Professional Documents

Culture Documents

Grocery

Uploaded by

Tax FoundationCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Grocery

Uploaded by

Tax FoundationCopyright:

Available Formats

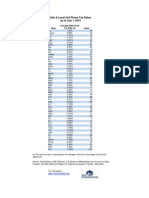

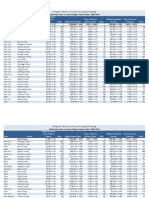

Sales Tax Treatment of Groceries, Candy and Soda, As of January 1, 2012

State General Sales Tax 4.00% 6.60% 6.00% 7.25% 2.90% 6.00% 6.00% 4.00% 4.00% 6.25% 6.25% 7.00% 6.00% 6.30% 6.00% 4.00% 5.00% 6.00% 6.25% 6.00% 6.875% 7.00% 4.225% 5.50% 6.85% 7.00% 5.13% 4.00% 5.75% 5.00% 5.50% 4.50% 6.00% 7.00% 6.00% 4.00% 7.00% 6.25% 5.95% 6.00% 5.00% 6.50% 6.00% 5.00% 4.00% 6.00% Grocery Treatment Included in Base Exempt 2.00% Exempt Exempt Exempt Exempt Exempt Included in Base Included in Base 1.00% Exempt Exempt Included in Base Exempt Exempt Exempt Exempt Exempt Exempt Exempt Included in Base 1.23% Exempt Exempt Exempt Exempt Exempt Exempt Exempt Exempt Included in Base Exempt Exempt Exempt Included in Base 5.50% Exempt 1.75% Exempt 2.50% Exempt 3.00% Exempt Exempt Exempt Candy Treated as Groceries? Yes Yes Yes Yes No No No Yes Yes Yes No No No Yes No Yes No No Yes Yes No Yes Yes Yes Yes No Yes No No No Yes Yes Yes No Yes Yes Yes No Yes Yes Yes Yes Yes No Yes Yes Soda Treated as Groceries? Yes Yes Yes No No No No Yes Yes Yes No No No Yes No Yes No No Yes Yes No Yes Yes Yes Yes No Yes No No No No Yes No No Yes Yes Yes No Yes Yes Yes No No No Yes No

State Ala. Alaska Ariz. Ark. Calif. Colo. Conn. Del. Fla. Ga. Hawaii Idaho Ill. Ind. Iowa Kans. Ky. La. Maine Md. Mass. Mich. Minn. Miss. Mo. Mont. Nebr. Nev. N.H. N.J. N.M. N.Y. N.C. N.D. Ohio Okla. Ore. Pa. R.I. S.C. S.D. Tenn. Tex. Utah Vt. Va. Wash. W.Va. Wis. Wyo. D.C.

Source: Tax Foundation, Overreaching on Obesity: Governments Consider New Taxes on Soda and Candy (Oct. 2011).

Tax Foundation www.TaxFoundation.org

You might also like

- Fed U.S. Federal Individual Income Tax Rates History, 1862-2013Document68 pagesFed U.S. Federal Individual Income Tax Rates History, 1862-2013Tax Foundation96% (23)

- State Corporate Income Tax Rates As of January 1, 2012Document56 pagesState Corporate Income Tax Rates As of January 1, 2012Tax FoundationNo ratings yet

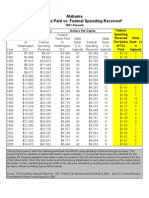

- Federal Taxes Paid Vs Federal Spending Received by States, 1981-2005Document51 pagesFederal Taxes Paid Vs Federal Spending Received by States, 1981-2005Javier Arvelo-Cruz-SantanaNo ratings yet

- Facts and Figures 2012: Sales Tax Treatment of Groceries, Candy and Soda, As of January 1, 2012Document1 pageFacts and Figures 2012: Sales Tax Treatment of Groceries, Candy and Soda, As of January 1, 2012Tax FoundationNo ratings yet

- State General Sales Tax Rates, 2012: (As of January 1, 2012)Document13 pagesState General Sales Tax Rates, 2012: (As of January 1, 2012)api-227498766No ratings yet

- State Coll PC 2010Document1 pageState Coll PC 2010Tax FoundationNo ratings yet

- State Rev PC 2010Document1 pageState Rev PC 2010Tax FoundationNo ratings yet

- LotteryDocument1 pageLotteryTax FoundationNo ratings yet

- Factors Influencing The Consumer Behaviour When Buying FoodDocument9 pagesFactors Influencing The Consumer Behaviour When Buying Foodqwerty asdfghjklNo ratings yet

- SL Sales RatesDocument1 pageSL Sales RatesTax FoundationNo ratings yet

- Jlerivol19no2 With Cover Page v2Document116 pagesJlerivol19no2 With Cover Page v2Lifw BellNo ratings yet

- Unemployment Rates For WikiDocument6 pagesUnemployment Rates For WikiblruddNo ratings yet

- Income Guidelines 2015Document1 pageIncome Guidelines 2015Brett ScottNo ratings yet

- Econ 5 Supply and Demand Analysis Module 2Document5 pagesEcon 5 Supply and Demand Analysis Module 2Ponkan BNo ratings yet

- Fred Thompson 4/6/10Document6 pagesFred Thompson 4/6/10patrick_emerson6704No ratings yet

- Thesis Statement Sugar ConsumptionDocument6 pagesThesis Statement Sugar Consumptionangieloveseattle100% (2)

- Po5 ckv-3Document8 pagesPo5 ckv-3api-288056236No ratings yet

- TIC ContributorsDocument5 pagesTIC ContributorsPatrick SvitekNo ratings yet

- State Corp Tax Coll PCDocument1 pageState Corp Tax Coll PCTax Foundation100% (1)

- SITXFIN004 AssignmentDocument21 pagesSITXFIN004 AssignmentNateeNo ratings yet

- SL Rev PC 2010Document1 pageSL Rev PC 2010Tax FoundationNo ratings yet

- Fact UrasDocument26 pagesFact UrasEdwin JimenezNo ratings yet

- Top 10 Retailers of 2012Document3 pagesTop 10 Retailers of 2012Sumit RoyNo ratings yet

- Budget Planner - Overview / Help: InstructionsDocument7 pagesBudget Planner - Overview / Help: InstructionsmrbundlezNo ratings yet

- Gujarat Six Pay CalculatorDocument2 pagesGujarat Six Pay Calculatormanojpgdca98No ratings yet

- Sales Performance and Target Achievement by Outlets (March - August 2016Document69 pagesSales Performance and Target Achievement by Outlets (March - August 2016popopioNo ratings yet

- HMWK 02Document2 pagesHMWK 02david johnsonNo ratings yet

- Consumer Price Index - Apr 13 FinalDocument4 pagesConsumer Price Index - Apr 13 FinalPatricia bNo ratings yet

- Economic Highlights - Inflation Rate Inched Up To +1.6% Yoy in May - 18/6/2010Document3 pagesEconomic Highlights - Inflation Rate Inched Up To +1.6% Yoy in May - 18/6/2010Rhb InvestNo ratings yet

- Sales TaxesDocument1 pageSales Taxeshornynow904No ratings yet

- Wisconsin - Claims Paid - FPW - 2007-2010Document114 pagesWisconsin - Claims Paid - FPW - 2007-2010Matt J KorgerNo ratings yet

- Give Local PDFDocument1 pageGive Local PDFAnonymous J8Ro5ENo ratings yet

- New PT PacketDocument11 pagesNew PT PacketKrishnaSomayajulaNo ratings yet

- Final PaperDocument8 pagesFinal Paperapi-316127704No ratings yet

- Zambia - Statistics - March 2012Document23 pagesZambia - Statistics - March 2012chifwalobwalyaNo ratings yet

- Analysis of The Official Resolution To Implement The IEPS Tax, To Sugar BeveragesDocument2 pagesAnalysis of The Official Resolution To Implement The IEPS Tax, To Sugar BeveragesMariel LunaNo ratings yet

- Joy To Live EbookDocument417 pagesJoy To Live Ebookmarkuswolf11No ratings yet

- SL Debt PCDocument1 pageSL Debt PCTax FoundationNo ratings yet

- Causes and Effects of The Great Depression EssayDocument6 pagesCauses and Effects of The Great Depression Essayafibojmbjifexj100% (2)

- Whitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Document2 pagesWhitehall: Monitoring The Markets Vol. 5 Iss. 21 (June 17, 2015)Whitehall & CompanyNo ratings yet

- 2020 Vision - Global Food & Beverage Industry OutlookDocument21 pages2020 Vision - Global Food & Beverage Industry OutlookBaby SinghNo ratings yet

- Book 1Document6 pagesBook 1api-272706217No ratings yet

- Coffee - US - September 2010 Market Drivers: Key PointsDocument7 pagesCoffee - US - September 2010 Market Drivers: Key Pointsjksingh88No ratings yet

- ALICE New YorkDocument311 pagesALICE New YorkMatthew LeonardNo ratings yet

- Stope Rasta Cijena Na Malo U RS 2005-2019Document4 pagesStope Rasta Cijena Na Malo U RS 2005-2019Ranko MandicNo ratings yet

- Food Letter 06Document3 pagesFood Letter 06Sunlight FoundationNo ratings yet

- SL Cell 2010Document1 pageSL Cell 2010Tax FoundationNo ratings yet

- Cashflow StatementDocument6 pagesCashflow Statementapi-271333426No ratings yet

- Pines City Colleges: College of PharmacyDocument1 pagePines City Colleges: College of PharmacyKarla KatNo ratings yet

- OK Budget Outlook - Oct09Document36 pagesOK Budget Outlook - Oct09sdesignNo ratings yet

- Backbar Liquor Inventory Spreadsheet TemplateDocument1,672 pagesBackbar Liquor Inventory Spreadsheet Templatenakitare makanaNo ratings yet

- Oklahoma Budget Trends and Outlook (December 2009)Document39 pagesOklahoma Budget Trends and Outlook (December 2009)dblattokNo ratings yet

- Republic of The Philippines Philippine Statistics Authority Quezon CityDocument3 pagesRepublic of The Philippines Philippine Statistics Authority Quezon CityJackophiliNo ratings yet

- State Cig Rates Jan12Document1 pageState Cig Rates Jan12Tax Foundation100% (1)

- CPI-SPECIAL RELEASE - Mar2022Document5 pagesCPI-SPECIAL RELEASE - Mar2022harrison guiananNo ratings yet

- Pharmaceutical Therapeutic Categories Outlook: March 2002Document333 pagesPharmaceutical Therapeutic Categories Outlook: March 2002nergaliusNo ratings yet

- GEO Travel ExpendituresDocument66 pagesGEO Travel ExpendituresAmy OliverNo ratings yet

- Cadbury - PLC: Gayathiri Thiagaraj (089044856/1)Document13 pagesCadbury - PLC: Gayathiri Thiagaraj (089044856/1)rebekah_beckyNo ratings yet

- Cadbury - PLC: Gayathiri Thiagaraj (089044856/1)Document11 pagesCadbury - PLC: Gayathiri Thiagaraj (089044856/1)rebekah_beckyNo ratings yet

- 2015 Federal Poverty GuidelinesDocument1 page2015 Federal Poverty GuidelinesJulian RodriguezNo ratings yet

- Economic Highlights - Inflation Picked Up in June and Will Likely Accelerate Following The Removal of Fuel and Sugar Subsidies - 22/07/2010Document3 pagesEconomic Highlights - Inflation Picked Up in June and Will Likely Accelerate Following The Removal of Fuel and Sugar Subsidies - 22/07/2010Rhb InvestNo ratings yet

- Tax Foundation 2014 Annual ReportDocument32 pagesTax Foundation 2014 Annual ReportTax FoundationNo ratings yet

- Christmas Cheer Return: Filing StatusDocument2 pagesChristmas Cheer Return: Filing StatusTax FoundationNo ratings yet

- Explainer: Nevada Governor Sandoval's Business License Fee Restructuring - Appendix ADocument10 pagesExplainer: Nevada Governor Sandoval's Business License Fee Restructuring - Appendix ATax FoundationNo ratings yet

- How Is The Money Used? Federal and State Cases Distinguishing Taxes and FeesDocument98 pagesHow Is The Money Used? Federal and State Cases Distinguishing Taxes and FeesTax FoundationNo ratings yet

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Facts & Figures 2015: How Does Your State Compare?Document55 pagesFacts & Figures 2015: How Does Your State Compare?Tax FoundationNo ratings yet

- North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformDocument84 pagesNorth Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformTax Foundation100% (1)

- Facts and Figures 2014Document55 pagesFacts and Figures 2014Tax FoundationNo ratings yet

- Facts and Figures 2013Document56 pagesFacts and Figures 2013Tax FoundationNo ratings yet

- Fiscal Cliff MSA TableDocument11 pagesFiscal Cliff MSA TableTax FoundationNo ratings yet

- Tax Watch, Winter 2013Document28 pagesTax Watch, Winter 2013Tax FoundationNo ratings yet

- Powerpoint Presentation For "North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth Reform"Document38 pagesPowerpoint Presentation For "North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth Reform"Tax FoundationNo ratings yet

- Facts and Figures - How Does Your State Compare? 2013 EditionDocument56 pagesFacts and Figures - How Does Your State Compare? 2013 EditionTax FoundationNo ratings yet

- Tax Watch Summer 2012Document24 pagesTax Watch Summer 2012Tax FoundationNo ratings yet

- Fiscal Cliff MSA TableDocument11 pagesFiscal Cliff MSA TableTax FoundationNo ratings yet

- Scott Hodge, President Will Mcbride, Chief EconomistDocument20 pagesScott Hodge, President Will Mcbride, Chief EconomistTax FoundationNo ratings yet

- Federal Income Tax Rates History, Nominal Dollars, 1913-2013Document66 pagesFederal Income Tax Rates History, Nominal Dollars, 1913-2013Tax Foundation100% (1)

- Proptax 08 10 TaxespaidDocument67 pagesProptax 08 10 TaxespaidTax FoundationNo ratings yet

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Proptax 06 10 TaxpaidDocument102 pagesProptax 06 10 TaxpaidTax FoundationNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Proptax10 Taxes PaidDocument27 pagesProptax10 Taxes PaidTax FoundationNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- Proptax 08 10 IncomeDocument66 pagesProptax 08 10 IncomeTax FoundationNo ratings yet

- Proptax 06 10 HomevalueDocument102 pagesProptax 06 10 HomevalueTax FoundationNo ratings yet