Professional Documents

Culture Documents

Assignment Question

Assignment Question

Uploaded by

imran1972Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment Question

Assignment Question

Uploaded by

imran1972Copyright:

Available Formats

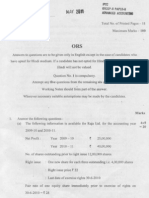

Assignment Course Name: Corporate Accounting -1 Student Name: Section: 1 Assignment question Sam and Mike were partners

sharing profits equally. Their Balance Sheet as on March 31, 2010 was as follows: Liabilities Creditors Bills payable Out standing expenses Capital: Sam 60,000 Mike 40,000 Total Amount 50,000 15,000 3,000 Assets Cash Cash at Bank Debtors 20,000 Less Provision 500 Stock Furniture Machinery Land & Building Total Amount 12,000 15,000 19,500 20,000 10,000 18,000 73,500 168,000 Marks ____/10 Student ID: Due date: April 10, 2011

100,000 168,000

On that date, they agreed to admit Tom as a partner on the following terms: 1. Tom shall get 1/5th share in profits and he will bring RO. 20,000 as his capital and RO. 5,000 as his share of goodwill 2. Goodwill brought by Tom shall be withdrawn by Sam and Mike. 3. Provision for bad and doubtful debts should be brought up to 5% on debtors. 4. Machinery is depreciated by RO. 2,000 and furniture by 12.5 %. 5. Stock is valued at RO. 23,000. 6. Land & Building be appreciated by 20%, and 7. Investments of RO. 2,000 which did not appear in books should be duly recorded. Required: Record necessary journal entries and prepare the revaluation account and capital account of partners.

Profit on revaluation = Rs. 15,950 Balance of Capital accounts = Rs. 67,975, Rs. 47,975, Rs. 20,000 Total of Balance Sheet = Rs. 2,03,950

You might also like

- Final Upload Buad 280 Practice Exam Midterm 3Document7 pagesFinal Upload Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- The Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent and Digital FilmsFrom EverandThe Independent Filmmaker's Law and Business Guide: Financing, Shooting, and Distributing Independent and Digital FilmsRating: 4.5 out of 5 stars4.5/5 (2)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Quiz-Chapter1 Partnership Formation and OperationsDocument2 pagesQuiz-Chapter1 Partnership Formation and Operationsalellie100% (1)

- Chapter 49-Pfrs For SmesDocument6 pagesChapter 49-Pfrs For SmesEmma Mariz Garcia40% (5)

- DU B.com (H) First Year (Financial Acc.) - Q Paper 2010Document7 pagesDU B.com (H) First Year (Financial Acc.) - Q Paper 2010mouryastudypointNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 5Document11 pagesCa Ipcc May 2011 Qustion Paper 5Asim DasNo ratings yet

- Isc Specimen Question Paper Accounts 2014Document9 pagesIsc Specimen Question Paper Accounts 2014BIKASH166No ratings yet

- PartnershipDocument8 pagesPartnershipganwooigai0% (1)

- Final AccountsDocument12 pagesFinal Accountsanandm1986100% (1)

- Practice Exam Chapter 13-15Document5 pagesPractice Exam Chapter 13-15John Arvi ArmildezNo ratings yet

- Final Answer Key Buad 280 Practice Exam Midterm 3Document7 pagesFinal Answer Key Buad 280 Practice Exam Midterm 3Connor JacksonNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- ACC 205 Complete Class HomeworkDocument40 pagesACC 205 Complete Class HomeworkSwadesh BangladeshNo ratings yet

- Accounts Final Exam of BCADocument6 pagesAccounts Final Exam of BCAAtul Kumar100% (1)

- Paper 1: AccountingDocument30 pagesPaper 1: AccountingSatyajit PandaNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavNo ratings yet

- YuyutuDocument15 pagesYuyutuDeepak R GoradNo ratings yet

- Assignment Accounting FundamentalsDocument2 pagesAssignment Accounting FundamentalsRajshree DewooNo ratings yet

- Accounting I.com 2Document4 pagesAccounting I.com 2Saqlain KazmiNo ratings yet

- ch1 8 5eDocument9 pagesch1 8 5eJean Pierre HitimanaNo ratings yet

- Final Account HWDocument5 pagesFinal Account HWniks4585No ratings yet

- Concept of Installment SystemDocument5 pagesConcept of Installment Systemshambhuling ShettyNo ratings yet

- FOA II 2nd AssignmentDocument5 pagesFOA II 2nd Assignmentshekaibsa38No ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- Finance Accounting 3 May 2012Document15 pagesFinance Accounting 3 May 2012Prasad C MNo ratings yet

- Ias 20, 23, 40 Practice Questions-1Document4 pagesIas 20, 23, 40 Practice Questions-1Ivy NjorogeNo ratings yet

- Problems Inter Acc1Document10 pagesProblems Inter Acc1Chau NguyenNo ratings yet

- ACC 205 Complete Class AssignmentsDocument39 pagesACC 205 Complete Class AssignmentsDecemberjaan0% (1)

- Advance AccDocument8 pagesAdvance AccjayaNo ratings yet

- Acc 291 GeniusDocument42 pagesAcc 291 GeniusdavidNo ratings yet

- FR15. Provision, Contingent Liab & Assets (Practice)Document4 pagesFR15. Provision, Contingent Liab & Assets (Practice)duong duongNo ratings yet

- Adjustments:: B.Sc. Degree Examination, 2012Document3 pagesAdjustments:: B.Sc. Degree Examination, 2012Priyanka ChoudhuryNo ratings yet

- Solved Answer Accounts CA IPCC May. 2010Document13 pagesSolved Answer Accounts CA IPCC May. 2010Akash GuptaNo ratings yet

- Legt2751 s2 2009 Final ExamDocument5 pagesLegt2751 s2 2009 Final ExamYvonne ChanNo ratings yet

- Acc AssignmentDocument5 pagesAcc AssignmentBlen tesfayeNo ratings yet

- Mock Test Paper 6Document5 pagesMock Test Paper 6FarrukhsgNo ratings yet

- New Model Test Paper 1Document8 pagesNew Model Test Paper 1Harry AryanNo ratings yet

- 7 Adjustments To Final AccountsDocument11 pages7 Adjustments To Final AccountsBhavneet SachdevaNo ratings yet

- Poa 2010 P2Document10 pagesPoa 2010 P2Jam Bab100% (2)

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- Practice Exam Pool 1Document11 pagesPractice Exam Pool 1Ey ZalimNo ratings yet

- Premidterm ExaminationDocument5 pagesPremidterm ExaminationAnne Camille AlfonsoNo ratings yet

- Unsolved Paper Part IDocument107 pagesUnsolved Paper Part IAdnan KazmiNo ratings yet

- For Students Provision and Contingent LiabilityDocument4 pagesFor Students Provision and Contingent LiabilityHardly Dare GonzalesNo ratings yet

- Retirement of A PartnerDocument8 pagesRetirement of A Partnerpiyushn_7No ratings yet

- Documents Subject Accounts Form4 9PartnershipAccountsDocument16 pagesDocuments Subject Accounts Form4 9PartnershipAccountsCartello008No ratings yet

- Final AccountsDocument5 pagesFinal AccountsGopal KrishnanNo ratings yet

- CBSE Class 11 Accountancy Sample Paper SA1 2015Document4 pagesCBSE Class 11 Accountancy Sample Paper SA1 2015Ritikesh GuptaNo ratings yet

- Workout QuestionsDocument5 pagesWorkout Questionssam100% (1)

- Partnership HandoutsDocument9 pagesPartnership HandoutsEuniceChungNo ratings yet

- Ena Company Had The Following Balances in The Owners': J Equity Section of The Balance Sheet On December 31, 20x5Document3 pagesEna Company Had The Following Balances in The Owners': J Equity Section of The Balance Sheet On December 31, 20x5Justine Mae AgapitoNo ratings yet

- International Relations: A Simple IntroductionFrom EverandInternational Relations: A Simple IntroductionRating: 5 out of 5 stars5/5 (9)

- Irregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryFrom EverandIrregularities, Frauds and the Necessity of Technical Auditing in Construction IndustryNo ratings yet

- Should Municipal Bonds be a Tool in Your Retirement Planning Toolbox?From EverandShould Municipal Bonds be a Tool in Your Retirement Planning Toolbox?No ratings yet