Professional Documents

Culture Documents

Assignment 405

Uploaded by

Shyam KrishnanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 405

Uploaded by

Shyam KrishnanCopyright:

Available Formats

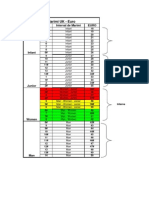

ARMY INSTITUTE OF MANAGEMENT, KOLKATA FM-405, Assignment All questions are compulsory. Q.No.

1 [5 marks] A person gets an interest free loan of USD 3,00,000. Repayment is to be done in three equal half-yearly installments. Assume the following rates: A. Today : Six months forward rate 42 / 42.50 B. At the end of six months : Spot 43/43.10 Six months forward 43.40 / 43.50 C. At the end of one year : Spot 44/ 44.10 Six month forward 44.50 / 44.60 D. At the end of one & half year : Spot 45 / 45.10 Find the amount he has to pay in rupees in following three cases. Give your recommendations. i) No hedging ii) Rupee roll over forward iii) Three separate forward contracts, one today, one after six months and one after one year from today. (Ignore bank commission) Q. No. 2 [5 marks] M/s Omega Electronics Ltd exports air-conditioners to Germany by importing the components from Singapore. The company is exporting 2400 units at a price of Euro 500 per unit. The cost of imported components is S$ 800 per unit, The fixed cost and other variable cost per unit are Rs. 1000 and Rs. 1500 respectively. The cash-flows in foreign currencies are due in six months. The current exchange rates are as follows: Rs./Euro Rs./S$ After six months Rs./Euro Rs./S$ 51.50/55 27.20/25 the exchange rates turn out as follows: 52.00/05 27.70/75

(1) You are to calculate the gain/loss due to transaction exposure. (2) Based on the following additional information calculate the loss/gain due to transaction and operating exposure if the contracted price of the air conditioner is Rs.25,000. (i) the current exchange rate is :

Rs./Euro 51.75/80 Rs./S$ 27.10/15 (ii) Price elasticity of demand is estimated to be 1.5. (iii) Payments and receipts are to be settled in six-months.

You might also like

- Imt 59Document3 pagesImt 59Prabhjeet Singh GillNo ratings yet

- Svu Bcom CA Syllabus III and IVDocument19 pagesSvu Bcom CA Syllabus III and IVram_somala67% (9)

- AssigmentDocument8 pagesAssigmentnonolashari0% (1)

- 01 s303 CmapaDocument3 pages01 s303 Cmapaimranelahi3430No ratings yet

- Test Papers: FoundationDocument23 pagesTest Papers: FoundationUmesh TurankarNo ratings yet

- BWFF2023 Financial Management ExamDocument21 pagesBWFF2023 Financial Management ExamSkuan TanNo ratings yet

- Shree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementDocument6 pagesShree Guru Kripa's Institute of Management: Cost Accounting and Financial ManagementVeerraju RyaliNo ratings yet

- Tutorial 1 - Sp16Document3 pagesTutorial 1 - Sp16Abir AllouchNo ratings yet

- Sem IV (Internal 2010)Document15 pagesSem IV (Internal 2010)anandpatel2991No ratings yet

- Financial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988Document7 pagesFinancial Management-I Term End Examinations: 31 Stdev 14.30 10.91 Beta 0.26 CORRR 0.1988EshanMishraNo ratings yet

- Acf 318 M 2018Document4 pagesAcf 318 M 2018Bulelwa HarrisNo ratings yet

- Advanced Financial Management: Tuesday 3 June 2014Document13 pagesAdvanced Financial Management: Tuesday 3 June 2014SajidZiaNo ratings yet

- Pravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperDocument9 pagesPravinn Mahajan CA FINAL SFM-NOV2011 Ques PaperPravinn_MahajanNo ratings yet

- CS Final - Financial Tresurs and Forex Management - June 2004Document4 pagesCS Final - Financial Tresurs and Forex Management - June 2004Rushikesh DeshmukhNo ratings yet

- Assignment For CB TechniquesDocument2 pagesAssignment For CB TechniquesRahul TirmaleNo ratings yet

- F 9Document32 pagesF 9billyryan1100% (2)

- Cost Accounting 2013Document3 pagesCost Accounting 2013GuruKPO0% (1)

- Actuarial Society of India Examinations: Subject 102 - Financial MathematicsDocument5 pagesActuarial Society of India Examinations: Subject 102 - Financial MathematicsbrcsNo ratings yet

- Subjectct52005 2009 PDFDocument181 pagesSubjectct52005 2009 PDFpaul.tsho7504No ratings yet

- FM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocDocument6 pagesFM202 - Exam Q - 2011-2 - Financial Accounting 202 V3 - AM NV DRdocMaxine IgnatiukNo ratings yet

- Forex Problems1Document4 pagesForex Problems1skalidasNo ratings yet

- BFDDocument4 pagesBFDaskermanNo ratings yet

- Assignments: Program: Mba Ib Semester-IiDocument13 pagesAssignments: Program: Mba Ib Semester-IiSekla ShaqdieselNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- f5 2012 Jun Q PDFDocument7 pagesf5 2012 Jun Q PDFcatcat1122No ratings yet

- Problem ForexDocument8 pagesProblem ForexKushal SharmaNo ratings yet

- 7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFDocument32 pages7891FinalGr1paper2ManagementAccountingandFinancilAnalys PDFPrasanna SharmaNo ratings yet

- Problems On PPEDocument8 pagesProblems On PPEDibyansu KumarNo ratings yet

- C.A. Final Financial Reporting Consolidated BSDocument7 pagesC.A. Final Financial Reporting Consolidated BSDivyesh TrivediNo ratings yet

- Test Paper -1: Derivatives, IRRM, Forex and IFMDocument7 pagesTest Paper -1: Derivatives, IRRM, Forex and IFMAbhu ArNo ratings yet

- Deepak QuestionsDocument5 pagesDeepak Questionsvivek ghatbandheNo ratings yet

- Financial Treasury and Forex Management: NoteDocument7 pagesFinancial Treasury and Forex Management: Notesks0865No ratings yet

- CGA May 2011Document20 pagesCGA May 2011Srinivasan SethuramanNo ratings yet

- Lecture 8 NotesDocument9 pagesLecture 8 NotesAna-Maria GhNo ratings yet

- Bfi 300Document3 pagesBfi 300mahmoudfatahabukarNo ratings yet

- Financial Management 1Document36 pagesFinancial Management 1nirmljnNo ratings yet

- CA IPCC Nov 2010 Accounts Solved AnswersDocument13 pagesCA IPCC Nov 2010 Accounts Solved AnswersprateekfreezerNo ratings yet

- Accounting Test Paper 1: Key ConceptsDocument30 pagesAccounting Test Paper 1: Key ConceptsSatyajit PandaNo ratings yet

- Characteristics of A Budget: Cash ReceiptsDocument11 pagesCharacteristics of A Budget: Cash ReceiptsMukesh ManwaniNo ratings yet

- M1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon SessionDocument20 pagesM1 - CIMA Masters Gateway Assessment 22 May 2012 - Tuesday Afternoon Sessionkarunkumar89No ratings yet

- Accounting For Decision Makers (MBA401) - Model PaperDocument6 pagesAccounting For Decision Makers (MBA401) - Model Papertg100% (1)

- Project Planning Appraisal and Control AssignmentDocument31 pagesProject Planning Appraisal and Control AssignmentMpho Peloewtse Tau50% (2)

- Business Finance Assignment EnaaDocument4 pagesBusiness Finance Assignment EnaaEna Bandyopadhyay100% (1)

- Advertisement Hiring of Consultants CBM Asset BokaroDocument5 pagesAdvertisement Hiring of Consultants CBM Asset Bokarosunny KumarNo ratings yet

- Assignment or BCADocument5 pagesAssignment or BCAkuku288No ratings yet

- Case Study: Abc Garments LTD.: Land Building & Site Development MachineryDocument3 pagesCase Study: Abc Garments LTD.: Land Building & Site Development Machinerynllsh100% (1)

- CCE E MBA (Aviation Management) Assignment 1Document6 pagesCCE E MBA (Aviation Management) Assignment 1Sukhi MakkarNo ratings yet

- STRATEGIC FINANCIAL MANAGEMENT EXAMDocument21 pagesSTRATEGIC FINANCIAL MANAGEMENT EXAMCLIVENo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- Pen & Paper Final Group I SFM April 10 Test 1Document4 pagesPen & Paper Final Group I SFM April 10 Test 1rbhadauria_1No ratings yet

- QP March2012 f2Document16 pagesQP March2012 f2g296469No ratings yet

- 2011 JunDocument10 pages2011 JunShihan HaniffNo ratings yet

- FPDocument20 pagesFPRadhika ParekhNo ratings yet

- ct52010 2013Document162 pagesct52010 2013Wei SeongNo ratings yet

- Institute of Actuaries of India: ExaminationsDocument6 pagesInstitute of Actuaries of India: ExaminationsmailrahulrajNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- SERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKFrom EverandSERIES 79 EXAM STUDY GUIDE 2022 + TEST BANKNo ratings yet

- Rhoton - OpenStack Cloud Computing EbookDocument67 pagesRhoton - OpenStack Cloud Computing EbookpalimariumNo ratings yet

- Deloitte Digital Maturity ModelDocument24 pagesDeloitte Digital Maturity ModelShyam Krishnan100% (3)

- Battery Balance of System Charrette! Post-Charrette Report!: Contacts:!Document37 pagesBattery Balance of System Charrette! Post-Charrette Report!: Contacts:!Shyam KrishnanNo ratings yet

- A Functional Description of AutomationDocument7 pagesA Functional Description of AutomationShyam KrishnanNo ratings yet

- Cae Software PDFDocument9 pagesCae Software PDFShyam KrishnanNo ratings yet

- Hyundai Mobis (012330) : BUY (Maintain) W350,000Document2 pagesHyundai Mobis (012330) : BUY (Maintain) W350,000Shyam KrishnanNo ratings yet

- Hindalco Annual Report 2011-12Document180 pagesHindalco Annual Report 2011-12RahulYelisettiNo ratings yet

- HealthcareDocument43 pagesHealthcareRepu DamanNo ratings yet

- New Microsoft Office Word DocumentDocument8 pagesNew Microsoft Office Word DocumentShyam KrishnanNo ratings yet

- Nielsen Middle India Report 2011Document24 pagesNielsen Middle India Report 2011pavanmetriNo ratings yet

- Shyam EMRDocument5 pagesShyam EMRShyam KrishnanNo ratings yet

- Verbal Communication: "A Wise Man Reflects Before He Speaks A Fool Speaks, and Then Reflects On What He Has Uttered."Document31 pagesVerbal Communication: "A Wise Man Reflects Before He Speaks A Fool Speaks, and Then Reflects On What He Has Uttered."Shyam KrishnanNo ratings yet

- Share This:: Matter & EnergyDocument2 pagesShare This:: Matter & EnergyShyam KrishnanNo ratings yet

- Quantum Users Guide-3Document209 pagesQuantum Users Guide-3Shyam Krishnan100% (2)

- Framework: Existing R & D NetworkDocument24 pagesFramework: Existing R & D NetworkShyam KrishnanNo ratings yet

- A Good Investment or Not?Document6 pagesA Good Investment or Not?Shyam KrishnanNo ratings yet

- SHABNAMDocument33 pagesSHABNAMShyam KrishnanNo ratings yet

- Quantum Users Guide-3Document209 pagesQuantum Users Guide-3Shyam Krishnan100% (2)

- AIMK-Summer Project Guidelines 2013 Mba 16Document4 pagesAIMK-Summer Project Guidelines 2013 Mba 16Army Institute of Management, KolkataNo ratings yet

- Horlicks: A Glaxosmith Kline CompanyDocument13 pagesHorlicks: A Glaxosmith Kline CompanyShyam KrishnanNo ratings yet

- Demand, Supply and Price 1Document104 pagesDemand, Supply and Price 1Shyam KrishnanNo ratings yet

- Grade 10 Maths Book RATIOSDocument23 pagesGrade 10 Maths Book RATIOSMartin HillNo ratings yet

- AIFS TemplateDocument13 pagesAIFS TemplateAnonymous FRxOWG2NF3No ratings yet

- Romania Crisis 2008Document28 pagesRomania Crisis 2008Sorocan NicolaeNo ratings yet

- Dersch, Popular Social Studies Teacher, Passes Memorial This Sunday - Beverly Hills Weekly, Issue #647Document2 pagesDersch, Popular Social Studies Teacher, Passes Memorial This Sunday - Beverly Hills Weekly, Issue #647BeverlyHillsWeeklyNo ratings yet

- Eu Furniture MarketDocument307 pagesEu Furniture MarketCarolina0% (1)

- Ar2018 WebDocument162 pagesAr2018 Webit4728No ratings yet

- IFM 2017 Final Exam-Solution-SampleDocument12 pagesIFM 2017 Final Exam-Solution-SampleApiwat Benji PradmuangNo ratings yet

- Deloitte GTCE VAT Refund Guide 2022Document164 pagesDeloitte GTCE VAT Refund Guide 2022Ali AyubNo ratings yet

- Plastic OmniumDocument2 pagesPlastic Omniumgsravan_23No ratings yet

- Investments trends across sectorsDocument6 pagesInvestments trends across sectorsGiang NgôNo ratings yet

- Group Cash Flow Statement GuideDocument28 pagesGroup Cash Flow Statement GuideImran MobinNo ratings yet

- Roland Berger Wealth Management in New Realities 20131023Document92 pagesRoland Berger Wealth Management in New Realities 20131023Muthu Barathi ParamasivamNo ratings yet

- RFPDocument245 pagesRFPMadhav ReddyNo ratings yet

- Aviva PLC Annual Report and Accounts 2013Document320 pagesAviva PLC Annual Report and Accounts 2013Aviva GroupNo ratings yet

- EY Renewable Energy Country Attractiveness Index Recai 43Document40 pagesEY Renewable Energy Country Attractiveness Index Recai 43Max PowerNo ratings yet

- A Lawyer'S Guide To Working OverseasDocument24 pagesA Lawyer'S Guide To Working OverseastehnicratNo ratings yet

- Dobbs - The NEWNEY Approach To Unscrambling The EuroDocument70 pagesDobbs - The NEWNEY Approach To Unscrambling The Euroonat85No ratings yet

- 2010 Math CXCDocument3 pages2010 Math CXCJerado PennantNo ratings yet

- Living and Studying in GeisenheimDocument2 pagesLiving and Studying in GeisenheimNabendu SahaNo ratings yet

- HBL Internship Report InsightsDocument65 pagesHBL Internship Report InsightsSherryMirzaNo ratings yet

- International Finance Textbook OverviewDocument188 pagesInternational Finance Textbook OverviewHải LongNo ratings yet

- Daily Treasury Report0424 ENGDocument3 pagesDaily Treasury Report0424 ENGBiliguudei AmarsaikhanNo ratings yet

- Weekender - GEI Industrial Systems - 05-08-11 PDFDocument5 pagesWeekender - GEI Industrial Systems - 05-08-11 PDFSwarupa DateNo ratings yet

- Nysut LM2 2010Document232 pagesNysut LM2 2010Scott WaldmanNo ratings yet

- Usa Gold Regular Archives CollectedDocument436 pagesUsa Gold Regular Archives Collectedmartijn1234No ratings yet

- ACCT 611 CHP 22BDocument25 pagesACCT 611 CHP 22BkwameNo ratings yet

- Week10-Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016) (Dragged)Document24 pagesWeek10-Elgin F. Hunt, David C. Colander - Social Science - An Introduction To The Study of Society-Routledge (2016) (Dragged)MuhammetNo ratings yet

- IBT Chapter 01Document39 pagesIBT Chapter 01Boysie Ceth GarvezNo ratings yet

- Tabel Marimi UK-EURDocument2 pagesTabel Marimi UK-EURmariela2mNo ratings yet

- (Full Paper) Greek Tourism Under Crisi - Strategies and The Way OutDocument24 pages(Full Paper) Greek Tourism Under Crisi - Strategies and The Way OutSotiris VarelasNo ratings yet