Professional Documents

Culture Documents

The Concept of Simple and Compound Interest

Uploaded by

Altaf Khoso الطاف کوسوOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Concept of Simple and Compound Interest

Uploaded by

Altaf Khoso الطاف کوسوCopyright:

Available Formats

Teaching and Learning

Guide 5: Finance and Growth

Section 3: Simple and Compound Interest

1. The concept of simple and compound Interest

As noted earlier, students will benefit from clear and cogent definitions at the beginning of the topic or module.

Definition of Simple Interest Simple interest is a fixed percentage of the principal, P, that is paid to an investor each year, irrespective of the number of years the principal has been left on deposit. Consequently an amount of money invested at simple interest will increase in value by the same amount each year.

Algebraically, the amount of simple interest, I, earned on a deposit, P0, invested at r% for t years is:

I = P0 x r x t Hence the total amount of money after t years is the principal plus the accrued interest:

P0 + P0 x r x t = P0(1 + rt) Definition of compound interest The view above of only the principal earning interest is a very simplistic one and normally the interest on money borrowed is usually compounded. Compound interest pays interest on the principal plus on any interest accumulated in previous years.

The total value after t years when a principal, P0, is compounded at r% per annum is: Pt = P0(1+r)t

Page 14 of 37

Teaching and Learning

Guide 5: Finance and Growth

2. Presenting the concept of simple and compound Interest

Worked examples are a good way for students to understand and apply the concepts and mathematical techniques. They also provide a reference for students to return if they need to when they are working independently on problem sets. Two worked examples are provided below to help colleagues present these two concepts. Presenting the calculation of simple interest If you borrow 1000 for five years at a simple interest rate of 10% p.a., the amount of interest you pay is:

I = P0 x r x t = 1000 x 0.1 x 5 = 500 Thus the cost of borrowing 1000 for five years at 10% p.a. simple interest is 500. The total amount due after five years would be:

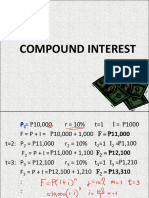

P0(1 + rt) = 1000 x (1 + 0.1 x 5) = 1500. Presenting the calculation of compound interest In order to demonstrate the fundamentals of compound interest consider a deposit of 1000 over 5 years at 10% per annum with interest compounded annually.

Principal at start of year 1000 1100 1210 1331 1464.10

Interest paid each year 100 110 121 133.10 146.41

Total at end of year 1100 1210 1331 1464.10 1610.51

Note the 1610.51 could have been obtained directly as: 1000 x (1 + 0.1)5 = 1000 x 1.61051 = 1610.51

Page 15 of 37

Teaching and Learning

Guide 5: Finance and Growth

Repeating the above example but using algebraic notation rather than numbers:

Principal at start of year P0

Interest earned each year r x P0

Total at end of year

P0 + rP0 = P0(1 + r) = P1

P1

r x P1

P1+rP1=P0(1 + r)+ rP0(1 + r) = P0(1+r)(1+r) = P0(1+r)2 = P2 P2+rP2=P0(1 + r)2+ rP0(1 + r)2 = P0(1+r)2(1+r) = P0(1+r)3 = P3

P2

r x P2

Pt-1

r x Pt-1

... P0(1+r)t = Pt

Notice that the totals at the end of each year form a geometric progression (including the initial amount): P0, P0(1+r), P0(1+r)2, P0(1+r)3, , P0(1+r)t Hence as stated previously the total value after t years when a principal, P0, is compounded at r% per annum is:

Pt = P0(1+r)t

3. Delivering the concept of simple and compound Interest to small and larger groups Students will need an initial and formal overview of simple and compound interest. This could be complemented by a more practical exercise where students visit banks and building societies in person or online to consider the different rates of interest offered by different financial products and to consider how the total return they would receive would be significantly affected by compounding.

Page 16 of 37

Teaching and Learning

Guide 5: Finance and Growth

Links to the online question bank There are questions on investment appraisal including simple and compound interest at http://www.metalproject.co.uk/METAL/Resources/Question_bank/Economics%20applications/in dex.html

Video clips The video clips for this Guide can be found at http://www.metalproject.co.uk/Resources/Films/Mathematics_of_finance/index.html Clips 3.01 to 3.03 (inclusive) offer good practical illustrations of compounding starting with an applied example of a student calculating how long it will take for them to save for a round the world trip.

4. Discussion

A simple competition and discussion could be created where students are paired and given a notional 1000 and a 10 year investment time frame and asked to select a savings account which would maximise their compounded interest. Higher ability students could look at foreign savings products and could factor in exchange rates when arriving at the Sterling figure.

5. Activities

Learning Objectives LO1: Students learn the meaning of key financial terms- bond, coupon, interest, simple and compound interest LO2: Students learn how to calculate simple and compound interest LO3: Students learn the distinction between simple and compound interest LO4: Students learn the impact which the frequency of compounding has upon the size of the total return

Task One A bond's coupon is the annual interest rate paid on the issuer's borrowed money, generally paid out semi-annually. The coupon is always tied to a bond's face or par value, and is quoted as a percentage of par. For instance, a bond with a par value of 1,000 and an annual interest rate of 4.5% has a coupon rate of 4.5% (45).

Page 17 of 37

Teaching and Learning

Guide 5: Finance and Growth

Say you invest in a six-year bond paying 5% per year, annually. Assuming you hold the bond to maturity, you will receive 6 interest payments of 250 each, or a total of 1,500. Plus the par value of 1000.This coupon payment is simple interest.

You can do two things with that simple interestspend it or reinvest it. Determine the total amount of money you will have after six years, assuming you can reinvest the interest at 5% per annum.

Task Two So far, it has been assumed that compound interest is compounded once a year. In reality interest may be compounded several times a year, e.g. daily, weekly, monthly, quarterly, semiannually or even continuously.

The value of an investment at the end of m compounding periods is: Pt = P0[1 + r/m]m x t Where m is the number of compounding periods per year and t is the number of years.

Using this information, solve the following problem:

(a)

1,000 is invested for three years at 6% per annum compounded semi-annually. Calculate

the total return after three years.

(b) What would the answer be if the interest was compounded annually?

(c) If the interest was compounded monthly is it true that the total amount after three years would be less than 1195.00?

(d) Using your answers to (a) (c) what can you infer about the frequency of compounding and the size of the total return?

Page 18 of 37

Teaching and Learning

Guide 5: Finance and Growth

rt

Task Three (Using the formula Pt = P0e ) It follows that when we compound interest continuously the value of the investment at the end of the period becomes Pt = P0ert. Worked example A financial consultant advises you to invest 1,000 at 6% continuously compounded for three years. Find the total value of your investment. Pt = P0ert = 1,000 x e(0.06 x 3) = 1,000 x 2.71830.18 = 1,197.22 In Excel to raise e to the power of another number you use the EXP function.

(a) Use Excel to set up a table comparing the growth of 1 invested for 25 years at 20% assuming interest is compounded (i) annually; (ii) quarterly; (iii) monthly and (iv) continuously. (b) Graph the outcome. (c) What conclusion can be drawn regarding the frequency of compounding?

Page 19 of 37

Teaching and Learning

Guide 5: Finance and Growth

ANSWERS Task One Time (years) 1 2 3 4 5 6 Totals Cash Flow received 250 250 250 250 250 1,250 2,500 Interest Earned at 5% 69.07 53.88 39.41 25.63 12.50 0.00 200.48

When you reinvest a coupon, however, you allow the interest to earn interest. The precise term is "interest-on-interest," (i.e. compounding). Assuming you reinvest the interest at the same 5% rate and add this to the 1,500 you made, you would earn a cumulative total of 2,700.48, or an extra 200.48 (of course, if the interest rate at which you reinvest your coupons is higher or lower, your total returns will be more or less).

Task Two (a) P3 = 1,000 x (1 + 0.06/2)2 x 3 = 1,000 x (1.03)6 = 1194.05 (b) Time (years) 1 2 3 Principal 1,000.00 1,060.00 1,123.60 Interest Earned 60.00 63.60 67.42 Total at End of Period 1,060.00 1,123.60 1,191.02

Which is the same as 1,000 x (1+0.06)3 = 1,191.02.

(c) FALSE since we would get Time (months) 1 2 Principal 1,000.00 1,005.00 Interest Earned 5.00 5.03 Total at End of Period 1,005.00 1,010.03

Page 20 of 37

Teaching and Learning

Guide 5: Finance and Growth

3 .. .. 35 36

1,010.03 .. .. 1,184.83 1,190.75

5.05 .. .. 5.92 5.95

1,015.08 .. .. 1,190.75 1,196.70

or 1,000 x (1 + 0.06/12)12 x 3 = 1,000 x (1.005)36 = 1,196.68 (note difference is due to rounding errors)

(d) Hence

the greater the compounding frequency the greater the total return. Thus if we

compound daily the total return would be: 1,000 x (1 + 0.06/365)365 x 3 = 1,197.20. To illustrate what happens as the compounding frequency is increased, consider the table below.

Compounding Frequency 1 2 4 8 12 52 365 730 1460 5000 10000 50000

Total at End of Period 1,191.02 1,194.05 1,195.62 1,196.41 1,196.68 1,197.09 1,197.20 1,197.21 1,197.21 1,197.22 1,197.22 1,197.22

Page 21 of 37

Teaching and Learning

Guide 5: Finance and Growth

As the value of m (the compounding frequency) increases the value of the investment becomes larger, but never exceeds 1.197.22

Note the final value is arrived at from: 1,000 x (1 + 0.06/50000)50000 x 3 = 1,197.22. Note: Higher ability students might want to consider the following explanation: By allowing m to approach infinity interest is being added to the investment more and more frequently and can be regarded as being added continuously, such that:

0.06 lim 1000 x 1 + m m

mx 3

= 1,197.22

Here we applied this formula: Pt = P0[1 + r/m]m x t

with P0 set at 1,000, r set at 0.06 and t set at 3 and varying m. If we now set P0 at 1, r at 100% (i.e. 1) and t set at 1 year we arrive at the following answer for m set at 50,000: Pt = 1x [1 + 1/50,000]50,000 = 2.7183 Thus we can say that:

1 lim 1 + m m

= 2.7183

You may recognise this number, 2.7183, the natural logarithm, e. Note log to the base e of 2.7183 (denoted loge(2.7183) = 1).

Page 22 of 37

Teaching and Learning

Guide 5: Finance and Growth

Task Three

(a) and (b)

The Growth of 1 at r = 20% using different compounding frequencies 160.00 140.00 120.00 100.00 80.00 60.00 40.00 20.00 0.00 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 Year

Value ('s)

Annually Quarterly Monthly Continuously

(c) We can observe from the chart that the continuous method of compounding leads to the greatest cumulative total after 20 years, while the annual method gives the smallest sum. Furthermore, the longer the investment is left on deposit the wider the differences when compounded by the different methods.

Page 23 of 37

Teaching and Learning

Guide 5: Finance and Growth

6. Top Tips

Remind students that the interest rate is always quoted as a percentage, i.e. r%. Many students erroneously enter interest rates into a variety of financial problems. As a good check it is useful to ask students to undertake a simple commonsense check: look at the answer and ask if its reasonable. For example if I invest 100 for one year at 10% would I really expect to get 1100 back at the end of the year (100 x (1+10)) or is 110 more realistic (100 x (1+0.01))? This intuition is impossible to teach but students can acquire and develop it if they practise stopping and reflecting on their answers rather than accepting whatever appears on their calculator screens.

Students appreciate real examples rather than made up examples. You will find a huge wealth of examples at http://www.nsandi.com/products/frsb/calculator.jsp

Section 4: Investment Appraisal

1. The concept of investment appraisal

It would be helpful to start by explaining what is meant by the term, Investment Appraisal and also that it is necessary to first consider the time value of money and the concept of present value.

2. Presenting the concept of investment appraisal

A good way to get students thinking about investment appraisal is to ask the group of students would you rather have 100 now or 100 in a years time?. One would expect everyone to respond with 100 now!. Then repeat the question at 85, 90, 95, 96, 97, 98 and 99. One would be surprised if anyone said yes at 85, 90 or even 95.

But if they do you can question their logic. They may choose to take the money now because they favour present consumption over future consumption. But if they argue that they could the

Page 24 of 37

You might also like

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- First-Reporter-Compound-Interest .2Document25 pagesFirst-Reporter-Compound-Interest .2Mherie Joy Cantos GutierrezNo ratings yet

- Mathematics of FinanceDocument11 pagesMathematics of FinanceAnis Fadzilah ZulkifleNo ratings yet

- First Reporter Compound Interest .2Document29 pagesFirst Reporter Compound Interest .2Golden Gate Colleges Main LibraryNo ratings yet

- LAS 9 GenMath 11Document9 pagesLAS 9 GenMath 11Chantal AltheaNo ratings yet

- Simple and Compound InterestDocument46 pagesSimple and Compound InterestAndres MabiniNo ratings yet

- Chapter Four Lecture Notes On Business MathematicsDocument24 pagesChapter Four Lecture Notes On Business MathematicsErmias Guragaw100% (3)

- Calculating Interest Rates in Simple and Compound FormulasDocument39 pagesCalculating Interest Rates in Simple and Compound FormulasEdwardJohnG.CalubIINo ratings yet

- Compound Interest No. 2Document5 pagesCompound Interest No. 2Jayron GordonNo ratings yet

- Chapter 4 StudentDocument21 pagesChapter 4 Studentgerearegawi721No ratings yet

- Bus Fin Module 4 Basic Long-Term Financial ConceptsDocument21 pagesBus Fin Module 4 Basic Long-Term Financial ConceptsMariaShiela PascuaNo ratings yet

- Bba 1007 Business Mathematics and StatisticsDocument20 pagesBba 1007 Business Mathematics and StatisticsVentusNo ratings yet

- Interest Encon 1Document10 pagesInterest Encon 1Erina SmithNo ratings yet

- Text 1Document11 pagesText 1Ray Joshua Angcan BalingkitNo ratings yet

- Simple and Compound InterestDocument2 pagesSimple and Compound InterestRaymond EdgeNo ratings yet

- Lesson 5Document22 pagesLesson 5Aniqah Mardi Macuja EscarianNo ratings yet

- Math Finance EssentialsDocument10 pagesMath Finance EssentialsEduardo Tello del PinoNo ratings yet

- Maths CH-4 PPT-1Document31 pagesMaths CH-4 PPT-1newaybeyene5No ratings yet

- Unit 4 MMDocument21 pagesUnit 4 MMChalachew EyobNo ratings yet

- FM I Chapter 3Document12 pagesFM I Chapter 3mearghaile4No ratings yet

- Groupp-1 Topic 1Document37 pagesGroupp-1 Topic 1Shaina BaptistaNo ratings yet

- Compound InterestDocument33 pagesCompound InterestENGLAND DE ASIS ESCLAMADONo ratings yet

- DE BORJA, RON JIMMUEL I Teaching Guide Math PDFDocument12 pagesDE BORJA, RON JIMMUEL I Teaching Guide Math PDFRon jimmuel De borjaNo ratings yet

- Mathschapter FourDocument41 pagesMathschapter FourAsteway MesfinNo ratings yet

- Models For Finance and AccountingDocument56 pagesModels For Finance and Accountingpramodh kumarNo ratings yet

- Interest FormulaDocument17 pagesInterest FormulaHarlene CorigalNo ratings yet

- Gen Math - Q2 - Module 1Document14 pagesGen Math - Q2 - Module 1Julie Anne MacuseNo ratings yet

- Week 8 General MathematicsDocument11 pagesWeek 8 General MathematicsMarcel Baring ImperialNo ratings yet

- Fundamentals of Engineering EconomicsDocument112 pagesFundamentals of Engineering EconomicsDanialNo ratings yet

- Learn the fundamentals of simple interest and discountDocument19 pagesLearn the fundamentals of simple interest and discountShiena mae IndacNo ratings yet

- Chapter 9: Mathematics of FinanceDocument55 pagesChapter 9: Mathematics of FinanceQuang PHAMNo ratings yet

- Unit 4: Mathematics of FinanceDocument34 pagesUnit 4: Mathematics of FinanceDawit MekonnenNo ratings yet

- Compound InterestDocument5 pagesCompound InterestMimimiyuhNo ratings yet

- Financial Mathematics Lecture Notes Fina PDFDocument71 pagesFinancial Mathematics Lecture Notes Fina PDFTram HoNo ratings yet

- Fin118 Unit 9Document25 pagesFin118 Unit 9ayadi_ezer6795No ratings yet

- Ch.4 Math of Finance-1Document19 pagesCh.4 Math of Finance-1hildamezmur9No ratings yet

- Mathematics of Finance: Faculty of Business Studies (FBS) Bangladesh University of Professionals (BUP)Document52 pagesMathematics of Finance: Faculty of Business Studies (FBS) Bangladesh University of Professionals (BUP)Sadia Afrin ArinNo ratings yet

- Lecture 1: Compound Interests: Chapter 1: Mathematics of FinanceDocument34 pagesLecture 1: Compound Interests: Chapter 1: Mathematics of FinanceSa NguyenNo ratings yet

- # 4. Money-Time Relationships: Capital Returns and InterestsDocument38 pages# 4. Money-Time Relationships: Capital Returns and InterestsJean Claire LlemitNo ratings yet

- Compound Interest Learning Activity SheetDocument9 pagesCompound Interest Learning Activity SheetHababa AziwazaNo ratings yet

- Calculate Compound Interest EasilyDocument16 pagesCalculate Compound Interest EasilyVj McNo ratings yet

- C3-Principles-of-Interest-StudentsDocument59 pagesC3-Principles-of-Interest-StudentsHeleana Faye BundocNo ratings yet

- Module 1wk1 To 2final Term in General Math 2021 2022 PDFDocument15 pagesModule 1wk1 To 2final Term in General Math 2021 2022 PDFateyakayeeNo ratings yet

- Notes-All Session 1Document12 pagesNotes-All Session 1datcu2802No ratings yet

- General Mathematics: I.2 Learning ActivitiesDocument6 pagesGeneral Mathematics: I.2 Learning ActivitiesAndrea InocNo ratings yet

- Chapter 1 StudentDocument24 pagesChapter 1 Studentmaha aleneziNo ratings yet

- ASB4416 Financial Modelling: Time Value of Money: AnswersDocument5 pagesASB4416 Financial Modelling: Time Value of Money: AnswersQuinn TranNo ratings yet

- BUSINESS MATHS 1 INTEREST-1Document24 pagesBUSINESS MATHS 1 INTEREST-1emmanuelifende1234No ratings yet

- A. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyDocument12 pagesA. Simple Interest B. Compound Interest Simple Interest: Interest Is Simply The Price Paid For The Use of Borrowed MoneyArcon Solite BarbanidaNo ratings yet

- C3 Principles of Interest Annuity Due PerpetuityDocument87 pagesC3 Principles of Interest Annuity Due PerpetuityErroll Joshua Matusalem FonteNo ratings yet

- Financial Mathematics 1 NotesDocument20 pagesFinancial Mathematics 1 NotesLukong LouisNo ratings yet

- Lecture Engineering Economic AnalysisDocument64 pagesLecture Engineering Economic Analysisvon11No ratings yet

- TVM Principles and CalculationsDocument27 pagesTVM Principles and Calculationshassan baradaNo ratings yet

- Gen Math Mod67Document15 pagesGen Math Mod67Jun ChavezNo ratings yet

- Learning Activity Sheet q2w1-2Document4 pagesLearning Activity Sheet q2w1-2Mark Anthony Bell BacangNo ratings yet

- Lecture 4Document41 pagesLecture 4Tamer MohamedNo ratings yet

- Ge 114 Module 7Document7 pagesGe 114 Module 7frederick liponNo ratings yet

- Grade 11 Math MOd 6Document12 pagesGrade 11 Math MOd 6John Lois VanNo ratings yet

- Mathematics of Finance: Md. Aktar Kamal Lecturer Department of Management Bangladesh University of Professionals (BUPDocument14 pagesMathematics of Finance: Md. Aktar Kamal Lecturer Department of Management Bangladesh University of Professionals (BUPZubaer RiadNo ratings yet