Professional Documents

Culture Documents

NRI Trading

NRI Trading

Uploaded by

ssajeev2010Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

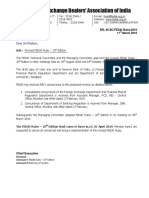

NRI Trading

NRI Trading

Uploaded by

ssajeev2010Copyright:

Available Formats

Guidelines for NRI Trading: An NRI can deal with only one bank at any point of time.

PIS (Portfolio Investment Scheme) approval can be issued by only one bank. Intra day trading is not allowed for NRIs. NRIs can trade only in delivery-based transactions. BTST(Buy Today Sell Tomorrow) is not allowed to NRIs. NRI will be allowed to invest only up to 5 % of the paid up capital of the company. NRIs are NOT allowed to buy certain scrips under this regulation. Report of the same is available on the RBI website. http://www.rbi.org.in/scripts/BS_FiiUSer.aspx NRIs need to have 100% funds at the time of buying. No exposure is given to NRIs. Same way, they need to have 100% stock available to them while selling. No short selling allowed. Contract notes of NRIs are daily reported to respective Bank and bank in turn report them to RBI. Reporting is taken care by Sharekhan. A NRI is required to make bill-to-bill payments. No adjustments of purchase against sale consideration can be done. Purchase and Sales will be dealt separately for payments / receipts. IPOs/Mutual funds can be applied through NON PIS i.e. Through NRE/NRO Savings account. FNO transactions can be routed through NRO NON PIS i.e. through NRO Savings account For FNO transactions separate code is allotted by NSE and the same has to be punched at the time of placing FNO order for NRI clients along with the client code.. It may kindly be noted that NRI A/c's are controlled both by SEBI and RBI. Non compliance on the above defined parameters is a very serious offence and is taken very seriously as the same is taken a violations in FEMA

You might also like

- Call Money MarketDocument24 pagesCall Money MarketiyervsrNo ratings yet

- PIS Applicati HDFCDocument3 pagesPIS Applicati HDFCDesikanNo ratings yet

- Who Is An NRI?: NRI Can Invest in The Following ProductsDocument7 pagesWho Is An NRI?: NRI Can Invest in The Following ProductsnikmanojNo ratings yet

- Foreign Portfolio Investment in IndiaDocument26 pagesForeign Portfolio Investment in Indiasachin100% (1)

- Faq For Nris ON Depository AccountDocument2 pagesFaq For Nris ON Depository Accountkrissh_87No ratings yet

- 16 Money Market InstrumentsDocument2 pages16 Money Market InstrumentsrickyakiNo ratings yet

- Faq Nro RMD New 16092016Document4 pagesFaq Nro RMD New 16092016jtalukdar78No ratings yet

- Answers To Question in All NRIs' Minds - 'What To Do When You Become An NRI' - The Economic TimesDocument2 pagesAnswers To Question in All NRIs' Minds - 'What To Do When You Become An NRI' - The Economic TimesPriya NarayanNo ratings yet

- ForxDocument12 pagesForxrahul857No ratings yet

- Notes 4Document8 pagesNotes 4HARINo ratings yet

- Foreign Exchange Management Act 1999 FemaDocument38 pagesForeign Exchange Management Act 1999 FemaVishal BhardwajNo ratings yet

- Topics For Nukkad NatakDocument3 pagesTopics For Nukkad NatakMahesh BabuNo ratings yet

- Portfolio Investment Scheme (PIS) Application Form: Personal DetailsDocument12 pagesPortfolio Investment Scheme (PIS) Application Form: Personal DetailsVijaNo ratings yet

- 6 B Treasury InstrumentsDocument10 pages6 B Treasury InstrumentsRavi kumarNo ratings yet

- Foreign Portfolio InvestmentDocument11 pagesForeign Portfolio InvestmentSudha PanneerselvamNo ratings yet

- Structure of Foreign Portfolio InvestmentDocument15 pagesStructure of Foreign Portfolio InvestmentNisarg ShahNo ratings yet

- Meaning and Features of Treasury BillsDocument4 pagesMeaning and Features of Treasury BillsHarshit NavadiyaNo ratings yet

- FmisDocument49 pagesFmisIqra AfsarNo ratings yet

- Self-Declaration by Resident Individual For Release of Foreign Exchange Under LRSDocument2 pagesSelf-Declaration by Resident Individual For Release of Foreign Exchange Under LRSCHAITANYA SAHUNo ratings yet

- Regulatory Framework For Financial Services in IndiaDocument25 pagesRegulatory Framework For Financial Services in IndiaBishnu PhukanNo ratings yet

- FCNR Swap Deal: What It Means For NrisDocument5 pagesFCNR Swap Deal: What It Means For NrisPrateek MohapatraNo ratings yet

- Cust Declaration For Capital Acc LRS NetbankingDocument2 pagesCust Declaration For Capital Acc LRS NetbankingVishal Kumar SinghNo ratings yet

- Comprehensive Portfolio Management Services: State Bank of IndiaDocument13 pagesComprehensive Portfolio Management Services: State Bank of IndiaGreen Sustain EnergyNo ratings yet

- FEMA Regulations Ver 2.0Document12 pagesFEMA Regulations Ver 2.0sayamchopra2507No ratings yet

- Introduction To ForexDocument10 pagesIntroduction To ForexVinit MehtaNo ratings yet

- FDI - Important PointsDocument17 pagesFDI - Important PointsSavoir PenNo ratings yet

- FEDAIRulesDocument14 pagesFEDAIRulesGaurav KhuranaNo ratings yet

- Banking Notes For RBI & SBI ExamsDocument3 pagesBanking Notes For RBI & SBI ExamsSankar DasNo ratings yet

- Repo Rate - Meaning, Reverse Repo Rate & Current Repo RateDocument10 pagesRepo Rate - Meaning, Reverse Repo Rate & Current Repo Ratevikas royNo ratings yet

- BCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS AccountDocument6 pagesBCIP Application: Mode of Investment Ocbc Deposit Account Ocbc Online Banking Ocbc SRS Accountmugger123456No ratings yet

- FAQs For NRI Trading AccountDocument13 pagesFAQs For NRI Trading AccountSathish ChelliahNo ratings yet

- Summary of NRO AccountDocument2 pagesSummary of NRO AccountKIRAN REDDYNo ratings yet

- Participatory NotesDocument3 pagesParticipatory NotesAmit KumarNo ratings yet

- Asg 3Document4 pagesAsg 3Mrugaja Gokhale AurangabadkarNo ratings yet

- Chapter 09Document8 pagesChapter 09siddhant singhNo ratings yet

- What Are The Money Market Instruments in PakistanDocument2 pagesWhat Are The Money Market Instruments in PakistanWajiah Rahat100% (1)

- FAQs On Sovereign Gold Bond SCHEME Annx1Document6 pagesFAQs On Sovereign Gold Bond SCHEME Annx1Alok Kr MishraNo ratings yet

- Treasury Management in BankingDocument6 pagesTreasury Management in BankingShambhavi BhansaliNo ratings yet

- Call Money MarketDocument17 pagesCall Money MarketAnkit SaxenaNo ratings yet

- Money MarketDocument6 pagesMoney MarketredsaluteNo ratings yet

- Mahindra Finance Fixed Deposit FAQsDocument4 pagesMahindra Finance Fixed Deposit FAQsPoonam ShardaNo ratings yet

- NRI TaxationDocument9 pagesNRI TaxationTekumani Naveen KumarNo ratings yet

- NBFCDocument21 pagesNBFCNiraj PatelNo ratings yet

- Fema SNNRDocument3 pagesFema SNNRRahul KanoujiaNo ratings yet

- Exchange Control?: MF0007 - International Financial ManagementDocument14 pagesExchange Control?: MF0007 - International Financial ManagementAmbrishNo ratings yet

- Fedai Rules LatestDocument25 pagesFedai Rules LatestVIJAYASEKARANNo ratings yet

- Role of Fii in Share MarketDocument7 pagesRole of Fii in Share MarketMukesh Kumar MishraNo ratings yet

- An Introductory Startup Guide For NRB: Dhaka Stock Exchange LimitedDocument6 pagesAn Introductory Startup Guide For NRB: Dhaka Stock Exchange LimitedSoyodo HamidoNo ratings yet

- All About BankingDocument31 pagesAll About BankinggoyaltarunNo ratings yet

- Debt Funding in India, Nishith Desai Associates, Available At, Last Visited On 8 April, 2019 External Commercial Borrowings & Trade Credits, Available at Last Visited On 9 April 2019Document3 pagesDebt Funding in India, Nishith Desai Associates, Available At, Last Visited On 8 April, 2019 External Commercial Borrowings & Trade Credits, Available at Last Visited On 9 April 2019Kunwar AbhudayNo ratings yet

- FM, Class 3Document23 pagesFM, Class 3NITYA NAYARNo ratings yet

- Nri BankingDocument36 pagesNri Bankingabin 2003No ratings yet

- Nature of ExchangeDocument4 pagesNature of Exchangedeepak_chamaylNo ratings yet

- Who Is A NonDocument12 pagesWho Is A NonBala MrgmNo ratings yet

- Who Is A NonDocument12 pagesWho Is A NonBala MrgmNo ratings yet

- Banking Notes Functions of BanksDocument17 pagesBanking Notes Functions of Banksbestread67No ratings yet

- EFDAIDocument5 pagesEFDAIJanardhana JaanuNo ratings yet

- Powerpoint Presentation On FIIDocument13 pagesPowerpoint Presentation On FIIManali Rana100% (1)

- 006eafd0-f2c2-4db1-8d18-872683c00b26Document14 pages006eafd0-f2c2-4db1-8d18-872683c00b26ShivamSinghNo ratings yet