Professional Documents

Culture Documents

Inher Rates

Uploaded by

Tax FoundationOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inher Rates

Uploaded by

Tax FoundationCopyright:

Available Formats

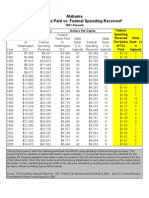

Inheritance Tax Rates and Exemptions, As of January 1, 2012

State Ind. Heir type Spouse/Charity Class A Class B Class C Class A Class B Class C Class A Class B Class C Lineal Heirs All others Immediate Relative Remote Relative All others Class A Class C Class D Lineal Heirs Siblings Others Exemption 100% Exempt $100,000 $500 $100 100% Exempt No exemption No exemption 100% Exempt $1,000 $500 100% Exempt No exemption $40,000 $15,000 $10,000 100% Exempt $25,000 $500 $3,500 No exemption No exemption Rate (Min. to Max.) 0 1% - 10% 7% - 15% 10% - 20% 0 5% - 10% 10% - 15% 0 4% - 16% 6%-16% 0% 10% 1% 13% 18% 0% 16% 16% 5% 12% 15%

Iowa

Ky.

Md. (a) Nebr. (b)

N.J. (a, c)

Pa.

Note: Inheritance taxes are levied on the the posthumous transfer of assets based on relationship to the decedent. Generally, Class A beneficiaries are spouses, children, and often siblings. Class B beneficiaries are non-immediate family members. Class C beneficiaries are non-family members. Unlike estate taxes, the term "exemption" here applies not to the size of the estate, but the size of the gift itself. (a) Maryland and New Jersey have both an estate tax and an inheritance tax (b) Nebraska's inheritance tax is levied at the county level. (c) New Jersey's inheritance tax only applies to estates over $1M. Source: American Family Business Foundation. Tax Foundation www.TaxFoundation.org

You might also like

- Estate Tax Rates 2012Document1 pageEstate Tax Rates 2012Tax FoundationNo ratings yet

- A Perfect LifeDocument19 pagesA Perfect LifeAmal ChinthakaNo ratings yet

- Banks ComparisonDocument2 pagesBanks ComparisonZachary Jon EngelNo ratings yet

- 2013 Tax RatesDocument4 pages2013 Tax Ratesapi-241405153No ratings yet

- Pam 61 eDocument1 pagePam 61 eNaga RajNo ratings yet

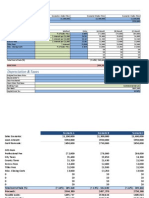

- Expense BudgetDocument1 pageExpense Budgetapi-218669047No ratings yet

- Income Tax Rates PDFDocument1 pageIncome Tax Rates PDFAditi SharmaNo ratings yet

- Financial AnalysisDocument2 pagesFinancial Analysisvnguyen5651No ratings yet

- Budget Sheet ShareDocument5 pagesBudget Sheet Sharenonsense45No ratings yet

- Tax Audit Limit & Tax RatesDocument6 pagesTax Audit Limit & Tax RatesPhani SankaraNo ratings yet

- Preserve South RussellDocument2 pagesPreserve South RussellStephen J. Latkovic, Esq., CPANo ratings yet

- Eyes Wide Open: The Implications and Opportunities of The Current Tax Reform DebateDocument12 pagesEyes Wide Open: The Implications and Opportunities of The Current Tax Reform DebaterepsandylevinNo ratings yet

- Tax RatesDocument3 pagesTax RatesHaneef ShaikNo ratings yet

- Franchise Fact FileDocument5 pagesFranchise Fact FileJaewon ChoiNo ratings yet

- Oct 15Document1 pageOct 15api-286093121No ratings yet

- WN Interest Rates Tcm428 588513Document4 pagesWN Interest Rates Tcm428 588513firefxyNo ratings yet

- New Hire Benefits Summary: Medical Plan OptionsDocument3 pagesNew Hire Benefits Summary: Medical Plan OptionsRavi Prakash MayreddyNo ratings yet

- Jan 16Document1 pageJan 16api-286093121No ratings yet

- Collection State LawsDocument13 pagesCollection State LawsFreedomofMindNo ratings yet

- My Life in The FutureDocument14 pagesMy Life in The Futureapi-281762512No ratings yet

- Dec 15Document1 pageDec 15api-286093121No ratings yet

- California Cities and County Sales and Use Tax Rates 2012Document23 pagesCalifornia Cities and County Sales and Use Tax Rates 2012L. A. PatersonNo ratings yet

- Paul Simon Public Policy Institute Tax Poll: March 2015Document4 pagesPaul Simon Public Policy Institute Tax Poll: March 2015Reboot IllinoisNo ratings yet

- Canada Tax RatesDocument2 pagesCanada Tax RatesFilip CanoNo ratings yet

- Income Tax Rates For The Past 10 YearsDocument10 pagesIncome Tax Rates For The Past 10 YearsTarang DoshiNo ratings yet

- October, 2012: Propositions 30 & 38 in Context - California Funding For Public SchoolsDocument40 pagesOctober, 2012: Propositions 30 & 38 in Context - California Funding For Public Schoolsk12newsnetworkNo ratings yet

- Welcome PR 5.4Document4 pagesWelcome PR 5.4glasscityjungleNo ratings yet

- Millers' Tax Computati: Known ParametersDocument2 pagesMillers' Tax Computati: Known ParametersYadav_BaeNo ratings yet

- The Cost of BusinessDocument1 pageThe Cost of BusinessDrew HansenNo ratings yet

- Monthly Budget Justine LawrenceDocument6 pagesMonthly Budget Justine Lawrenceapi-277278641No ratings yet

- Denali Individual Dental All Other States - AETNADocument10 pagesDenali Individual Dental All Other States - AETNAJohn BerkowitzNo ratings yet

- Amended Belen Water and Sewer Rates OrdinanceDocument5 pagesAmended Belen Water and Sewer Rates OrdinanceVCNews-BulletinNo ratings yet

- Aetna 2014Document1 pageAetna 2014Vignesh EswaranNo ratings yet

- Zip Code Detailed Profile: Were You Denied A Mortgage?Document32 pagesZip Code Detailed Profile: Were You Denied A Mortgage?ashes_xNo ratings yet

- Surcharge: On Contributi Employee Use Business Proportion - 100% Cost X OperatingDocument4 pagesSurcharge: On Contributi Employee Use Business Proportion - 100% Cost X Operatinglouis_parker_5553No ratings yet

- Senator Heller 2014 Finance ReportDocument8 pagesSenator Heller 2014 Finance ReportLas Vegas Review-JournalNo ratings yet

- Facts and Figures 2012: Sales Tax Treatment of Groceries, Candy and Soda, As of January 1, 2012Document1 pageFacts and Figures 2012: Sales Tax Treatment of Groceries, Candy and Soda, As of January 1, 2012Tax FoundationNo ratings yet

- Budget JulyDocument27 pagesBudget Julyapi-235718346No ratings yet

- Budget 4Document14 pagesBudget 4api-235297320No ratings yet

- Income Tax Slabs 2007-08 To 2010-11Document4 pagesIncome Tax Slabs 2007-08 To 2010-11Manoj ThuthijaNo ratings yet

- Net Proceeds PDFDocument2 pagesNet Proceeds PDFTan Ming KwanNo ratings yet

- 2015 Brackets & Planning Limits (Janney)Document5 pages2015 Brackets & Planning Limits (Janney)John CortapassoNo ratings yet

- Mary Lawrence DisclosureDocument32 pagesMary Lawrence DisclosuredhmontgomeryNo ratings yet

- Annuity CommissionsDocument18 pagesAnnuity CommissionsScott Dauenhauer, CFP, MSFP, AIFNo ratings yet

- Determine The Donor's Tax Due On Each DonationDocument1 pageDetermine The Donor's Tax Due On Each DonationRobert Jayson UyNo ratings yet

- Donor'S Tax: BIR Form 1800Document4 pagesDonor'S Tax: BIR Form 1800JAYAR MENDZNo ratings yet

- Income TaxDocument5 pagesIncome TaxAshish NarulaNo ratings yet

- Lesson 14-Budget Planning WorksheetDocument6 pagesLesson 14-Budget Planning Worksheetapi-253889154No ratings yet

- Brokerage Margin Account and Interest Rates - TD AmeritradeDocument10 pagesBrokerage Margin Account and Interest Rates - TD AmeritradeNash Paul PolzlNo ratings yet

- Pay Calc 1Document3 pagesPay Calc 1Gobi ArumugamNo ratings yet

- Metabolic AcidosisDocument16 pagesMetabolic Acidosisloglesb1No ratings yet

- Income Tax Calculator 2013-14Document2 pagesIncome Tax Calculator 2013-14kirang gandhiNo ratings yet

- Budget 090403 Fact FictionDocument2 pagesBudget 090403 Fact FictionAlfonso RobinsonNo ratings yet

- Central New York School Boards Association Annual Legislative BreakfastDocument19 pagesCentral New York School Boards Association Annual Legislative BreakfastTime Warner Cable NewsNo ratings yet

- Income InequalityDocument36 pagesIncome InequalityKate CongerNo ratings yet

- 529credit SS1Document1 page529credit SS1loristurdevantNo ratings yet

- Income Tax Slab For Ay 11Document1 pageIncome Tax Slab For Ay 11mmmukhtarNo ratings yet

- Nov 15Document2 pagesNov 15api-286093121No ratings yet

- A Submission to the Government of Canada on the Subject of Poverty ReductionFrom EverandA Submission to the Government of Canada on the Subject of Poverty ReductionNo ratings yet

- For Single Military Women Only: 10 Easy-Breezy Retirement TipsFrom EverandFor Single Military Women Only: 10 Easy-Breezy Retirement TipsNo ratings yet

- Federal Taxes Paid Vs Federal Spending Received by States, 1981-2005Document51 pagesFederal Taxes Paid Vs Federal Spending Received by States, 1981-2005Javier Arvelo-Cruz-SantanaNo ratings yet

- Tax Foundation 2014 Annual ReportDocument32 pagesTax Foundation 2014 Annual ReportTax FoundationNo ratings yet

- Christmas Cheer Return: Filing StatusDocument2 pagesChristmas Cheer Return: Filing StatusTax FoundationNo ratings yet

- Facts & Figures 2015: How Does Your State Compare?Document55 pagesFacts & Figures 2015: How Does Your State Compare?Tax FoundationNo ratings yet

- Explainer: Nevada Governor Sandoval's Business License Fee Restructuring - Appendix ADocument10 pagesExplainer: Nevada Governor Sandoval's Business License Fee Restructuring - Appendix ATax FoundationNo ratings yet

- Facts and Figures - How Does Your State Compare? 2013 EditionDocument56 pagesFacts and Figures - How Does Your State Compare? 2013 EditionTax FoundationNo ratings yet

- Facts and Figures 2014Document55 pagesFacts and Figures 2014Tax FoundationNo ratings yet

- Facts and Figures 2013Document56 pagesFacts and Figures 2013Tax FoundationNo ratings yet

- Fed U.S. Federal Individual Income Tax Rates History, 1862-2013Document68 pagesFed U.S. Federal Individual Income Tax Rates History, 1862-2013Tax Foundation96% (23)

- How Is The Money Used? Federal and State Cases Distinguishing Taxes and FeesDocument98 pagesHow Is The Money Used? Federal and State Cases Distinguishing Taxes and FeesTax FoundationNo ratings yet

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Tax Watch, Winter 2013Document28 pagesTax Watch, Winter 2013Tax FoundationNo ratings yet

- Powerpoint Presentation For "North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth Reform"Document38 pagesPowerpoint Presentation For "North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth Reform"Tax FoundationNo ratings yet

- Tax Watch Summer 2012Document24 pagesTax Watch Summer 2012Tax FoundationNo ratings yet

- Federal Income Tax Rates History, Nominal Dollars, 1913-2013Document66 pagesFederal Income Tax Rates History, Nominal Dollars, 1913-2013Tax Foundation100% (1)

- Fiscal Cliff MSA TableDocument11 pagesFiscal Cliff MSA TableTax FoundationNo ratings yet

- North Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformDocument84 pagesNorth Carolina Tax Reform Options: A Guide To Fair, Simple, Pro-Growth ReformTax Foundation100% (1)

- Fiscal Cliff MSA TableDocument11 pagesFiscal Cliff MSA TableTax FoundationNo ratings yet

- Federal Individual Individual Income Tax Rate, Adjusted For InflationDocument66 pagesFederal Individual Individual Income Tax Rate, Adjusted For InflationTax Foundation100% (4)

- Scott Hodge, President Will Mcbride, Chief EconomistDocument20 pagesScott Hodge, President Will Mcbride, Chief EconomistTax FoundationNo ratings yet

- Proptax 08 10 TaxespaidDocument67 pagesProptax 08 10 TaxespaidTax FoundationNo ratings yet

- Proptax10 Taxes PaidDocument27 pagesProptax10 Taxes PaidTax FoundationNo ratings yet

- Property Taxes On Owner-Occupied HousingDocument28 pagesProperty Taxes On Owner-Occupied HousingTax FoundationNo ratings yet

- Proptax10 Home ValueDocument28 pagesProptax10 Home ValueTax FoundationNo ratings yet

- Proptax 06 10 IncomeDocument102 pagesProptax 06 10 IncomeTax FoundationNo ratings yet

- Proptax 06 10 TaxpaidDocument102 pagesProptax 06 10 TaxpaidTax FoundationNo ratings yet

- Proptax 08 10 IncomeDocument66 pagesProptax 08 10 IncomeTax FoundationNo ratings yet

- Proptax 06 10 HomevalueDocument102 pagesProptax 06 10 HomevalueTax FoundationNo ratings yet