Professional Documents

Culture Documents

Equalization Slide Centennial

Equalization Slide Centennial

Uploaded by

deb_griffiths8365Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Equalization Slide Centennial

Equalization Slide Centennial

Uploaded by

deb_griffiths8365Copyright:

Available Formats

Equalization is about Tax Fairness

Equal access to levy dollars.

Equalization is tax relief to taxpayers. It's a "match" of state aid that makes local levies more affordable for citizens in low property wealth districts. Calculation of the state aid/local levy split for voter-approved referendum % of referendum that is paid by local property taxpayers (the state provides aid for the remainder)

100%

Districts referendum market value per student

$476,000 (equalization factor)

Unfortunately, equalization factor was set in 1993 and has not been adjusted to reflect escalating property values. The Erosion of Referendum Equalization

80%

60%

48% 59% 53% 68% 64% 76% 74% 74% 74% 73% 78%

40% 34%

14% 17% 16% 23% 19%

40%

20%

47% 52% 36% 41% 26% 26% 27% 32% 22% 24% 26%

Pay 95 Pay 96 Pay 97 Pay 98 Pay 99 Pay 00 Pay 01 Pay 02 Pay 03 Pay 04 Pay 05

60% 66%

86% 83% 84% 77% 81%

x 100

0% Pay 06 Pay 07 Pay 08 Pay 09 Pay 10 Pay 11 Pay 12

Local Levy

State Aid

For every referendum dollar approved by Centennial voters in 1995, the state paid 78 cents while the local taxpayers were responsible for the other 22 cents. This was the amount of state aid needed so a Centennial taxpayers burden per levy dollar for their schools was similar to taxpayers in every other school district. However, since the equalization factor has never been increased to reflect rising property values, this erosion has made levy dollars significantly more expensive for the Centennial taxpayer.

You might also like

- Dauphin County Police Regionalization StudyDocument30 pagesDauphin County Police Regionalization StudyBarbara MillerNo ratings yet

- Richmond Tax Relief Analysis by Benjamin PaulDocument4 pagesRichmond Tax Relief Analysis by Benjamin PaulRoberto RoldanNo ratings yet

- Chris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Document20 pagesChris Fick League of Oregon Cities Mayors Open Forum September 27, 2012Statesman JournalNo ratings yet

- West Weber Feasibility StudyDocument35 pagesWest Weber Feasibility StudyThe Salt Lake TribuneNo ratings yet

- Property Tax Reform PresentationDocument29 pagesProperty Tax Reform PresentationStatesman JournalNo ratings yet

- 2014 Premiums by StateDocument1 page2014 Premiums by StateMaine Trust For Local NewsNo ratings yet

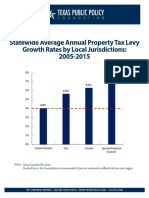

- 2017-07 Statewide Property Tax Levy Growth Rates Graph 1-PagerDocument1 page2017-07 Statewide Property Tax Levy Growth Rates Graph 1-PagerTPPFNo ratings yet

- Affordable Housing Making Development Match NeedDocument41 pagesAffordable Housing Making Development Match NeedCharles Elsesser100% (1)

- Lecture 11Document32 pagesLecture 11Rak ADURNo ratings yet

- Rapp School Board FY24 Budget - HighlightsDocument9 pagesRapp School Board FY24 Budget - HighlightsChuck JacksonNo ratings yet

- MC 3189Document5 pagesMC 3189chris.vitelaNo ratings yet

- In North Dakota: Oil & Gas DevelopmentDocument6 pagesIn North Dakota: Oil & Gas DevelopmentRob PortNo ratings yet

- Special: Federal Tax Burdens and Expenditures by StateDocument8 pagesSpecial: Federal Tax Burdens and Expenditures by StateDoxCak3No ratings yet

- Taxpayer AgendaDocument7 pagesTaxpayer Agendaczajkowski7No ratings yet

- Property Tax and Income - Brief - FINALDocument9 pagesProperty Tax and Income - Brief - FINALThe GazetteNo ratings yet

- Hubbard County Truth-in-Taxation Hearing PresentationDocument19 pagesHubbard County Truth-in-Taxation Hearing PresentationShannon GeisenNo ratings yet

- Gov. Maura Healey's Budget ProposalDocument4 pagesGov. Maura Healey's Budget ProposalNBC 10 WJARNo ratings yet

- State and Local Sales Tax Rates, Midyear 2016: Fiscal FactDocument7 pagesState and Local Sales Tax Rates, Midyear 2016: Fiscal FactrkarlinNo ratings yet

- City of North Las Vegas Temporary Rental and Utility Assistance Program TRUA 6-24-20Document2 pagesCity of North Las Vegas Temporary Rental and Utility Assistance Program TRUA 6-24-20Phillip MoyerNo ratings yet

- FY18 BudgetDocument2 pagesFY18 BudgetKevinOhlandtNo ratings yet

- Good Jobs First Study On CPS AbatementsDocument17 pagesGood Jobs First Study On CPS AbatementsMadeline MitchellNo ratings yet

- Revenue Discussion 7.19.17Document21 pagesRevenue Discussion 7.19.17Terry FranckeNo ratings yet

- The Few Decide - ReportDocument12 pagesThe Few Decide - ReportRobert GarciaNo ratings yet

- Residential Neighborhood and Real Estate Report For The Lenexa, Kansas Zip Code 66227Document8 pagesResidential Neighborhood and Real Estate Report For The Lenexa, Kansas Zip Code 66227Chris DowellNo ratings yet

- Trulia Data On Affordable Cities 2014Document6 pagesTrulia Data On Affordable Cities 2014Michael_Lee_RobertsNo ratings yet

- Texans' Homestead Protection ActDocument2 pagesTexans' Homestead Protection ActJennifer HarrisNo ratings yet

- University of Massachusetts Amherst/WCVB October 2022 Massachusetts PollDocument9 pagesUniversity of Massachusetts Amherst/WCVB October 2022 Massachusetts PollPeter ChiancaNo ratings yet

- 0917BUS EconsnapshotDocument1 page0917BUS EconsnapshotThe Dallas Morning NewsNo ratings yet

- Local Salary Commercial Pilots TexasDocument2 pagesLocal Salary Commercial Pilots TexasSailorrentNo ratings yet

- Solid Waste Draft Rate ResolutionsDocument5 pagesSolid Waste Draft Rate Resolutionstawals tawalsNo ratings yet

- EDC Bond PresentationDocument51 pagesEDC Bond PresentationTim PeckNo ratings yet

- Tax Rate PropDocument23 pagesTax Rate PropDC StrongNo ratings yet

- Bonus Depreciation Kuhlemeyer Wachowicz ArticleDocument7 pagesBonus Depreciation Kuhlemeyer Wachowicz ArticlearchitbumbNo ratings yet

- Approved BudgetDocument4 pagesApproved BudgetAnonymous Pb39klJNo ratings yet

- 2007 Tax RatesDocument3 pages2007 Tax RatesmobiletaxboysNo ratings yet

- Required Supplementary Information Schedules of Employer ContributionsDocument5 pagesRequired Supplementary Information Schedules of Employer ContributionsAnonymous Ul3litqNo ratings yet

- Hubbard County Payable 2024 Preliminary Levy ChartDocument2 pagesHubbard County Payable 2024 Preliminary Levy ChartShannon GeisenNo ratings yet

- WHAC Housing Work PlanDocument50 pagesWHAC Housing Work PlanKelly KenoyerNo ratings yet

- Individual Mandate Tax Penalty - 2016Document2 pagesIndividual Mandate Tax Penalty - 2016Jason PyeNo ratings yet

- Long-Term Ferry Funding Study: Findings and Final RecommendationsDocument24 pagesLong-Term Ferry Funding Study: Findings and Final RecommendationsDan TurnerNo ratings yet

- Theory and Reality: Arizona's Tax StructureDocument29 pagesTheory and Reality: Arizona's Tax StructuredavygabriNo ratings yet

- Madison Place Subdivision Neighborhood Real Estate StatsDocument9 pagesMadison Place Subdivision Neighborhood Real Estate StatsChris DowellNo ratings yet

- Zip Code Detailed Profile: Were You Denied A Mortgage?Document32 pagesZip Code Detailed Profile: Were You Denied A Mortgage?ashes_xNo ratings yet

- Lease PosterDocument1 pageLease PosterDeDe Beaty JonesNo ratings yet

- Ny Ultra Millionaires Taxes Poll MemoDocument3 pagesNy Ultra Millionaires Taxes Poll Memocbs6albanyNo ratings yet

- Pennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationDocument22 pagesPennsylvania State Spending & Fiscal Crunch: What Now: by Nathan Benefield Commonwealth FoundationNathan BenefieldNo ratings yet

- Fiscal Sustainability Analysis: Nassau CountyDocument22 pagesFiscal Sustainability Analysis: Nassau Countyapi-298511181No ratings yet

- How Many?: A Numbers Guide For Lame Duck Fence Sitting Anti Fair Share Millionaires Over Middle Class Members of CongressDocument14 pagesHow Many?: A Numbers Guide For Lame Duck Fence Sitting Anti Fair Share Millionaires Over Middle Class Members of CongressCitizen Action of New YorkNo ratings yet

- FairTax Presentation 2014 - Bob FrenzelDocument23 pagesFairTax Presentation 2014 - Bob FrenzelEric McGraneNo ratings yet

- Property Tax Cap - 745pm PDFDocument16 pagesProperty Tax Cap - 745pm PDFjspectorNo ratings yet

- Town of Holden Beach: "Unofficial" Minutes & CommentsDocument17 pagesTown of Holden Beach: "Unofficial" Minutes & Commentscutty54No ratings yet

- Living Wage Report 2023 With Cover PageDocument28 pagesLiving Wage Report 2023 With Cover PageCTV Calgary DigitalNo ratings yet

- A Roadmap To BetterDocument16 pagesA Roadmap To BetterTexas Comptroller of Public AccountsNo ratings yet

- Proposed Millionaire Tax To Massachusetts Constitution (RULED UNCONSTITUTIONAL 6/18/2018)Document2 pagesProposed Millionaire Tax To Massachusetts Constitution (RULED UNCONSTITUTIONAL 6/18/2018)ChrisWhittleNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet