Professional Documents

Culture Documents

D 000168

Uploaded by

aptureinc0 ratings0% found this document useful (0 votes)

5 views10 pagesOriginal Title

d000168

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views10 pagesD 000168

Uploaded by

aptureincCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

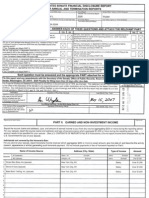

FORMA Page tof7

For use by Members, officers, and employees

UNITED STATES HOUSE OF REPRESENTATIVES

FINANCIAL DISCLOSURE STATEMENT FOR CALENDAR YEAR 2006

‘Nathan Deal

(Ft Name)

‘4685 Nopone Road Gainesville, GA 30506 5-621

(HAND DELWERE

FIVE RESOURCE CENTE

AT UK LT PH 356

(Otice Use Oaly),

a

eSENTATVE

Filer | M4 Member of the U.S. _ | Officer Or

Status, House of Representatives pisticr Employee

Employing Office:

be assessed against

anyone who files

more than 30 days

Tid you or your spots Fave “errata og SAAT Oro) SHIT "Did yor, your spaan, oF 8 dopondnn ia aca wy operas

er more om any source inthe reporting period? Yes jg} No (-]_ Vl reporting pwd te, agorepning moreihan S06 anc etomareet Yes) No

yes, complete and attach Schedule 1 | yetteomplte and attach Schedula Vi

Did any nvdual or orgatzaon mate »donaonochahy Reo psyng ‘idyu, your spoume ors dependent hi eceve ay reportable travel

1. youtora speech, appearance, orale nthe roporng pei? Yes (7 No ig Winker tat iterpoing ped woth moron 3 Yan) NOY)

tye, complete and attach Schedule \Fyee, complet and attach Schedule VI

Did you, our spouse, oa dependent cit recets “unearned ncome ot ‘it you nol any reportable postions on or ets the date of ing Inthe

|. mortar em mpringeridor ha anjrpaaba acter Yen 7) No) MM Coon snentr yen? Yes WoO

{Ryes, complete and attach Schedule I __ yee, compote and attach Schedule VII.

ty, 2H Yo, your spoune or dependent nd purchase oc xchange 27 1 yor have ny roporabe agra or wrangemen wih am ouside

+ represen vanancn sncouig 1,08 date opotng” Yen 6g) No []) % swt Ya 1) Mey

Tyee, complete and attach Schedule IV. ee |. --tfom comlat and tach Sead

1 you, your spoune, or epandent ch ave any report Kl (re

7 nee eres nt Yes jj No [] Each question in thie part must be answered and the appropriate

schedule attached for each "Yes" response.

EXCLUSION OF ‘SPOUSE, DEPENDENT, OR TRUST INFORMATION — ANSWER EACH OF THESE QUESTIONS

Detalerogarding "Qualifies Bind Trusts” approved by the Commilise on Standards of Oficial Conduct and certain other “oxceplag

trusts" need not be disclosed. Have you exclided from thi rport details of ech a trust benefiting you, your spouse, or dapenaent Ye® () NOW

oni? ee

Exemptions Have you excluded trom this report any other assets, “unearned” income, transactions, or Nabiles ofa spouse or dependent child

because they meet al three tests for exemption? Yes] Noy

CERTIFICATION -- THIS DOCUMENT MUST BE SIGNED BY THE REPORTING INDIVIDUAL AND DATED

‘This Financial Disclosure Statement is eequired by the Ethics in Government Act of 1978, as amended. The Statement wil be available fo ary requesting person upon writen

‘pplication and wil be reviewed by the Commitee on Standards of Oficial Conduct or itt designee. Any indvidual who knowingly and wilfully flsfies, or who knowingly and

wal fails to fle tis report may be subject fo cl penaties and cxmminal tanctions (See 5 U.S.C. app. 4, 5104 and U.S.C. § 1001),

Cerication TSionatue of Reporing maiiavar

I CERTIFY thal he sltants | ham mae 0 ho snd ated chain

tein compl and eons eboney kaon a ae \\ dre Dead

SCHEDULE | - EARNED INCOME

Name Nathan Deat

Page 2of 7

[List the source, type, and amount of earned income from any source (other than the fler’s current employment by the U.S. Government) totaling $200 or more

the source and amount of any honoraria; list only the source for other spouse eared income exceeding

lduring the preceding calendar year. For a spouse, li

s1,000,

\legiaslative pension

' Educator Retirement pension

$15,000

SCHEDULE Ill - ASSETS AND "UNEARNED" INCOME

Name Nathan Dea

BLOCK A BLOCK B ‘BLOCK ‘BLOCK D BLOCK E

Asset and/or Income Source Year-End Type of Income | Amount of Income | Transaction

dentity (a) each asset held for investment or production ot income with | Value of Asset | Shockallcolumns tnat | For retiroment plans or Indicate If asset

{afar market value exceeding $1,000 atthe end ofthe reporting period, apply. Check "None" it | accounts that donot allow | had purchases

‘and (b) any othor asset or source of income which generated more than | at close of reporting | asset did not gonerate any| you to choose specific P), sales (8), oF

'$200 in “unearned” income during the year. For rental property or land, | year. Myou use a income during the Investments, youmay write | exchanges (€)

provide an address. Provide full names of any mutual funds. Fora self | valuation method other | calendar year. other | *NA" for income. For ‘exceeding

Girected IRA (Le, one where you have the powor to select the specific | than fair market value, | tran one ofthe listed | other aosets, indicate the | $4,000 in

investments) provide information on each asset in the account that categories, specify he | category of income by reporting year.

‘exceeds the reporting threshold and the Income earnied for the account.

For an IRA or retirement plan that Is not solf-directed, name the

‘type of income by writing | checking the appropriate

2 brief description in this. | box below. Dividends, even

institution holding the account and provide its value atthe end of the Hock. (For example: | ifrinvested, should be

Partnership income or | listed as income. Chock

Farm income) “None” if no income was

For additional information, see instruction booklet for the reporting ‘earned.

year.

Exclude: Your personal residence(s) (unless there is rental income);

‘any debt owed to you By your spouse, or by your or your spouse's child,

parent, or sibling; any deposits totaling $5,000 of less in personal

‘savings accounts; any financial interest in or income derived from U.S.

Government retirement programe.

Ityou s0 choose, you may indicato that an asset or income source is

that of your spouse (SP) or dependent child (OC) or is jntly hold (JT), in

the optional column on the far left.

5 acres on Log Cabin Road, | $1,000,001 - None

Demorest, Georgia $5,000,000 i

‘

| 50% ownership in Gainesville $1,000,001 - RENT $15,001 - $50,000

Slavage and Disposal, DBA $5,000,000 1

C&D Investements, DBA C&D c

Leasing, DBA Recovery

Services Inc.

___ Gainesville, Georgia eee i ‘tet eH So ae eeCeeEeC eee

50% Ownership, Wilder $250,001 - New Business, NONE

Outdoors Inc., Baldwin, Georgia $500,000 no income i

_ ae eae aD ecco ee oie eae eee eas ce

T Commerciat Building and 3.2 $500,001 - None

Acres on Hwy 365, $1,000,000

3840 State Highway 365

Baldwin, Georgia

You might also like

- Y 000033Document6 pagesY 000033aptureinc100% (6)

- K 000148Document92 pagesK 000148aptureinc100% (7)

- Y 000031Document2 pagesY 000031aptureinc100% (5)

- Y 000031Document7 pagesY 000031aptureinc100% (4)

- Y 000033Document7 pagesY 000033aptureinc100% (6)

- Y 000031Document2 pagesY 000031aptureinc100% (5)

- W 000779Document5 pagesW 000779aptureinc100% (3)

- Y 000062Document7 pagesY 000062aptureinc100% (3)

- Y 000033Document6 pagesY 000033aptureinc100% (5)

- W 000784Document4 pagesW 000784aptureinc100% (7)

- W 000784Document4 pagesW 000784aptureinc100% (4)

- W 000795Document7 pagesW 000795aptureinc100% (2)

- Y 000062Document6 pagesY 000062aptureinc100% (3)

- W 000784Document10 pagesW 000784aptureinc100% (4)

- W 000672Document15 pagesW 000672aptureinc100% (4)

- W 000793Document9 pagesW 000793aptureinc100% (3)

- W 000779Document4 pagesW 000779aptureinc100% (1)

- W 000738Document6 pagesW 000738aptureinc100% (3)

- W 000738Document5 pagesW 000738aptureinc100% (1)

- W 000793Document7 pagesW 000793aptureinc100% (3)

- W 000672Document17 pagesW 000672aptureinc100% (2)

- W 000672Document10 pagesW 000672aptureinc100% (3)

- W 000804Document6 pagesW 000804aptureinc100% (5)

- W 000793Document6 pagesW 000793aptureinc100% (2)

- W 000738Document8 pagesW 000738aptureinc100% (3)

- W 000795Document9 pagesW 000795aptureincNo ratings yet

- W 000795Document8 pagesW 000795aptureincNo ratings yet

- W 000789Document34 pagesW 000789aptureincNo ratings yet

- W 000801Document6 pagesW 000801aptureincNo ratings yet

- W 000801Document12 pagesW 000801aptureincNo ratings yet