Professional Documents

Culture Documents

14 Procedure For Vat RC

14 Procedure For Vat RC

Uploaded by

ashish27602030Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

14 Procedure For Vat RC

14 Procedure For Vat RC

Uploaded by

ashish27602030Copyright:

Available Formats

REQUIREMENTS FOR NEW VAT REGISTRATION NUMBER IN THE STATE OF GUJARAT

Copy of Memorandum & Article of Association in the case of LTD or PVT LTD Company. Copy of partnership deed in case of partnership firm. Two recent passport size photographs of each Partner/Director or of Proprietor. List of Partner or Director with name, address, age & signature. Copy of PAN number allotted by IT department of Firm, Company and of each Partner/Director or of Proprietor. Board resolution for commencing business in the state of Gujarat in case of LTD or PVT LTD Company. Certified copy of bank accountant. Proof of place of Business: Certified copy of agreement being proof of place of business. If owned then copy of allotment letter, copy of possession letter, copy of share certificate or sale deed (any two of this). If rented then copy of rent agreement, rent receipt & ownership documents of landlord, as stated in case of owned premises. In any other case consent letter of the owner of the premises along with ownership documents. Proof of residence of all Partner/Director or of Proprietor: Similar documents as stated above. In addition to above documents certified copy of ration card, passport, election card, driving license, insurance policy of all Partner/Director or of Proprietor. Also copy of Muni. Tax bill, Elec. Bill & Telephone bill is required of all Partner/Director or of Proprietor. Copy of registration certificate under shop & establishment Act, if the place of business is within the Municipal limits of Ahmedabad. A minimum turnover of RS. 5 lacs is required in case of reseller and in case of Manufacturer or Importer a minimum turnover of Rs.2 lacs is required which must includes taxable purchases of RS.10, 000/-. If there is no turnover then a deposit of RS.25000/- is to be deposited for a period of two years. This can be adjusted against the tax, interest or penalty. (This facility is not available to Non-resident dealer) As per the provisions of the GVAT ACT a bank guarantee of Rs.50000/- maximum is to be submitted, this can be reduced to Rs.10000/- by providing any three of the following. 1. Last paid electric bill in his name, his partners name or his spouses name. 2. Last paid telephone bill in his name, his partners name or his spouses name. 3. PAN number issued by the IT department. 4. Any document as proof of ownership of principal place of business in his name, his partners name or his spouses name. 5. Any document as proof of ownership of residential property in his name, his partners name or his spouses name. 6. Notarized photocopy of the passport of proprietor, managing partner or managing director. 7. Certificate obtained form the shop and establishment department. 8. Registration certificate from the Custom and Central Excise Authority. All the above documents are required in duplicate and should be certified by Class I officer of Government or notarized.

You might also like

- Request For Providing KYC Documents: in Case of IndividualsDocument3 pagesRequest For Providing KYC Documents: in Case of IndividualsVishal Yadav100% (1)

- Note Brokering for Profit: Your Complete Work At Home Success ManualFrom EverandNote Brokering for Profit: Your Complete Work At Home Success ManualNo ratings yet

- Bank Procedure and FormalitiesDocument59 pagesBank Procedure and Formalitiesrakesh19865No ratings yet

- VAT Procedure in MaharashtraDocument14 pagesVAT Procedure in MaharashtraDeva DrillTechNo ratings yet

- Documents Needed For GST Registration IncludeDocument3 pagesDocuments Needed For GST Registration IncludeShilpiNo ratings yet

- ChecklistDocument1 pageChecklistvikrantgoudaNo ratings yet

- SBI & AXIS BANK Home LOANS INFORMATIONDocument57 pagesSBI & AXIS BANK Home LOANS INFORMATIONSakshi KadamNo ratings yet

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliNo ratings yet

- One Person Company IncorporationDocument1 pageOne Person Company Incorporationazconsulting.connectNo ratings yet

- Application Form For MSEsDocument5 pagesApplication Form For MSEsSenthil_kumar_palaniNo ratings yet

- GST RegistrationDocument59 pagesGST Registrationvinayak tiwariNo ratings yet

- List of KYC DocumentsDocument3 pagesList of KYC DocumentsSumit KumarNo ratings yet

- Registration of Partnership Firm in DelhiDocument7 pagesRegistration of Partnership Firm in DelhiTushar GuptaNo ratings yet

- Unit - II Indirect Taxation-1Document55 pagesUnit - II Indirect Taxation-1praveensenthamarai25No ratings yet

- Licenses For FoodDocument9 pagesLicenses For FoodChandana SurthiNo ratings yet

- B9-057-VanshPatel-Assignment 2Document9 pagesB9-057-VanshPatel-Assignment 2Vansh PatelNo ratings yet

- Terms of State Bank of IndiaDocument5 pagesTerms of State Bank of IndiaexperinmentNo ratings yet

- REGISTRATION On GST NotesDocument6 pagesREGISTRATION On GST NotesRohan SinhaNo ratings yet

- SBI-SME-Checklist SME Smart ScoreDocument2 pagesSBI-SME-Checklist SME Smart ScorebiaravankNo ratings yet

- Company Registration ProcessDocument8 pagesCompany Registration ProcessSultan AndrewNo ratings yet

- SBI SME Checklist Working CapitalDocument5 pagesSBI SME Checklist Working CapitaleswarscribdNo ratings yet

- Check List: Shishu: Checklist of Enclosures To Pmmy ApplicationsDocument1 pageCheck List: Shishu: Checklist of Enclosures To Pmmy ApplicationsVijay PatilNo ratings yet

- Checklist of Every Loan FileDocument1 pageChecklist of Every Loan FileDheeraj VarkhadeNo ratings yet

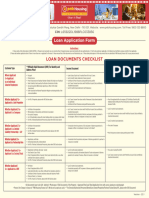

- Loan Application FormDocument6 pagesLoan Application FormnavabharathsrinivasanNo ratings yet

- Start-Up Docs ReqdDocument1 pageStart-Up Docs ReqdamiteshnegiNo ratings yet

- Company Reg Docs - Indian CoDocument3 pagesCompany Reg Docs - Indian CoNanu9711 JaiswalNo ratings yet

- VAT Registration: A. For Fresh RegistrationDocument2 pagesVAT Registration: A. For Fresh RegistrationMalaya2100No ratings yet

- Small Biz LoanDocument4 pagesSmall Biz LoanJulian AlbaNo ratings yet

- MVAT ACT, 2002: Who Needs To Register?Document14 pagesMVAT ACT, 2002: Who Needs To Register?CAJigarThakkarNo ratings yet

- All in One Statutory Forms & Order Form of OPCDocument23 pagesAll in One Statutory Forms & Order Form of OPCraajverma1000mNo ratings yet

- How To Open Demat Account in Zerodha PDFDocument18 pagesHow To Open Demat Account in Zerodha PDFjassibro2005No ratings yet

- LegalDocument32 pagesLegalAkriti SinghNo ratings yet

- Major Banks PrivateDocument3 pagesMajor Banks PrivateYashesh PatelNo ratings yet

- PhonePe PG - Onboarding DocumentsDocument1 pagePhonePe PG - Onboarding DocumentsDr. Ashwin Raja MBBS MSNo ratings yet

- GST Registration Procedure Chapter 2Document22 pagesGST Registration Procedure Chapter 2Amreen kousarNo ratings yet

- Revised Checklist - SELDocument1 pageRevised Checklist - SELLavkush ShuklaNo ratings yet

- VAT FormDocument8 pagesVAT FormSonila JainNo ratings yet

- Nepal Bank LimitedDocument9 pagesNepal Bank LimitedSuman ThakuriNo ratings yet

- Propietorship FirmDocument2 pagesPropietorship FirmDebajit BurhagohainNo ratings yet

- MSE ApplicApplication For MSME Loan Upto Rs. 100 LakhsationDocument6 pagesMSE ApplicApplication For MSME Loan Upto Rs. 100 Lakhsationprabhu.gampalaNo ratings yet

- GST Registration: List of Documents For Different Types of Entities (Https://taxguru - In/goods-And-Service-Tax/gst-Registration-List-Documents - HTML)Document9 pagesGST Registration: List of Documents For Different Types of Entities (Https://taxguru - In/goods-And-Service-Tax/gst-Registration-List-Documents - HTML)amit22505No ratings yet

- Documents Required For RegistrationDocument13 pagesDocuments Required For RegistrationNikita BaliNo ratings yet

- Procedure For Public Limited Company FormationDocument4 pagesProcedure For Public Limited Company Formationlalbabu guptaNo ratings yet

- Green Veh OnepagerDocument2 pagesGreen Veh OnepagerRohith RaoNo ratings yet

- Guide Rent RegardingDocument2 pagesGuide Rent RegardingManjunatha ReddyNo ratings yet

- Home Loan Application Form - WEBDocument8 pagesHome Loan Application Form - WEBanandNo ratings yet

- LLP RegistrationDocument1 pageLLP RegistrationarvapallydikshitNo ratings yet

- Minimum Requirement To Start A LLPDocument1 pageMinimum Requirement To Start A LLPgulanikar7694No ratings yet

- Gr6 SecB Limited Liability PartnershipDocument23 pagesGr6 SecB Limited Liability PartnershipKanika SharmaNo ratings yet

- Private Limited Company Incorporation and DocumentsDocument18 pagesPrivate Limited Company Incorporation and DocumentsSolubilisNo ratings yet

- List of Required Documents PDFDocument2 pagesList of Required Documents PDFFarhan FaizNo ratings yet

- Requirements On Car Loan FacilityDocument2 pagesRequirements On Car Loan FacilityKarl Kenneth FloresNo ratings yet

- Limited Liability PartnershipDocument12 pagesLimited Liability PartnershipananthkalviNo ratings yet

- Membership Application FormDocument5 pagesMembership Application FormTanvir Ahmed100% (2)

- MSME Loans Upto Rs.10 Crore - CHECK LISTDocument1 pageMSME Loans Upto Rs.10 Crore - CHECK LISTArunkumarNo ratings yet

- What Are The List of Documents Required For GST Registration?Document16 pagesWhat Are The List of Documents Required For GST Registration?Dhiraj Ranjan RayNo ratings yet

- UNIFEEDS TaxDocument64 pagesUNIFEEDS TaxRheneir MoraNo ratings yet

- Mudra Check List PDFDocument2 pagesMudra Check List PDFThabir Sai ChoudhuriNo ratings yet

- Documents Required RegistrationDocument8 pagesDocuments Required RegistrationFinance & Health ExpressNo ratings yet