Professional Documents

Culture Documents

Why Do We Study Money N Banking

Why Do We Study Money N Banking

Uploaded by

Niraj KaushikOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Why Do We Study Money N Banking

Why Do We Study Money N Banking

Uploaded by

Niraj KaushikCopyright:

Available Formats

8/29/09

Money-n-Banking.com

Why Do We Study Money and Banking?

Fall 2009

2009 by Michael McAteer

Money-n-Banking.com

What is Money and Banking? A means and method of allocating and reallocating resources The means is what we call Money The method is called Banking or the Financial System

Fall 2009 2009 by Michael McAteer 2

8/29/09

Money-n-Banking.com

What is Money, and Banking?

The Financial system

Financial Markets Financial intermediaries

The role of money in the economy

Fall 2009

2009 by Michael McAteer

Money-n-Banking.com

Why Study Financial Markets?

Financial Markets channel funds from savers to investors. A method of acquiring personal wealth, hence effecting the behavior of firms.

Fall 2009

2009 by Michael McAteer

8/29/09

Money-n-Banking.com

Financial Markets

A financial instrument (otherwise known as a security) is a claim on the issuers future income or assets A bond is a claim on future income A stock is a claim on assets

Fall 2009 2009 by Michael McAteer 5

Money-n-Banking.com

The Bond Market

A bond is a debt security that promises to make payments periodically for a specified period of time Interest is the cost of borrowing or the price paid for the rental of funds

Fall 2009

2009 by Michael McAteer

8/29/09

Money-n-Banking.com

20 18 16 14 12 10 8 6 4 2 0 Jan-55 Corporate Bonds BAA Three Month US Treasury Bills L/T US Gov't Debt

Jan-60

Jan-65

Jan-70

Jan-75

Jan-80

Jan-85

Jan-90

Jan-95

Jan-00

Jan-05

Source: Federal Reserve Statistical Release H.6

Fall 2009

2009 by Michael McAteer

Money-n-Banking.com

The Stock Market

Common stock represents a share of ownership in a corporation A share of stock is a claim on the earnings and assets of the corporation

Fall 2009

2009 by Michael McAteer

8/29/09

Money-n-Banking.com

16000 14000

12000

10000

8000

6000

4000

2000

Source: Federal Reserve Statistical Release H.6

Fall 2009

2009 by Michael McAteer

Money-n-Banking.com

The Foreign Exchange Market

Foreign Exchange Market - where funds are converted from one currency into another Foreign Exchange Rate - the price of one currency in terms of another currency The Foreign Exchange Rate is determined by the Foreign Exchange Market

Fall 2009

2009 by Michael McAteer

10

8/29/09

140 130 120 110 100 90 80 70 60 50 40 1973

Money-n-Banking.com

Dollar Index 1973 - 2009

1978

1983

1988

1993

1998

2003

2008

Source: Source: Federal Reserve Statistical Release H.6

Fall 2009

2009 by Michael McAteer

11

Money-n-Banking.com

Banking and Financial Institutions

Financial Intermediaries borrow funds from people who have saved and make loans to other people Banksinstitutions that accept deposits and make loans Other Financial Institutionsinsurance companies, finance companies, pension funds, mutual funds and investment banks Financial Innovationa primary reason why financial intermediaries exist

Fall 2009 2009 by Michael McAteer 12

8/29/09

Money-n-Banking.com

Money and Business Cycles

Evidence suggests that money plays an important role in generating business cycles Recessions (unemployment) and booms (inflation) affect all of us Monetary Theory ties changes in the money supply to changes in aggregate economic activity and the price level

Fall 2009 2009 by Michael McAteer 13

Money-n-Banking.com

Money and Inflation

The aggregate price level is the average price of goods and services in an economy A continual rise in the price level (inflation) affects all economic players Research shows a correlation between the money supply and the price level

Fall 2009 2009 by Michael McAteer 14

8/29/09

Money-n-Banking.com

100 90 80 70 60 50 40 30 20 10 0 0 10

US UK Chile Peru Russia

Money Growth

Belarus

Brazil Argentina Colombia Uruguay Mexico

Romania Venezuela

Inflation Rate

30 40 50 60 70 80 90 100

20

Inflation Rates and Money Growth in Selected Countries 1998-2008

Source: International Financial Statistics

Fall 2009

2009 by Michael McAteer

15

Money-n-Banking.com

Money and Interest Rates

Interest rates are the price of money In the past interest rates on long-term Govt Bonds and the Money Supply were correlated Since the 1980s, this is no longer the case

Fall 2009

2009 by Michael McAteer

16

8/29/09

Money-n-Banking.com

18.00 16.00 14.00 12.00 10.00 8.00 6.00 4.00 2.00 0.00 Jan-60 M2 Growth Rate (Annual) L/T Gov't Bond Interest Rates

Jan-65

Jan-70

Jan-75

Jan-80

Jan-85

Jan-90

Jan-95

Jan-00

Jan-05

Source: Federal Reserve Statistical Release H.6

Fall 2009

2009 by Michael McAteer

17

Money-n-Banking.com

Monetary and Fiscal Policy

Monetary policy is conducted by a countries Central Bank- in the US that is the Federal Reserve Fiscal policy is government spending and taxation

Budget deficits are excess spending by the government Any deficit must be financed by borrowing Budget surpluses are excess revenues collected by the government

Fall 2009 2009 by Michael McAteer 18

8/29/09

Percentage of GDP

3.0 2.0 1.0 0.0 -1.0 -2.0 -3.0 -4.0 -5.0 -6.0 -7.0 1950 1960

Money-n-Banking.com

Surplus

Deficit

1970 1980 1990 2000

U. S. Government Budget Deficit/Surplus as Percentage of GDP

Source:

Fall 2009

2009 by Michael McAteer

19

10

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- 2014 Y12 Chapter 5 - CDDocument22 pages2014 Y12 Chapter 5 - CDtechnowiz11No ratings yet

- Evolution of Exchange Rate Regime Impact On Macro Economy of BangladeshDocument37 pagesEvolution of Exchange Rate Regime Impact On Macro Economy of BangladeshAftab UddinNo ratings yet

- Concepts of Paper Money in Islamic Legal ThoughtDocument15 pagesConcepts of Paper Money in Islamic Legal ThoughtSyifa Rahmaliya0% (1)

- Wholesale Investor Edition 6Document40 pagesWholesale Investor Edition 6stevetorso100% (1)

- Newsbriefs 20110107Document3 pagesNewsbriefs 20110107Maien VitalNo ratings yet

- Economic Recovery Plan For MalawiDocument14 pagesEconomic Recovery Plan For MalawiJohn Richard KasalikaNo ratings yet

- Remittance and Its Economic Impacts On BangladeshDocument16 pagesRemittance and Its Economic Impacts On BangladeshM A Akad MasudNo ratings yet

- Impact of LPG PDFDocument12 pagesImpact of LPG PDFRavi Kiran JanaNo ratings yet

- (LAW) BLS LLB Sem-1 - Economics NotesDocument25 pages(LAW) BLS LLB Sem-1 - Economics NotesVinit P PatelNo ratings yet

- Getting To The Core: Budget AnalysisDocument37 pagesGetting To The Core: Budget AnalysisVishu KutaskarNo ratings yet

- Macro Economic Framework Statement 2010 11Document6 pagesMacro Economic Framework Statement 2010 11emmanuel JohnyNo ratings yet

- ArqamDocument10 pagesArqamwaleedthapetNo ratings yet

- Africam Group Presentation Uc BerkeleyDocument6 pagesAfricam Group Presentation Uc BerkeleyvargasjeffreyNo ratings yet

- CIMB Navigating Thailand 2015 Dec 2014 PDFDocument212 pagesCIMB Navigating Thailand 2015 Dec 2014 PDFBLBVORTEXNo ratings yet

- Business Environment NotesDocument48 pagesBusiness Environment NotesPriyanka Gharat AcharekarNo ratings yet

- Mrunal (Economic Survey Ch6) Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER PrintDocument14 pagesMrunal (Economic Survey Ch6) Balance of Payments, Forex Reserves, Currency Exchange, NEER, REER PrintAnil CletusNo ratings yet

- 09 External DebtDocument14 pages09 External DebtAmanullah Bashir GilalNo ratings yet

- Export-Led Growth in Laitn America 1870 To 1930Document18 pagesExport-Led Growth in Laitn America 1870 To 1930sgysmnNo ratings yet

- Forex Risk ManagementDocument114 pagesForex Risk ManagementNasir UddinNo ratings yet

- Analysis of Financial Statement Bank Alfalah ReportDocument14 pagesAnalysis of Financial Statement Bank Alfalah ReportIjaz Hussain BajwaNo ratings yet

- ECONOMICS-III Project On: Industrialisation and Its RoleDocument15 pagesECONOMICS-III Project On: Industrialisation and Its RoleDeepak Sharma100% (1)

- Balance of Payment AdjustmentDocument37 pagesBalance of Payment AdjustmentJash ShethiaNo ratings yet

- International LiquidityDocument4 pagesInternational LiquidityAshish TagadeNo ratings yet

- Ecn 230 Assignment Three - 1Document5 pagesEcn 230 Assignment Three - 1Nurul Fetty LyzzNo ratings yet

- Literature ReviewDocument4 pagesLiterature ReviewkictoddNo ratings yet

- Feinstein C.H. (Ed.) Banking, Currency, and Finance in Europe Between The Wars (OUP, 1995) (ISBN 0198288034) (O) (555s) - GH - PDFDocument555 pagesFeinstein C.H. (Ed.) Banking, Currency, and Finance in Europe Between The Wars (OUP, 1995) (ISBN 0198288034) (O) (555s) - GH - PDFIsmith PokhrelNo ratings yet

- In AIADMK's Manifesto, Jayalalithaa's National Ambitions, Freebies For AllDocument46 pagesIn AIADMK's Manifesto, Jayalalithaa's National Ambitions, Freebies For AllNDTVNo ratings yet

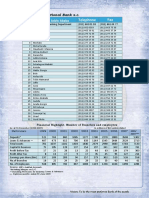

- No Telephone Fax: Branches in Addis AbabaDocument35 pagesNo Telephone Fax: Branches in Addis AbabaHay Jirenyaa100% (1)

- Full 2014 2015 PDFDocument282 pagesFull 2014 2015 PDFFarjana Hossain DharaNo ratings yet