Professional Documents

Culture Documents

Work Life Balance

Work Life Balance

Uploaded by

shoebahmed03Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Work Life Balance

Work Life Balance

Uploaded by

shoebahmed03Copyright:

Available Formats

Page |1

Section 1

1.0 Introduction:

he issue of Work-Life Balance within banking services has drawn considerable attention over the past few years. The movement towards the better service has increased the development of the banking industry. Employees of the banks are providing lots of services in order to remain competitive in a rapidly changing market. On the other hand banks are rewarding those employees by providing lots of benefits. Nevertheless banks maintain some policies to support employees in balancing their work and life responsibilities. The objective of the report is to examine work-life balance services provided by the banks for their employees. While there have been efforts to study work-life balance services, there is no general measurement on the measurement of the concept. So that the survey questionnaire is divided into six types of policies those are taken by the banks. These are Leave Arrangements, Parenting and Pregnancy Policies, Flexible Work Arrangements, Additional Work Provisions, Formality of Policies and Experiences of the Employees. One of the aims of this study involves the use of Work-Life Balance Survey in order to ascertain how banks work life balance policies support its employees in balancing their work and life responsibilities. Another aim of this term paper is to point out how important are these services for the employees and how these policies could be improved. In the following I have mentioned about the work-life balance policies, findings of the work-life balance survey and the views of the employees about those policies.

1.1 Objective:

The objectives of the report is To measure the work-life balance policies of several banks. To understand the views of the employees about those policies. Finding the ways of improvement of those policies.

Page |2

Analysis of those findings.

1.2 Methodology:

To measure the work-life balance policies I have used here Work-Life Balance SurveyEmployees. The measurement of the policies using this method contains questions about some work-life balance policies from six specific aspects. For four of the aspects I have graded twice: first, whether the bank has the policy or not, then how important the policy is from the employees view. Then I have counted the percentage that whether the bank possess the service or not. I have also measured the score according to the banks employees view.

1.3 Rationale of the Study:

The rationale of this study is that, we dont know all the work-life balance policies provided by different banks. As a result we can not assess how the employees are balancing their work and life responsibilities. So that I have made the analysis of the Work-Life Balance SurveyEmployees to assess the work-life balance policies of different banks.

1.4 Scope and Limitation:

The scope of the report is that we can know about a banks work-life balance policies. As a result we can assess how the employees are balancing their work and life responsibilities. The limitation is that some employees do not want some policies for them. The survey is based on the employees perception. So it may vary.

Page |3

Section 2

2.0 Work-Life Balance Survey-Employees and Its Importance Better work-life balance survey:

The Better Work-Life Balance Survey is a free questionnaire to help employers in evaluating and improving their work-life balance policies. The survey aims to measure how effectively organizations accommodate work-life balance, by assessing employees awareness of work-life balance policies and their comfort levels in using these policies.

Why work-life balance?

Effective work-life balance policies are valuable to businesses and organisations for a number of reasons, including:

reduced staff turnover rates becoming a good employer or an employer of choice increased return on investment in training as employees stay longer reduced absenteeism and sick leave improved morale or satisfaction greater staff loyalty and commitment improved productivity

How the survey will help business/organization

The Better Work-Life Balance survey can help an organization improve and promote work-life balance in the workplace by:

identifying areas of policy development and implementation where change may be required (e.g. improve awareness; change workplace culture); monitoring the effectiveness of organizational changes by readministering the survey after changes have been made; responding to the changing needs of your employees and ensuring employees are aware of existing and changed policies by readministering the survey periodically.

Page |4

Section 3

3.0 Company Information:

In this study I have made the survey on five banks. These are the EXIM Bank, AB Bank, Brac Bank, Islami Bank Bangladesh Ltd and Dutch-Bangla Bank Ltd. In the following I have mentioned the brief of these banks.

3.1 AB Bank

AB Bank Limited, the first private sector bank was incorporated in Bangladesh on 31st December 1981 as Arab Bangladesh Bank Limited and started its operation with effect from April 12, 1982. AB Bank is known as one of leading bank of the country since its commencement 28 years ago. It continues to remain updated with the latest products and services, considering consumer and client perspectives. AB Bank has thus been able to keep their consumers and clients trust while upholding their reliability, across time. During the last 28 years, AB Bank Limited has opened 77 Branches in different Business Centers of the country, one foreign Branch in Mumbai, India and also established a wholly owned Subsidiary Finance Company in Hong Kong in the name of AB International Finance Limited. To facilitate cross border trade and payment related services, the Bank has correspondent relationship with over 220 international banks of repute across 58 countries of the World. In spite of adverse market conditions, AB Bank Limited which turned 28 this year, concluded the 2008 financial year with good results. The Banks consolidated profit after taxes amounted to Taka 230 cr which is 21% higher than that of 2007. The asset base of AB grew by 32% from 2007 to stand at over Tk 8,400 cr as at the end of 2008. The Bank showed strong growth in loans and deposits. Deposit of the Bank rose by Tk. 1518 cr ie., 28.45% while the diversified Loan Portfolio grew by over 30% during the year and recorded a Tk 1579 cr increase. Foreign Trade Business handled was Tk 9,898 cr indicating a growth of over 40% in 2008. The Bank maintained its sound credit rating in 2008 to that of the previous year. The Credit Rating Agency of Bangladesh Limited (CRAB) awarded the Bank an A1 rating in the long term and ST-2 rating in the short Term. AB Bank believes in modernization. The bank took a conscious decision to rejuvenate its past identity an identity that the bank carried as Arab Bangladesh Bank Limited for twenty five long years. As a result of this decision, the bank chose to rename itself as AB Bank Limited and the Bangladesh Bank put its affirmative stamp on November 14, 2007.

Page |5

3.2 Brac Bank

BRAC Bank is a Bangladesh-based financial institution that offers a range of financial and banking services. The company offers corporate banking, retail banking, personal banking, and small and medium enterprise (SME) banking services. It also offers phone banking, locker services, short message service (SMS) banking and internet banking services. The company primarily operates in Bangladesh, where it is headquartered in Dhaka. BRAC Bank Limited, with institutional shareholdings by BRAC, International Finance Corporation (IFC) and Shorecap International, has been the fastest growing Bank in 2004 and 2005. BRAC Bank has been rated as one of the four most successful and sustainable SME Banks in the world. It also has been recognized for ICMAB Best Corporate Award 2007. It had been rated as A in Long Term and ST-2 in short term. A fully operational Commercial Bank, BRAC Bank focuses on pursuing unexplored market niches in the Small and Medium Enterprise Business, which hitherto has remained largely untapped within the country. In the last five years of operation, the Bank has disbursed over BDT 1500 crores in loans to nearly 50,000 small and medium entrepreneurs. The management of the Bank believes that this sector of the economy can contribute the most to the rapid generation of employment in Bangladesh. Since inception in December 2007, the Bank's footprint has grown to 36 branches, 392 SME unit offices and 67 ATM sites across the country. BRAC went public following an initial public offer (IPO) and got listed on Dhaka Stock Exchange (DSE) in 2006. The Company, after approval from SEC, issued 50mn shares at Tk. 170 per share including Tk.70 premium. By the end of 2007, a major portion of the Companys shares were held by the institutions and general public, which accounted for 47.11%.

3.3 Dutch-Bangla Bank Ltd

Dutch-Bangla Bank started operation is Bangladesh's first joint venture bank. The bank was an effort by local shareholders spearheaded by M Sahabuddin Ahmed (founder chairman) and the Dutch company FMO. From the onset, the focus of the bank has been financing high-growth manufacturing industries in Bangladesh. The rationale being that the manufacturing sector exports Bangladeshi products worldwide. Thereby financing and concentrating on this sector allows Bangladesh to achieve the desired growth. DBBL's other focus is Corporate Social Responsiblity (CSR). Even though CSR is now a cliche, DBBL is the pioneer in this sector and termed the contribution simply as 'social responsiblity'. Due to its investment in this sector, DBBL has become one of the largest donors and the largest bank donor in Bangladesh. The bank has won numerous international awards because of its unique approach as a socially conscious bank. DBBL was the first bank in Bangladesh to be fully automated. The Electronic-Banking Division was established in 2002 to undertake rapid automation and bring modern banking services into this field. Full automation was completed in 2003 and hereby introduced plastic money to the Bangladeshi masses. DBBL also operates the nation's largest ATM fleet and in the process drastically cut consumer costs and fees by 80%. Moreover, DBBL choosing the low profitability

Page |6

route for this sector has surprised many critics. DBBL had pursued the mass automation in Banking as a CSR activity and never intended profitability from this sector. As a result it now provides unrivaled banking technology offerings to all its customers. Because of this mindset, most local banks have joined DBBL's banking infrastructure instead of pursuing their own. Even with a history of hefty technological investments and even larger donations, consumer and investor confidence has never waned. Dutch-Bangla Bank stock set the record for the highest share price in the Dhaka Stock Exchange in 2008.

3.4 EXIM Bank

EXIM Bank Limited was established in 1999 under the leadership of Late Mr. Shahjahan Kabir, founder chairman who had a long dream of floating a commercial bank which would contribute to the socio-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream. In deed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. Nazrul Islam Mazumder became the honorable chairman after the demise of the honorable founder chairman. This bank starts functioning from 3rd August, 1999 with Mr. Alamgir Kabir, FCA as the advisor and Mr. Mohammad Lakiotullah as the Managing Director. Both of them have long experience in the financial sector of our country. By their pragmatic decision and management directives in the operational activities, this bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management. The authorized capital and paid up capital of the bank are Tk. 3500.00 million and Tk 2677.80 million respectively. The bank has migrated all of its conventional banking operation into Shariah based Islami banking since July/2004.

3.5 Islami Bank Bangladesh Ltd

Bangladesh is one of the largest Muslim countries in the world. The people of this country are deeply committed to Islamic way of life as enshrined in the Holy Qur'an and the \ Sunnah. Naturally, it remains a deep cry in their hearts to fashion and design their economic lives in accordance with the precepts of Islam. The establishment of Islami Bank Bangladesh Limited on March 13, 1983, is the true reflection of this inner urge of its people, which started functioning with effect from March 30, 1983. This Bank is the first of its kind in Southeast Asia. It is committed to conduct all banking and investment activities on the basis of interest-free profitloss sharing system. In doing so, it has unveiled a new horizon and ushered in a new silver lining of hope towards materializing a long cherished dream of the people of Bangladesh for doing

Page |7

their banking transactions in line with what is prescribed by Islam. With the active co-operation and participation of Islamic Development Bank (IDB) and some other Islamic banks, financial institutions, government bodies and eminent personalities of the Middle East and the Gulf countries, Islami Bank Bangladesh Limited has by now earned the unique position of a leading private commercial bank in Bangladesh. IBBL at a glance:

Date of Incorporation Inauguration of 1st Branch (Local office, Dhaka) Formal Inauguration Share of Capital Local Shareholders Foreign Shareholders Authorized Capital Paid-up Capital Deposits Investment (including Investment in Shares) Foreign Exchange Business

13th March 1983 30th March 1983 12th August 1983

41.77% 58.23% Tk. 10,000.00 million Tk. 7,413.00 million Tk. 265,193.00 million Tk. 255,178.00 million Tk. 277,739.00 million

Page |8

Section 4

4.0 Data Analysis:

In this study I have measured whether a bank follows the work-life balance policies or not. Then I have counted the percentage of it. The importance of the policies according to the employees view is also mentioned here. Work-life balance survey-employees contain six types of policies such as Leave Arrangement, Parenting and Pregnancy Policies, Flexible Work Arrangements, Additional Work Provisions, Formality of Policies and Experiences of the Employees. These policies have been analyzed below from the perspectives of five banks.

4.1 Leave Arrangements:

Leave arrangements are different types of leaves that the bank has for its employees. Bank provides these services to its employees for balancing their work and life responsibilities. I have made survey on five banks. Based on the leave arrangements dimension the findings of these banks are: Name of Banks Leave Arrangements Does the bank has this policy? (In Importance terms of %) Score (In scale of 40) Yes No Dont Know 37.5% 62.5% 0 24 62.5% 37.5% 0 35 62.5% 50% 25% 50% 50% 12.5% 0 0 35 35 28 Description of the Score Average Very Important Very Important Very Important Important

AB Bank Brac Bank Dutch-Bangla Bank Ltd EXIM Bank

Islami Bank Bangladesh 50% Ltd

Importance Range:

Range of the Score 0 - 8 9 - 16 17- 24 25- 32 33- 40 Description Very Unimportant Unimportant Average Important Very Important

Page |9

Explanation Using Chart: Maintenance of the policy by the Banks:

Importance Score (In scale of 40):

P a g e | 10

4.2 Parenting and Pregnancy policies:

This is another type of work-life balance policy. It indicates whether the bank provides paternity, maternity, adoption, pre-natal etc leaves or not. I have made survey on five banks. Based on the Paternity and Pregnancy Policy dimension the findings of these banks are:

Name of Banks

AB Bank Brac Bank Dutch-Bangla Bank Ltd

Parenting and Pregnancy Policy Does the bank has this policy? (In Importance terms of %) Score (In scale of 50) Yes No Dont Know 50% 50% 0 38 40% 60% 0 41 50% 30% 70% 50% 20% 10% 0 40 36 34

Description of the Score Important Very Important Important Important Important

EXIM Bank 20% Islami Bank Bangladesh 50% Ltd

Importance Range:

Range of the Score 0 - 10 11 - 20 21- 30 31- 40 41- 50 Description Very Unimportant Unimportant Average Important Very Important

P a g e | 11

Explanation Using Chart: Maintenance of the policy by the Banks:

Importance Score (In scale of 50):

P a g e | 12

4.3 Flexible Work Arrangement:

It indicates that whether an employee can share his or her job or not, can work from home or not, has the opportunity to negotiate part-time work for full-time, option of self-rostering, gradual retirement. I have made survey on five banks. Based on the flexible work arrangement dimension the findings of these banks are:

Name of Banks

AB Bank Brac Bank Dutch-Bangla Bank Ltd

Flexible Work Management Does the bank has this policy? (In Importance terms of %) Score (In scale of 35) Yes No Dont Know 0 100% 0 26 14.29% 71.43% 14.29% 24 14.29% 57.14% 28.57% 30 85.71% 85.71% 14.29% 0 19 22

Description of the Score Important Important Very Important Average Important

EXIM Bank 0 Islami Bank Bangladesh 14.29% Ltd

Importance Range:

Range of the Score 0 - 7 8 - 14 15- 21 22- 28 29- 35 Description Very Unimportant Unimportant Average Important Very Important

P a g e | 13

Explanation Using Chart: Maintenance of the policy by the Banks:

Importance Score (In scale of 35):

P a g e | 14

4.4 Additional Work Provision:

This work-life balance policy consists of telephone for personal use, counselling services for employees, referral services for employees, health programs, parenting or family suppport program, exercise facilities, relocation or placement assistances, equal access to promotion. I have made survey on five banks. Based on the additional work provision dimension the findings of these banks are:

Name of Banks

AB Bank Brac Bank Dutch-Bangla Bank Ltd EXIM Bank

Additional Work Provision Does the bank has this policy? (In Importance terms of %) Score (In scale of 40) Yes No Dont Know 25% 75% 0 30 37.5% 50% 12.5% 27 37.5% 62.5% 0 33 62.5% 25% 62.5% 12.5% 0 37 28

Description of the Score Important Important Very Important Very Important Important

Islami Bank Bangladesh 37.5% Ltd

Importance Range:

Range of the Score 0 - 8 9 - 16 17- 24 25- 32 33- 40 Description Very Unimportant Unimportant Average Important Very Important

P a g e | 15

Explanation Using Chart: Maintenance of the policy by the Banks:

Importance Score (In scale of 40):

P a g e | 16

4.5 Formality of Policies:

I have made survey on five banks. Based on the formality of policies dimension the findings of these banks are:

Name of Banks

Formality of policies Does the bank has this policy? (In terms of %) Yes No Dont Know 100% 0% 0% 0% 100% 0% 100% 0% 0% 66.67% 0% 0% 33.33% 0%

AB Bank Brac Bank Dutch-Bangla Bank Ltd EXIM Bank

Islami Bank Bangladesh 100% Ltd

Explanation Using Chart: Agreement Level of Employees:

P a g e | 17

4.6 Employees Experiences in the Organization;

This section describes employees experiences about the work-life balance policies. It also shows their level of agreement for each statement. I have made survey on five banks. Based on the experiences of employees about the work-life balance policies the findings of these banks are: Name of Banks AB Bank Brac bank Dutch-Bangla Bank Ltd EXIM Bank Islami Bank Bangladesh Ltd Employees Experiences in the Organization Score (In the Description of the Score scale of 105) 75 Agree 65 Agree 70 Agree 72 Agree 55 Uncertain

Agreement Level Range:

Range of the Score 0 - 21 22 - 42 43- 63 64- 84 85- 105 Description Strongly Disagree Disagree Uncertain Agree Strongly Agree

Explanation Using Chart:

P a g e | 18

Overall Comparison:

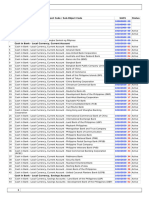

Name of Scal AB Bank Policies e of Scor Policy Imp e Mainte orta nance nce Scor e Leave 37.5% 24 Arrangem ent 40 Parenting 50 50% 38 and Pregnancy Policies Flexible 35 0% 26 Work Arrangem ent Additional 40 25% 30 Work Provision Formality of Policies Employee 105 s Experienc e in the organizati on 100% 75 _ _

Brac Bank Policy Mainte nance 62.5% 40%

DBBL

EXIM Bank Impo Policy rtanc Mainte e nance Score 35 40 50% 20% Impo rtanc e Scor e 35 36

IBBL Policy Sco Maint re enance 50% 50% 28 34

Impo Policy rtanc Mainte e nance Score 35 41 62.5% 50%

14.29%

24

14.29%

30

0%

19

14.29 % 37.5%

22

37.5%

27

37.5%

33

62.5%

37

28

0% 65 _

100% 70 _

0% 72 _

100%

_ 55

P a g e | 19

Explanation Using Chart:

Maintenance of the Policies:

Grading of Banks:

In my study I have found that different banks are following different work-life balance policies. And all the work-life balance policies are not maintained by all banks. So that I have graded these banks according to their maintenance of the work-life balance policies.

P a g e | 20

Policy Maintenance level Name of Policies AB Bank Brac Bank DBBL EXIM Bank Islami Bank

Leave 37.5% Arrangement *** Parenting Pregnancy Policies and 50% *****

62.5% ***** 40% **** 14.29% ***** 37.5% **** 0% 18

62.5% ***** 50% ***** 14.29% ***** 37.5% **** 100% ***** 24

50% **** 20% *** 0%

50% **** 50% ***** 14.29% ***** 37.5% **** 100% ***** 23

Flexible Work 0% Arrangement Additional Work 25% Provision *** Formality Policies Total value of 100% ***** 16

62.5% ***** 0% 12

No. of star ***** **** *** ** *

Indication Grade-1 Grade-2 Grade-3 Grade-4 Grade-5

Value of grade 5 4 3 2 1

P a g e | 21

Explanation Using Chart:

P a g e | 22

Section 5

5.0 Conclusion and Recommendation: Conclusion:

In this paper, after getting the responses from the employees of the banks I have analyzed those data. I have graded those banks according to their policy maintenance level. I have given value for each grade based on their maintenance level. The total score of the banks according to their maintenance level are- Dutch-Bangla Bank-24, Islami Bank Bangladesh Ltd-23, Brac Bank18, AB Bank-16, EXIM Bank-12. So it can be realized that the Dutch-Bangla Bank Ltd is in the superior position, Islami Bank Bangladesh ltd is in the second position, Brac Bank is in the third position, AB Bank is in the fourth position and EXIM Bank is in the fifth position. So DutchBangla Bank Ltd is maintaining better work-life balance policies for their employees. So graphically it has been depicted in the following-

P a g e | 23

Recommendations:

Though these banks are following work-life balance policies, but they are not following these policies fully. So these banks should upgrade their lacking to provide the better work-life balance policies. Though DBBL is in the superior position it should increase its flexible work arrangement and additional work provision policies. IBBL should increase its flexible work arrangements, leave arrangements and parenting & pregnancy polices. Brac Bank should increase its parenting & pregnancy policies, flexible work arrangement, additional work provision and formality of policies. AB Bank should increase its flexible work arrangements and additional work provisions. EXIM Bank should increase its parenting & pregnancy policies, flexible work arrangements and formality of policies.

References: www.google.com www.dbbl.com.bd www.ibbl.com.bd www.bracbank.com www.abbank.com.bd www.eximbankbd.com

Appendix: Questionnaire of the Better Work-Life Balance Survey.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- September 13, 2018 Statement PDFDocument6 pagesSeptember 13, 2018 Statement PDFAnonymous MNcPT60% (1)

- Banking: What You Should Know About..Document16 pagesBanking: What You Should Know About..Muhammad Fahad AkhterNo ratings yet

- An Analysis On Education Loan.Document71 pagesAn Analysis On Education Loan.Akash Kamlakar60% (5)

- Muthopay PPT April 2019 - Compressed PDFDocument14 pagesMuthopay PPT April 2019 - Compressed PDFReyad RahmanNo ratings yet

- Introduction To M CommerceDocument20 pagesIntroduction To M Commerceshubhangi vijayNo ratings yet

- Daily Bell Review On Wörgl, Gesell, The Fabian Society, and The Alternative MediaDocument147 pagesDaily Bell Review On Wörgl, Gesell, The Fabian Society, and The Alternative MediaprofdrgenNo ratings yet

- Accounts Project Work: ST Xavier S Sen SEC SchoolDocument23 pagesAccounts Project Work: ST Xavier S Sen SEC SchoolVivek Pandey100% (1)

- Patterns in International Banking: Key Take-Aways and ImplicationsDocument14 pagesPatterns in International Banking: Key Take-Aways and ImplicationsDenis DenisNo ratings yet

- Chart of AccountDocument31 pagesChart of Accountjerome.barco.0694No ratings yet

- Chinese Bond Buying ProgramDocument2 pagesChinese Bond Buying Programshahil_4u100% (1)

- BPI Vs Suarez G.R. No. 167750Document10 pagesBPI Vs Suarez G.R. No. 167750JetJuárezNo ratings yet

- CA CPT Express Material 2015 16 Caultimates ComDocument112 pagesCA CPT Express Material 2015 16 Caultimates Comrishabh jain100% (1)

- Cavite Development Bank Vs Sps Lim, GR No. 131679Document5 pagesCavite Development Bank Vs Sps Lim, GR No. 131679LOUISE ELIJAH GACUANNo ratings yet

- Training Manager VP Banking in Chicago IL Resume Anthony FernandezDocument2 pagesTraining Manager VP Banking in Chicago IL Resume Anthony FernandezAnthonyFernandez2No ratings yet

- Determinants of Deposit Mobilization of Private Commercial PDFDocument8 pagesDeterminants of Deposit Mobilization of Private Commercial PDFNahidul Islam IUNo ratings yet

- Comparative Analysis Among Different Types of SME Loan Products of BRAC Bank LimitedDocument71 pagesComparative Analysis Among Different Types of SME Loan Products of BRAC Bank LimitedRuhul Rony Syed100% (1)

- Hons AdmitCard 2022 2023 HONS 5309015Document1 pageHons AdmitCard 2022 2023 HONS 5309015Zonayat HosainNo ratings yet

- AR Invoice InterfaceDocument4 pagesAR Invoice InterfaceprinjurpNo ratings yet

- MW 86Document25 pagesMW 86ekibentoNo ratings yet

- FAQs On DBS Wealth Management AccountDocument2 pagesFAQs On DBS Wealth Management AccountkarpeoNo ratings yet

- Qualification Recognition ManualDocument16 pagesQualification Recognition Manualannapanna1No ratings yet

- 9706 s06 QP 1Document12 pages9706 s06 QP 1roukaiya_peerkhanNo ratings yet

- Review Test in General Mathematics 11: Clara Mae Macatangay 1Document5 pagesReview Test in General Mathematics 11: Clara Mae Macatangay 1Clara Mae0% (1)

- Cash Flow Statement Analysis Hul FinalDocument10 pagesCash Flow Statement Analysis Hul FinalGursimran SinghNo ratings yet

- Account Statement From 1 Feb 2019 To 31 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Feb 2019 To 31 Jan 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceITI AnjarNo ratings yet

- State Bank of TravancoreDocument3 pagesState Bank of TravancoreSwati TiwariNo ratings yet

- Atm With An EyeDocument20 pagesAtm With An EyeSohail KhanNo ratings yet

- SUNNY English PDFDocument4 pagesSUNNY English PDFSRIBGIONo ratings yet

- AIS Chapter-12 Test BankDocument8 pagesAIS Chapter-12 Test BankAhmed Naser100% (2)

- Press Note 2 of FDI 2012Document2 pagesPress Note 2 of FDI 2012balaji84_caNo ratings yet