Professional Documents

Culture Documents

Ias 10

Uploaded by

Grishma DoshiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ias 10

Uploaded by

Grishma DoshiCopyright:

Available Formats

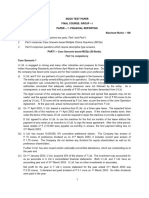

-Example 1 During the year 2005, Reliance Limited was sued by a competitor for Rs.

15 million for infringement of a trademark. Based on the advice of the companys legal counsel, Reliance Limited accrued the sum of Rs. 10 million as a provision in its financial statements for the year ended December 31, 2005. Subsequent to the balance sheet date, on February 15, 2006, the Supreme Court decided in favour of the party alleging infringement of the trademark and ordered the defendant to pay the aggrieved party a sum of Rs. 14 million. The financial statements were prepared by the companys management on January 31, 2006, and approved by the board on February 20, 2006. Should Reliance Limited adjust its financial statements for the year ended December 31, 2005?

Solution Reliance Limited should adjust the provision upward by Rs. 4 million to reflect the award decreed by the Supreme Court (assumed to be the final appellate authority on the matter in this example) to be paid by Reliance Limited to its competitor. Had the Judgment of the Supreme Court been delivered on February 25, 2006, or later, this post-balance sheet event would have occurred after the cut off point (i.e., the date the financial statements were authorized for original issuance). If so, adjustment of financial statements would not have been required. Example 2 Tata Limited carries its inventory at the lower of cost and net realizable value. At December 31, 2005, the cost of inventory, determined under the first-in, first-out (FIFO) method, as reported in its financial statements for the year then ended, was Rs. 10 million. Due to severe recession and other negative economic trends in the market, the inventory could not be sold during the entire month of January 2006. On February 10, 2006, Tata Limited entered into an agreement to sell the entire inventory to a competitor for Rs. 6 million. Presuming the financial statements were authorized for issuance on February 15, 2006, should Tata Limited recognize a write-down of Rs. 4 million in the financial statements for the year ended December 31, 2005? Solution: Yes, Tata Limited should recognize a write-down of Rs. 4 million in the financial statements for the year ended December 31, 2005.

Example 3 The statutory audit of Taj Limited for year ended June 30, 2005, was completed on August 30, 2005. the financial were signed by the managing director on September 8, 2005, and approved by the shareholders on October 10, 2005. the next events have occurred. 1) On July 15, 2005 a customers owing Rs. 9,00,000 to Taj Limited filed for bankruptcy. The financial statements include an allowance for doubtful debts pertaining to this customer only of Rs. 50,000. 2) Taj Limited s issued capital comprised 100,000 equity shares, the company announced a bonus issue of 25,000 shares on august 1, 2005. 3) Specialized equipment costing Rs. 5,45,000 purchased on March 1, 2005 was destroyed by fire on June 13, 2005. On June 30, 2005, Taj Limited has booked a receivable of Rs. 4,00,000 from the insurance company pertaining to this claim. After the insurance company completed its investigation, it was discovered that the fire took place due to negligence of the machine operator. As a result, the insurers liability was zero on this claim by Taj Limited. How should Taj Limited account for these three post-balance sheet events?

Solution 1) Taj Limited should increase its allowance for doubtful debts to Rs. 9,00,000 because the customers bankruptcy is indicative of a financial condition that existed at the balance sheet date. This is an adjusting event. 2) IAS 33, Earnings per Share, requires a disclosure of transaction as Stock splits or rights issue, which are of signification importance at the balance sheet. This is a non-adjusting event, and only disclosure is needed. 3) This is an adjusting event because it relates to an asset that was recognized at the balance sheet date. However, as the insurance companys liability is Zero, Taj Limited must adjust its receivable on the claim to zero. Example 4 At the balance sheet date, December 31, 2005, Taj Limited carried a receivable from XYZ, a major customer, at Rs. 10 million. The authorization date of the financial statements is on February 16, 2006. XYZ declared bankruptcy on Valentines Day (February 14, 2006.) Taj Limited will: a) Disclose the fact XYZ has declared bankruptcy in the footnotes. b) Make a provision for this post-balance sheet event in its financial statements (as opposed to disclosure in footnotes). c) Ignore the event and wait for the outcome of the bankruptcy because the event took place after the year-end. d) Reverse the sale pertaining to this receivable in the comparatives for the prior period and treat this as an error under IAS 8. Answer: (b)

Example 5 Ram Limited built a new factory building during 2005 at a cost of Rs. 20 million. At December 31, 2005, the net book value of the building was Rs. 19 million. Subsequent to year-end, on March 15, 2006, the building was destroyed by fire and the claim against the insurance company proved futile because the cause of the fire was negligence on the part of the caretaker of the building. If the date of authorization of the financial statements for the year ended December 31, 2005, was March 31, 2006, Ram Limited should: a) Write off the net book value to its scrap value because the insurance claim would not fetch any compensation. b) Make a provision for one-half of the net book value of the buildings. c) Make a provision for three-fourths of the net book value of the building based on prudence. d) Disclose this non-adjusting event in the footnotes. Answer: (d) Example 6 Tata Motors Limited deals extensively with foreign entities, and its financial statements reflect these foreign currency transactions. Subsequent to the balance sheet date, and before the date of authorization of the issuance of the financial statements, there were abnormal fluctuations in foreign currency rates. Tata Motors Limited should a) Adjust the foreign exchange year-end balances to reflect the abnormal adverse fluctuations in foreign exchange rates. b) Adjust the foreign exchange year-end balances to reflect all the abnormal fluctuations in foreign exchange rates (and not just adverse movements). c) Disclose the post-balance sheet event in footnotes as a non-adjusting event. d) Ignore the post-balance sheet event. Answer: (c) Example 7 Arun Limited decided to operate a new amusement park that will cost Rs. 1 million to build in the year 2005. Its financial year end is December 31, 2005. Arun Limited. Has applied for a letter of guarantee for Rs. 7, 00,000. The letter of guarantee was issued on March 31, 2006. the audited financial statements have been authorized to be issued on April 18, 2006. The adjustment required to be made to the financial statement for the year ended December 31, 2005, should be a) Booking a Rs. 7, 00,000 long-term payable. b) Disclosing Rs. 7, 00,000 as a contingent liability in 2005 financial statement. c) Increasing the contingency reserve by Rs. 7,00,000. d) Do nothing.

Answer: (b) Example 8 A new drug named AAA was introduced by Beta Chemicals Limited in the market on December 1, 2005. Beta Chemicals Limited s Financial year ends on December 31, 2005. it was the only company that was permitted to manufacture this patented drug. The drug is used by patients suffering from an irregular heartbeat. On March 31, 2006, after the drug was introduced, more than 2,000 patients died. After a series of investigation, authorities discovered that when this drug was simultaneously used with DDD, a drug used to regulate hypertension, the patients blood would clot and the patient suffered a stroke. A lawsuit for Rs. 200 crores has been filed against Beta Chemicals Limited. The financial statements were authorized for issuance on April 30, 2006. which of the following option is the appropriate accounting treatment for this post-balance sheet event under Ind-AS 10? a) The entity should provide Rs. 200 crores because this is an adjusting event and the financial statements were authorized to be issued after the accident. b) The entity should disclose Rs. 200 crores as a contingent liability because it is an adjusting event. c) The entity should disclose Rs. 200 crores as a contingent liability because it is a present obligation with an improbable outflow. d) Assuming the probability of the lawsuit being decided against Beta Chemicals Limited is remote, the entity should disclose it in the footnotes, because it is a nonadjusting material event. Answer: (C)

You might also like

- Case Study PSAKDocument4 pagesCase Study PSAKKristina FransiskaNo ratings yet

- FR15. Provision, Contingent Liab & Assets (Practice)Document4 pagesFR15. Provision, Contingent Liab & Assets (Practice)duong duongNo ratings yet

- Events After The Reporting Period (IAS 10)Document16 pagesEvents After The Reporting Period (IAS 10)AbdulhafizNo ratings yet

- Ias 10 Events After Reporting PeriodDocument13 pagesIas 10 Events After Reporting Periodesulawyer2001No ratings yet

- FR QuestionsDocument12 pagesFR Questionsram_eiNo ratings yet

- Events After The Reporting Period Final 6 KiloDocument13 pagesEvents After The Reporting Period Final 6 Kilonati100% (1)

- Disclaimer: © The Institute of Chartered Accountants of IndiaDocument35 pagesDisclaimer: © The Institute of Chartered Accountants of IndiajaimaakalikaNo ratings yet

- IAS 37 Provisions, Contingent LiabilitiesDocument3 pagesIAS 37 Provisions, Contingent LiabilitiesAbdul SamiNo ratings yet

- 09 Ias 10Document3 pages09 Ias 10Irtiza AbbasNo ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- Financial Reporting Final AttemptedDocument10 pagesFinancial Reporting Final AttemptedMAGOMU DAN DAVIDNo ratings yet

- Session 8Document12 pagesSession 8Adil AnwarNo ratings yet

- For ClassDocument21 pagesFor ClassRimissha Udenia 2No ratings yet

- AspDocument6 pagesAspCaramakr ManthaNo ratings yet

- Acct 2005 Practice Exam 1Document16 pagesAcct 2005 Practice Exam 1laujenny64No ratings yet

- MCom - Accounts Ch-3 Topic7Document20 pagesMCom - Accounts Ch-3 Topic7Sameer GoyalNo ratings yet

- FR MTP-1 May-24Document11 pagesFR MTP-1 May-24chandrakantchainani606No ratings yet

- GRP 1 Series 1 MTP CompiledDocument72 pagesGRP 1 Series 1 MTP CompiledSairamNo ratings yet

- FR MTP Nov'22Document27 pagesFR MTP Nov'22Kushagra SoniNo ratings yet

- Institute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsDocument4 pagesInstitute of Cost and Management Accountants of Pakistan Spring (Summer) 2010 ExaminationsIrfanNo ratings yet

- Advance Auditing F20 PDFDocument55 pagesAdvance Auditing F20 PDFpiyalhassanNo ratings yet

- Events After The Balance SheetDocument7 pagesEvents After The Balance SheetirvanNo ratings yet

- Assignment 3: NameDocument2 pagesAssignment 3: NameBaburam AdNo ratings yet

- Advanced Auditing: T I C A PDocument4 pagesAdvanced Auditing: T I C A PDanish KhanNo ratings yet

- Tutorial Questions 1 - CHP 1 4Document2 pagesTutorial Questions 1 - CHP 1 4Samantha NarayanNo ratings yet

- CA INTERMDEDIATE IPC INDIGOLEARN AS 29 Q&ADocument8 pagesCA INTERMDEDIATE IPC INDIGOLEARN AS 29 Q&ADipen AdhikariNo ratings yet

- Audit and Assurance CAP II Exam Suggested Answers 2010-2015Document111 pagesAudit and Assurance CAP II Exam Suggested Answers 2010-2015shankar k.c.No ratings yet

- Diploma in International Financial Reporting: Thursday 9 December 2010Document11 pagesDiploma in International Financial Reporting: Thursday 9 December 2010Zain Rehman100% (1)

- IAS 10 Presentation. RecoveryDocument16 pagesIAS 10 Presentation. Recoverysaidkhatib368No ratings yet

- FR New Papers & RTP'sDocument165 pagesFR New Papers & RTP'sKeshav SethiNo ratings yet

- Paper - 1: Financial Reporting Questions Analysis of Financial Statements/ Ind AS 101Document30 pagesPaper - 1: Financial Reporting Questions Analysis of Financial Statements/ Ind AS 101ritz meshNo ratings yet

- CFAP 6 AARS Winter 2017Document3 pagesCFAP 6 AARS Winter 2017shakilNo ratings yet

- IAS - 10 Questions-FinalDocument6 pagesIAS - 10 Questions-FinalAbdul SamiNo ratings yet

- IAS 10 - IAS 37 Questions Final 27032024 103049amDocument8 pagesIAS 10 - IAS 37 Questions Final 27032024 103049amAbdullah ButtNo ratings yet

- Answer Key Week 3Document14 pagesAnswer Key Week 3Luigi Enderez Balucan100% (2)

- LKAS 37 - StudentsDocument7 pagesLKAS 37 - StudentskawindraNo ratings yet

- Ias 10 Events After The Reporting PeriodDocument9 pagesIas 10 Events After The Reporting PeriodTawanda Tatenda HerbertNo ratings yet

- Ias-10: Events After The Reporting Period: ScopeDocument3 pagesIas-10: Events After The Reporting Period: ScopennwritiNo ratings yet

- Financial Accounting and Reporting I: Additional Practice QuestionsDocument34 pagesFinancial Accounting and Reporting I: Additional Practice Questionsalia khanNo ratings yet

- CA INTER Paper 5 Expected Questions May 2022Document138 pagesCA INTER Paper 5 Expected Questions May 2022gimNo ratings yet

- Problem 1: Take Home Quiz Mid Term Advanced Accounting 2Document3 pagesProblem 1: Take Home Quiz Mid Term Advanced Accounting 2Mohamad Nurreza RachmanNo ratings yet

- Related Party Disclosures Events PeriodTITLE Disclosures Events Period FinancialsTITLE Related Disclosures Events Financial ReportingDocument15 pagesRelated Party Disclosures Events PeriodTITLE Disclosures Events Period FinancialsTITLE Related Disclosures Events Financial ReportingChin FiguraNo ratings yet

- Final Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Document10 pagesFinal Examination Advice ACC3200 T2 2020 Date of Exam: 11 November 2020 Time: 4 PM - 7 PM (3 Hours) - Part A: Multiple Choice Questions (50 Marks)Hariprasad KSNo ratings yet

- Past Exam QuestionDocument95 pagesPast Exam Questionabsankey770No ratings yet

- Financial Accounting: The Institute of Chartered Accountants of PakistanDocument4 pagesFinancial Accounting: The Institute of Chartered Accountants of PakistanShakeel IshaqNo ratings yet

- Group II AccountsDocument14 pagesGroup II AccountsPardeep GuptaNo ratings yet

- Audit, Assurance and Related Services: Certified Finance and Accounting Professional Stage ExaminationDocument3 pagesAudit, Assurance and Related Services: Certified Finance and Accounting Professional Stage Examinationmunira 22No ratings yet

- Case Set 7 - Subsequent Events and Going ConcernDocument5 pagesCase Set 7 - Subsequent Events and Going ConcernTimothy WongNo ratings yet

- Assessment Test 1Document3 pagesAssessment Test 1Arslan AhmadNo ratings yet

- Trial Balance As On 31 March, 2003: Particulars Debit (RS.)Document3 pagesTrial Balance As On 31 March, 2003: Particulars Debit (RS.)Jesse LucasNo ratings yet

- IAs 10-Events After Reporting DateDocument4 pagesIAs 10-Events After Reporting DateSujan ShresthaNo ratings yet

- Acc217 Quation and AnswersDocument27 pagesAcc217 Quation and AnswersLeroyNo ratings yet

- Test Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsDocument5 pagesTest Series: August, 2018 Mock Test Paper - 1 Final (New) Course: Group - I Paper - 3: Advanced Auditing and Professional EthicsRobinxyNo ratings yet

- Non Current Asset Held For Sale Final-1Document29 pagesNon Current Asset Held For Sale Final-1nati100% (4)

- Problem 1:: Company Final Accounts: Problems and Solutions - AccountingDocument28 pagesProblem 1:: Company Final Accounts: Problems and Solutions - AccountingRafidul Islam100% (1)

- Chap 18 As 4Document12 pagesChap 18 As 4rajpurohitvrindaNo ratings yet

- Chap 19 AS 5Document8 pagesChap 19 AS 5Srushti AgarwalNo ratings yet

- FINANCIAL & CORPORATE REPORTING KEY ISSUESDocument4 pagesFINANCIAL & CORPORATE REPORTING KEY ISSUESrezwan_scribdNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Module 2 - Extra Practice Questions With SolutionsDocument3 pagesModule 2 - Extra Practice Questions With SolutionsYatin WaliaNo ratings yet

- The Seven Stages of the Entrepreneurial Life CycleDocument17 pagesThe Seven Stages of the Entrepreneurial Life Cycleshruti latherNo ratings yet

- Contract: Organisation Details Buyer DetailsDocument4 pagesContract: Organisation Details Buyer DetailsMukhiya HaiNo ratings yet

- Case Study - Swiss ArmyDocument16 pagesCase Study - Swiss Armydineshmaan50% (2)

- Catalogue 2012 Edition 6.1 (2012-11) PDFDocument382 pagesCatalogue 2012 Edition 6.1 (2012-11) PDFTyra SmithNo ratings yet

- Review of Financial Statements PDFDocument13 pagesReview of Financial Statements PDFMartin EgozcueNo ratings yet

- Importance of Entrepreneurship EducationDocument8 pagesImportance of Entrepreneurship EducationRansel Burgos100% (1)

- Ctpat Prog Benefits GuideDocument4 pagesCtpat Prog Benefits Guidenilantha_bNo ratings yet

- Cabanlit - Module 2 SPDocument2 pagesCabanlit - Module 2 SPJovie CabanlitNo ratings yet

- Stocks&Commodities S&C 03-2017Document64 pagesStocks&Commodities S&C 03-2017Edgar Santiesteban Collado50% (2)

- PDFDocument14 pagesPDFBibhuti B. Bhardwaj100% (1)

- PEFINDO Key Success FactorsDocument2 pagesPEFINDO Key Success Factorsanubhav saxenaNo ratings yet

- PodDocument1 pagePodfacebook crawlNo ratings yet

- A Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerDocument11 pagesA Casestudy On Sap BW Aspects in Divestiture Project of A Large Automotive CustomerBryan AdamsNo ratings yet

- Dynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivDocument2 pagesDynamic Cables Pvt. LTD.: WORKS ORDER-Conductor DivMLastTryNo ratings yet

- BharatBenz FINALDocument40 pagesBharatBenz FINALarunendu100% (1)

- EMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaDocument17 pagesEMPLOYEE PARTICIPATION: A STRATEGIC PROCESS FOR TURNAROUND - K. K. VermaRaktim PaulNo ratings yet

- IDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleaseDocument50 pagesIDA - MTCS X-Cert - Gap Analysis Report - MTCS To ISO270012013 - ReleasekinzaNo ratings yet

- Audit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryDocument24 pagesAudit Report Under Section 49 of The Delhi Value Added Tax Act, 2004 Executive SummaryrockyrrNo ratings yet

- Prepaid Shipping TitleDocument2 pagesPrepaid Shipping TitleShivam AroraNo ratings yet

- Financial Statement of A CompanyDocument49 pagesFinancial Statement of A CompanyApollo Institute of Hospital Administration100% (3)

- Ghuirani Syabellail Shahiffa/170810301082/Class X document analysisDocument2 pagesGhuirani Syabellail Shahiffa/170810301082/Class X document analysisghuirani syabellailNo ratings yet

- AWS Compete: Microsoft's Response to AWSDocument6 pagesAWS Compete: Microsoft's Response to AWSSalman AslamNo ratings yet

- 0 AngelList LA ReportDocument18 pages0 AngelList LA ReportAndrés Mora PrinceNo ratings yet

- GodrejDocument4 pagesGodrejdeepaksikriNo ratings yet

- Umjetnost PDFDocument92 pagesUmjetnost PDFJuanRodriguezNo ratings yet

- Lesson 6 EntrepreneurshipDocument13 pagesLesson 6 EntrepreneurshipRomeo BalingaoNo ratings yet

- New Ideas, Technologies To Support "Build, Build, Build": Position PaperDocument8 pagesNew Ideas, Technologies To Support "Build, Build, Build": Position PaperCloudKielGuiangNo ratings yet

- The Cochran Firm Fraud Failed in CA Fed. CourtDocument13 pagesThe Cochran Firm Fraud Failed in CA Fed. CourtMary NealNo ratings yet

- MphasisDocument2 pagesMphasisMohamed IbrahimNo ratings yet