Professional Documents

Culture Documents

Conta Refresh

Uploaded by

Renzo Viale PaivaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Conta Refresh

Uploaded by

Renzo Viale PaivaCopyright:

Available Formats

Finanzas: esclava de la contabilidad

cash

other current assets

ppe

non op assets

ASSETS

spontaneous liabilities

debt

equity (2,400 x $1)

otros datos

price x share (end)

calculos

ebitda

market cap (end)

p/e (ttm)

p/b (end)

roe (beg)

ic (beg)

noplat=ebit x (1-tax)

roic

kd

ks

K (end)

EV

FCFnG=noplat + depre - capex.m

EPV firm

EPV equity=EPV firm - debt + non op

per share

book

price

EPV.equity (iv)

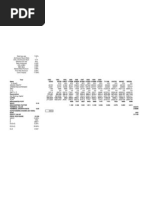

c5: -(d2-a2)

c6: (d6-a6)

c15: c1+c2+c8-b8*(1-tax rate)

c16: c7+c8

d1: a1+c14

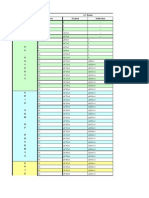

B/S - beg

300

1,100

2,500

300

4,200

200

1,300

2,700

a1

a2

a3

a4

a5

a6

a7

a8

1.27

f1

1,390

3,184

6.4

1.0

18.3%

3,700

579

15.6%

10.0%

23.9%

19.3%

3,590

779

4,034

3,184

f2

f3

f4

f5

f6

f7

f8

f9

f10

f11

f12

f13

f14

f15

f16

sales

-cogs

-depre

gross income

-manag options

-sga

op income=ebit

-interest

pretax income

-taxes (35%)

net income

I/S

10,000

(8,000)

(500)

1,500

(10)

(600)

890

(130)

760

(266)

494

b1

b2

b3

b4

b5

b6

b7

b8

b9

b10

b11

net income

+depre

+manag options

cash provided by ops

-inc current assets

+inc sp liabs

cash from operations

cash from investing activities=capex.m

-debt repayment

issuance of common stock (200x$1.85)

-buybacks (100*$1.90)

-dividends

cash from financing activities

total cash flow->

C/F

494

500

10

1,004

(100)

10

914

(300)

(150)

370

(190)

(200)

(170)

444

c1

c2

c3

c4

c5

c6

c7

c8

c9

c10

c11

c12

c13

c14

779

614

c15

c16

FCFnG

FCF

1.27

1.27

1.27

d3: a3+b3-c8

d4: 4a

d7: a7+c9

d8: d5-d6-d7

e1: a8

e2: b11

e3: c10

e4: -b5

e5: c11

e6: c12

f2: b7-b3

f4: f3/b11

f5: f3/d8

f6: b11/a8

f7: a1+a2+a3-a6

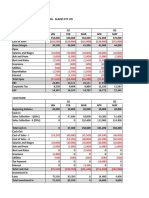

cash

other current assets

ppe

non op assets

ASSETS

spontaneous liabilities

debt

equity (2,500 x $1)

starting equity

+net income

+share issuance

+manag options

-buybacks

-dividends

ending equity

Ks

book

price

EPV.equity (iv)

B/S - end

744

1,200

2,300

300

4,544

210

1,150

3,184

C/E

$

2,700

494

370

10

(190)

(200)

3,184

d1

d2

d3

d4

d5

d6

d7

d8

e1

e2

e3

e4

e5

e6

# sh

2,400

200

-100

2,500

roic>k

roic=k

roic<k

P=B=iv

17.6%

18.9%

20.3%

23.9%

1.27

1.27

1.27

1.27

1.27

1.27

1.27

1.27

1.79

1.65

1.53

1.27

g da valor

g no valor g destr. valno intang

mdo efic.

nav = book

f9: f8/f7

f12: ((d7/(d7+d8))*f10*(1-tax rate)+ ((d8/(d7+d8))*f11

f13: f3+d7-d1

f15: f14/f12

f16: f15-d7+d4

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- External Capital Rationing Internal Capital RationingDocument10 pagesExternal Capital Rationing Internal Capital RationingSiva SubramaniamNo ratings yet

- Home Work Excel SolutionDocument16 pagesHome Work Excel SolutionSunil KumarNo ratings yet

- CH 15 SolDocument4 pagesCH 15 SolSilviu TrebuianNo ratings yet

- Mathematical Formulas for Economics and Business: A Simple IntroductionFrom EverandMathematical Formulas for Economics and Business: A Simple IntroductionRating: 4 out of 5 stars4/5 (4)

- Corporate Finance Formula SheetDocument4 pagesCorporate Finance Formula Sheetogsunny100% (3)

- Answers to Selected Problems in Multivariable Calculus with Linear Algebra and SeriesFrom EverandAnswers to Selected Problems in Multivariable Calculus with Linear Algebra and SeriesRating: 1.5 out of 5 stars1.5/5 (2)

- Penman 5ed AppendixDocument32 pagesPenman 5ed AppendixHirastikanah HKNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Mellon Valuation AnalysisDocument7 pagesMellon Valuation AnalysisAmber Hill100% (1)

- FINC 3511 - Corporate Finance formulas guideDocument2 pagesFINC 3511 - Corporate Finance formulas guideirquadriNo ratings yet

- Formula Sheets-GDBA505 – must be returned after exam < 40Document3 pagesFormula Sheets-GDBA505 – must be returned after exam < 40FLOREAROMEONo ratings yet

- Corporate Finance - FormulasDocument3 pagesCorporate Finance - FormulasAbhijit Pandit100% (1)

- Formulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceDocument6 pagesFormulas - All Chapters - Corporate Finance Formulas - All Chapters - Corporate FinanceNaeemNo ratings yet

- FIN 401 - Cheat SheetDocument2 pagesFIN 401 - Cheat SheetStephanie NaamaniNo ratings yet

- PPPPPPPPPPPP PDocument2 pagesPPPPPPPPPPPP PNishtha SethiNo ratings yet

- AFM Solution 2010Document6 pagesAFM Solution 2010Ashish AgarwalNo ratings yet

- Financial Management Formula SheetDocument2 pagesFinancial Management Formula SheetSantosh Kumar100% (2)

- Finance Cheat SheetDocument4 pagesFinance Cheat SheetRudolf Jansen van RensburgNo ratings yet

- Formula Sheet: 1. FV PV (1 + R) 2. Present Value of An Annuity PV CF X A.FDocument4 pagesFormula Sheet: 1. FV PV (1 + R) 2. Present Value of An Annuity PV CF X A.FKlaus MikaelsonNo ratings yet

- Chapter19 - AnswerDocument27 pagesChapter19 - AnswerxxxxxxxxxNo ratings yet

- Calculating WACC and Valuing Projects with Different Costs of CapitalDocument7 pagesCalculating WACC and Valuing Projects with Different Costs of CapitalkasimgenelNo ratings yet

- Comprehensive Audit of Balance Sheet and Income Statement AccountsDocument25 pagesComprehensive Audit of Balance Sheet and Income Statement AccountsJin KyNo ratings yet

- CorpFinance Cheat Sheet v2.2Document2 pagesCorpFinance Cheat Sheet v2.2subtle69100% (4)

- Finance Formula SheetDocument8 pagesFinance Formula SheetMatchagirlieNo ratings yet

- 4 - Cost of CapitalDocument10 pages4 - Cost of Capitalramit_madan7372No ratings yet

- Cost-Estimation-16-Water-JacketDocument3 pagesCost-Estimation-16-Water-JacketPranav PatilNo ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelnotes 1No ratings yet

- Character Level Exalted Deflection AC BonusDocument12 pagesCharacter Level Exalted Deflection AC BonusDan PingelNo ratings yet

- Operatin G Cost $ (9) Ebit $ (10) NI $ (11) : Assignment 3 (A)Document1 pageOperatin G Cost $ (9) Ebit $ (10) NI $ (11) : Assignment 3 (A)Hardwork BoyNo ratings yet

- R) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVDocument9 pagesR) (1 CF ...... R) (1 CF R) (1 CF CF NPV: Invesment Initial NPV 1 Invesments Initial Flows Cash Future of PVAgnes LoNo ratings yet

- CFA Formula Cheat SheetDocument9 pagesCFA Formula Cheat SheetChingWa ChanNo ratings yet

- Deferred Taxes and Accelerated Depreciation An Example: Balance SheetDocument14 pagesDeferred Taxes and Accelerated Depreciation An Example: Balance SheetcatherinephilippouNo ratings yet

- 3int 2004 Dec ADocument7 pages3int 2004 Dec AFloyd DaltonNo ratings yet

- Financial Accounting First AssignmentDocument2 pagesFinancial Accounting First AssignmentedwardfangthuNo ratings yet

- Chapter 10 Discounted DividendDocument5 pagesChapter 10 Discounted Dividendmahnoor javaidNo ratings yet

- ACCA F9 Financial Management Complete Text Errata Sheet 210909Document4 pagesACCA F9 Financial Management Complete Text Errata Sheet 210909kcp123No ratings yet

- Chapter 18 Revised Incl Sampa Case 2022Document23 pagesChapter 18 Revised Incl Sampa Case 2022SSNo ratings yet

- AFM. Resources. Useful FormulasDocument4 pagesAFM. Resources. Useful FormulasAnonymous MeNo ratings yet

- Airbus TemplateDocument2 pagesAirbus Templateveda20No ratings yet

- Economic Profit Model and APV ModelDocument16 pagesEconomic Profit Model and APV Modelsanket patilNo ratings yet

- Kapitel 8Document1 pageKapitel 8Kevin KevNo ratings yet

- FMV Cheat SheetDocument1 pageFMV Cheat SheetAyushi SharmaNo ratings yet

- Hex2Dec: 0 1 2 3 1A 1B 7Fffffffff 8000000000 FFFFFFFFFF Fffffffffe FFFFFFFFFDDocument1 pageHex2Dec: 0 1 2 3 1A 1B 7Fffffffff 8000000000 FFFFFFFFFF Fffffffffe FFFFFFFFFDarunasagar_2011No ratings yet

- Corporate Finance Formula SheetDocument5 pagesCorporate Finance Formula SheetChan Jun LiangNo ratings yet

- Boston Beer CompanyDocument1 pageBoston Beer CompanyBunny SethiNo ratings yet

- Lecture 16Document6 pagesLecture 16MukarramNo ratings yet

- Risk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskDocument12 pagesRisk Equity Share PM Capital Preference Shares PVT Sector Bonds Govt Risk Securities Free Int. RiskrajjoNo ratings yet

- CoffeeDocument6 pagesCoffeeAllen NellaNo ratings yet

- Risk Aversion and Capital AllocationDocument5 pagesRisk Aversion and Capital AllocationPrince ShovonNo ratings yet

- Ie463 CHP5 (2010-2011)Document6 pagesIe463 CHP5 (2010-2011)Gözde ŞençimenNo ratings yet

- General 4-Stage Model: Model 10-05A (Revenue Growth Model)Document2 pagesGeneral 4-Stage Model: Model 10-05A (Revenue Growth Model)JNNo ratings yet

- Chapter 8: Cost of CapitalDocument12 pagesChapter 8: Cost of CapitalSeekander AhmedNo ratings yet

- Chapter 8 Equity Valuation Assignment Chapter 8Document4 pagesChapter 8 Equity Valuation Assignment Chapter 8mehandiNo ratings yet

- COst of Capital - BringhamDocument16 pagesCOst of Capital - BringhamHammna AshrafNo ratings yet

- Today's Investing StylesDocument9 pagesToday's Investing StylesRenzo Viale PaivaNo ratings yet

- Today's Investing StylesDocument9 pagesToday's Investing StylesRenzo Viale PaivaNo ratings yet

- Tilson Behavioral FinanceDocument19 pagesTilson Behavioral Financeapi-3709940100% (1)

- Annual Report CitiDocument312 pagesAnnual Report Citiashley_t13No ratings yet

- Tilson Behavioral FinanceDocument19 pagesTilson Behavioral Financeapi-3709940100% (1)

- Annual Report 2019Document228 pagesAnnual Report 2019Rohit PatelNo ratings yet

- Part-1-General - and - Financial - Awareness Set - 1Document4 pagesPart-1-General - and - Financial - Awareness Set - 1Anto KevinNo ratings yet

- Grant Thornton Dealtracker H1 2018Document47 pagesGrant Thornton Dealtracker H1 2018AninditaGoldarDuttaNo ratings yet

- 3.1.2 IFM Module2Document18 pages3.1.2 IFM Module2Aishwarya M RNo ratings yet

- Practice Quiz - Review of Working CapitalDocument9 pagesPractice Quiz - Review of Working Capitalcharisse nuevaNo ratings yet

- Vajiram & Ravi Civil Services Exam Details for Sept 2022-23Document3 pagesVajiram & Ravi Civil Services Exam Details for Sept 2022-23Appu MansaNo ratings yet

- INVESTMENT MANAGEMENT-lakatan and CondoDocument22 pagesINVESTMENT MANAGEMENT-lakatan and CondoJewelyn C. Espares-CioconNo ratings yet

- LTD Report Innocent Purchaser For ValueDocument3 pagesLTD Report Innocent Purchaser For ValuebcarNo ratings yet

- Social Security in America (Full Book) - Publication of The Social Security AdministrationDocument328 pagesSocial Security in America (Full Book) - Publication of The Social Security AdministrationNikolai HamboneNo ratings yet

- Personal Finance PowerPointDocument15 pagesPersonal Finance PowerPointKishan KNo ratings yet

- Elements of Financial StatementsDocument31 pagesElements of Financial StatementsThelearningHightsNo ratings yet

- B.A.Ll.B. Viii Semester: Subject: Drafting of Pleading & Conveyancing CODE: BL-805 Topic: Promissory Note & ReceiptDocument4 pagesB.A.Ll.B. Viii Semester: Subject: Drafting of Pleading & Conveyancing CODE: BL-805 Topic: Promissory Note & ReceiptGaurav KumarNo ratings yet

- CMA Case Study Blades PTY LTDDocument6 pagesCMA Case Study Blades PTY LTDMuhamad ArdiansyahNo ratings yet

- Jupiter Intelligence Report On Miami-Dade Climate RiskDocument11 pagesJupiter Intelligence Report On Miami-Dade Climate RiskMiami HeraldNo ratings yet

- Maximizing Advantages of China JV for HCFDocument10 pagesMaximizing Advantages of China JV for HCFLing PeNnyNo ratings yet

- Bank Marketing MixDocument87 pagesBank Marketing MixAnisa_Rao89% (9)

- Statement of Compliance - Auditor Review Report On CoCGDocument3 pagesStatement of Compliance - Auditor Review Report On CoCGManagerHRDNo ratings yet

- Accounting and FinanceDocument5 pagesAccounting and FinanceHtoo Wai Lin AungNo ratings yet

- BPI's Opposition to Sarabia Manor's Rehabilitation PlanDocument2 pagesBPI's Opposition to Sarabia Manor's Rehabilitation PlanJean Mary AutoNo ratings yet

- In The United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument2 pagesIn The United States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsNo ratings yet

- Role of Derivatives in Economic Growth and DevelopmentDocument22 pagesRole of Derivatives in Economic Growth and DevelopmentKanika AnejaNo ratings yet

- Impact of The Tax System On The Financial Activity of Business EntitiesDocument6 pagesImpact of The Tax System On The Financial Activity of Business EntitiesOpen Access JournalNo ratings yet

- Online Transfer Claim FormDocument2 pagesOnline Transfer Claim FormSudhakar JannaNo ratings yet

- 1st PB-TADocument12 pages1st PB-TAGlenn Patrick de LeonNo ratings yet

- Fabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Document19 pagesFabm2: Quarter 1 Module 1.2 New Normal ABM For Grade 12Janna Gunio0% (1)

- Real Estate - Understanding U.S. Real Estate DebtDocument16 pagesReal Estate - Understanding U.S. Real Estate DebtgarchevNo ratings yet

- Certificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document32 pagesCertificate of Creditable Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Sakura AvhrynNo ratings yet

- Leadership in Change Management Group WorkDocument11 pagesLeadership in Change Management Group WorkRakinduNo ratings yet

- Bank Mandiri ProfileDocument2 pagesBank Mandiri ProfileTee's O-RamaNo ratings yet

- The Land Acquisition Act 1894Document25 pagesThe Land Acquisition Act 1894Shahid Jamal TubrazyNo ratings yet