Professional Documents

Culture Documents

GUARANTY - An Agreement by Which One Person: Reporters

Uploaded by

Rey DumpitOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GUARANTY - An Agreement by Which One Person: Reporters

Uploaded by

Rey DumpitCopyright:

Available Formats

Reporters: Hanna Ross A. Bihasa John Rhodale C. Guadiz Reynaldo C.

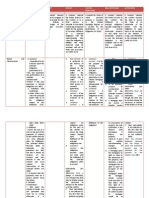

Dumpit GUARANTY - An agreement by which one person assumes the responsibility of assuring payment or fulfillment of another's debts or obligations. Effects of Guaranty Between the Guarantor and the Creditor Art. 2058. The guarantor cannot be compelled to pay the creditor unless the latter has exhausted all the property of the debtor, and has resorted to all the legal remedies against the debtor. (1830a) Art. 2059. The excussion shall not take place: (1) If the guarantor has expressly renounced it; (2) If he has bound himself solidarily with the debtor; (3) In case of insolvency of the debtor; (4) When he has absconded, or cannot be sued within the Philippines unless he has left a manager or representative; (5) If it may be presumed that an execution on the property of the principal debtor would not result in the satisfaction of the obligation. (1831a) Art. 2060. In order that the guarantor may make use of the benefit of exclusion, he must set it up against the creditor upon the latter's demand for payment from him, and point out to the creditor available property of the debtor within Philippine territory, sufficient to cover the amount of the debt. (1832) Art. 2061. The guarantor having fulfilled all the conditions required in the preceding article, the creditor who is negligent in exhausting the property pointed out shall suffer the loss, to the extent of said property, for the insolvency of the debtor resulting from such negligence. (1833a) Art. 2062. In every action by the creditor, which must be against the principal debtor alone, except in the cases mentioned in Article 2059, the former shall ask the court to notify the guarantor of the action. The guarantor may appear so that he may, if

he so desire, set up such defenses as are granted him by law. The benefit of excussion mentioned in Article 2058 shall always be unimpaired, even if judgment should be rendered against the principal debtor and the guarantor in case of appearance by the latter. (1834a) Art. 2063. A compromise between the creditor and the principal debtor benefits the guarantor but does not prejudice him. That which is entered into between the guarantor and the creditor benefits but does not prejudice the principal debtor. (1835a) Art. 2064. The guarantor of a guarantor shall enjoy the benefit of excussion, both with respect to the guarantor and to the principal debtor. (1836) Art. 2065. Should there be several guarantors of only one debtor and for the same debt, the obligation to answer for the same is divided among all. The creditor cannot claim from the guarantors except the shares which they are respectively bound to pay, unless solidarity has been expressly stipulated. The benefit of division against the co-guarantors ceases in the same cases and for the same reasons as the benefit of excussion against the principal debtor. (1837) Effects of Guaranty Between the Debtor and the Guarantor Art. 2066. The guarantor who pays for a debtor must be indemnified by the latter. The indemnity comprises: (1) The total amount of the debt; (2) The legal interests thereon from the time the payment was made known to the debtor, even though it did not earn interest for the creditor; (3) The expenses incurred by the guarantor after having notified the debtor that payment had been demanded of him; (4) Damages, if they are due. (1838a) Art. 2067. The guarantor who pays is subrogated by virtue thereof to all the rights which the creditor had against the debtor.

If the guarantor has compromised with the creditor, he cannot demand of the debtor more than what he has really paid. (1839) Art. 2068. If the guarantor should pay without notifying the debtor, the latter may enforce against him all the defenses which he could have set up against the creditor at the time the payment was made. (1840) Art. 2069. If the debt was for a period and the guarantor paid it before it became due, he cannot demand reimbursement of the debtor until the expiration of the period unless the payment has been ratified by the debtor. (1841a) Art. 2070. If the guarantor has paid without notifying the debtor, and the latter not being aware of the payment, repeats the payment, the former has no remedy whatever against the debtor, but only against the creditor. Nevertheless, in case of a gratuitous guaranty, if the guarantor was prevented by a fortuitous event from advising the debtor of the payment, and the creditor becomes insolvent, the debtor shall reimburse the guarantor for the amount paid. (1842a) Art. 2071. The guarantor, even before having paid, may proceed against the principal debtor: (1) When he is sued for the payment; (2) In case of insolvency of the principal debtor; (3) When the debtor has bound himself to relieve him from the guaranty within a specified period, and this period has expired; (4) When the debt has become demandable, by reason of the expiration of the period for payment; (5) After the lapse of ten years, when the principal obligation has no fixed period for its maturity, unless it be of such nature that it cannot be extinguished except within a period longer than ten years; (6) If there are reasonable grounds to fear that the principal debtor intends to abscond; (7) If the principal debtor is in imminent danger of becoming insolvent.

In all these cases, the action of the guarantor is to obtain release from the guaranty, or to demand a security that shall protect him from any proceedings by the creditor and from the danger of insolvency of the debtor. (1834a) Art. 2072. If one, at the request of another, becomes a guarantor for the debt of a third person who is not present, the guarantor who satisfies the debt may sue either the person so requesting or the debtor for reimbursement. (n) Effects of Guaranty as Between Co-Guarantors Art. 2073. When there are two or more guarantors of the same debtor and for the same debt, the one among them who has paid may demand of each of the others the share which is proportionally owing from him. If any of the guarantors should be insolvent, his share shall be borne by the others, including the payer, in the same proportion. The provisions of this article shall not be applicable, unless the payment has been made by virtue of a judicial demand or unless the principal debtor is insolvent. (1844a) Art. 2074. In the case of the preceding article, the co-guarantors may set up against the one who paid, the same defenses which would have pertained to the principal debtor against the creditor, and which are not purely personal to the debtor. (1845) Art. 2075. A sub-guarantor, in case of the insolvency of the guarantor for whom he bound himself, is responsible to the co-guarantors in the same terms as the guarantor. (1846) EXTINGUISHMENT OF GUARANTY Art. 2076. The obligation of the guarantor is extinguished at the same time as that of the debtor, and for the same causes as all other obligations. (1847) Art. 2077. If the creditor voluntarily accepts immovable or other property in payment of the debt, even if he should afterwards lose the same through eviction, the guarantor is released. (1849)

Art. 2078. A release made by the creditor in favor of one of the guarantors, without the consent of the others, benefits all to the extent of the share of the guarantor to whom it has been granted. (1850) Art. 2079. An extension granted to the debtor by the creditor without the consent of the guarantor extinguishes the guaranty. The mere failure on the part of the creditor to demand payment after the debt has become due does not of itself constitute any extention of time referred to herein. (1851a) Art. 2080. The guarantors, even though they be solidary, are released from their obligation whenever by some act of the creditor they cannot be subrogated to the rights, mortgages, and preference of the latter. (1852) Art. 2081. The guarantor may set up against the creditor all the defenses which pertain to the principal debtor and are inherent in the debt; but not those that are personal to the debtor. (1853) SURETY A surety or guaranty, in finance, is a promise by one party (the guarantor) to assume responsibility for the debt obligation of a borrower if that borrower defaults. The person or company that provides this promise, is also known as a surety or guarantor. The situation in which a surety is most typically required is when the ability of the primary obligor or principal to perform its obligations to the obligee (counterparty) under a contract is in question, or when there is some public or private interest which requires protection from the consequences of the principal's default or delinquency. In most common law jurisdictions, a contract of suretyship is subject to the statute of frauds (or its equivalent local laws) and is only enforceable if recorded in writing and signed by the surety and the principal. If the surety is required to pay or perform due to the principal's failure to do so, the law will usually give the surety a right of subrogation, allowing the surety to "step into the shoes of" the principal and use his (the surety's) contractual rights to recover the cost of making payment or performing on the principal's behalf, even in the absence of an express agreement to that effect between the surety and the principal.

Traditionally, a distinction was made between a suretyship arrangement and that of a guaranty. Both involve lending added credit and credibility to a loan of money. However, the surety's liability was joint and primary with the principal, whereas the guarantor's liability was ancillary and derivative. That just means that a creditor must first attempt to collect the debt from the debtor before looking to the guarantor for payment. With a suretyship, the creditor may attempt to collect the debt from either. Many jurisdictions have abolished this distinction.

You might also like

- Declaration of Share TrustDocument1 pageDeclaration of Share TrustKendell GillNo ratings yet

- Concept, Classification and Characteristics Civil Code, Arts. 2047, 2051, 2055, 2048, 2052, 2053, 2054Document33 pagesConcept, Classification and Characteristics Civil Code, Arts. 2047, 2051, 2055, 2048, 2052, 2053, 2054Tricia Montoya100% (1)

- Credit Notes GuarantyDocument3 pagesCredit Notes GuarantyRyan Suaverdez100% (1)

- Land Development in SarawakDocument20 pagesLand Development in SarawakLee Wai Keat100% (1)

- Transfer Taxpayer Registration Power of AttorneyDocument1 pageTransfer Taxpayer Registration Power of AttorneyJohn DoeNo ratings yet

- Codal ProvisionsDocument8 pagesCodal ProvisionsRomNo ratings yet

- Title XV GuarantyDocument50 pagesTitle XV GuarantyRussell Stanley Que GeronimoNo ratings yet

- Effects of GuarantyDocument3 pagesEffects of GuarantyEmman KailanganNo ratings yet

- Title XV Guaranty (2047-2084)Document7 pagesTitle XV Guaranty (2047-2084)BreAmberNo ratings yet

- Title XV GuarantyDocument5 pagesTitle XV GuarantyMark SaysonNo ratings yet

- Title Xv. - Guaranty Nature and Extent of GuarantyDocument3 pagesTitle Xv. - Guaranty Nature and Extent of GuarantyMaisie ZabalaNo ratings yet

- GuarantyDocument9 pagesGuarantyCresteynTeyngNo ratings yet

- Guaranty obligations under Philippine lawDocument5 pagesGuaranty obligations under Philippine lawMarkNo ratings yet

- V. Guaranty A. Arts. 2047 To 2081, Civil CodeDocument12 pagesV. Guaranty A. Arts. 2047 To 2081, Civil CodeMunchie MichieNo ratings yet

- Guaranty obligations and effects under Philippine lawDocument2 pagesGuaranty obligations and effects under Philippine lawfe rose sindinganNo ratings yet

- Week 10Document8 pagesWeek 10DANICA FLORESNo ratings yet

- Guaranty and PledgeDocument7 pagesGuaranty and PledgeJhannes Gwendholyne Gorre OdalNo ratings yet

- (Law 4) Final ReviewerDocument10 pages(Law 4) Final ReviewerChester de GuzmanNo ratings yet

- Philippine Laws on Credit TransactionsDocument5 pagesPhilippine Laws on Credit TransactionsCamille ArominNo ratings yet

- Nature and extent of guaranty definedDocument5 pagesNature and extent of guaranty definedMaria Divina Gracia D. MagtotoNo ratings yet

- Rights of guarantor against debtorDocument13 pagesRights of guarantor against debtorshai shaiNo ratings yet

- Guaranty and SuretyhipDocument6 pagesGuaranty and SuretyhipMic UdanNo ratings yet

- Guaranty: Title XVDocument12 pagesGuaranty: Title XVThomas EdisonNo ratings yet

- Credit Transactions Final ReviewerDocument5 pagesCredit Transactions Final ReviewerJumen Gamaru Tamayo100% (1)

- Guaranty Oct. 9 2020Document5 pagesGuaranty Oct. 9 2020HK FreeNo ratings yet

- GUARANTY Surety Mortgages Pledge AntichresisDocument35 pagesGUARANTY Surety Mortgages Pledge AntichresisJennilyn TugelidaNo ratings yet

- Title XV Guaranty Nature and Extent of GuarantyDocument2 pagesTitle XV Guaranty Nature and Extent of Guarantyzandree burgosNo ratings yet

- Credit - 2nd AssignmentDocument11 pagesCredit - 2nd AssignmentTom HerreraNo ratings yet

- Guaranty and PledgeDocument4 pagesGuaranty and PledgeJapon, Jenn RossNo ratings yet

- Guaranty Rights and ObligationsDocument3 pagesGuaranty Rights and ObligationsjorgNo ratings yet

- LawDocument4 pagesLawMaricar Salvador PenaNo ratings yet

- Common provisions for pledge and mortgageDocument6 pagesCommon provisions for pledge and mortgagemarmiedyanNo ratings yet

- Credit Transactions Reviewer Group ReportDocument263 pagesCredit Transactions Reviewer Group ReportTricia MontoyaNo ratings yet

- Finals ReviewerDocument13 pagesFinals ReviewerIshmael SalisipNo ratings yet

- CREDIT TRANSACTION Guaranty Chapter 2Document4 pagesCREDIT TRANSACTION Guaranty Chapter 2Soremn PotatoheadNo ratings yet

- Reviewer For Credit TransactionDocument22 pagesReviewer For Credit TransactionMaristela Mark JezrelNo ratings yet

- Guaranty and Suretyship ExplainedDocument10 pagesGuaranty and Suretyship ExplainedFrancois MarcialNo ratings yet

- Contract of Pledge and Mortgage GuideDocument10 pagesContract of Pledge and Mortgage GuideheyheyNo ratings yet

- Credit RevDocument3 pagesCredit RevCARLO JOSE BACTOLNo ratings yet

- Nature and Extent of GuarantyDocument5 pagesNature and Extent of GuarantyNikka GloriaNo ratings yet

- Credit NotesDocument2 pagesCredit NotesAnonymous U7Az3W8IANo ratings yet

- Anti ChresisDocument21 pagesAnti ChresisKaren Sheila B. Mangusan - DegayNo ratings yet

- CREDITSDocument21 pagesCREDITSKaren Sheila B. Mangusan - DegayNo ratings yet

- Guaranty Atty Uribe Chavez MarianDocument5 pagesGuaranty Atty Uribe Chavez MarianKenneth AbuanNo ratings yet

- Table of Comparison - FinalsDocument5 pagesTable of Comparison - FinalsDonna Samson100% (1)

- Arts. 2132-2139 Concept (2132) : Chapter 4: ANTICHRESISDocument5 pagesArts. 2132-2139 Concept (2132) : Chapter 4: ANTICHRESISSherri BonquinNo ratings yet

- PledgeDocument72 pagesPledgeJhedel MacabitNo ratings yet

- BorgtochtDocument12 pagesBorgtochteksarettaniaNo ratings yet

- Pledge, MortgageDocument9 pagesPledge, MortgageAmie Jane MirandaNo ratings yet

- Art 2058Document3 pagesArt 2058Ellaine Pearl AlmillaNo ratings yet

- CREDIT TRANSACTION Guaranty Chapter 1Document4 pagesCREDIT TRANSACTION Guaranty Chapter 1Soremn PotatoheadNo ratings yet

- Insurance NotesDocument9 pagesInsurance Notespaul_jurado18No ratings yet

- 4 Pledge Mortage and AntichresisDocument39 pages4 Pledge Mortage and AntichresisJohn Rey LabasanNo ratings yet

- Liwag - Art. 2071-2075Document8 pagesLiwag - Art. 2071-2075AjilNo ratings yet

- Guaranty QuizDocument51 pagesGuaranty Quizmcris101No ratings yet

- Antich Res IsDocument4 pagesAntich Res IseogyramNo ratings yet

- Antichresis (ARTICLES 2132-2139) : Writing OtherwiseDocument4 pagesAntichresis (ARTICLES 2132-2139) : Writing OtherwiseLisa Bautista100% (1)

- Effects of Guaranty As Between Co-GuarantorsDocument9 pagesEffects of Guaranty As Between Co-GuarantorsSRS AccountingNo ratings yet

- 4 - Pledge - 11Document52 pages4 - Pledge - 11Karla Mari Orduña GabatNo ratings yet

- Araullo University College of Law report on pledgeDocument6 pagesAraullo University College of Law report on pledgeRicel CriziaNo ratings yet

- Quiz 3Document3 pagesQuiz 3Jane BaggyNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- Life, Accident and Health Insurance in the United StatesFrom EverandLife, Accident and Health Insurance in the United StatesRating: 5 out of 5 stars5/5 (1)

- Political DynastyDocument10 pagesPolitical DynastyRey DumpitNo ratings yet

- TSNA E VersionDocument44 pagesTSNA E VersionJhuvzCLunaNo ratings yet

- Valedictory SpeechDocument2 pagesValedictory SpeechRey DumpitNo ratings yet

- School LR TemplateDocument2 pagesSchool LR TemplateRey DumpitNo ratings yet

- IPCRFDocument4 pagesIPCRFRey DumpitNo ratings yet

- Eading AND Writing Money ValuesDocument35 pagesEading AND Writing Money ValuesRey DumpitNo ratings yet

- Nat Review Vi Narrative Report: Ramada Elementary SchoolDocument2 pagesNat Review Vi Narrative Report: Ramada Elementary SchoolRey DumpitNo ratings yet

- School FormsDocument36 pagesSchool FormsFranco Evale YumulNo ratings yet

- Summary On The Selection of Honor Pupils: Ramada Elementary SchoolDocument2 pagesSummary On The Selection of Honor Pupils: Ramada Elementary SchoolRey DumpitNo ratings yet

- Test Yourself Fill in the blanksDocument5 pagesTest Yourself Fill in the blanksRey DumpitNo ratings yet

- List of Nat ExamineesDocument1 pageList of Nat ExamineesRey DumpitNo ratings yet

- Extra Curricular DepedDocument1 pageExtra Curricular DepedRey DumpitNo ratings yet

- Coco JamDocument1 pageCoco JamRey DumpitNo ratings yet

- Kinds of Informal ReportDocument2 pagesKinds of Informal ReportRey Dumpit100% (2)

- Classroom ProgramDocument2 pagesClassroom ProgramRey DumpitNo ratings yet

- Four Fundamental Operation GraphDocument1 pageFour Fundamental Operation GraphRey DumpitNo ratings yet

- Timeline AMDDocument6 pagesTimeline AMDRey DumpitNo ratings yet

- School Report On Kindergarten Volunteer ProgramDocument2 pagesSchool Report On Kindergarten Volunteer ProgramesormikNo ratings yet

- Reinstatement of DutyDocument2 pagesReinstatement of DutyRey DumpitNo ratings yet

- Classroom Behavioral ProblemDocument12 pagesClassroom Behavioral ProblemRey DumpitNo ratings yet

- Reasons For DeadlockDocument2 pagesReasons For DeadlockRey DumpitNo ratings yet

- Local TaxationDocument2 pagesLocal TaxationRey DumpitNo ratings yet

- All Kinds of OSDocument11 pagesAll Kinds of OSRey Dumpit100% (1)

- Apply Quality Standards and ProceduresDocument1 pageApply Quality Standards and ProceduresRey DumpitNo ratings yet

- Early Microcomputer DesignDocument1 pageEarly Microcomputer DesignRey DumpitNo ratings yet

- Early Registration FormDocument1 pageEarly Registration FormRey DumpitNo ratings yet

- Catalytic Cracking and Fuel StabilityDocument4 pagesCatalytic Cracking and Fuel StabilityRey DumpitNo ratings yet

- All Kinds of OSDocument11 pagesAll Kinds of OSRey Dumpit100% (1)

- Jeorge Business Plan 2Document17 pagesJeorge Business Plan 2Rey DumpitNo ratings yet

- Notes in Business Organization Ii Atty ZacDocument31 pagesNotes in Business Organization Ii Atty ZacSe'f BenitezNo ratings yet

- Gabrito vs. CA, G.R. No. 77976 November 24, 1988Document6 pagesGabrito vs. CA, G.R. No. 77976 November 24, 1988Kimberly SendinNo ratings yet

- Land Titles and Deeds Finals ReviewerDocument6 pagesLand Titles and Deeds Finals ReviewerLeslie Javier BurgosNo ratings yet

- Legal WritingDocument111 pagesLegal WritingLevi Isalos100% (2)

- Regalado - Special ProceedingsDocument216 pagesRegalado - Special ProceedingsGelo MacaranasNo ratings yet

- Rosario E. Cahambing, vs. Victor Espinosa and Juana AngDocument13 pagesRosario E. Cahambing, vs. Victor Espinosa and Juana AngLiza Melle Ledesma PenaflorNo ratings yet

- Borja vs. Salcedo: Judge violated rules on issuing TROsDocument2 pagesBorja vs. Salcedo: Judge violated rules on issuing TROsSam FajardoNo ratings yet

- 32 Heirs of Telesforo Julao vs. de JesusDocument11 pages32 Heirs of Telesforo Julao vs. de JesusgabbieseguiranNo ratings yet

- Silverio Vs SilverioDocument6 pagesSilverio Vs SilverioMark Lester Lee AureNo ratings yet

- Manchester Vs CADocument3 pagesManchester Vs CARhob-JoanMoranteNo ratings yet

- DRAFTINGDocument8 pagesDRAFTINGMukul BajajNo ratings yet

- Specific Relief Act 1963 Key ConceptsDocument34 pagesSpecific Relief Act 1963 Key ConceptsNitu sharma100% (1)

- Contract of Indemnity and GuaranteeDocument35 pagesContract of Indemnity and GuaranteeDileep ChowdaryNo ratings yet

- Affidavit disputes false accusationsDocument2 pagesAffidavit disputes false accusationsBee SiaNo ratings yet

- Thomas More Society's Response For Illinois Catholic Charities' MEMORANDUM IN OPPOSITION TO DEFENDANTS' CROSS MOTION FOR SUMMARY JUDGMENTDocument246 pagesThomas More Society's Response For Illinois Catholic Charities' MEMORANDUM IN OPPOSITION TO DEFENDANTS' CROSS MOTION FOR SUMMARY JUDGMENTTom CiesielkaNo ratings yet

- Extrajudicial Settlement of EstateDocument2 pagesExtrajudicial Settlement of EstateMulticredit Lending CorpNo ratings yet

- False Cause For The Institutions of Heirs... Requirements in Order To Render Institution VoidDocument24 pagesFalse Cause For The Institutions of Heirs... Requirements in Order To Render Institution VoidCharm Divina LascotaNo ratings yet

- Paradine V Jane: Court of King'S Bench Bacon and Rolle JJDocument3 pagesParadine V Jane: Court of King'S Bench Bacon and Rolle JJTimishaNo ratings yet

- 2 Exam Tested AreasDocument1 page2 Exam Tested AreasShangavi SNo ratings yet

- Seville Vs National DevelopmentDocument20 pagesSeville Vs National DevelopmentJohnde MartinezNo ratings yet

- 2021-Spring Baileywi A506 Legal Analysis, Research and WritingDocument13 pages2021-Spring Baileywi A506 Legal Analysis, Research and WritingKevin AnneNo ratings yet

- Macasaet v. CoDocument4 pagesMacasaet v. CoYodh Jamin OngNo ratings yet

- July 28, 2020, Nidhi Gupta, Hague Convention and India, AKK - Fest SchriftDocument12 pagesJuly 28, 2020, Nidhi Gupta, Hague Convention and India, AKK - Fest SchriftAmi TandonNo ratings yet

- Bar Prep - Outline - Wills - ShortDocument10 pagesBar Prep - Outline - Wills - ShortAnonymous Cbr8Vr2SX100% (1)

- Pearson V IACDocument10 pagesPearson V IACElaine Aquino MaglaqueNo ratings yet

- GR No. 162808 Ruling on Dismissal of Criminal ComplaintDocument1 pageGR No. 162808 Ruling on Dismissal of Criminal Complaintjilo03No ratings yet

- Gamboa Et Al Vs CA GR NO L-41053 Nov 28 1975 PDFDocument3 pagesGamboa Et Al Vs CA GR NO L-41053 Nov 28 1975 PDFDayana DawnieNo ratings yet