Professional Documents

Culture Documents

Say No To Foreclosure A Plan To Consider Save Your Home

Say No To Foreclosure A Plan To Consider Save Your Home

Uploaded by

Johan WibergOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Say No To Foreclosure A Plan To Consider Save Your Home

Say No To Foreclosure A Plan To Consider Save Your Home

Uploaded by

Johan WibergCopyright:

Available Formats

August 20, 2010 by Neil Garfield UPDATE: This is THE OUTLINE of a plan that is current in its evolution but

by no means complete or the last word. It replaces the entry I made in February of this year. The assumption here is that even without taking mortgage foreclosure cases into consideration, the percentage of cases that actually go to trial is between 5%-15% depending upon how you categorize cases. On the other hand, if you are not prepared for trial and counting on settlement, your opposition will generally know it and have the upper hand in negotiating a settlement. They are going to play for keeps. You should too. Dont assume that the note in front of you is the actual original. Close inspection often reveals it is a color copy. And for heaven sake dont stand there with your mouth hanging open when someone says you are looking for a free house. You are looking for justice. You had your purse snatched in this transaction, you know there is an obligation, but you also know that they didnt perfect the security interest (not your fault) and they received multiple payments from multiple parties on these securitized loans. You want a FULL accounting of all such transactions to determine what balance is due after insurance payments, who is subrogated or substituted on claims, and an opportunity to negotiate a settlement or modification with someone who actually has advanced money on THIS transaction and can show it to be so. WORD OF CAUTION: IF YOU ARE ALREADY IN PROCESS, YOU ARE REQUIRED TO ACT WITHIN THE TIMES SET FORTH BY STATE LAW, FEDERAL LAW, OR THE LAWS OF CIVIL PROCEDURE. FAILURE TO DO SO LEAVES YOU IN AN UPHILL BATTLE TO REVERSE ACTIONS ALREADY TAKEN. ON THE OTHER HAND ACTIONS ALREADY TAKEN FIX THE POSITION OF YOUR OPPOSITION, SINCE THEY CAN NO LONGER ASSERT CHANGES IN CREDITOR, LENDER OR TRUSTEE. THUS IT MIGHT BE EASIER, ACCORDING TO SOME SUCCESSFUL LITIGATORS OUT THERE, TO WAIT UNTIL THE SALE HAS OCCURRED AND THEN ATTACK IT AS A FRAUDULENT SALE, THAN TO TRY TO STOP IT WITH A TEMPORARY RESTRAINING ORDER ETC. CONSIDER BANKRUPTCY, ESPECIALLY CHAPTER 13, WHERE THERE ARE MORE REMEDIES THAN YOU MIGHT THINK IF YOU FILL OUT YOUR SCHEDULES PROPERLY. WE ARE SEEING BETTER RESULTS IN SOME BANKRUPTCY COURTS THAN FEDERAL OR STATE CIVIL COURT PROCEEDINGS.

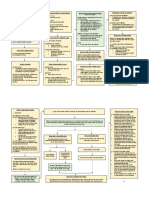

1. Get your act together, stop fighting amongst the members of your household and make a decision as to what you want to do fight or flight? 2. GET SOME HELP NO MATTER WHAT YOU DECIDE. GET THE LOAN SPECIFIC TITLE SEARCH, GET A SECURITIZATION SEARCH, AND GET A LAWYER LICENSED IN THE COUNTY WHERE YOUR PROPERTY IS LOCATED AND MAKE SURE HE/SHE IS NOT STUCK ON THE PROPOSITION THAT YOU SHOULD LOSE. 3. If you choose flight, then by all means try the short-sale or jingle mail strategies that have been discussed on this blog. Do not try to make money on the short-sale, since nobody is going to give it to you. You can make a few dollars by riding out the time in foreclosure without making payments (and hopefully saving the money you would have paid) and by negotiating as high a price (a few thousand dollars) as you can in a deal known as cash for keys. Even for this, you should employ the services of a local licensed attorney at least for consultation. There are several short-sale options that have evolved. Google Edge Simonson or Prime financial. Ive been working on a short-sale-leaseback option that seems to be picking up steam. 4. STRATEGIC DEFAULTS RISING: More and more people of all walks of life including those that have some considerable wealth, are walking away from these properties that were the subject of transactions in which the presumed value of the property was preposterous. This is an option that scare the hair off the pretender lenders because it pouts the power in your hands. They in turn are trying to scare the public with threats of deficiency judgments etc and collections. It is doubtful that many or indeed any deficiency judgments would be awarded, even if they were allowed. But in many cases, particularly in non-judicial states, deficiency judgments are NOT allowed. A version of the strategic default that many people like is to stay as long as possible without paying and then walk. If you are smart about it, you raise your own capital by socking away the payments you would have made. 5. If the decision is fight then the second decision to make is to answer the question fight for what? If you want to buy time, there are many strategies that can be employed, which basically are the same strategies as those used if you are fighting for real. And you might be surprised by the result. Some people get a year or two or even more without payments. You are going to take a FICO hit anyway so why not put some cash in your pocket while you hold back payments. 6. AVOID crazy deals where you give your property or share your property with a stranger. If you persist in engaging such people at least call references and make sure the references are real. Ask questions about their situation and how they feel it worked out to them. Get as much detail as possible. 7. AVOID mortgage modification firms. If you persist in engaging such people at least call references and make sure the references are real. Ask questions about their situation and how they feel it worked out to them. Get as much detail as possible. My opinion is that if they dont pursue an aggressive litigation strategy the statistical probability of you accomplishing anything by going to them is near zero. 8. In all cases, if at all possible: (a) Get all your information together along with a short executive summary of your journal (even if you create the journal now). That means all closing documents, any information you have on title, recording in the county recorders office, the names of all

parties who were at closing (that means not just the actual people who were there, but he names of companies that were represented or mentioned at closing). Also, include in the file any notices of default(NOD) or notice of Trustee sale (NOTS) or summons from a court. (b) Get a MORTGAGE ANALYSIS of the loan transaction itself. THIS INVOLVES THREE PARTS (1) LOAN SPECIFIC TITLE SEARCH AND CHAIN OF TITLE, EXAMINATION OF THE DOCUMENTS, SIGNATURES, AND DATES OF DOCUMENTS PURPORTING TO BE REAL, (2) SECURITIZATION SEARCH THAT CHASES THE MONEY TRAIL AND WILL PROBABLY LEAD YOU TO SOME IMPORTANT ISSUES LIKE THE VERY EXISTENCE OF THE TRUST ASSERTING IT HAS THE RIGHT TO FORECLOSE AS WELL AS MONETARY ISSUES SUCH AS APPLICATION OR ALLOCATION OF PAYMENTS RECEIVED BY THE INVESTOR WHO ADVANCED THE FUNDS FOR THE LOAN AND (3) COMMENTARY AND ANALYSIS THAT IS USABLE BY AN ATTORNEY IN COURT SUCH THAT HE/SHE CAN ARGUE THAT THERE ARE QUESTIONS OF FACT ENTITLING YOU TO PURSUE DISCOVERY. IF YOU WIN THAT POINT YOU ARE ON YOUR WAY TO A SUCCESSFUL CONCLUSION. BUT NOBODY IS GOING TO MAKE IT EASY FOR YOU. (c) Who is your creditor? The TILA Audit alone does nothing without taking further steps. The Trustees Take-down report should be demanded in non-judicial states and if the house is in foreclosure, your written objection should be sent to the Trustee. (d) If someone tells you they are pretty sure or can definitely stop your foreclosure or promises a favorable outcome, and asks for money up front, then run like hell. This is a scam. IF THEY TELL YOU THEY WILL DO WHAT THEY CAN, AND THEY GIVE YOU SOME EXAMPLES OF WHAT THEY WILL BE DOING FOR YOU THEN LISTEN AND GET REFERENCES. (e) Only a Court order stops foreclosure or a Trustee Sale. No letter of any form or substance will stop it unless the other side is intimidated into stopping the action, which sometimes happens when they know their paperwork is out of order. (f) Get a Forensic Mortgage Analysis Report OR AN EXPERT DECLARATION that summarizes in a few pages the potential issues that you should be investigating AND WHICH LENDS SUPPORT TOY OUR DENIAL OF THE DEFAULT, DENIAL OF

THE RIGHT OF THE OPPOSING PARTY TO CLAIM A DEFAULT, DENIAL OF THE RIGHT OF THE OPPOSING PARTY TO FORECLOSE. (g) Get an Expert Declaration that uses the forensic report and the expert opinions of specific experts (like appraisers, title analysts) and which identifies the probable chain of securitization and the money trail. Youll be surprised when you find out there were two yield spread premiums not disclosed to you and that they can total as much or more than the loan itself. GET EXPERT OPINION ON PROBABLE DAMAGES INCLUDING RETURN OF UNDISCLOSED FEES, INTEREST, ETC. (SEE LAWYERS WORKBOOK FROM GARFIELD CONTINUUM). (h) Send the Forensic Report and expert declaration to the known parties, with an instruction to forward it to all other parties known to them in the securitization chain. Include a Qualified Written Request(QWR) AND a Debt Validation Letter(DVL) (which is really a debt verification letter). Dont be surprised if your pretender lenders will come back and tell you your QWR is defective or improper in some way, but thats OK, you have followed statutory procedure and they didnt. With the help of an attorney and with consultation with your experts decide on what resolution you will demand damages, rescission, etc. (i) Dont believe a word about modification. Practically none of them go through. They are leading you into default so they can collect more service fees, and get money out of you that you think is stopping the foreclosure. (j) Dont believe a word that any pretender lender or representative says or represents, even if they are a lawyer, particularly verbal communications that they refuse to confirm in writing. Challenge everything.

(k) Dont accept any document as authentic. Many documents are being fabricated or forged, including affidavits. This is why you need a lawyer and an expert and a Forensic mortgage analysis to determine what documents and parties are suspect and what you should be asking for in discovery and in the QWR and DVL.

(l) YOUR FIRST STRATEGY IS TO RAISE NOT PROVE ISSUES OF FACT. BY PRODUCING A FORENSIC REPORT AND EXPERT DECLARATION, NEITHER YOU NOR YOUR LAWYER NEEDS TO ACQUIRE EXPERTISE IN SECURITIZED LOANS. YOU ONLY NEED TO RAISE THE ISSUE OF FACT BY

SHOWING THE COURT THAT YOU HAVE EXPERTS WHO SAY THE PRETENDER LENDERS/TRUSTEES ETC. ARE NOT CREDITORS AND NOT AUTHORIZED AGENTS WORKING FOR THE CREDITORS. THEY SAY THEY ARE IN FACT THE CREDITORS OR HAVE SOME AUTHORITY GRANTED BY AN ALLEGED CREDITOR. IT IS NOT FOR THE COURT TO ACCEPT ONE VIEW OR THE OTHER, BUT RATHER TO ALLOW DISCOVERY AND AN EVIDENTIARY HEARING ON THE ISSUE OF STANDING (SEE MANY RECENT CASES REPORTED SINCE FEBRUARY ON THIS BLOG). (m) Be very aggressive on discovery. They will argue that even if they are not the creditor and even if they refuse to disclose the identity of the creditor, they are still entitled to disclose because they are the holder of the note and/or mortgage. Your argument will probably be that they still have a duty to disclose the identity of the creditor and the source of the their authority to represent the creditor, along with proof that the creditor has received notice of these proceedings.

Neil Garfield is an attorney with a background on Wall Street. His website is self-help. He offers courses, audits and he opines. Neil is not offering his legal services with this posting. Always consult a competent attorney.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Lawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 2015Document35 pagesLawyer Antognini Files Reply Brief in The Yvanova v. New Century Mortgage, OCWEN, Deutsche California Appeal Case at The California Supreme Court - Filed March 201583jjmack100% (2)

- Digest - Sps. Tio vs. Bpi (Foreclosure) Jan 2019Document1 pageDigest - Sps. Tio vs. Bpi (Foreclosure) Jan 2019Sam LeynesNo ratings yet

- Zarro Inference 2 The Affidavit of Chris Collins On Behalf of JPmorgan Chase Bank, N.A. - July 27, 2011Document29 pagesZarro Inference 2 The Affidavit of Chris Collins On Behalf of JPmorgan Chase Bank, N.A. - July 27, 2011DeontosNo ratings yet

- Landmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD FormatDocument32 pagesLandmark Decision For Homeowners Feb. 2016 From The California Supreme Court in Yvanova v. New Century Appeal in WORD Format83jjmack100% (2)

- Huge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New CenturyDocument33 pagesHuge Win For California Homeowners From The California Supreme Court Feb. 2016 in Yvanova v. New Century83jjmack0% (1)

- Appellant Brief - Alan Jacobs As Trustee For The New Century Liquidating TrustDocument94 pagesAppellant Brief - Alan Jacobs As Trustee For The New Century Liquidating Trust83jjmack100% (3)

- Amicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third CircuitDocument29 pagesAmicus Brief by The National Association of Consumer Bankruptcy Attorneys in The New Century TRS Holdings, Inc. Appeal at The Third Circuit83jjmack100% (1)

- FEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may15Document361 pagesFEDERAL JUDGE DENISE COTE'S 361 PAGE OPINION OF MAY 11, 2015 ON THE CASE: FHFA v. Nomura Decision 11may1583jjmack100% (1)

- The Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 2015Document36 pagesThe Didak Law Office Files Amicus Curiae in Support of Yvanova's Appeal To The California Supreme Court Case S218973 - Amicus Filed April 201583jjmack100% (2)

- New Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.Document4 pagesNew Century Liquidating Trust Still Has Over $23 Million in Cash in Their Bankruptcy - 1ST Quarter 2014 Financial Report From Alan M Jacobs The Apptd. Bankruptcy Trustee For Nclt.83jjmack100% (1)

- New Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For HomeownerDocument34 pagesNew Century Mortgage Bankruptcy Judge's Order Is Vacated by Usdc in Delaware On Appeal - Huge Win For Homeowner83jjmack100% (2)

- Violations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good NewsDocument2 pagesViolations of California Civil Code 1095 - Power of Attorney Law Violated-Gives Homeowner Good News83jjmackNo ratings yet

- Bank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 2014Document2 pagesBank of America Missing Documents-Ginnie Mae Halts Transfer of Servicing Rights April 201483jjmackNo ratings yet

- Homeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering BriefDocument57 pagesHomeowner Helen Galope Overjoyed at Decision by Ninth Circuit Court of Appeal - March 27 2014 - This Is The Deutsche Bank Appellee Answering Brief83jjmackNo ratings yet

- In-Re-MERS V Robinson 12 June 2014Document31 pagesIn-Re-MERS V Robinson 12 June 2014Mortgage Compliance InvestigatorsNo ratings yet

- LPS COURT EXHIBIT #7 Service Providers Even Lexis NexisDocument6 pagesLPS COURT EXHIBIT #7 Service Providers Even Lexis Nexis83jjmackNo ratings yet

- Answering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq ServicingDocument31 pagesAnswering Brief of Appellees Barclays Bank PLC and Barclays Capital Real Estate Inc. D/B/A Homeq Servicing83jjmackNo ratings yet

- Analysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.Document8 pagesAnalysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.83jjmackNo ratings yet

- AIG Offer To Buy Maiden Lane II SecuritiesDocument43 pagesAIG Offer To Buy Maiden Lane II Securities83jjmackNo ratings yet

- The Helen Galope 9th Circuit Filed Appellant Reply Brief Case 12 56892Document73 pagesThe Helen Galope 9th Circuit Filed Appellant Reply Brief Case 12 56892dbush2778No ratings yet

- In The Helen Galope Matter - Plaintiffs Revised Statement of Genuine IssuesDocument28 pagesIn The Helen Galope Matter - Plaintiffs Revised Statement of Genuine Issues83jjmack100% (1)

- Glaski Stands Published Feb. 26 2014 in Decision by The California Supreme CourtDocument4 pagesGlaski Stands Published Feb. 26 2014 in Decision by The California Supreme Court83jjmack100% (1)

- Bank of New York V RomeroDocument19 pagesBank of New York V RomeroMortgage Compliance InvestigatorsNo ratings yet

- Audit of The Department of Justice's Efforts To Address Mortgage FraudDocument57 pagesAudit of The Department of Justice's Efforts To Address Mortgage FraudSam E. AntarNo ratings yet

- Valentine's Day Surprise - A Win For Bruce in Colorado - Order For Dismissal-2014Document5 pagesValentine's Day Surprise - A Win For Bruce in Colorado - Order For Dismissal-201483jjmackNo ratings yet

- Results For "Carrington Mortgage" From The SEC EDGAR: 20 RegistrantsDocument2 pagesResults For "Carrington Mortgage" From The SEC EDGAR: 20 Registrants83jjmackNo ratings yet

- Mers List of Signing OfficersDocument4 pagesMers List of Signing Officers83jjmackNo ratings yet

- Abell Report: Overcoming Barriers To Homeownership in Baltimore CityDocument28 pagesAbell Report: Overcoming Barriers To Homeownership in Baltimore CityKevin ParkerNo ratings yet

- Esther Williams New Client PackageDocument16 pagesEsther Williams New Client PackagejackpotleeNo ratings yet

- Real Estate Principles 11Th Edition Jacobus Test Bank Full Chapter PDFDocument34 pagesReal Estate Principles 11Th Edition Jacobus Test Bank Full Chapter PDFoctogamyveerbxtl100% (8)

- Pacific Wide CaseDocument8 pagesPacific Wide Casewiggie27No ratings yet

- Makati Leasing and Finance Corp. vs. Wearever Textile Mills, Inc. 122 Scra 296Document5 pagesMakati Leasing and Finance Corp. vs. Wearever Textile Mills, Inc. 122 Scra 296Apple Ke-eNo ratings yet

- Magdalena S. de Barretto, Et Al. vs. Jose G. Villanueva, Et Al.Document5 pagesMagdalena S. de Barretto, Et Al. vs. Jose G. Villanueva, Et Al.Arste GimoNo ratings yet

- Credit Cases CompilationDocument65 pagesCredit Cases CompilationCyrusNo ratings yet

- Land Titles and Deeds Complete Compilation of CasesDocument77 pagesLand Titles and Deeds Complete Compilation of CasesmaaNo ratings yet

- Chua vs. NLRCDocument31 pagesChua vs. NLRCAnneNo ratings yet

- 3.1 Ayala Land Inc V CastilloDocument72 pages3.1 Ayala Land Inc V CastilloSheena Reyes-BellenNo ratings yet

- 133 Ridad v. Filipinas InvestmentDocument3 pages133 Ridad v. Filipinas InvestmentMaribel Nicole LopezNo ratings yet

- Credit DigestsDocument22 pagesCredit Digestsjojazz74No ratings yet

- Bachrach Motor V IcarangalDocument2 pagesBachrach Motor V IcarangalKent UgaldeNo ratings yet

- 2.1. Mercene V GSISDocument14 pages2.1. Mercene V GSISJoseph Lorenz AsuncionNo ratings yet

- Uy Siu Pin V CantollasDocument3 pagesUy Siu Pin V CantollasIsabela AlgarmeNo ratings yet

- BWBB3043 Topic 5 Legal Charge.2015Document39 pagesBWBB3043 Topic 5 Legal Charge.2015Wyt TanNo ratings yet

- State of Michigan Tax-Foreclosed Property Auction.Document40 pagesState of Michigan Tax-Foreclosed Property Auction.LansingStateJournalNo ratings yet

- Case Digests (Recent 2022 Cases)Document20 pagesCase Digests (Recent 2022 Cases)Raymer Oclarit100% (1)

- G.R. No. 201264, January 11, 2016 FLORANTE VITUG, Petitioner, v. EVANGELINE A. ABUDA, Respondent. Decision Leonen, J.Document136 pagesG.R. No. 201264, January 11, 2016 FLORANTE VITUG, Petitioner, v. EVANGELINE A. ABUDA, Respondent. Decision Leonen, J.Ronna Faith MonzonNo ratings yet

- Evid Mar 7Document9 pagesEvid Mar 7YANG FLNo ratings yet

- Group 5 - Flowchart of Settlement of Intestate Estate (FINAL)Document4 pagesGroup 5 - Flowchart of Settlement of Intestate Estate (FINAL)Allana Nacino100% (1)

- FORECLOSURE Response To JP Morgan Chase ForeclosureDocument102 pagesFORECLOSURE Response To JP Morgan Chase ForeclosureLAUREN J TRATAR96% (24)

- Key Facts Statement 4605593Document7 pagesKey Facts Statement 4605593Chiranjeet PANDITNo ratings yet

- First Sarmiento Property Holdings, Inc. vs. Philippine Bank of Communications, G.R. No. 202836Document21 pagesFirst Sarmiento Property Holdings, Inc. vs. Philippine Bank of Communications, G.R. No. 202836Sheridan TanNo ratings yet

- Foreclosure of Mortgage LTDDocument29 pagesForeclosure of Mortgage LTDNorr Mann100% (1)

- DBP Vs NLRCDocument2 pagesDBP Vs NLRCKym HernandezNo ratings yet

- Extra Judicial Foreclosure - TayaoDocument5 pagesExtra Judicial Foreclosure - Tayaoroxsanne capatiNo ratings yet

- Property - ReviewDocument71 pagesProperty - ReviewShaniemielle Torres-Bairan100% (1)