from an

economic point of view. These students would include some depreciation cost based on the

asset's fair value in their evaluation of how “successful” the business has been to date.

You might also like

- Waltham Oil Lube Centre Inc - FinalDocument10 pagesWaltham Oil Lube Centre Inc - Finalerarun2267% (3)

- Group 04 Case 03Document3 pagesGroup 04 Case 03Saranya VsNo ratings yet

- Solution Manual For Accounting Text andDocument17 pagesSolution Manual For Accounting Text andanon_995783707No ratings yet

- Accounting Text & Cases Ed 13th Case 6-3Document1 pageAccounting Text & Cases Ed 13th Case 6-3Ki UmbaraNo ratings yet

- Accounting Case 2Document3 pagesAccounting Case 2ayushishahNo ratings yet

- Cash Flow CH 11Document2 pagesCash Flow CH 11ayush sharma75% (4)

- Lone Pine CafeDocument4 pagesLone Pine CafeRahul TiwariNo ratings yet

- Accounting:Text and Cases 2-1 & 2-3Document3 pagesAccounting:Text and Cases 2-1 & 2-3Mon Louie Ferrer100% (5)

- ACCOUNTING STERN CORPORATION (A) AnswerDocument4 pagesACCOUNTING STERN CORPORATION (A) AnswerPradina RachmadiniNo ratings yet

- Inventories BemDocument62 pagesInventories BemRosedel Rosas100% (2)

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Chemalite BDocument12 pagesChemalite BTatsat Pandey100% (2)

- Import Distributors, Inc. : Case 26-1Document2 pagesImport Distributors, Inc. : Case 26-1NishaNo ratings yet

- Baldwin Bicycle Company Case PresntationDocument24 pagesBaldwin Bicycle Company Case Presntationrajwansh_aran100% (4)

- Case Report - Grenell FarmDocument5 pagesCase Report - Grenell Farmajsibal100% (1)

- Chemalite SolutionHBSDocument10 pagesChemalite SolutionHBSManoj Singh0% (1)

- 01 Ribbons N' Bows - SolutionDocument4 pages01 Ribbons N' Bows - SolutionShivam Kanojia100% (2)

- AHM13e Chapter 05 Solution To Problems and Key To CasesDocument21 pagesAHM13e Chapter 05 Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Waltham Oil and Lube CentreDocument5 pagesWaltham Oil and Lube CentreAnirudh Singh0% (2)

- Accounting-Lone Pine Cafe CaseDocument28 pagesAccounting-Lone Pine Cafe CaseMuadz Akbar100% (1)

- Problem 3-1Document2 pagesProblem 3-1Omar CirunayNo ratings yet

- Save Mart and Copies Express CaseDocument7 pagesSave Mart and Copies Express CaseanushaNo ratings yet

- 7-2 John Holtz (C) Case Study SolutionsDocument14 pages7-2 John Holtz (C) Case Study SolutionsAashima Grover100% (1)

- Case 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalDocument5 pagesCase 4-4 Waltham Oil & Lube Center, Inc.: $40,000 Deposit With NationalCyd Marie VictorianoNo ratings yet

- Chap 011Document8 pagesChap 011Neetu RajaramanNo ratings yet

- Maria Hernandez and AssociatesDocument9 pagesMaria Hernandez and AssociatesMalik Fahad YounasNo ratings yet

- 3-The Accounting Information SystemDocument98 pages3-The Accounting Information Systemtibip12345100% (1)

- Chapter 11 Balance SheetDocument12 pagesChapter 11 Balance SheetSha HussainNo ratings yet

- Chapter 3Document17 pagesChapter 3Phan Anh HaoNo ratings yet

- Basic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDocument19 pagesBasic Accounting Concepts: The Income Statement: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- anthonyIM 06Document18 pagesanthonyIM 06Jigar ShahNo ratings yet

- Solution For Lone Pine Cafe CaseDocument5 pagesSolution For Lone Pine Cafe CaseShammika Krishna75% (4)

- Waltham Oil and Lube WorkingsDocument5 pagesWaltham Oil and Lube WorkingsGaurav Sahu100% (1)

- Lone Pine CafeDocument13 pagesLone Pine CafeCynthia Anggi Maulina100% (1)

- Case 2-3 Lone Pine Café (A)Document15 pagesCase 2-3 Lone Pine Café (A)Cynthia Anggi Maulina100% (1)

- Bill French Case Study SolutionsDocument8 pagesBill French Case Study SolutionsMurat Kalender100% (1)

- Revenue and Monetary Assets: Changes From Eleventh EditionDocument22 pagesRevenue and Monetary Assets: Changes From Eleventh EditionDhiwakar SbNo ratings yet

- Lone Pine Cafe SolutionDocument5 pagesLone Pine Cafe SolutionRitu ChhipaNo ratings yet

- Chapter 7 (Case) : Joan HoltzDocument2 pagesChapter 7 (Case) : Joan Holtzjenice joy100% (1)

- (Case 6-7) 5-1 Stern CorporationDocument1 page(Case 6-7) 5-1 Stern CorporationJuanda0% (1)

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- AHM13e Chapter - 03 - Solution To Problems and Key To CasesDocument24 pagesAHM13e Chapter - 03 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Case Summary WalthamDocument2 pagesCase Summary WalthamAnurag ChatarkarNo ratings yet

- anthonyIM 09Document17 pagesanthonyIM 09Ki Umbara100% (1)

- Chema LiteDocument8 pagesChema LiteHàMềmNo ratings yet

- Basic Concepts of Accounting (Balance Sheet)Document12 pagesBasic Concepts of Accounting (Balance Sheet)badtzmaru0506No ratings yet

- Accounting: Stern CorporationDocument12 pagesAccounting: Stern CorporationCamelia Indah Murniwati100% (3)

- Lori Crump Accounting Case StudyDocument1 pageLori Crump Accounting Case StudyHarsh Anchalia100% (1)

- 4a. Ribbons An' Bows Inc Case & TNDocument7 pages4a. Ribbons An' Bows Inc Case & TNnikhilNo ratings yet

- Ribons and Bows Case Study AccountingDocument6 pagesRibons and Bows Case Study Accountingsalva89830% (1)

- Economie HomeworkDocument6 pagesEconomie HomeworkEdith Muñoz LunaNo ratings yet

- ACCT212 - Financial Accounting - Mid Term AnswersDocument5 pagesACCT212 - Financial Accounting - Mid Term AnswerslowluderNo ratings yet

- ACCA F3 Jan 2014 Examiner ReportDocument4 pagesACCA F3 Jan 2014 Examiner Reportolofamojo2No ratings yet

- FMA - Ethical Case A, RevisedDocument12 pagesFMA - Ethical Case A, RevisedYezena Tegegne75% (4)

- IMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Document3 pagesIMT-07 - Working Capital Management - Need Solution - Ur Call/Email Away - 9582940966/ambrish@gypr - In/getmyprojectready@Ambrish (gYpr.in)No ratings yet

- 6120 - Rana Mahmoud Abd El-Moneim DerbalaDocument4 pages6120 - Rana Mahmoud Abd El-Moneim DerbalaRana MahmoudNo ratings yet

- Lesson 2. Chapter 3. Journal Entries and Prepare Trial BalanceDocument14 pagesLesson 2. Chapter 3. Journal Entries and Prepare Trial BalanceColleen GuimbalNo ratings yet

- CH 1Document52 pagesCH 1Jakaria UzzalNo ratings yet

- Chap 3 Accounting For ManagersDocument19 pagesChap 3 Accounting For ManagersBitan BanerjeeNo ratings yet