Professional Documents

Culture Documents

Affidavit of Cosimo Borrelli - China Medical

Uploaded by

kerrcap0 ratings0% found this document useful (0 votes)

789 views8 pagesBondholders have proposed Cosimo Borrelli as one of the liquidators to lead the liquidation of China Medical Technologies.

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentBondholders have proposed Cosimo Borrelli as one of the liquidators to lead the liquidation of China Medical Technologies.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

789 views8 pagesAffidavit of Cosimo Borrelli - China Medical

Uploaded by

kerrcapBondholders have proposed Cosimo Borrelli as one of the liquidators to lead the liquidation of China Medical Technologies.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 8

You might also like

- Elec 4 BlackDocument1 pageElec 4 Blackyudo08No ratings yet

- Charles D Ghilani - Paul R Wolf - Elementary Surveying - An Introduction To Geomatics-Pearson Prentice Hall (2012) - ExtractoDocument19 pagesCharles D Ghilani - Paul R Wolf - Elementary Surveying - An Introduction To Geomatics-Pearson Prentice Hall (2012) - ExtractoRodrigo DelBarrioNo ratings yet

- All Art Is Propaganda PDFDocument2,708 pagesAll Art Is Propaganda PDFPau_Brand_25500% (2)

- What A Wonderful World Eb - Bass Trombone PDFDocument1 pageWhat A Wonderful World Eb - Bass Trombone PDFJose HerreroNo ratings yet

- 2020Document14 pages2020mintrikpalougoudjoNo ratings yet

- Cicuta Tibia - TubaDocument2 pagesCicuta Tibia - TubaYohan Octavio Vera DelgadoNo ratings yet

- If I Were Born Here Volume II (Greece, India, Kenya, Mexico, Israel)From EverandIf I Were Born Here Volume II (Greece, India, Kenya, Mexico, Israel)No ratings yet

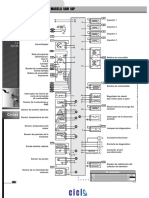

- GM Inyección Electrónica S10 Blazer 2.2 Efi Delphi Multec emDocument2 pagesGM Inyección Electrónica S10 Blazer 2.2 Efi Delphi Multec emyayixdfuego131No ratings yet

- Escort 18 16 ZetecDocument2 pagesEscort 18 16 ZetecOsvaldo LópezNo ratings yet

- Flow Design Formulas For Calculation - Exported From (HTM - 02 - 01 - Part - A)Document8 pagesFlow Design Formulas For Calculation - Exported From (HTM - 02 - 01 - Part - A)wesam allabadi50% (2)

- GM Relés y Fusibles Corsa PDFDocument1 pageGM Relés y Fusibles Corsa PDFcorylinNo ratings yet

- Lagenda Violin PDFDocument2 pagesLagenda Violin PDFMarvin Jong0% (1)

- El Pastor - VihuelaDocument1 pageEl Pastor - VihuelaDamian Guardia SalazarNo ratings yet

- Mix Trompeta ChilombianoDocument1 pageMix Trompeta ChilombianoDenise AlvaradoNo ratings yet

- 09 - Chapter 1Document20 pages09 - Chapter 1Dr. POONAM KAUSHALNo ratings yet

- Business Startup Guides-Preparing Yourself Ver 2Document4 pagesBusiness Startup Guides-Preparing Yourself Ver 2Minh Huỳnh100% (1)

- UTS ELT MDE S1 Coursebook Evaluation ChecklistDocument3 pagesUTS ELT MDE S1 Coursebook Evaluation ChecklistHanin Khalishah WaqqasNo ratings yet

- 388 1006 1 PBDocument20 pages388 1006 1 PBGabriel Evangelista dos SantosNo ratings yet

- Music To Watch Girls by MJDocument3 pagesMusic To Watch Girls by MJMarvin JongNo ratings yet

- 5Document2 pages5Abel Salazar PianoNo ratings yet

- Enfermeiro Ebsrh 2015Document10 pagesEnfermeiro Ebsrh 2015Neila Reis da SilvaNo ratings yet

- Fiat CoupeDocument1 pageFiat CoupeJulio FaninNo ratings yet

- Indian Express 19 AugustDocument20 pagesIndian Express 19 AugustTension Dene kaNo ratings yet

- 6periostitisDocument10 pages6periostitisAntonioNo ratings yet

- Xsara 18 - Berlingo 18 - 18 Xu7jb PDFDocument2 pagesXsara 18 - Berlingo 18 - 18 Xu7jb PDFJorge Daniel DiazNo ratings yet

- Aural RitmoDocument1 pageAural RitmofabioNo ratings yet

- Renault Inyección Electrónica Clio 1.4 Ac Delco Monopoint P PDFDocument2 pagesRenault Inyección Electrónica Clio 1.4 Ac Delco Monopoint P PDFGood CarNo ratings yet

- 113-SEW Brake DetailsDocument10 pages113-SEW Brake DetailsTarak Nath RakshitNo ratings yet

- Los Mareados Arreglo Hernan PossettiDocument2 pagesLos Mareados Arreglo Hernan PossettiteomondejarmusicaNo ratings yet

- Mix Serpiente - BandaDocument53 pagesMix Serpiente - BandaJohn Carlos Vilca VelizNo ratings yet

- Ibfc 142 Engenheiro MecanicoDocument16 pagesIbfc 142 Engenheiro MecanicoJosé Maria junior100% (2)

- Trompeta 2Document2 pagesTrompeta 2Mauricio TorresNo ratings yet

- 5756867Document1,027 pages5756867Sách Việt Nam50% (2)

- Building ActDocument136 pagesBuilding ActVeronika RaušováNo ratings yet

- Calculus Cheat Sheet DerivativesDocument4 pagesCalculus Cheat Sheet DerivativesRajatNo ratings yet

- Extracto Destinos-Elementos-para-la-gestión-de-destinos-turisticosDocument76 pagesExtracto Destinos-Elementos-para-la-gestión-de-destinos-turisticosEnzo Navarrete UlloaNo ratings yet

- Strong Enough - DrumsDocument2 pagesStrong Enough - DrumsКолянсур ИвановNo ratings yet

- PDF Parts Catalog Tvs Rockz - CompressDocument104 pagesPDF Parts Catalog Tvs Rockz - CompressaspareteNo ratings yet

- Greenwashing Nas EmpresasDocument37 pagesGreenwashing Nas EmpresasLara GagoNo ratings yet

- All The Things You AreDocument1 pageAll The Things You ArePeppe LiottaNo ratings yet

- Trompeta 1Document2 pagesTrompeta 1Mauricio TorresNo ratings yet

- ElvisDocument1 pageElvismaui3No ratings yet

- Como Quien Pierde Una Estrella VozDocument2 pagesComo Quien Pierde Una Estrella VozGerardo100% (2)

- Hecho Del PíncipeDocument11 pagesHecho Del PíncipeEdisson MoralesNo ratings yet

- 01 - Lista de Parametros SimplificadaDocument8 pages01 - Lista de Parametros SimplificadaLuis Felipe VidigalNo ratings yet

- Taita Salasaca - Conga Drums 2Document2 pagesTaita Salasaca - Conga Drums 2Carlos XavierNo ratings yet

- Planes APIDocument10 pagesPlanes APIManuel FigueroaNo ratings yet

- Tema 6. CULTURADocument7 pagesTema 6. CULTURAMarinaNo ratings yet

- Excercise in FDocument2 pagesExcercise in FPaz Villahoz100% (2)

- Renault Inyección Electrónica Kangoo RL-RN 1.6 1999 Siemens Sirius 32b PDFDocument2 pagesRenault Inyección Electrónica Kangoo RL-RN 1.6 1999 Siemens Sirius 32b PDFOsvaldo LópezNo ratings yet

- Tu Me Gustas Trompeta 1Document2 pagesTu Me Gustas Trompeta 1JonathanNo ratings yet

- Detail (1-1) To R.C. Strip Footing (Sf1) : A B E F H J KDocument1 pageDetail (1-1) To R.C. Strip Footing (Sf1) : A B E F H J KThomas Garcia0% (1)

- Paradise Violín IIDocument2 pagesParadise Violín IIJavier Rubio PérezNo ratings yet

- 101 Problems in AlgebraDocument160 pages101 Problems in AlgebraTrishaii Cuaresma96% (28)