Professional Documents

Culture Documents

Role of Technical Analysis: As A Tool For Trading Decisions

Role of Technical Analysis: As A Tool For Trading Decisions

Uploaded by

cbrcoderOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Role of Technical Analysis: As A Tool For Trading Decisions

Role of Technical Analysis: As A Tool For Trading Decisions

Uploaded by

cbrcoderCopyright:

Available Formats

ROLE OF TECHNICAL ANALYSIS: AS A TOOL FOR TRADING DECISIONS

What is Technical Analysis? We can define Technical Analysis as a study of the stock market considering factors related to the supply and demand of stocks. Technical Analysis doesnt look at underlying earnings potential of a company while evaluating stocks {unlike fundamental Analysis}. It uses charts and computer programs to study the stocks trading volume and price movements in the hope of identifying a trend. In fact the decision made on the basis of technical analysis is done only after inferring a trend and judging the future movement of the stock on the basis of the trend. Technical Analysis assumes that the market is efficient and the price has already taken into consideration the other factors related to the company and the industry. It is because of this assumption that many think technical analysis is a tool, which is effective for short-term investing.

History of Technical Analysis: Technical Analysis as a tool of investment for the average investor thrived in the late nineteenth century when Charles Dow, then editor of the Wall Street Journal, proposed the Dow theory. He recognized that the movement is caused by the action/reaction of the people dealing in stocks rather than the news in itself. Walter Deemer was one of the technical analysts of that time. He started at Merrill Lynch in New York as a member of Bob Farrell' department. Then when the legendary Gerry s Tsai moved from Fidelity to found the Manhattan Fund in 1966, Deemer joined him. Tsai used to consult him before every major block trade, at the start of a time when large volume institutional trading became the norm and the meal ticket for brokers. Deemer, could recreate market history on his charts and cite statistics. He maintained contact with the group of other pros around then, who shared their insights with each other in a collegial confidence worthy of the priesthood.

How is Technical Analysis done? Technical Analysis is done by identifying the trend from past movements and then using it as a tool to predict future price movements of the stock. It can be done by using any of the following methods: a) Moving AveragesThis method is used to predict the trend and specify various support and resistance levels in the short and long term period. Most commonly used moving averages are 30 DMAs and 200 DMAs. Where DMA means Days Moving Average.

b) Charts & PatternsSome analysts uses charts and patterns to decide on the trend and then judge the future movement. The tool used by such analyst is converting the chart in one of the many form of many shapes commonly formed by stocks. Some of such patterns are: Reversal Patterns: 1. Bump and Run 2. Double Top 3. Double Top 4. Double Bottom 5. Head And Shoulders Top 6. Head And Shoulders Bottom 7. Falling Wedge 8. Rising Wedge 9. Rounding Bottom 10. Triple Top 11. Triple Bottom Continuation Patterns: 1.Cup with Handle 2. Flag Pennant 3. Symmetric Triangle 4.Ascending Triangle 5. Descending Triangle 6. Price Channel 7. Rectangle 8. Measured {Bear} Move

Types of trends: Trends can be classified broadly in 3 types. They are: a) Uptrend: - Generally a stock moves in any direction with phases of consolidation or moving against the trend for a short period. But still it creates a higher Highs and Lows in case of an uptrend. In short each short rally will create new High for the stock. b) Downward: - In this case as against Uptrend the stock creates lower Highs and Lows. Furthermore in case of Downtrend the fall is much more steeper than the rise in case of Uptrend. c) Range-bound: - In case of such a trend the price moves in a small range for the long period. There is no apparent direction as far as trend is concerned in this case. Role of Volume: Volume plays a key role in deciding about the kind of future movement in stock. Whenever there is a sudden rise in the volume of the stock and if it is not followed by a price fall, it is a sign of consolidation and that the price may rise in near future. Generally if any stock breaks any trend it is accompanied by huge rise in volume. In case of range bound trend the volume tends to die down to a great extent. Smart investors uses technical analysis to judge the rise in volume and take early positions in the stock during breakthroughs

Who uses Technical Analysis? Investors for their short-term trading decisions use Technical Analysis. This short-term may be further divided in day trading, short-term investment and for hedging purposes. The role played by Technical Analysis in each case is as follows: 1) Day Traders: A day trader is one who takes and squares off his position both on the same day. Mostly a day trader counts on turnover rather than margin. A day trader will interpret the market movement in the manner stated below. . Suppose Mr. X is a day trader who deals in S&P CNX Nifty. The movement of Nifty during a particular day is stated below, if Mr. X follows the recommendations made by Technical Analysis he should sell the Nifty at 1904-1908 levels and again at 1890 level. It can be clearly seen that buying is coming at the level of 1870-1875; it is better He Squares off and can even become a net buyer at this range.

Price falling so better take a sell position

Consistent buying coming at this level thus it is better to take a net buyer position.

2) Short term investors: These people form the biggest clientele base of both the brokers and the Technical Analyst. To explain the working lets take the price movement curve of Infosys Technologies on NSE for the period 1st January 2003 to 9th April 2003. On closely analyzing the chart you will notice that a sustained buying is coming at the level of around Rs.4000. Another aspect, which should be noted, is the declining trend in terms of short term High created by the stock. We can clearly deduce that each short-term rally is creating a lower high over the given term. In such a situation it is recommended by analyst to buy at the resistance level but sell it off immediately if it breaks the level by a margin of 2-3%. This is just an illustrative example and the level of analysis varies with each case.

Infosys Price range

5000 4800 4600 4400 4200 4000 3800 3600 1/1/03 1/15/03 1/29/03 2/12/03 2/26/03 3/12/03 3/26/03 4/9/03 4/9/03 4/23/03

PRICE

DATE

3.Hedgers: These are generally big investors, who have lot of money at stake and hence they look to have some hedging of their risk. The strategy followed by this section of investors is that they compare the stock in consideration with the index and on the basis of the result of this comparison they take their position in the stock. This can be explained by comparing the movement of nifty on the graph with Infosys movement as we have done in the figure given below. If we look at both the charts of nifty movement with Infosys movement we find that although both have fallen over the period but Infosys has witnessed some rallies and hence we can clearly say that a hedger will benefit by using technical Analysis and getting out at the periods when Infosys has given an upward rally.

NIFTY MOVEMENT 1200 index 1100 1000 900 800 1/1/03 1/15/03 1/29/03 2/12/03 2/26/03 3/12/03 3/26/03

DATE

Is Technical Analysis Helpful? If we use only technical analysis in itself and do not consider other aspects it is very unlikely that we will have much success in the long run, particularly in case of short-term investments. But if we use Technical analysis along with fundamental analysis or discount the industry and company related news while considering the valuation, our chances of minimizing the risk brightens. One thing that we must realize is that technical analysis provides us only with the trend and judge future on that basis, it can be far from actual in few cases, one of them was the day Infosys crashed by 30% on a single day. By no imagination and no analysis one could have guessed the same or rather have come closed to it. Therefore the best use of technical analysis is to realize the trend and levels at which it will break the trend so that one is prepared to take positions when such trend breaks. It is because of this disadvantage that Technical analysis more useful only for short-term investing

References: 1.Security Analysis and Portfolio management: D.E.Fisher & R.J.Jordon 2.http://www.datek.smartmoney.com 3.http://www.tradersedgeindia.com 4. http://www.deanlebaron.com 5. http://www.stockcharts.com 6.http://www.nseindia.com

Mridul J alan PGP-1, IIM-Calcutta

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Hippo Valley Research Report August 2012Document18 pagesHippo Valley Research Report August 2012Loretta WiseNo ratings yet

- Corporations Organization Stock Transactions and DividendsDocument8 pagesCorporations Organization Stock Transactions and DividendsMarcoBonaparteNo ratings yet

- FIN80002 Research Assignment 2 Information SheetDocument5 pagesFIN80002 Research Assignment 2 Information SheetashibhallauNo ratings yet

- Cover Page Must Include:: Business Plan FormatDocument2 pagesCover Page Must Include:: Business Plan Formatjhohan freestyle0% (1)

- ACCA Question BankDocument66 pagesACCA Question Bankbbosatravo100% (1)

- Eo 228Document5 pagesEo 228givemeasign24No ratings yet

- Financial Analysis of A BankDocument7 pagesFinancial Analysis of A BankLourenz Mae AcainNo ratings yet

- Record MMMDocument30 pagesRecord MMMAhmad NizarNo ratings yet

- Erona Ress: Schools and MoreDocument16 pagesErona Ress: Schools and MoreAnonymous 9eadjPSJNgNo ratings yet

- Accounting GlossaryDocument242 pagesAccounting GlossaryNelson FernandezNo ratings yet

- Gillette Company: Pressure To Change: Case AnalysisDocument19 pagesGillette Company: Pressure To Change: Case AnalysisAbdul KodirNo ratings yet

- AsianCounsel V8i9Document64 pagesAsianCounsel V8i9Simon Agar100% (1)

- A-Passive Residual Theory of Dividends: 1. Explain The Following TermsDocument8 pagesA-Passive Residual Theory of Dividends: 1. Explain The Following TermsJemmy RobertNo ratings yet

- Sociopolitical IssuesDocument7 pagesSociopolitical IssuesZona StoneNo ratings yet

- Eeee PDFDocument17 pagesEeee PDFAtequr Rahman RanaNo ratings yet

- Worksheet No 1 Bond Pricing - 2016Document2 pagesWorksheet No 1 Bond Pricing - 2016z_k_j_vNo ratings yet

- Mid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340Document12 pagesMid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340yoonNo ratings yet

- Checklist For BuildersDocument4 pagesChecklist For BuildersShinu Nambiar0% (1)

- Financing SME and Economic Development On Brac Bank LTDDocument62 pagesFinancing SME and Economic Development On Brac Bank LTDRifat HossainNo ratings yet

- Annual VBF 2015 Short Report EngDocument277 pagesAnnual VBF 2015 Short Report EngĐỗ Như PhươngNo ratings yet

- TSM Fundraising New Venture AnalysisDocument4 pagesTSM Fundraising New Venture Analysisapi-239554482No ratings yet

- EDUCO101214C-2010-354 - Managing Payroll in Msia - v2Document4 pagesEDUCO101214C-2010-354 - Managing Payroll in Msia - v2khairul100No ratings yet

- Gepco 100609154629 Phpapp02Document60 pagesGepco 100609154629 Phpapp02SyedAshirBukhariNo ratings yet

- PWC Etude2015 Ceo Success StudyDocument53 pagesPWC Etude2015 Ceo Success StudyArnaud DumourierNo ratings yet

- Project Profile On Banana Chips (Big Unit) PDFDocument2 pagesProject Profile On Banana Chips (Big Unit) PDFMridul BarmanNo ratings yet

- India China Growth ComparisonDocument11 pagesIndia China Growth ComparisonSaurabh SabharwalNo ratings yet

- FMR Feb08Document5 pagesFMR Feb08Salman ArshadNo ratings yet

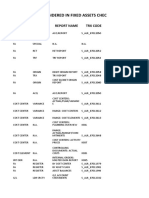

- Points To Be Considered in Fixed Assets Check in Sap: Key 1 Key 2 Report Name TRX CodeDocument7 pagesPoints To Be Considered in Fixed Assets Check in Sap: Key 1 Key 2 Report Name TRX CodeB.S. RawatNo ratings yet

- Kieso Inter Acctg 13e 4p 3Document4 pagesKieso Inter Acctg 13e 4p 3pcsriNo ratings yet

- Lost Stock Certificate, Affidavit ofDocument2 pagesLost Stock Certificate, Affidavit ofShehzad AhmedNo ratings yet