Professional Documents

Culture Documents

CC CC: CCCC C

Uploaded by

Cristopher Andres AgustinOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CC CC: CCCC C

Uploaded by

Cristopher Andres AgustinCopyright:

Available Formats

Capital asset pricing model

From Wikipedia, the free encyclopedia

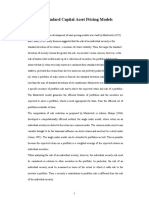

An estimation of the CAPM and the Security Market Line (purple) for the Dow Jones Industrial Average over 3 years for monthly data.

In finance, the capital asset pricing model (CAPM) is used to determine a theoretically appropriate required rate of return of an asset, if that asset is to be added to an already well-diversified portfolio, given that asset's non-diversifiable risk. The model takes into account the asset's sensitivity to nondiversifiablerisk (also known as systematic risk or market risk), often represented by the quantity beta ( ) in the financial industry, as well as the expected return of the market and the expected return of a theoretical risk-free asset. The model was introduced by Jack Treynor (1961, 1962),[1] William Sharpe (1964), John Lintner (1965a,b) and Jan Mossin (1966) independently, building on the earlier work of Harry Markowitz on diversification and modern portfolio theory. Sharpe, Markowitz and Merton Miller jointly received the Nobel Memorial Prize in Economics for this contribution to the field of financial economics.

Contents

1 The formula 2 Security market line 3 Asset pricing 4 Asset-specific required return 5 Risk and diversification 6 The efficient frontier 7 The market portfolio 8 Assumptions of CAPM 9 Problems of CAPM 10 See also 11 References

You might also like

- Analysis of Financial Instruments Using CAPMDocument7 pagesAnalysis of Financial Instruments Using CAPMadjoeadNo ratings yet

- A Survey On Risk-Return AnalysisDocument23 pagesA Survey On Risk-Return Analysisberhanabera80No ratings yet

- Fama&MacBeth PresentationDocument16 pagesFama&MacBeth PresentationAntonio J FernósNo ratings yet

- Dynamic Asset Allocation For Stocks, Bonds, and Cash : Isabelle Bajeux-BesnainouDocument25 pagesDynamic Asset Allocation For Stocks, Bonds, and Cash : Isabelle Bajeux-BesnainouricardomartinsramosNo ratings yet

- Capital Asset Pricing Model (CAPM) : by Himani GrewalDocument48 pagesCapital Asset Pricing Model (CAPM) : by Himani Grewalshekhar_anand1235807No ratings yet

- Market Microstructure Term PaperDocument20 pagesMarket Microstructure Term PaperMburu SNo ratings yet

- Review of key capital asset pricing modelsDocument12 pagesReview of key capital asset pricing modelsdaohoa8x100% (1)

- INTRODUCTIONDocument1 pageINTRODUCTIONPavan H.P.No ratings yet

- JEL Classification Keywords: BstractDocument35 pagesJEL Classification Keywords: BstractsexscansexNo ratings yet

- Portfolio Selection Revisited: Evidence from Indian Stock MarketDocument30 pagesPortfolio Selection Revisited: Evidence from Indian Stock Marketsumit singalNo ratings yet

- Capital Growth With SecurityDocument18 pagesCapital Growth With SecurityMimumNo ratings yet

- On Estimating The Expected Return On The Market An Exploratory InvestigationDocument39 pagesOn Estimating The Expected Return On The Market An Exploratory InvestigationClaudio bastidasNo ratings yet

- SSRN Id249579Document15 pagesSSRN Id249579Art DesaiNo ratings yet

- 345 DanielDocument39 pages345 Danielsajidobry_847601844No ratings yet

- Sumit Saurav - Term - Paper - FOFDocument7 pagesSumit Saurav - Term - Paper - FOFsumit saurabNo ratings yet

- Option Pricing in Continuous-Time: The Black-Scholes-Merton Theory and Its ExtensionsDocument57 pagesOption Pricing in Continuous-Time: The Black-Scholes-Merton Theory and Its ExtensionsMonish ShahNo ratings yet

- Ec371 Topic 3Document13 pagesEc371 Topic 3Mohamed HussienNo ratings yet

- Capm - Theory of Market Equilibrium Under Conditions of Risk - Sharpe WDocument19 pagesCapm - Theory of Market Equilibrium Under Conditions of Risk - Sharpe WWilliam Santiago Núñez LópezNo ratings yet

- YarosDocument3 pagesYarossfsdhg,kNo ratings yet

- Journal Article Analyzes Conditions for Applying Single-Period Asset Pricing Models to Multi-Period SettingsDocument24 pagesJournal Article Analyzes Conditions for Applying Single-Period Asset Pricing Models to Multi-Period SettingsAndreas KarasNo ratings yet

- Presentation PPT (Finance)Document21 pagesPresentation PPT (Finance)Muhammad Ahmed HaroonNo ratings yet

- Multivariate Jump Diffusion Models For The Foreign Exchange MarketDocument33 pagesMultivariate Jump Diffusion Models For The Foreign Exchange MarketSui Kai WongNo ratings yet

- Testing The Performance of Asset Pricing Models During The Covid-19 Crisis Evidence From European Stock MarketsDocument40 pagesTesting The Performance of Asset Pricing Models During The Covid-19 Crisis Evidence From European Stock MarketsZurab OshkhneliNo ratings yet

- Capm Evidence Indian Stock MarketDocument15 pagesCapm Evidence Indian Stock MarketnipuntrikhaNo ratings yet

- Solution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiDocument10 pagesSolution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiJonathanBradshawsmkc100% (42)

- Capital Markets, Theory and EvidenceDocument72 pagesCapital Markets, Theory and EvidenceIjeoma OnuosaNo ratings yet

- Capital Asset Pricing ModelDocument25 pagesCapital Asset Pricing ModelCesar Monterroso100% (1)

- Conditional Asset Pricing With Higher Moments: Volker ZiemannDocument50 pagesConditional Asset Pricing With Higher Moments: Volker ZiemannMuhammad KashifNo ratings yet

- The European Journal of FinanceDocument21 pagesThe European Journal of FinanceMushtaq AliNo ratings yet

- Security Performance-Capm Sa&Moroc Aajfa040205 CoffieDocument21 pagesSecurity Performance-Capm Sa&Moroc Aajfa040205 CoffieakpanyapNo ratings yet

- Lecture 3.1: The Capital Asset Pricing Model (CAPM) : MotivationDocument12 pagesLecture 3.1: The Capital Asset Pricing Model (CAPM) : MotivationHugo PagolaNo ratings yet

- An Anatomy of Trading Strategies: Jennifer ConradDocument31 pagesAn Anatomy of Trading Strategies: Jennifer ConradRicardo NuñezNo ratings yet

- Group 17C - Draft 05 v2Document78 pagesGroup 17C - Draft 05 v2yasir.esapzaiNo ratings yet

- Net Net USDocument70 pagesNet Net USFloris OliemansNo ratings yet

- CAIA Level II Essay Questions Asset Allocation OptimizationDocument31 pagesCAIA Level II Essay Questions Asset Allocation Optimizationmirela2g100% (2)

- Lit ReveiwDocument29 pagesLit ReveiwSarikaNo ratings yet

- The Real Option Model - Evolution and ApplicationsDocument35 pagesThe Real Option Model - Evolution and ApplicationsIQ3 Solutions GroupNo ratings yet

- 20.09.investment Valuation and Asset Pricing - Models and MethodsDocument306 pages20.09.investment Valuation and Asset Pricing - Models and MethodsLinhNo ratings yet

- Market Neutral Hedge FundsDocument36 pagesMarket Neutral Hedge FundsMichael GuanNo ratings yet

- Theory of Portfolio Investment: A Review of Literature: Worapot Ongkrutaraksa, PH.DDocument8 pagesTheory of Portfolio Investment: A Review of Literature: Worapot Ongkrutaraksa, PH.Dvouzvouz7127No ratings yet

- IPM - A Quantitative Stock Prediction System Based On Financial NewsDocument29 pagesIPM - A Quantitative Stock Prediction System Based On Financial NewsBo FerrisNo ratings yet

- Barra Model JournalDocument6 pagesBarra Model JournalKurniawan Indonanjaya100% (1)

- Mono 2008 M As08 1 ThakurDocument27 pagesMono 2008 M As08 1 Thakuraruna2707No ratings yet

- Asset Pricing Assignment - 1 Devika KamalDocument3 pagesAsset Pricing Assignment - 1 Devika KamaldevikaNo ratings yet

- G.M. Constant in Ides, A.G. MalliarisDocument30 pagesG.M. Constant in Ides, A.G. MalliarisphatsaweeNo ratings yet

- 00K - Antifragile Asset Allocation Model - GioeleGiordano - 1st PlaceDocument19 pages00K - Antifragile Asset Allocation Model - GioeleGiordano - 1st Placenaren.bansalNo ratings yet

- Literature On CapmDocument14 pagesLiterature On CapmHitesh ParmarNo ratings yet

- Mathematical Finance - WikipediaDocument7 pagesMathematical Finance - WikipediaDAVID MURILLONo ratings yet

- Chapter II Review of LiteratureDocument31 pagesChapter II Review of LiteratureHari PriyaNo ratings yet

- Theory of Capital Markets: A Review of Literature: Worapot Ongkrutaraksa, PH.DDocument7 pagesTheory of Capital Markets: A Review of Literature: Worapot Ongkrutaraksa, PH.DAylwin zechariah JohnNo ratings yet

- Principal Portfolios: Recasting The Efficient Frontier: M. Hossein Partovi Michael CaputoDocument10 pagesPrincipal Portfolios: Recasting The Efficient Frontier: M. Hossein Partovi Michael CaputoHernan ArrigoneNo ratings yet

- The Standard Capital Asset Pricing ModelsDocument12 pagesThe Standard Capital Asset Pricing ModelsRifat HelalNo ratings yet

- Fama French For Indian MarketDocument23 pagesFama French For Indian MarketRohit DhandaNo ratings yet

- Dynamic CAPM Model Tests Supply Effect on Asset PricesDocument75 pagesDynamic CAPM Model Tests Supply Effect on Asset PricesRoha KhanNo ratings yet

- MODERN FINANCE THEORIESDocument38 pagesMODERN FINANCE THEORIESAnggari SaputraNo ratings yet

- Guenster Et Al. Riding BubblesDocument48 pagesGuenster Et Al. Riding BubblesecrcauNo ratings yet

- Capital Asset Prices Model (Sharpe)Document23 pagesCapital Asset Prices Model (Sharpe)David PereiraNo ratings yet

- Dynamic Asset Allocation For Varied Financial Markets Under Regime Switching FrameworkDocument9 pagesDynamic Asset Allocation For Varied Financial Markets Under Regime Switching FrameworkFarhan SarwarNo ratings yet

- أثر تباين مخاطر السوق على قدرة نموذج تسعير الأصول الرأسمالية على تفسير التغير في عوائد الأسهمDocument23 pagesأثر تباين مخاطر السوق على قدرة نموذج تسعير الأصول الرأسمالية على تفسير التغير في عوائد الأسهمHamza AlmostafaNo ratings yet

- Cost Data Managerial DecisionsDocument3 pagesCost Data Managerial DecisionsCristopher Andres AgustinNo ratings yet

- Brentline HospitalDocument3 pagesBrentline HospitalCristopher Andres AgustinNo ratings yet

- Introduction To Corporate Finance 2eDocument3 pagesIntroduction To Corporate Finance 2eCristopher Andres AgustinNo ratings yet

- 68 CEO ResponsibilitiesDocument3 pages68 CEO ResponsibilitiesmerttanNo ratings yet