Professional Documents

Culture Documents

Vat Rate

Vat Rate

Uploaded by

Swaminathan KonarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vat Rate

Vat Rate

Uploaded by

Swaminathan KonarCopyright:

Available Formats

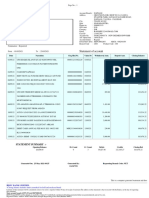

As on 05 Jan 2012 (Pls.

refer the Act before finalising on the rate

Sr. No. State Name

VAT %

5.0

14.5

12.5

5.0

13.5

Add Tax /

SSC / SC %

TOTAL /

Effective

Rate %

1

2

3

4

5

Andra Pradesh

Andra Pradesh

Arunachal Pradesh

Assam

Assam

5.00

14.50

12.50

5.00

13.50

Bihar

5.0

5.00

Bihar

13.5

13.50

8

9

10

11

12

13

Chandigarh

Chandigarh

Chhattisgarh

Chhattisgarh

Delhi

Delhi

5.0

12.5

5.0

14.0

5.0

12.5

5.00

12.50

5.00

14.00

5.00

12.50

14

15

16

17

18

19

20

21

22

23

Goa

Goa

Gujarat

Gujarat

Haryana

Haryana

Himachal Pradesh

Himachal Pradesh

Jammu & Kashmir

Jammu & Kashmir

5.0

12.5

4.0

12.5

5.0

12.5

5.0

13.8

5.0

13.5

5.00

12.50

5.00

15.00

5.25

13.125

5.00

13.75

5.00

13.50

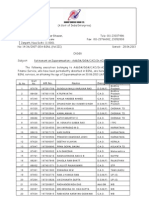

24

Jharkhand

5.0

5.00

25

26

Jharkhand

Karnataka

14.0

5.0

14.00

5.00

27

28

29

30

31

32

33

34

35

36

37

38

39

40

41

42

43

44

45

Karnataka

Kerala

Kerala

Madhya Pradesh

Madhya Pradesh

Maharashtra

Maharashtra

Orissa

Orissa

Puducherry

Puducherry

Punjab

Punjab

Rajasthan

Rajasthan

Tamil Nadu

Tamil Nadu

Tripura

Tripura

14.0

4.0

12.5

5.0

13.0

5.0

12.5

4.0

13.5

5.0

14.5

5.0

12.5

5.0

14.0

5.0

14.5

5.0

13.5

46

Uttar Pradesh

4.0

1.00

5.00

47

48

49

50

51

52

53

54

55

Uttar Pradesh

Uttarakhand

Uttarakhand

West Bengal

West Bengal

Meghalaya

Meghalaya

Manipiur

Manipiur

12.5

4.0

12.5

4.0

13.5

5.0

13.5

5.0

13.5

1.00

0.50

1.00

13.50

4.50

13.50

4.00

13.50

5.00

13.50

5.00

13.50

1.00

2.50

5.00

5.00

1.00

1.00

10.00

10.00

14.00

4.04

12.63

5.00

13.00

5.00

12.50

4.00

13.50

5.00

14.50

5.50

13.75

5.00

14.00

5.00

14.50

5.00

13.50

You might also like

- Invoice (3) BookDocument1 pageInvoice (3) BookNumerologist PankajNo ratings yet

- (A Government of India Enterprise) : Investment Details Details of Pending TY AdvancesDocument1 page(A Government of India Enterprise) : Investment Details Details of Pending TY AdvancesindianroadromeoNo ratings yet

- Data Siswa/Siswi Tahun 2021 Sekolah Menengah Kejuruan Cabang Dinas Pendidikan RantauprapatDocument68 pagesData Siswa/Siswi Tahun 2021 Sekolah Menengah Kejuruan Cabang Dinas Pendidikan RantauprapatAkang Joko SusiloNo ratings yet

- CA NoDocument3 pagesCA NoGrish ChandraNo ratings yet

- Bank Account StatementDocument2 pagesBank Account StatementaaltafhussainNo ratings yet

- Your Airtel Duplicate StatementDocument59 pagesYour Airtel Duplicate StatementScheherazade SandhuNo ratings yet

- Allocation 2013 14Document1 pageAllocation 2013 14Sushama VermaNo ratings yet

- Ledger PDFDocument1 pageLedger PDFParbat RajpurohitNo ratings yet

- Kind Attn: Mr. Tarun Malik (Propritor) Sno Invoice No/ Date AmountDocument1 pageKind Attn: Mr. Tarun Malik (Propritor) Sno Invoice No/ Date Amountapexindustries5199No ratings yet

- Nova Technologies, S.A.: Dep No AsociadosDocument5 pagesNova Technologies, S.A.: Dep No Asociadostcamacho80No ratings yet

- AR Cabs Pending Bill Deatails-12Document3 pagesAR Cabs Pending Bill Deatails-12Raja MadhanNo ratings yet

- Bill of Karan Roadways June 2015Document6 pagesBill of Karan Roadways June 2015MILAN GAUTAMNo ratings yet

- Sidecar ModernDocument5 pagesSidecar ModernKat GamesNo ratings yet

- Sr. No. Company Concern Person StatusDocument6 pagesSr. No. Company Concern Person Statusjmpnv007No ratings yet

- Bharat Sanchar Nigam Limited HR Management System Madhuravada Summary and Monthwise Details of 2nd PRC IDA ArrearDocument6 pagesBharat Sanchar Nigam Limited HR Management System Madhuravada Summary and Monthwise Details of 2nd PRC IDA ArrearKrishna GNo ratings yet

- Salary Statement of Sh. Ram Niwas Sharma For Year 2012-13: Month Basic Pay DA HRA Total GPFDocument2 pagesSalary Statement of Sh. Ram Niwas Sharma For Year 2012-13: Month Basic Pay DA HRA Total GPFcmtssikarNo ratings yet

- Database of Restricted SuppliersDocument3 pagesDatabase of Restricted SuppliersWhistleblowers SaNo ratings yet

- KFC SM Davao PaDocument4 pagesKFC SM Davao PaDarge GmentizaNo ratings yet

- QT700K122155Document1 pageQT700K122155ws.partscdNo ratings yet

- Existing VAT Rates VAT Is Payable On Pts / MRP Entry Tax, If Applicable Return Filing Rate RevisionDocument2 pagesExisting VAT Rates VAT Is Payable On Pts / MRP Entry Tax, If Applicable Return Filing Rate RevisionAjay SumalNo ratings yet

- G Legal FirmsDocument1 pageG Legal FirmsPrashanth RamdasNo ratings yet

- Imperial Auto Industries LTD.: Voucher No: BPI01/16/04/00609Document3 pagesImperial Auto Industries LTD.: Voucher No: BPI01/16/04/00609Vikas KasanaNo ratings yet

- TALLYDocument5 pagesTALLYS.K. SaiyanNo ratings yet

- What's Taxable Under The HST and What's Not?: 112 West 12th - Street North Vancouver. V7M1N3 British Columbia. CanadaDocument9 pagesWhat's Taxable Under The HST and What's Not?: 112 West 12th - Street North Vancouver. V7M1N3 British Columbia. CanadaDayarayan CanadaNo ratings yet

- M/S Sri Sai Enterprises: Purchase/Sales Details of VAT 200 For The Period 01-04-2011-31-10-2012Document2 pagesM/S Sri Sai Enterprises: Purchase/Sales Details of VAT 200 For The Period 01-04-2011-31-10-2012Phani KuncharapuNo ratings yet

- Telangana State Power Generation Corporation LTD Tsgenco Corporate Office: HyderabadDocument1 pageTelangana State Power Generation Corporation LTD Tsgenco Corporate Office: HyderabadyashodharrajuNo ratings yet

- Earnings: 10 Ca (PH Allowance)Document15 pagesEarnings: 10 Ca (PH Allowance)asrahaman9No ratings yet

- Loan Calculator With Extra Payments: Enter Values InstructionsDocument2 pagesLoan Calculator With Extra Payments: Enter Values Instructionsrakeshsharma5790No ratings yet

- Graduate Engineering Apprentice Results 2012 13Document17 pagesGraduate Engineering Apprentice Results 2012 13Arvind IndiaNo ratings yet

- 2A. HDFC May 2020 EstatementDocument10 pages2A. HDFC May 2020 EstatementNanu PatelNo ratings yet

- LoopByte - 42535Document2 pagesLoopByte - 42535rsaimaheshNo ratings yet

- Pre GSTRateFinalDocument3 pagesPre GSTRateFinalTax NatureNo ratings yet

- Aa 17.05.12Document1 pageAa 17.05.12ummed_shekhawatNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceRakshee AsaarNo ratings yet

- Leave RecordDocument50 pagesLeave RecordDiyanaNo ratings yet

- Serc Apdrp 2012 FinalDocument76 pagesSerc Apdrp 2012 FinalBilal AhmadNo ratings yet

- HR No. Name Design. CircleDocument2 pagesHR No. Name Design. CircleKabul DasNo ratings yet

- Hartford Pcard Report, All UsersDocument257 pagesHartford Pcard Report, All UsersKevin BrookmanNo ratings yet

- Qty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDocument1 pageQty Gross Amount Discount Other Charges Taxable Amount CGST SGST/ Ugst Igst Cess Total AmountDEEPAK CHANDELNo ratings yet

- Panther SurveillanceDocument1 pagePanther SurveillanceHardik PatelNo ratings yet

- Bca 0517Document12 pagesBca 0517ramaNo ratings yet

- Ghaziabad Telecom District: Account SummaryDocument1 pageGhaziabad Telecom District: Account SummaryShweta GuptaNo ratings yet

- GmmpfaudlerDocument16 pagesGmmpfaudlerJay PatelNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceNanu PatelNo ratings yet

- Sale Tax 2nd QTR of 12-13Document35 pagesSale Tax 2nd QTR of 12-13khajuriaonlineNo ratings yet

- Corporate Benefit Trigger 08072013Document5 pagesCorporate Benefit Trigger 08072013Bawonda IsaiahNo ratings yet

- F PDFDocument1 pageF PDFKaran SahiNo ratings yet

- SAP CJ - 7 Maret 2024Document114 pagesSAP CJ - 7 Maret 2024Andi Prasetyo 9922No ratings yet

- Khadi, 2Document8 pagesKhadi, 2bhagyanagarkhadiNo ratings yet

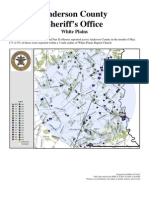

- Anderson County Sheriff's Office: White PlainsDocument8 pagesAnderson County Sheriff's Office: White Plainsalpca8615No ratings yet

- अ4धकतम 7व8युत आपू<त+ ि=थ<त ?रपोट+ (संशो4धत) /Peak Power Supply Position Report (Revised)Document1 pageअ4धकतम 7व8युत आपू<त+ ि=थ<त ?रपोट+ (संशो4धत) /Peak Power Supply Position Report (Revised)@nshu_theachieverNo ratings yet

- CB Complain Daily Report 02-04-13Document8 pagesCB Complain Daily Report 02-04-13jayesh mehtaNo ratings yet

- Alpha Offline Final Reject 574Document15 pagesAlpha Offline Final Reject 574Sanjeev ShethNo ratings yet

- 21 - Vendas Dia - Dezembro 2020Document96 pages21 - Vendas Dia - Dezembro 2020Logan SantosNo ratings yet

- Premium Due List For The Agent LIC11767123 For 05/2022Document1 pagePremium Due List For The Agent LIC11767123 For 05/2022GAURI KANT JHANo ratings yet

- Jammu and Kashmir Pay Fixation SoftwareDocument24 pagesJammu and Kashmir Pay Fixation SoftwarejayakumarbalajiNo ratings yet

- Ecode Marks-Fya 1. QUIZ / 40 Total Score AG QUIZ MarksDocument2 pagesEcode Marks-Fya 1. QUIZ / 40 Total Score AG QUIZ Marksudit raj singhNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet