Professional Documents

Culture Documents

Tds Rates Chart A

Tds Rates Chart A

Uploaded by

Vivek ChawlaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tds Rates Chart A

Tds Rates Chart A

Uploaded by

Vivek ChawlaCopyright:

Available Formats

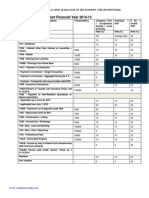

TDS Rates Chart A.Y. 2012-13/F.Y.

2011-12 [updated: June 2011]

With effect from 1-4-2010, the deductee shall furnish his PAN (Permanent Account Number) to deductor, failing which tax at the below rates of TDS or at the rate of 20% whichever is higher shall be deducted at source. Where PAN provided to the deductor is invalid or does not belong to the deductee, it shall be deemed that deductee has not furnish his PAN to the deductor and higher rate of TDS as mentioned below shall be applicable. No surcharge, education cess and secondary and higher education cess is leviable for the financial year 2010-11 onwards for TDS purposes in case of payment to resident. But in respect of TDS on salary, cess will be leviable.

TDS Rates Chart assessment year 2012-13 or financial year 2011-12 (ay 12-13 / FY 11-12)

Relevant Nature of Payment (to resident) Threshold Individual HUF Section Limit (Resident in India)

Company Firm/Coop Sec. Local Authority (Domestic Company)

192

Payment of salary resident/non-resident

to

193 194 194A 194B

194BB 194C 194D 194EE 194F

194G 194H 194-I

Interest on securities Deemed dividends u/s 2(22)(e) Interest other than Interest on 5000 securities Lottery or crossword puzzleor 10000 card game or other game of any sort. Horse races 5000 Contracts/sub-contracts 30000 Insurance Commission 20000 Payment in respect of deposits 2500 under NSS Payment on account of 1000 repurchase of units of MF or UTI Commission on sale of lottery 1000 tickets Commission or brokerage 5000 Rent of Plant and Machinery 180000

Normal Income Tax Rates: See Income Tax Slab 10 10 10 10 10 10 30 30

30 1 10 20 20

30 2 10 10

10 10 2

10 10 2

194J 194LA

Rent of Land or Building or 180000 Furniture and Fitting Fees for professional or 30000 technical services Payment of compensation to a 100000 resident on acquisition of certain immovable property

10 10 10

10 10 10

Notes: we.f. 1.10.2009, no TDS is to be deducted on payment to a contractor/sub-contractor, during the course of business of plying, hiring or leasing goods carriages, if the payee furnishes his PAN to the deductor [sec. 194C(6)]

You might also like

- Tax Deduction at SourceDocument62 pagesTax Deduction at SourcePallavisweet100% (1)

- Form 1600Document4 pagesForm 1600KialicBetito50% (2)

- Tds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #SimpletaxindiaDocument11 pagesTds Rate Chart Fy 2014-15 Ay 2015-16 Tds Due Dates #Simpletaxindiashivashankari86No ratings yet

- Hand BookDocument82 pagesHand Booknmshamim7750No ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceChaitany Joshi0% (2)

- Sl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersDocument4 pagesSl. No. Section Nature of Payment Cut Off Rate %: Huf/Ind OthersLisa StewartNo ratings yet

- Tds Rate Chart Fy 2014-15 Ay 2015-16Document26 pagesTds Rate Chart Fy 2014-15 Ay 2015-16shivashankari86No ratings yet

- TDS Rate Financial Year 13-14Document10 pagesTDS Rate Financial Year 13-14Heena AgreNo ratings yet

- With Holding Tax RatesDocument3 pagesWith Holding Tax Ratesvenkat6299No ratings yet

- Introduction To TDS:-: Tax Deducted at SourceDocument3 pagesIntroduction To TDS:-: Tax Deducted at Sourcepadmanabha14No ratings yet

- TDS Chart FY 2010-11 & FY 2011-12Document1 pageTDS Chart FY 2010-11 & FY 2011-12R.Gowri Sankar RajaNo ratings yet

- TDS Rate Chart PDFDocument2 pagesTDS Rate Chart PDFjdhamdeep07No ratings yet

- RMC 72-2004 Issues On Withholding RatesDocument9 pagesRMC 72-2004 Issues On Withholding RatesEva HubadNo ratings yet

- Question Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneDocument5 pagesQuestion Bank: Errorless Taxation by Ca Pranav Chandak at Pranav Chandak Academy, PuneSimran MeherNo ratings yet

- TDS Rate Chart Financial Year 2012-13Document3 pagesTDS Rate Chart Financial Year 2012-13jeet2211No ratings yet

- Payment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumDocument1 pagePayment in Excess of Rs. 1,20,000/-Per Annum Payment in Excess of Rs. 1,20,000/ - Per AnnumMadhan RajNo ratings yet

- Tax Deducted at SourceDocument29 pagesTax Deducted at SourceAmbar Pratik MishraNo ratings yet

- Revised TDS Rate Chart (FY 2009-10)Document1 pageRevised TDS Rate Chart (FY 2009-10)haldharkNo ratings yet

- Tax Deduction at SourceDocument5 pagesTax Deduction at SourceSarayu BhardwajNo ratings yet

- 1601e Form PDFDocument3 pages1601e Form PDFLee GhaiaNo ratings yet

- TDS On SalariesDocument3 pagesTDS On SalariesSpUnky RohitNo ratings yet

- Tax PlanningDocument6 pagesTax PlanningprasadNo ratings yet

- RMC 72-2004 PDFDocument9 pagesRMC 72-2004 PDFBobby LockNo ratings yet

- Intro of TdsDocument6 pagesIntro of Tdsshivani singhNo ratings yet

- Tax Deducted at Source (TDS)Document7 pagesTax Deducted at Source (TDS)Rupali SinghNo ratings yet

- RMC 72-04Document9 pagesRMC 72-04ai0412No ratings yet

- Lecture Witholding TaxDocument152 pagesLecture Witholding Taxemytherese100% (2)

- For Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Document6 pagesFor Assessment Year - 2011 - 12 TDS Rates Chart Rates of TDS For Major Nature of Payments For The Financial Year 2010-11Savoir PenNo ratings yet

- Tax Deducted at Source UnitDocument13 pagesTax Deducted at Source Unitsatyanarayan dashNo ratings yet

- TDS 3Document16 pagesTDS 3payal AgrawalNo ratings yet

- Income Tax in IndiaDocument19 pagesIncome Tax in IndiaConcepts TreeNo ratings yet

- TDS Rates and ReturnsDocument3 pagesTDS Rates and ReturnsKashishKumarNo ratings yet

- Tax Deduction at SourceDocument4 pagesTax Deduction at SourcevishalsidankarNo ratings yet

- 2551QDocument3 pages2551QnelsonNo ratings yet

- Changes in TDS Limits - F Y 2010-11Document1 pageChanges in TDS Limits - F Y 2010-11Ronak RanaNo ratings yet

- TDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14Document2 pagesTDS/TCS Rates Chart For A.Y. 2014-15 or F.Y. 2013-14CaCs Piyush SarupriaNo ratings yet

- Tax Guide - 2011: Kantilal Patel & CoDocument0 pagesTax Guide - 2011: Kantilal Patel & Coanpuselvi125No ratings yet

- Digitally Sign and Email Form 16/form 16ADocument1 pageDigitally Sign and Email Form 16/form 16Aparminder211985No ratings yet

- CH - 4 Public Finace@2015 Part 1Document32 pagesCH - 4 Public Finace@2015 Part 1firaolmosisabonkeNo ratings yet

- Food Corporation of India - 41202411354277Document9 pagesFood Corporation of India - 41202411354277abhimanyu7004No ratings yet

- Bir 0605Document11 pagesBir 0605Sheelah Sawi0% (1)

- All About Tax Deducted at Source (TDS) - Taxguru - inDocument11 pagesAll About Tax Deducted at Source (TDS) - Taxguru - inwaqtkeebaatein12No ratings yet

- Bhubaneswar 08112015 Session I PDFDocument42 pagesBhubaneswar 08112015 Session I PDFsachin NegiNo ratings yet

- TDS Rates and ReturnsDocument4 pagesTDS Rates and ReturnsMohanlal BishnoiNo ratings yet

- Tax Deduct at SourceDocument4 pagesTax Deduct at Sourceankit1070No ratings yet

- Tds (Tax Deduction at Source) Presented byDocument17 pagesTds (Tax Deduction at Source) Presented byPooja JaiswalNo ratings yet

- Tax Deduction at Source (TDS)Document15 pagesTax Deduction at Source (TDS)dinesh8maharjanNo ratings yet

- Adv Tax, TDS, TCS, Return Filing, Total Income - SolutionDocument8 pagesAdv Tax, TDS, TCS, Return Filing, Total Income - SolutionBharatbhusan RoutNo ratings yet

- Current Changes of TDS: Presented By, Ghanshyam WatekarDocument10 pagesCurrent Changes of TDS: Presented By, Ghanshyam Watekarpraful_watekarNo ratings yet

- TDS Rate ChartDocument2 pagesTDS Rate Chartshashi370No ratings yet

- BIR Form 1600Document39 pagesBIR Form 1600maeshach60% (5)

- Sl. No Section of Act Nature of Payment in Brief Threshold Limit Rate %Document8 pagesSl. No Section of Act Nature of Payment in Brief Threshold Limit Rate %amit2201No ratings yet

- What Is TDS?: Tax Deducted at Source (TDS)Document8 pagesWhat Is TDS?: Tax Deducted at Source (TDS)Sandeep RajpootNo ratings yet

- Individual Heads of IncomeDocument5 pagesIndividual Heads of Incomeamitratha77No ratings yet

- Creditable Tax ReportDocument131 pagesCreditable Tax ReportJieve Licca G. FanoNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- 1040 Exam Prep Module III: Items Excluded from Gross IncomeFrom Everand1040 Exam Prep Module III: Items Excluded from Gross IncomeRating: 1 out of 5 stars1/5 (1)