Professional Documents

Culture Documents

A Sample Set of Financial Statements) Is Shown Below

A Sample Set of Financial Statements) Is Shown Below

Uploaded by

Geneveve Casil FalconOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Sample Set of Financial Statements) Is Shown Below

A Sample Set of Financial Statements) Is Shown Below

Uploaded by

Geneveve Casil FalconCopyright:

Available Formats

Understanding Basic Financial Statements During the accounting cycle, the accounting system is used to track, organize and

record the financial transactions of an organization. At the close of each period, the information is used to prepare the financial statements, which are usually composed of a balance sheet (statement of financial position); income statement (statement of income and expenses); statement of retained earnings (owners equity); and a statement of cash flow. A sample set of financial statements) is shown below. Financial statements prepared by a Chartered Accountant with a Review Engagement Report or Audit Opinion attached, are prepared (unless noted otherwise) according to "Canadian generally accepted accounting principles", or GAAP. Financial statements that are only compiled or that have a "Notice to Reader" attached, are not necessarily prepared according to GAAP. Balance Sheet The balance sheet is based on the equation: assets = liabilities + owners' equity. It indicates everything the company owns (assets), everything the company owes to creditors (liabilities) and the value of the ownership stake in the company (shareholders' equity, or capital). The balance sheet date is the ending date of the period or year, and is a continuation of the amounts recorded since the inception of the company or organization. The balance sheet is a "snapshot" of the financial position of the company at the balance sheet date and shows the accumulated balance of the accounts. Assets and liabilities are separated between current and long-term, where current items are those items, which will be realized or paid, within one year of the balance sheet date. Typical current assets are cash, prepaid expenses, accounts receivable and inventory. Income Statement An income statement is a type of summary flow report that lists and categorizes the various revenues and expenses that result from operations during a given period - a year, a quarter or a month. The difference between revenues and expenses represents a company's net income or net loss. The amounts shown in the income statement are the amounts recorded for the given period - a year, a quarter or a month. The next periods income statement will start over with all amounts reset to zero. While the balance sheet shows accumulated balances since inception, the income statement only shows the amounts earned or expensed during the period in question. Statement of Retained Earnings The statement of retained earnings shows the amount of accumulated earnings that have been retained within the company since its inception. At the end of each fiscal year-end, the amount of net income or loss is added to the opening amount of retained earnings to arrive at the closing retained earnings. Retained earnings can be decreased by such items as dividends paid to shareholders. On the sample financial statements shown below, the statement of retained earnings is combined with the income statement presentation. Statement of Cash Flow The statement of cash flow shows all sources and uses of a company's cash during the accounting period. Sources of cash listed on the statement include revenues, long-term financing, sales of noncurrent assets, an increase in any current liability account or a decrease in any current asset account. Uses of cash include operating losses, debt repayment, equipment purchases and increases in current asset accounts.

XYZ COMPANY LIMITED BALANCE SHEET AS AT JUNE 30, 2002 UNAUDITED - See "Notice to Reader" 2002 ASSETS CURRENT Cash Accounts receivable Deposits and prepaid expenses Inventory 2001

11,552 42,970 2,942 159,144 216,608

-50,595 2,688 156,657 209,940 76,318 45,001

PROPERTY, PLANT AND EQUIPMENT (Note 2) INVESTMENTS $ LIABILITIES CURRENT Bank overdraft Bank loan Accounts payable and accrued liabilities Long-term debt - current portion Income tax payable

59,890 -276,498 $

331,259

--82,053 25,200 14,387 121,640

9,474 60,000 91,343 --160,817 231,791 -392,608

DUE TO SHAREHOLDER (Note 3) LONG-TERM DEBT (Note 4)

51,591 86,100 259,331

SHAREHOLDER'S EQUITY STATED CAPITAL (Note 5) RETAINED EARNINGS (DEFICIT) $ APPROVED 1 17,166 17,167 276,498 $ 1 (61,350) (61,349) 331,259

The accompanying summary of significant accounting policies and notes are an integral part of these financial statements.

XYZ COMPANY LIMITED STATEMENT OF INCOME AND RETAINED EARNINGS FOR THE YEAR ENDED JUNE 30, 2002 UNAUDITED - See "Notice to Reader"

2002 REVENUE COST OF SALES Opening inventory Delivery Purchases Closing inventory $ 1,104,786

2001 $ 1,133,736

156,657 1,607 740,994 899,258 159,144 740,114

146,278 1,249 794,101 941,628 156,657 784,971 348,765 339,905 8,860

GROSS PROFIT OPERATING EXPENSES (schedule) INCOME FROM OPERATIONS OTHER INCOME (EXPENSES) Loss on disposal of property, plant and equipment Gain on sale of investment Miscellaneous

364,672 286,817 77,855

-16,149 (1,101) 15,048

(387) -337 (50) 8,810 -8,810 (54,160) (16,000) $ (61,350)

NET INCOME BEFORE TAX INCOME TAX EXPENSE NET INCOME (DEFICIT) - Beginning of Year DIVIDENDS RETAINED EARNINGS (DEFICIT) - End of Year $

92,903 14,387 78,516 (61,350) -17,166

The accompanying summary of significant accounting policies and notes are an integral part of these financial statements.

XYZ COMPANY LIMITED STATEMENT OF CASH FLOW FOR THE YEAR ENDED JUNE 30, 2002 UNAUDITED - See "Notice to Reader"

2002 CASH FLOWS FROM OPERATING ACTIVITIES Net income for the year Adjustment for: Amortization Loss on disposal of property, plant and equipment Gain on disposal of investment Cash derived from operations Decrease (increase) in working capital items Accounts receivable Deposits and prepaid expenses Inventory Accounts payable and accrued liabilities Long-term debt - current portion Income tax payable Cash flows from operating activities

2001

78,516 17,854 -(16,149) 80,221

8,810 16,856 387 -26,053

7,625 (254) (2,487) (9,290) 25,200 14,387 115,402

23,380 688 (904) 34,543 -2,206 85,966

CASH FLOWS FROM INVESTING ACTIVITIES Acquisition of property, plant and equipment Proceeds from disposal of property, plant and equipment Proceeds from disposal of investment Dividends Cash flows from investing activities

(1,426) -61,150 -59,724

(10,342) 3,113 -(16,000) (23,229)

CASH FLOWS FROM FINANCING ACTIVITIES Advances from (repayments to) shareholder Acquisition of (repayment of) long-term debt

(180,200) 86,100 (94,100)

(150,000) -(150,000)

NET INCREASE (DECREASE) IN CASH RESOURCES CASH (DEFICIENCY) RESOURCES - Beginning of Year CASH RESOURCES (DEFICIENCY) - End of Year Cash resources (deficiency) is comprised of: Cash Bank overdraft Bank loan $

81,026 (69,474) 11,552 $

(87,263) 17,789 (69,474)

11,552 --11,552

-(9,474) (60,000) (69,474)

The accompanying summary of significant accounting policies and notes are an integral part of these financial statements.

XYZ COMPANY LIMITED SCHEDULE OF OPERATING EXPENSES FOR THE YEAR ENDED JUNE 30, 2002 UNAUDITED - See "Notice to Reader"

2002

2001

OPERATING EXPENSES Advertising Amortization Bad debts Bank charges and interest Insurance Interest on long-term debt Legal and accounting Management fees Memberships and licences Office and general Rent and utilities Repairs and maintenance Subcontracting Supplies Travel Wages and benefits Vehicle $ 18,801 17,854 199 5,510 4,779 11,876 13,155 -3,212 12,382 18,795 4,289 19,825 4,571 3,736 142,713 5,120 286,817 $ 30,715 16,856 179 9,356 4,035 -11,766 12,525 3,413 15,155 21,955 4,979 18,692 8,557 8,003 168,806 4,913 339,905

The accompanying summary of significant accounting policies and notes are an integral part of these financial statements.

XYZ COMPANY LIMITED NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED JUNE 30, 2002 UNAUDITED - See "Notice to Reader"

1.

SIGNIFICANT ACCOUNTING POLICIES AND GENERAL INFORMATION Nature of Business The company is a Canadian-controlled private corporation subject to the Business Corporations Act, 1982 (Ontario), was incorporated in May 1995 and operates as a manufacturer of widgets in Anytown, Ontario. Significant Accounting Policies INVENTORY The inventory is valued at the lower of cost or market, with cost being determined on a first-in, first-out basis. PROPERTY, PLANT AND EQUIPMENT Property, plant and equipment are stated at cost less accumulated amortization. Amortization is recorded at rates designed to amortize the cost of capital assets over their estimated useful lives. Amortization rates used are as follows: Furniture and equipment Vehicle Computer equipment Leasehold improvements 20% declining balance 30% declining balance 30% declining balance straight-line 5 years

2.

PROPERTY, PLANT AND EQUIPMENT Accumulated Amortization $ 11,300 15,460 6,457 14,439 26,760 $

Cost Furniture and equipment Vehicle Computer equipment Leasehold improvements $ 21,500 26,486 22,210 37,350 47,986

Net Book Value 2002 10,200 11,026 15,753 22,911 59,890 $

Net Book Value 2001 12,750 15,752 20,466 27,350 76,318

XYZ COMPANY LIMITED NOTES TO THE FINANCIAL STATEMENTS FOR THE YEAR ENDED JUNE 30, 2002 UNAUDITED - See "Notice to Reader"

3.

DUE TO SHAREHOLDER The amount due to the shareholder bears interest at a rate determined annually and has no fixed terms of repayment. Interest paid for 2002 was $1,823 (2001 - $6,831)

4.

LONG - TERM DEBT Bank term loan bearing interest at prime plus 2%, repayable in monthly principal instalments of $2,100.00 plus interest to November 2007, secured by a general security agreement on the assets of the company and a personal guarantee from the shareholder. 2002 $ 111,300 $ 2001 --

Less current portion $ Approximate principal repayments are as follows: 2004 2005 2006 2007 $

25,200 86,100 25,200 25,200 25,200 10,500 86,100 $

---

5.

STATED CAPITAL Authorized: Unlimited number of Common shares Unlimited number of non-cumulative, redeemable, voting, Class "A" Special shares 2002 Issued: 1 Common shares $ 1 $ 2001 1

You might also like

- Annex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Document4 pagesAnnex B-1 Guide, Instructions and Blank Copy: (Several Income Payors)Kristel Anne LiwagNo ratings yet

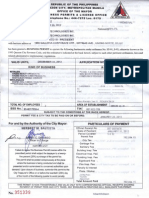

- Business Permit 2011Document1 pageBusiness Permit 2011Patrick Henry LopezNo ratings yet

- Cash Disbursement Journal TemplateDocument2 pagesCash Disbursement Journal TemplateJeov100% (1)

- 1604-CF FormDocument2 pages1604-CF Formjenie_rojen200423100% (2)

- Petty Cash VoucherDocument6 pagesPetty Cash VoucherALMA MORENANo ratings yet

- Appendices - SAAFDocument2 pagesAppendices - SAAFRussel SarachoNo ratings yet

- FSED 002 Application Form FSIC 07aug2018Document1 pageFSED 002 Application Form FSIC 07aug2018Jr CatapangNo ratings yet

- Credit Investigation or Background Investigation PDFDocument4 pagesCredit Investigation or Background Investigation PDFjoan100% (3)

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Kristine JoyceNo ratings yet

- Elegant Beauty Salon Transactions Chart of AccountsDocument17 pagesElegant Beauty Salon Transactions Chart of AccountsTherese Noelle R. ARMADANo ratings yet

- Annex D Bir InventoryDocument17 pagesAnnex D Bir InventoryDada SalesNo ratings yet

- Notes To Financial StatementsDocument8 pagesNotes To Financial Statementsjiday23100% (2)

- Letter For Business ClosureDocument1 pageLetter For Business ClosureZelQuippo Digital PrintingNo ratings yet

- Authorization - Letter Quezon City HallDocument2 pagesAuthorization - Letter Quezon City HallSky Dweller Holding Inc100% (2)

- BPLO FormsDocument6 pagesBPLO FormsLoy LoNo ratings yet

- Lessee Information Statement: For Subsequent FilingDocument3 pagesLessee Information Statement: For Subsequent Filingtax departmentNo ratings yet

- City Business Permit 2012Document1 pageCity Business Permit 2012Claire BarnesNo ratings yet

- Fine Properties-GIS (2009!07!13)Document8 pagesFine Properties-GIS (2009!07!13)Lila ShahaniNo ratings yet

- Admission Requirements Checklist College FreshmanDocument1 pageAdmission Requirements Checklist College FreshmanRonibeMalinginNo ratings yet

- CenomarDocument2 pagesCenomartoscanini2008100% (1)

- Tertiary Education Subsidy (Tes) Application Form Commission On Higher EducationDocument1 pageTertiary Education Subsidy (Tes) Application Form Commission On Higher EducationMona Gong100% (1)

- FORM FAAS Land Other Improvements PDFDocument2 pagesFORM FAAS Land Other Improvements PDFEmmanuel A. AranasNo ratings yet

- Annex B-2 RR 11-2018Document1 pageAnnex B-2 RR 11-2018Princess RegalaNo ratings yet

- Application Form DoleDocument2 pagesApplication Form DoleShanan DamokingNo ratings yet

- 2316Document1 page2316FedsNo ratings yet

- Procedure RegistrationDocument2 pagesProcedure Registrationhyro_221791% (22)

- Independent: Auditor'S ReportDocument3 pagesIndependent: Auditor'S ReportRene Huyo-aNo ratings yet

- Picpa 2019 September 6 7 Seminar Invitation LetterDocument1 pagePicpa 2019 September 6 7 Seminar Invitation Lettersanglay99No ratings yet

- PEZA Form. ERD.-4-F.003Document7 pagesPEZA Form. ERD.-4-F.003Michael AlinaoNo ratings yet

- CDMF 96 1Document1 pageCDMF 96 1Mindanao Community SchoolNo ratings yet

- SSS Change RequestDocument3 pagesSSS Change RequestAngelica SarzonaNo ratings yet

- Affidavit of Loss ID SampleDocument1 pageAffidavit of Loss ID SampleAlexandra Nicole Manigos BaringNo ratings yet

- QMB - Session 19 - Worksheet 18 - Winter 2020 PDFDocument4 pagesQMB - Session 19 - Worksheet 18 - Winter 2020 PDFGrace StylesNo ratings yet

- Annex A C of RMC No. 57 2015Document13 pagesAnnex A C of RMC No. 57 2015Cheresse Agrabio RanarioNo ratings yet

- 2020 Form 1 Freshmen Revised 1 Application For Admission ADocument4 pages2020 Form 1 Freshmen Revised 1 Application For Admission AJasyon Matindi100% (1)

- Business Permit Lucena CityDocument3 pagesBusiness Permit Lucena CityAoi50% (4)

- City of Taguig: Business Permit Application FormDocument2 pagesCity of Taguig: Business Permit Application Formjane calipayNo ratings yet

- SM TAYTAY - New Tenant Profile Form PDFDocument2 pagesSM TAYTAY - New Tenant Profile Form PDFtokstutonNo ratings yet

- Copyright Procedure 09182019Document11 pagesCopyright Procedure 09182019Camille RegaladoNo ratings yet

- Pros and Cons of Human TraffickingDocument4 pagesPros and Cons of Human TraffickingCyril Ryan100% (1)

- CMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mDocument9 pagesCMO 7-2012 Supplemental Guidelines Automated Export Documentation System Implementation Under E2mMichael Joseph IgnacioNo ratings yet

- Data Commentary: Dr. Claudia Odette J. AyalaDocument39 pagesData Commentary: Dr. Claudia Odette J. AyalaJay VillanuevaNo ratings yet

- 2b Pag-IBIG File Converter-V3.0Document2 pages2b Pag-IBIG File Converter-V3.0Karen Ico100% (1)

- Cda ReD FR 029 Performance Audit Report Rev.1 FinalDocument34 pagesCda ReD FR 029 Performance Audit Report Rev.1 FinalMark Kevin III100% (1)

- Certification-COA Cell Card All 2021Document12 pagesCertification-COA Cell Card All 2021Maricris BiscarraNo ratings yet

- Application Form - COCOLIFE HEALTHCARDDocument1 pageApplication Form - COCOLIFE HEALTHCARDkimidors143No ratings yet

- Job Description Endorsement MemoDocument1 pageJob Description Endorsement MemoLMS-NHQNo ratings yet

- Appendix 32 - DISBURSEMENT VOUCHERDocument1 pageAppendix 32 - DISBURSEMENT VOUCHERPau PerezNo ratings yet

- DV, ORS, BURS & PayrollDocument7 pagesDV, ORS, BURS & PayrollMarlyn E. AzurinNo ratings yet

- PHILGASEA Membership Form 1Document1 pagePHILGASEA Membership Form 1Jean Kenneth AlontoNo ratings yet

- Procedures Alphalist deDocument2 pagesProcedures Alphalist deAngelo LabiosNo ratings yet

- 01 FabmDocument32 pages01 FabmMavs MadriagaNo ratings yet

- Sample FsDocument7 pagesSample FscharrisedelarosaNo ratings yet

- SAMPLE - Review All Financial Documents With Your Own CounselDocument11 pagesSAMPLE - Review All Financial Documents With Your Own CounselMikaela O.No ratings yet

- Jetlines PDFDocument33 pagesJetlines PDFAnonymous Xm6ODX0No ratings yet

- Bitfarms Q4 2021 FS FinalDocument46 pagesBitfarms Q4 2021 FS FinalAlexandru IonescuNo ratings yet

- Way Finders Brands Limited: Balance Sheet As at 31 March 2017Document2 pagesWay Finders Brands Limited: Balance Sheet As at 31 March 2017Shoaib ShaikhNo ratings yet

- 2017 Year End FinancialsDocument37 pages2017 Year End FinancialsFryan GreenhousegasNo ratings yet

- Pert. Ke 3. Analisa Kinerja KeuanganDocument25 pagesPert. Ke 3. Analisa Kinerja KeuanganYULIANTONo ratings yet

- Financial StatementsDocument6 pagesFinancial StatementsMohammad AdilNo ratings yet