Professional Documents

Culture Documents

Anf 3 C

Uploaded by

Nagu S PillaiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Anf 3 C

Uploaded by

Nagu S PillaiCopyright:

Available Formats

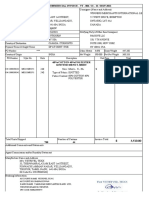

ANF 3C

Common Application Form for VKGUY, FMS and FPS (including MLFPS) For Exports made on or after 27.8.2009 (Kindly see Paras 3.13.1, 3.13.2, 3.13.3, 3.14, 3.15 of FTP and Para 3.7, 3.8, 3.8.1, 3.8.2, 3.9, 3.9.1 and 3.9.2 of HBPv1)

(Please note that separate applications are required to be filed for separate years (AM10, AM11 etc.) based on date of export. Please note that application has to be filed port-wise. One application cannot cover shipment from more than one port, whether EDI or Non-EDI port.) 1. IEC Number of Applicant:

2. Applicant Details i. Name ii. Address

3. RCMC Details i. RCMC Number iii. Issuing Authority v. Products for which registered ii. Date of Issue iv. Valid up to

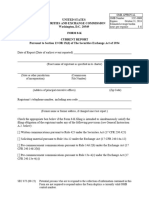

4. Application Details: (i) Export Licensing Year (pl. specify the year in which export has been made, based on date of export (Para 9.12 of HBPv1): (ii) Date of filing of Application: (iii) Port of Export for this Application: Note: Applicant to feed in the details of one shipping bill at a time and thereafter select the Scheme Name under which benefit for a particular shipping bill is being claimed. A maximum of 50 shipping bills can be filed in one application. For each shipping bill, the appendices details will appear after selecting the scheme name. The Scheme Names and relevant appendices are: VKGUY Appendix 37A, FMS Appendix 37C, FPS Appendix 37D, MLFPS Appendix 37D.

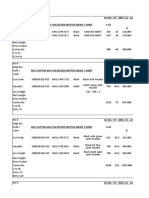

5. Details of Exports Shipping Bill Details Sl No NumberLEO Date Date of ITC Export* (HS) code (4) (5) Item FOB value Description of Exports (in free foreign exchange) (6) (7) Foreign Agency Commissio (FAC) (8) For conversion to Rupees, Customs Rate of Exchange, on LEO date (9) FOB Value (including up to 12.5% FAC) as per Shipping Bill, in Rupees (10) (10) = (9) * [(7) {(8) - 12.5%*(7)} if (8) is more than 12.5% of (7)]

(1)

(2)

(3)

Scheme Specific Details Scheme Name (11) Relevant Appendix Details (12) Rate of Entitlement (13) Details of Focus Market / Linked Market for MLFPS Market Name (14) Entitlement Amount (in Rs.) (15) (15) = (10) X(13) Late Cut applicable, if any (in Rs.) (16)

Entitlement (in Rs.) (17) (17) = (15) (16)

5. Date of Realization of Export Proceeds (in case where application is filed on post realization basis): (Kindly feed the date and enclose the BRC/FIRC along with the application. In cases of Pre-Realization filing of application, monitoring of such cases will be diligently done by RA concerned) 6. Number of Split Certificates required (in multiples of Rs 5 lakhs each): (Splits Certificates shall not be allowed for Duty Credit Scrip issued for exports from Non-EDI ports) 7. Port of Registration (for the purpose of imports)***: Note: No supplementary cut (Para 9.4 of HBPv1) shall be imposed, as multiple applications have to be filed. (* Date of Export shall be as per Para 9.12 of HBP v1.) (** In case of multiple dates of realization against a shipment, the last date of realization is to be mentioned in this column.) (*** The port of registration shall be the port of export.) 8. Application Submission Details (in case of electronically submitted applications) i. ECOM Reference Number ii. Date of Submission on Server iii. Submitted to which Regional Authority iv. File Number v. Date of Issue DECLARATION / UNDERTAKING 1. I hereby declare that particulars and statements made in this application are true and correct and nothing has been concealed or held there from. I fully understand that any information furnished in application if found incorrect or false will render my firm / company and me liable for any penal action or other consequences as may be prescribed in law or otherwise warranted. I hereby certify that none of Proprietor/ Partner(s) / Director(s) / Karta / Trustee of firm / company, as the case may be, is a Proprietor / Partner(s) / Director(s) / Karta / Trustee in any other firm / company which has come to adverse notice of DGFT. Consequentially, I further declare that under Foreign Trade (Development and Regulation) Act (FTDR Act) 1992, my firm / company have not been debarred in person from undertaking any export import business or activity by way of suspension or cancellation of IEC number. [If so debarred under FTDR Act, details of said order and period for which the same is operational may be provided]. I hereby certify that my firm / company has not defaulted from export obligation under any provisions of FTP and has not been placed under the Denied Entity List (DEL). [If under DEL List, kindly furnish details of order, current status etc.] I hereby declare that details of exports of goods of my firm / company are true and correct and in accordance with accounts maintained in my firm / company. I hereby declare that no benefit under VKGUY (Para 3.13 of FTP) or Focus Market Scheme, or Focus Product Scheme (FPS) (including for Market Linked Focus Products), as the case may be, was availed (or applied for) previously against Shipping Bills currently included in this application. I hereby declare that in terms of Para 3.17.8 of FTP, this application does not contain any export for which benefit under any other reward/incentive schemes (i.e. VKGUY (including Agriculture Infrastructure Incentive Scrip) - Para 3.13, FMS Para 3.14, FPS (including MLFPS) Para 3.15) of Chapter 3 of FTP has been / will be claimed. I hereby declare that in terms of Para 3.17.10 of FTP, this application does not contain any exports in contravention to this provision. I hereby declare that the Exported Product is covered under relevant Appendix and the exports, for which this application is being filed, are made on or after the respective admissible date of export, as indicated in relevant Appendix. I hereby declare that export product for which the duty credit scrip benefit is being claimed does not contain any shipment made w.e.f 27.8.2009 (as per Para 3.17.2 of FTP) from the following ineligible export categories / sectors: a. EOUs / EHTPs / BTPs who are availing direct tax benefits / exemption; b. Export of imported goods covered under Para 2.35 of FTP; c. Exports through transshipment, meaning thereby that exports originating in third country but transshipped through India;

2.

3. 4. 5.

6.

7. 8. 9.

d. e. f.

Deemed Exports Exports made by SEZ units or SEZ products exported through DTA units; and Items, which are restricted or prohibited for export under Schedule-2 of Export Policy in ITC (HS).

10. I hereby declare that the exports, for which benefit is being claimed under FMS (Para 3.14 of FTP), does not include any export and / or category covered under Para 3.14.3 of FTP. 11. I hereby certify that I am authorized to verify and sign this declaration as per Paragraph 9.9 of FTP. Place: Date: Signature: _ Name:

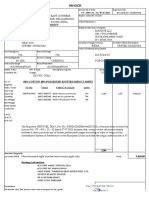

Documents to be submitted Designation: 1. Export promotion (EP) copy of Shipping Bill (or Bill of Export, including in Official Address: case of exports through Land Customs) 2. In cases of Post-realization, Relevant Original Bank Certificate of Exports and Realisation - Appendix 22A / Foreign Inward Remittance Certificates (FIRC) or offsetting of export proceeds with approval of RBI (Appendix 22D). In case the application is filed without BRC, the application shall be accompanied with BG / LUT in terms of Paragraph 2.20 of the HBPv1. Disclaimer in terms of Para 3.17.10, in case the duty credit scrip benefit is being claimed by the supporting manufacturer. For FMS and MLFPS, additionally the Market / Linked Market information will be required to be filled in, and Proof of Landing as per Para 3.8.2 of HBPv1 would also be required. Telephone: Email Address: Residential Address:

3.

4. 5.

Note: In case of FIRC, a declaration from exporter that remittance is in respect of Shipping Bill(s) No dtd shall also be furnished. Note 1: Each individual page of application has to be signed. One copy of ANF3C duly signed in the provided space. Copy of Updated Profile in ANF1 only if any changes have taken place and updated, along with copy of Valid RCMC.

Note 2: In cases where original EP copy of Shipping Bill(s) (Bill of export) and/or Bank Realisation Certificates has been submitted under any other scheme of FTP, a self attested photocopy(s) of the same be attached, quoting Reference File no. & concerned Regional Authority / Customs Authority where original documents have been submitted.

You might also like

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Document15 pagesDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jNo ratings yet

- ANF 5A EPCG ApplicationDocument6 pagesANF 5A EPCG ApplicationBaljeet SinghNo ratings yet

- ANF 5B LIC - NoDocument5 pagesANF 5B LIC - Nosuman_gourh100% (2)

- EPCG License RequirementsDocument14 pagesEPCG License RequirementsAmit AshishNo ratings yet

- Anf 1BDocument11 pagesAnf 1Bdkhatri01No ratings yet

- Anf 2CDocument3 pagesAnf 2CBaljeet SinghNo ratings yet

- DTREDocument15 pagesDTRESalman HamidNo ratings yet

- Application Form For Export of SCOMET ItemsDocument4 pagesApplication Form For Export of SCOMET Itemsakashaggarwal88No ratings yet

- Application For Redemption / No Bond CertificateDocument4 pagesApplication For Redemption / No Bond Certificateakashaggarwal88100% (1)

- FMS, FPS, MLFPS Schemes & Documents Reqd.Document7 pagesFMS, FPS, MLFPS Schemes & Documents Reqd.bibhas1No ratings yet

- Sub Section VIDocument9 pagesSub Section VIdvnambNo ratings yet

- List of ANFs for Import-Export CodeDocument175 pagesList of ANFs for Import-Export CodeSenthil MuruganNo ratings yet

- Export LicenseDocument3 pagesExport LicenseRoshaniNo ratings yet

- Application for Redemption or No Bond CertificateDocument4 pagesApplication for Redemption or No Bond CertificateAjaiKumarNo ratings yet

- ANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)Document4 pagesANF 4 I: (Please See Guidelines (Given at The End) Before Filling The Application)akashaggarwal88No ratings yet

- DGFT Notification No.08/2015-2020 Dated 4th June, 2015Document5 pagesDGFT Notification No.08/2015-2020 Dated 4th June, 2015stephin k jNo ratings yet

- Public Notice No 2Document98 pagesPublic Notice No 2Rajat MehtaNo ratings yet

- All About MEIS (Merchandise Exports From India Scheme) FULL DEATILSDocument6 pagesAll About MEIS (Merchandise Exports From India Scheme) FULL DEATILSKRISHNA GOPAL YADHUVANSINo ratings yet

- ANF5ADocument9 pagesANF5ACharles JacobNo ratings yet

- FEMA23RDocument9 pagesFEMA23RDrawing & Dishbursing OfficerNo ratings yet

- Workbook - 3rd SemDocument94 pagesWorkbook - 3rd SemKandu SahibNo ratings yet

- Sro 565-2006Document44 pagesSro 565-2006Abdullah Jathol100% (1)

- Exports - Furnishing of Bond/Letter of Undertaking For Exports - ClarificationDocument11 pagesExports - Furnishing of Bond/Letter of Undertaking For Exports - ClarificationRohan KulkarniNo ratings yet

- Register as Exporter in 4 StepsDocument6 pagesRegister as Exporter in 4 StepsNthabiseng Dinah MaidiNo ratings yet

- Handbook of Procedures GuideDocument174 pagesHandbook of Procedures GuideKrishna SinghNo ratings yet

- Sro 327 PDFDocument20 pagesSro 327 PDFOmer ToqirNo ratings yet

- Application For Enhancement in CIF FOB Value or Revalidation or EO Extension of AuthorisationDocument3 pagesApplication For Enhancement in CIF FOB Value or Revalidation or EO Extension of AuthorisationPrashantNo ratings yet

- Anf 5BDocument3 pagesAnf 5BAkash KediaNo ratings yet

- Advance Authorization SchemeDocument9 pagesAdvance Authorization SchemeVedant CorporationNo ratings yet

- Docs For Claiming Exp AssistanceDocument5 pagesDocs For Claiming Exp Assistancejuzerali007No ratings yet

- Appendix 11cDocument2 pagesAppendix 11cdaljitkaurNo ratings yet

- Online Export Obligation DischargeDocument6 pagesOnline Export Obligation DischargeChintan Shah /CEO's Office /SreiNo ratings yet

- Co Thailand - ModificadoDocument2 pagesCo Thailand - ModificadoSebastian Aguilar EscalanteNo ratings yet

- A1 For Import Goods PaymentsDocument3 pagesA1 For Import Goods PaymentskollarajasekharNo ratings yet

- Business Taxation Assignment On Central Sales TaxDocument6 pagesBusiness Taxation Assignment On Central Sales TaxbluisssNo ratings yet

- form8-kDocument40 pagesform8-kdouglas.doyerNo ratings yet

- Advance Import PaymentDocument8 pagesAdvance Import PaymentAshish GargNo ratings yet

- A Blank Nafta CooDocument2 pagesA Blank Nafta CooAna Patricia Castro MendozaNo ratings yet

- Export Oriented UnitsDocument20 pagesExport Oriented UnitsChunnuriNo ratings yet

- Nafta Cert of OriginDocument2 pagesNafta Cert of OriginCINTHYANo ratings yet

- Draft Refund RulesDocument7 pagesDraft Refund RulessridharanNo ratings yet

- GST Flyer Chapter25Document9 pagesGST Flyer Chapter25S Radhakrishna BhandaryNo ratings yet

- Sample in QDocument8 pagesSample in QMOHD SUHAILNo ratings yet

- Consti 2 CasesDocument249 pagesConsti 2 CasesLen Vicente - FerrerNo ratings yet

- Aayat Niryat FormsDocument179 pagesAayat Niryat FormsankitNo ratings yet

- Tendernotice 1Document23 pagesTendernotice 1shrekant potdarNo ratings yet

- ANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPDocument4 pagesANF-2D Application Format For Seeking Policy/Procedure Relaxation in Terms of para 2.58 of FTPUtkarsh KhandelwalNo ratings yet

- Phil. International Trading Corp. V AngelesDocument9 pagesPhil. International Trading Corp. V AngelesXing Keet LuNo ratings yet

- National Pavilions - Manufacturing Application Form - Oct'13Document6 pagesNational Pavilions - Manufacturing Application Form - Oct'13Durban Chamber of Commerce and IndustryNo ratings yet

- Related Press Release: A.P. (DIR Series) Circular No. 56 Dated June 28, 2010Document8 pagesRelated Press Release: A.P. (DIR Series) Circular No. 56 Dated June 28, 2010Moin LadhaNo ratings yet

- Application Form For End User Certificate UnderDocument4 pagesApplication Form For End User Certificate Underakashaggarwal88No ratings yet

- GST RFD 01Document15 pagesGST RFD 01Rajdev AssociatesNo ratings yet

- Check List For Application of EPCG AuthorisationDocument4 pagesCheck List For Application of EPCG AuthorisationsrinivasNo ratings yet

- DBK and DeecDocument3 pagesDBK and DeecManik RajNo ratings yet

- VETRIDocument4 pagesVETRINagu S PillaiNo ratings yet

- VT - 009 TJX UkDocument5 pagesVT - 009 TJX UkNagu S PillaiNo ratings yet

- VETRIDocument4 pagesVETRINagu S PillaiNo ratings yet

- VT - 006 WinnerDocument4 pagesVT - 006 WinnerNagu S PillaiNo ratings yet

- VT - 009 TJX UkDocument5 pagesVT - 009 TJX UkNagu S PillaiNo ratings yet

- How To Install GTA Vice City Game?Document1 pageHow To Install GTA Vice City Game?Nagu S PillaiNo ratings yet

- Appendix 21 A: Format For Deposit of Application FeeDocument2 pagesAppendix 21 A: Format For Deposit of Application FeeNagu S PillaiNo ratings yet

- Directorate General of Foreign Trade: Statement of Bank RealisationDocument1 pageDirectorate General of Foreign Trade: Statement of Bank RealisationNagu S Pillai100% (1)

- DGFT ID Cardappnd-20aDocument1 pageDGFT ID Cardappnd-20aNagu S PillaiNo ratings yet

- DGFT ID Cardappnd-20aDocument1 pageDGFT ID Cardappnd-20aNagu S PillaiNo ratings yet

- Courses of IgnouDocument270 pagesCourses of IgnouNilabh KumarNo ratings yet

- Color SwatchesDocument1 pageColor SwatchesNagu S PillaiNo ratings yet