Professional Documents

Culture Documents

Buy Profile

Buy Profile

Uploaded by

FuseFinancial Publications0 ratings0% found this document useful (0 votes)

16 views2 pagesProfile of FuseFinancial buyer interest level by asset class

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentProfile of FuseFinancial buyer interest level by asset class

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

16 views2 pagesBuy Profile

Buy Profile

Uploaded by

FuseFinancial PublicationsProfile of FuseFinancial buyer interest level by asset class

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 2

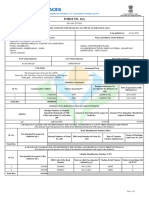

FUSEFINANCIAL

B UYE R P RO F I L E Contact Info

info@fusefinancial.com

General Interest Level by Asset Class www.fusefinancial.com

(800) 919-6974

Updated for Q2/09

While each buyer on the FuseFinancial platform has individual

preferences, the following buyer profile reflects a wide class of investors

looking for exceptional returns given the current financial market instability.

Transactions must meet a minimum investor acquisition cost of $10mm.

* Brokers - Fuse does not work with 3rd party brokers.

INTEREST LEVELS

Red = No Interest

Blue = Possible Interest with Specific Investors

Green = General Investor Interest

SECURITIES

U.S. Treasury securities

U.S. Government agency obligations (exclude mortgage-backed securities)

Securities issued by states and political subdivisions in the U.S.

Mortgage-backed securities (MBS):

1. Pass-through securities issued or guaranteed by FNMA, FHLMC, or GNMA.

2. Other mortgage-backed securities issued or guaranteed by FNMA, FHLMC,

or GNMA (include CMOs, REMICs, and stripped MBS)

LOANS

Loans secured by real estate:

1. Construction, land development, and other land loans

2. Secured by farmland (including farm residential and other improvements)

3. Secured by 1–4 family residential properties:

BUYER PROFILE 2

3.1. Revolving, open-end loans secured by 1–4 family residential properties and

extended under lines of credit

3.2. Closed-end loans secured by 1–4 family residential properties:

3.2.1. Secured by first liens

3.2.2. Secured by junior liens

3.2.3. Secured by multifamily (5 or more) residential properties

3.2.4. Secured by non-farm nonresidential properties

Commercial and Industrial loans

Loans to individuals for household, family, and other personal expenditures

(i.e., consumer loans, includes purchased paper):

1. Credit cards

2. Other revolving credit plans

3. Other consumer loans (includes single payment, installment and all student loans)

OTHER LOANS

Asset-backed securities:

1. Residential mortgage-backed securities

2. Commercial mortgage-backed securities

3. Credit card receivables

4. Home equity lines

5. Automobile loans

6. Other consumer loans

7. Commercial and industrial loans

8. Other

HARD ASSETS

1. Hotels and Restaurant properties

2. Office Buildings

3. Condominiums (All stages)

info@fusefinancial.com · (800) 919-6974

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5810)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Securitization Audit Report SampleDocument0 pagesSecuritization Audit Report SampleCFLA, IncNo ratings yet

- Ws Refe 20151016033538 Tsl2prod 109616Document285 pagesWs Refe 20151016033538 Tsl2prod 109616api-30756592050% (2)

- Consultant Finder's Fee Agreement SEADocument4 pagesConsultant Finder's Fee Agreement SEAShawn Aaron100% (1)

- Mcqs On ForexDocument43 pagesMcqs On ForexRam Iyer92% (12)

- Derivatives ProjectDocument109 pagesDerivatives Project47198666100% (4)

- Prime Bank LimitedDocument29 pagesPrime Bank LimitedShouravNo ratings yet

- Market Participants in Securities MarketDocument11 pagesMarket Participants in Securities MarketSandra PhilipNo ratings yet

- Reliance Power Limited - ProspectusDocument379 pagesReliance Power Limited - ProspectusSampath Kumar100% (2)

- Lecture Material of Chairman Emilio Aquino - RCC MCLE Lecture (Handout) 10.23.21Document127 pagesLecture Material of Chairman Emilio Aquino - RCC MCLE Lecture (Handout) 10.23.21Pia ChanNo ratings yet

- Testing The Weak Form Efficiency of VietDocument51 pagesTesting The Weak Form Efficiency of VietĐinh MinhNo ratings yet

- Payal DoDocument82 pagesPayal DoPayal PatelNo ratings yet

- ASEAN Capital Market Integration Issues and Challenges: Managing Director, Securities Commission of MalaysiaDocument13 pagesASEAN Capital Market Integration Issues and Challenges: Managing Director, Securities Commission of MalaysiaRizki HakimNo ratings yet

- Central University of South Bihar: School of Law & Governance Financial Market RegulationDocument22 pagesCentral University of South Bihar: School of Law & Governance Financial Market RegulationRajeev RajNo ratings yet

- Gamay Kag ItlogDocument11 pagesGamay Kag ItlogAlfie OmegaNo ratings yet

- Internship Report HoneyDocument82 pagesInternship Report HoneyAkshaya ilangoNo ratings yet

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToNanu PatelNo ratings yet

- Rediscovered Benjamin Graham - 1945 Lectures - Benjamin GrahamDocument48 pagesRediscovered Benjamin Graham - 1945 Lectures - Benjamin Grahamtatsrus1No ratings yet

- Sabero ValueDocument1 pageSabero ValuePrem KumarNo ratings yet

- Mea Assignment WordDocument23 pagesMea Assignment WordNabila Afrin RiyaNo ratings yet

- Sec-Ogc Opinion No. 10-18: First Associated Medical Distribution Co., IncDocument5 pagesSec-Ogc Opinion No. 10-18: First Associated Medical Distribution Co., IncShiela Hoylar-GasconNo ratings yet

- FAR 1 Reviewer AnswerDocument27 pagesFAR 1 Reviewer AnswerMary Joy CabilNo ratings yet

- Tata Motors LTD - Axis Alpha - BUY - 05102020 (1) - 05-10-2020 - 09Document5 pagesTata Motors LTD - Axis Alpha - BUY - 05102020 (1) - 05-10-2020 - 09Rohit BhangaleNo ratings yet

- Perez Valdovinos Karla Vianey M2T1Document27 pagesPerez Valdovinos Karla Vianey M2T1KarlyValdovinosNo ratings yet

- The Current Hurdle of CryptocurrenciesDocument2 pagesThe Current Hurdle of CryptocurrenciesGabrielAblolaNo ratings yet

- Microsoft SBC - English PDFDocument31 pagesMicrosoft SBC - English PDFAfif Al FattahNo ratings yet

- Bill Gross Investment Outlook Dec - 01Document5 pagesBill Gross Investment Outlook Dec - 01Brian McMorrisNo ratings yet

- PR 1Document16 pagesPR 1Faixan HashmeeNo ratings yet

- Mutual Fund Research PaperDocument22 pagesMutual Fund Research Paperphani100% (1)

- 18.functions of Commercial BanksDocument15 pages18.functions of Commercial BanksPraneeth KumarNo ratings yet

- Chapter 1 Fin 2200Document7 pagesChapter 1 Fin 2200cheeseNo ratings yet