Professional Documents

Culture Documents

Security Analysis & Portfolio Management Assignment Risk & Return Submitted To: Sir Adnan Akhtar Submitted By: Jibran Khalil 10-ARID-1395 MBA 4th

Security Analysis & Portfolio Management Assignment Risk & Return Submitted To: Sir Adnan Akhtar Submitted By: Jibran Khalil 10-ARID-1395 MBA 4th

Uploaded by

Jibran MalikOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Security Analysis & Portfolio Management Assignment Risk & Return Submitted To: Sir Adnan Akhtar Submitted By: Jibran Khalil 10-ARID-1395 MBA 4th

Security Analysis & Portfolio Management Assignment Risk & Return Submitted To: Sir Adnan Akhtar Submitted By: Jibran Khalil 10-ARID-1395 MBA 4th

Uploaded by

Jibran MalikCopyright:

Available Formats

Security Analysis & Portfolio Management

Assignment

Risk & Return

Submitted To:

Sir Adnan Akhtar

Submitted By:

JIBRAN KHALIL

10-ARID-1395

MBA 4th

Date

Dec-09

Jan-10

Feb-10

Mar-10

Apr-10

May-10

Jun-10

Jul-10

Aug-10

Sep-10

Oct-10

Nov-10

Dec-10

Jan-11

Feb-11

Mar-11

Apr-11

May-11

Jun-11

Jul-11

Aug-11

Sep-11

Oct-11

Nov-11

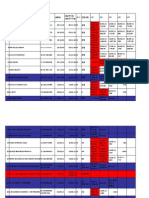

PAKISTAN ENGINEERING CO LIMITED (ENGINEERING SECTOR)

closing HPR

HPY= Rs(Rs - Rs)

(Rs - Rs)2

300

302.99

302.94

310

305

300

299.99

300

299.99

310

291.48

280.43

249.99

150

136.38

104.54

104

90

90

50.79

46.02

41.5

40.4

36.95

1.009967

0.999835

1.023305

0.983871

0.983607

0.999967

1.000033

0.999967

1.033368

0.940258

0.96209

0.891452

0.600024

0.9092

0.766535

0.994835

0.865385

1

0.564333

0.906084

0.901782

0.973494

0.914604

0.996667

-0.0165

2.330494

-1.6129

-1.63934

-0.00333

0.003333

-0.00333

3.336778

-5.97419

-3.791

-10.8548

-39.9976

-9.08

-23.3465

-0.51655

-13.4615

0

-43.5667

-9.39161

-9.82182

-2.6506

-8.5396

8.504946667

7.491777805

9.838774487

5.895376774

5.868935738

7.504946667

7.511613444

7.504946667

10.84505789

1.534086452

3.717282333

-3.34647876

-32.4893199

-1.57172

-15.8382517

6.991731311

-5.95325846

7.50828

-36.0583867

-1.88333252

-2.3135366

4.85767759

-1.03132396

72.3341178

56.1267347

96.8014834

34.7554673

34.4444067

56.3242245

56.4243365

56.3242245

117.615281

2.35342124

13.8181879

11.1989201

1055.55591

2.47030376

250.850218

48.8843067

35.4412863

56.3742686

1300.20725

3.54694139

5.35245161

23.5970316

1.06362911

35.99 0.974019

Dec-11

SUM

AM=

-2.59811 4.910174452 24.1098131

-180.199

Rs

-7.50828

s2=

142.3323

s=

3415.9742

11.93%

Cov(Rs,Rm)=

s=

s2=

3.212195

Cov(Rs,Rm)/m2

0.11957

0.014297

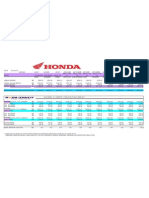

Analysis:

Rs=

-7.50828

s=

Rm=

m=

11.93%

0.93%

5.18%

e=

s=

Bm =

11.91%

0.11957

1

Risk of security(11.93%) contain 11.91% of unsystematic r

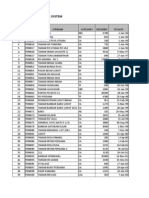

KSE 100 Index

Closing

9,386.92

9,614.19

9,657.79

10,178.43

10,428.12

9,326.42

9,721.91

10,519.02

9,813.05

10,013.31

10,598.40

11,234.76

12,022.46

12,359.36

11,289.22

11,809.54

12,057.54

12,123.15

12,496.03

12,190.37

11,070.58

11,761.97

11,868.88

11,532.83

HPR

HPY=Rm (Rm-Rm) (Rm-Rm)2

2.421135

0.453496

5.390881

2.453129

-10.5647

4.240534

8.199109

-6.711367

2.040752

5.843123

6.004303

7.011276

2.802255

-8.658539

4.608999

2.099997

0.544141

3.075768

-2.446057

-9.185857

6.245292

0.908946

-2.831354

1.490315

-0.477324

4.460061

1.522309

-11.49552

3.309714

7.268289

-7.642187

1.109932

4.912303

5.073483

6.080456

1.871435

-9.589359

3.678179

1.169177

-0.386679

2.144948

-3.376877

-10.11668

5.314472

-0.021874

-3.762174

1.024211

1.004535

1.053909

1.024531

0.894353

1.042405

1.081991

0.932886

1.020408

1.058431

1.060043

1.070113

1.028023

0.913415

1.04609

1.021

1.005441

1.030758

0.975539

0.908141

1.062453

1.009089

0.971686

(Rs - Rs) (Rm

-Rm)

2.221039

0.227838

19.89215

2.317424

132.1471

10.95421

52.82803

58.40302

1.231949

24.13072

25.74023

36.97194

3.502269

91.95581

13.529

1.366975

0.149521

4.600803

11.4033

102.3472

28.24361

0.000478

14.15395

12.67504909

-3.576002784

43.88153783

8.974584075

-67.46649102

24.83922616

54.59657754

-57.35420321

12.03727523

7.535897177

18.859567

-20.34811594

-60.80165405

15.07178725

-58.2559198

8.174572284

2.302000953

16.10487213

121.7647318

19.05306749

-12.29522451

-0.106255016

3.880020114

11,347.66 0.983944

-1.60559

-2.53641 6.433377

-12.45421706

22.3397

644.752

77.09268276

Rm=

0.930819

m2=

26.86466

m=

5.18%

Unsystematic Risk=

s2=

m22+e2

e2=

s2-m22

141.9482

e=

11.91%

11.91% of unsystematic risk. As the unsystematic risk is high so the investor will not invest in this security.

You might also like

- 통합파일Document157 pages통합파일batman1234No ratings yet

- Cashflow Sapi PotongDocument3 pagesCashflow Sapi PotongWidibae Jokothole100% (2)

- PennyDocument3 pagesPennystevenglobalNo ratings yet

- Master MISDocument464 pagesMaster MISnitin0606No ratings yet

- Files Status: 20-Jul 20-Jul 19-JulDocument11 pagesFiles Status: 20-Jul 20-Jul 19-JulabzaccaNo ratings yet

- Imperial Chemical Industries: Beta 1.15Document7 pagesImperial Chemical Industries: Beta 1.15Anis Ur Rehman KakakhelNo ratings yet

- Penny 1Document4 pagesPenny 1stevenglobalNo ratings yet

- Grease Removal System (JBIC Sunggala)Document23 pagesGrease Removal System (JBIC Sunggala)Saravanan RasayaNo ratings yet

- ArushaDocument813 pagesArushaankitch123100% (1)

- 91 25 Generated Nscp2015 Footing-Service 1 10.246 1262.267 - 14.245 - 15.368Document2 pages91 25 Generated Nscp2015 Footing-Service 1 10.246 1262.267 - 14.245 - 15.368John Carlo AmodiaNo ratings yet

- 37P Running PartsDocument4 pages37P Running PartsSachin BanwalaNo ratings yet

- Client-Sri Anand Kumar Purwar: Date Kinds OF Securit Y M.Rate Rate Qty. Value Dateo F Sale M.Rate Rate ValueDocument1 pageClient-Sri Anand Kumar Purwar: Date Kinds OF Securit Y M.Rate Rate Qty. Value Dateo F Sale M.Rate Rate ValueManKapNo ratings yet

- Onshore Histogram (Revised Latest 1) 0856 20130522Document1 pageOnshore Histogram (Revised Latest 1) 0856 20130522Abhiyan Anala ArvindNo ratings yet

- 13 Exel Solve FormulaDocument6 pages13 Exel Solve FormulaKunwar Muhammad HassanNo ratings yet

- Daily Agri Tech Report, August 10 2013Document2 pagesDaily Agri Tech Report, August 10 2013Angel BrokingNo ratings yet

- Go Ahead For F&O Report 09 April 2013 Mansukh Investment and Trading SolutionDocument5 pagesGo Ahead For F&O Report 09 April 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Lehi 10-24 Foh SchedDocument1 pageLehi 10-24 Foh SchedDerek ANo ratings yet

- Go Ahead For F&O Report 03 October 2011-Mansukh Investment and Trading SolutionDocument6 pagesGo Ahead For F&O Report 03 October 2011-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Budget Vs TGTDocument8 pagesBudget Vs TGTSarah DeanNo ratings yet

- 2010 Masterformat Sample JobCost Codes + NotesDocument11 pages2010 Masterformat Sample JobCost Codes + NotesYay B. GicoNo ratings yet

- Top 10 Cement Company of IndiaDocument2 pagesTop 10 Cement Company of IndiaAnshulSinghNo ratings yet

- List of Employees NPF Security Services: S.No Name DesignationDocument58 pagesList of Employees NPF Security Services: S.No Name Designationrizwanrahat7023No ratings yet

- Cement Consumption Details From19-09-2014 Date Opening Balance Receipt After Receipt Balance Consumption Detail Quntity Rate UnitDocument68 pagesCement Consumption Details From19-09-2014 Date Opening Balance Receipt After Receipt Balance Consumption Detail Quntity Rate UnitjalkunjNo ratings yet

- Summary of Excavated Soil Sample Results Dated 27.10.13Document4 pagesSummary of Excavated Soil Sample Results Dated 27.10.13Utpal MondalNo ratings yet

- F&O Report 07 August 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 07 August 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- IR Bore Grinding SHD 0536 Channel T-6Document15 pagesIR Bore Grinding SHD 0536 Channel T-6Tanpreet SinghNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Go Ahead For F&O Report 02 November 2011-Mansukh Investment and Trading SolutionDocument6 pagesGo Ahead For F&O Report 02 November 2011-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Go Ahead For F&O Report 10 May 2013 Mansukh Investment and Trading SolutionDocument5 pagesGo Ahead For F&O Report 10 May 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Pakistan Stock Exchange: National Clearing Company of Pakistan Limited (NCCPL)Document1 pagePakistan Stock Exchange: National Clearing Company of Pakistan Limited (NCCPL)thumbuNo ratings yet

- Address OverseasDocument88 pagesAddress Overseasvishal_vajat100% (1)

- Galian DrainaseDocument30 pagesGalian DrainaseArief AszharriNo ratings yet

- F&O Report 27 August 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 27 August 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 26 August 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 26 August 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Unofficial: Institute of Business Management (Iobm) Sections Available (Fall 2012)Document8 pagesUnofficial: Institute of Business Management (Iobm) Sections Available (Fall 2012)azharispk2004No ratings yet

- Ticker Full Name .Nsebank .Cnxit .Nsmid50 .NseiDocument6 pagesTicker Full Name .Nsebank .Cnxit .Nsmid50 .NseiWolfe Wave IndiaNo ratings yet

- Rent Given Balance Rent Given Balance Rent Names SR June July AugustDocument6 pagesRent Given Balance Rent Given Balance Rent Names SR June July Augustfaizijust4uNo ratings yet

- Ex 1b - Study of DMLDocument9 pagesEx 1b - Study of DMLMs.Thenmozhi IT DepartmentNo ratings yet

- Jadwal OJT Program Forum SharingDocument2 pagesJadwal OJT Program Forum SharingBudi SulaimanNo ratings yet

- F&O Report 28 August 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 28 August 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Looser and GainersDocument3 pagesLooser and GainersVivek PatelNo ratings yet

- Go Ahead For F&O Report 29 May 2013 Mansukh Investment and Trading SolutionDocument5 pagesGo Ahead For F&O Report 29 May 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 27 December 2011-Mansukh Investment and Trading SolutionDocument6 pagesF&O Report 27 December 2011-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- MRF NBP 25-04-2012Document14 pagesMRF NBP 25-04-2012AanchalMehraNo ratings yet

- Gurgaon Daily Flash Report 16th MayDocument1 pageGurgaon Daily Flash Report 16th MayMadhur DahiyaNo ratings yet

- Go Ahead For F&O Report 14 May 2013 Mansukh Investment and Trading SolutionDocument5 pagesGo Ahead For F&O Report 14 May 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Go Ahead For F&O Report 14 February 2013 Mansukh Investment and Trading SolutionDocument5 pagesGo Ahead For F&O Report 14 February 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Harga Adalah Tertakluk Kepada Harga Semasa Dan Sebarang Perubahan Harga Adalah Tanpa NotisDocument1 pageHarga Adalah Tertakluk Kepada Harga Semasa Dan Sebarang Perubahan Harga Adalah Tanpa NotisMohamad Hisham Bin RosleeNo ratings yet

- Parts Catalog: Imagerunner1750/1740/ 1730 SeriesDocument90 pagesParts Catalog: Imagerunner1750/1740/ 1730 SeriescollionsNo ratings yet

- Lehi 10-17 Foh Sched XLS-1Document1 pageLehi 10-17 Foh Sched XLS-1Derek ANo ratings yet

- Icf Directory PDFDocument104 pagesIcf Directory PDFeotp1No ratings yet

- Asia Motorworks LTD.: Environment, Health & Safety Management ProgramDocument1 pageAsia Motorworks LTD.: Environment, Health & Safety Management ProgramvirenahirNo ratings yet

- Coding ContestDocument82 pagesCoding ContestPunitGujrathiNo ratings yet

- Rebgv Area Charts - 2014-12 Vancouverwest Graphs-Listed Sold DollarvolumeDocument2 pagesRebgv Area Charts - 2014-12 Vancouverwest Graphs-Listed Sold DollarvolumeMaggie ChandlerNo ratings yet

- Manil West 1sept13 DoenDocument310 pagesManil West 1sept13 DoenRumelaSamantaDattaNo ratings yet

- Siesta Logistics (HK) Limited - Rate Sheet - 2012-10-04Document124 pagesSiesta Logistics (HK) Limited - Rate Sheet - 2012-10-04SIESTA LOGISTICS (HK) LIMITEDNo ratings yet