Professional Documents

Culture Documents

The Chairmen / Chief Executives of All Scheduled Banks (Excluding Rrbs and Labs) and All-India Term Lending and Refinancing Institutions

The Chairmen / Chief Executives of All Scheduled Banks (Excluding Rrbs and Labs) and All-India Term Lending and Refinancing Institutions

Uploaded by

Rohit NandanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Chairmen / Chief Executives of All Scheduled Banks (Excluding Rrbs and Labs) and All-India Term Lending and Refinancing Institutions

The Chairmen / Chief Executives of All Scheduled Banks (Excluding Rrbs and Labs) and All-India Term Lending and Refinancing Institutions

Uploaded by

Rohit NandanCopyright:

Available Formats

RBI/ 2011-12/90 IDMD.PCD.5 /14.01.

03/2011-12 July 1, 2011

The Chairmen / Chief Executives of All Scheduled Banks (excluding RRBs and LABs) and All-India Term Lending and Refinancing Institutions Dear Sir/Madam,

Master Circular - Guidelines for Issue of Certificates of Deposit With a view to further widening the range of money market instruments and giving investors greater flexibility in deployment of their short-term surplus funds, Certificates of Deposit (CDs) were introduced in India in 1989. Guidelines for issue of CDs are presently governed by various directives issued by the Reserve Bank of India, as amended from time to time. 2. A Master Circular incorporating all the existing guidelines / instructions / directives on the subject has been prepared for reference of the market participants and others concerned. It may be noted that this Master Circular consolidates and updates all the instructions / guidelines contained in the circulars listed in the Appendix as far as they relate to guidelines for issue of CDs. This Master Circular has also been placed on RBI website at http://www.mastercirculars.rbi.org.in

Yours faithfully,

(K. K. Vohra) Chief General Manager

Encl.: As above

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

Table of Content Sl. No. 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 Introduction Eligibility Aggregate Amount Minimum Size of Issue and Denominations Investors Maturity Discount/Coupon Rate Reserve Requirements Transferability Trades in CDs Loans / Buy-backs Format of CDs Security Aspect Payment of Certificate Issue of Duplicate Certificates Accounting Standardised Market Practices and Documentation Reporting Annexes I. Format of CDs II. Reporting Format III. Definitions Appendix: List of Circulars Consolidated 7 8 9 10 Topic Page No. 2 2 2 2 2 3 3 3 3 3 3 4 4 4 5 5 5 6

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

1. Introduction Certificate of Deposit (CD) is a negotiable money market instrument and issued in dematerialised form or as a Usance Promissory Note against funds deposited at a bank or other eligible financial institution for a specified time period. Guidelines for issue of CDs are presently govened by various directives issued by the Reserve Bank of India (RBI), as amended from time to time. The guidelines for issue of CDs, incorporating all the amendments issued till date, are given below for ready reference. 2. Eligibility CDs can be issued by (i) scheduled commercial banks {excluding Regional Rural Banks and Local Area Banks}; and (ii) select All-India Financial Institutions (FIs) that have been permitted by RBI to raise short-term resources within the umbrella limit (prescribed in paragraph 3.2 below) fixed by RBI. 3. Aggregate Amount 3.1 Banks have the freedom to issue CDs depending on their funding requirements. 3.2 An FI can issue CD within the overall umbrella limit prescribed in the Master Circular on Resource Raising Norms for FIs, issued by DBOD and updated from time-to-time. 4. Minimum Size of Issue and Denominations Minimum amount of a CD should be Rs.1 lakh, i.e., the minimum deposit that could be accepted from a single subscriber should not be less than Rs.1 lakh, and in multiples of Rs. 1 lakh thereafter. 5. Investors CDs can be issued to individuals, corporations, companies, trusts, funds, associations, etc. Non-Resident Indians (NRIs) may also subscribe to CDs, but only on non-repatriable basis, which should be clearly stated on the Certificate. Such CDs cannot be endorsed to another NRI in the secondary market.

6. Maturity

2

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

6.1 The maturity period of CDs issued by banks should not be less than 7 days and not more than one year, from the date of issue. 6.2 The FIs can issue CDs for a period not less than 1 year and not exceeding 3 years from the date of issue. 7. Discount / Coupon Rate CDs may be issued at a discount on face value. Banks / FIs are also allowed to issue CDs on floating rate basis provided the methodology of compiling the floating rate is objective, transparent and market-based. The issuing bank / FI is free to determine the discount / coupon rate. The interest rate on floating rate CDs would have to be reset periodically in accordance with a pre-determined formula that indicates the spread over a transparent benchmark. The investor should be clearly informed of the same. 8. Reserve Requirements Banks have to maintain appropriate reserve requirements, i.e., cash reserve ratio (CRR) and statutory liquidity ratio (SLR), on the issue price of the CDs. 9. Transferability CDs in physical form are freely transferable by endorsement and delivery. CDs in demat form can be transferred as per the procedure applicable to other demat securities. There is no lock-in period for the CDs. 10. Trades in CDs All OTC trades in CDs shall be reported within 15 minutes of the trade on the FIMMDA reporting platform. 11. Loans / Buy-backs Banks / FIs cannot grant loans against CDs. Furthermore, they cannot buy-back their own CDs before maturity. However, the RBI may relax these restrictions for temporary periods through a separate notification.

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

12. Format of CDs Banks / FIs should issue CDs only in dematerialised form. However, according to the Depositories Act, 1996, investors have the option to seek certificate in physical form. Accordingly, if an investor insists on physical certificate, the bank / FI may inform the Chief General Manager, Financial Markets Department, Reserve Bank of India, Central Office, Fort, Mumbai - 400 001 about such instances separately. Further, issuance of CDs will attract stamp duty. A format (Annex I) is enclosed for adoption by banks / FIs. There will be no grace period for repayment of CDs. If the maturity date happens to be a holiday, the issuing bank/FI should make payment on the immediate preceding working day. Banks / FIs, therefore, should fix the period of deposit in such a manner that the maturity date does not coincide with a holiday to avoid loss of discount / interest rate. 13. Security Aspect Since CDs in physical form are freely transferable by endorsement and delivery, it will be necessary for banks/FIs to see that the certificates are printed on good quality security paper and necessary precautions are taken to guard against tampering with the document. They should be signed by two or more authorised signatories. 14. Payment of Certificate 14.1 Since CDs are transferable, the physical certificates may be presented for payment by the last holder. The question of liability on account of any defect in the chain of endorsements may arise. It is, therefore, desirable that banks take necessary precautions and make payment only by a crossed cheque. Those who deal in these CDs may also be suitably cautioned. 14.2 The holders of dematted CDs will approach their respective depository participants (DPs) and give transfer / delivery instructions to transfer the security represented by the specific International Securities Identification Number (ISIN) to the 'CD Redemption Account' maintained by the issuer. The holders should also communicate to the issuer by a letter / fax enclosing the copy of the delivery instruction they had given to their respective DP and intimate the place at which the payment is requested to facilitate prompt payment. Upon receipt of the demat credit of CDs in the "CD Redemption Account", the issuer, on maturity date, would arrange to repay to holders / transferors by way of Banker's cheque / high value cheque, etc. 15. Issue of Duplicate Certificates

4

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

15.1 In case of loss of physical certificates, duplicate certificates can be issued after compliance with the following: a. b. A notice is required to be given in at least one local newspaper; Lapse of a reasonable period (say 15 days) from the date of the notice in the newspaper; and c. Execution of an indemnity bond by the investor to the satisfaction of the issuer of CDs

15.2 The duplicate certificate should be issued only in physical form. No fresh stamping is required as a duplicate certificate is issued against the original lost CD. The duplicate CD should clearly state that the CD is a Duplicate one stating the original value date, due date, and the date of issue (as "Duplicate issued on ________"). 16. Accounting Banks / FIs may account the issue price under the Head "CDs issued" and show it under deposits. Accounting entries towards discount will be made as in the case of "Cash Certificates". Banks / FIs should maintain a register of CDs issued with complete particulars. 17. Standardised Market Practices and Documentation Fixed Income Money Market and Derivatives Association of India (FIMMDA) may prescribe, in consultation with the RBI, for operational flexibility and smooth functioning of the CD market, any standardised procedure and documentation that are to be followed by the participants, in consonance with the international best practices. Banks / FIs may refer to the detailed guidelines issued by FIMMDA in this regard on June 20, 2002 and as amended from time to time (http://fimmda.org). 18. Reporting 18.1 Banks should include the amount of CDs in the fortnightly return under Section 42 of the RBI Act, 1934 and also separately indicate the amount so included by way of a footnote in the return. 18.2 Further, banks / FIs should submit a fortnightly return, as per the format given in Annex II, to the Chief General Manager, Financial Markets Department, RBI, Central Office Building, Fort, Mumbai - 400 001, Fax: 91-22-22630981 / 22634824 within 10 days from the end of the fortnight date. Additionally banks are also required to send the requisite

information in the format as per Annex II of this Master Circular in an MS Excel/ CSV file via

5

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

e-mail within 10 days from the end of the fortnight. Data on issuance of CDs, which are being reported in physical form/through e-mail should also be concurrently reported on the web-based module under the Online Returns Filing System (ORFS).

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

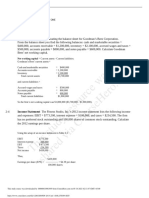

Annex I (See para 12) Format of Negotiable Certificate of Deposit (CD) Name of the Bank / Institution No. Rs. ___________ Dated ___________ NEGOTIABLE CERTIFICATE OF DEPOSIT ___________ months / days after the date hereof, ___________ <Name of the Bank / Institution> ___________, at ___________ <name of the place> ___________, hereby promise to pay to ___________ <name of the depositor> ___________ or order the sum of Rupees ___________ <in words> ___________ only, upon presentation and surrender of this instrument at the said place, for deposit received.

For ___________ <Name of the institution> ___________ Date of maturity ___________ without days of grace. Instructions 1. 1. 2. 3. 4. 5. Endorsements Date

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

Annex II (See para 18.2) Fortnightly Return on Certificates of Deposit (CDs)

(SFR III D )

Name of the Bank/Institution

For the Fortnight ended

Issue of Certificates of Deposit (CDs)

Total amount of CDs outstanding as at the end of the fortnight (1) On Discount Value Basis (Rs. Crore) Face Value Discounted Value

(2) On Coupon Bearing Basis (Rs. Crore) Face Value

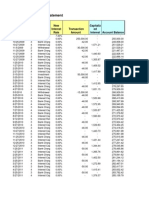

Particulars of CDs issued during the fortnight I Sr. No. 1 2 3 4 5 6 II Sr. No. 1 2 3 4 5 6 CDs issued on Floating Rate Basis Face value of CDs issued (Amount in Rs.) Maturity period (in days) Demat or Physical CDs issued (D/P) CDs issued on Discount value basis Discounted value of CDs issued (Amount in Rs.) Maturity period (in days) Effective interest rate (per cent per annum) Demat or Physical CDs issued (D/P)

Benchmark

Spread

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

Annex III Definitions In these guidelines, unless the context otherwise requires: (a) "Bank or Banking company" means a banking company as defined in clause (c) of Section 5 of the Banking Regulation Act, 1949 (10 of 1949) or a "corresponding new bank", "State Bank of India" or "subsidiary bank" as defined in clause (da), clause (nc) and clause (nd) respectively thereof and includes a "co-operative bank" as defined in clause (cci) of Section 5 read with Section 56 of that Act. (b) Scheduled bank means a bank included in the Second Schedule of the Reserve Bank of India Act, 1934. (c) All-India Financial Institutions (FIs) mean those financial institutions which have been permitted specifically by the Reserve Bank of India to raise resources by way of Term Money, Term Deposits, Certificates of Deposit, Commercial Paper and Inter-Corporate Deposits, where applicable, within the umbrella limit prescribed in paragraph 6.2 of the Master Circular . (e) "Corporate or Company" means a company as defined in Section 45 I (aa) of the Reserve Bank of India Act, 1934 but does not include a company which is being wound up under any law for the time being in force. (f) "Non-banking company" means a company other than banking company. (g) Non-banking financial company means a company as defined in Section 45 I (f) of the Reserve Bank of India Act, 1934. (j) words and expressions used but not defined herein and defined in the Reserve Bank of India Act, 1934 (2 of 1934) shall have the same meaning as assigned to them in the Act.

Master Circular - Guidelines for Issue of Certificates of Deposit (CDs)-July 1, 2011

Appendix List of Circulars Consolidated Sr. No Reference No. Date Subject

1. DBOD.No.BP.BC.134/65-89 2. DBOD.No.BP.BC.112/65-90 3. DBOD.No.BP.BC.60/65-90 4. DBOD.No.BP.BC.113/65-91 5. DBOD.No.BP.BC.83/65-92 6. DBOD.No.BC.119/12.021.001/92

June 6, 1989 Certificates of Deposit (CDs) May 23, 1990 Certificates of Deposit (CDs) December 20, 1990 Certificates of Deposit (CDs)

April 15, 1991 Certificates of Deposit (CDs) February 12, Certificates of Deposit (CDs) 1992 April 21, 1992 Section 42(1) of the Reserve Bank of India Act 1934 - Cash Reserve Ratio on incremental Certificates of Deposit - Exemption April 7, 1993 October 11, 1993 August 9, 1996 Certificates of Deposit (CDs) Enhancement of Limit Certificates of Deposit (CDs) Scheme Certificates of Deposit (CDs) Scheme

7. DBOD.No.BC.106/21.03.053/93 8. DBOD.No.BC.171/21.03.053/93 9. DBOD.No.BP.BC.109./21.03.053/96 10. DBOD.No.BP.BC.49/21.03.053/97 11. DBOD.No.BP.BC.128/21.03.053/97

April 22, 1997 Certificates of Deposit (CDs) October 21, 1997 Certificates of Deposit (CDs)

12. DBOD.No.Dir.BC.96/13.03.00/2001-02 April 29, 2002 Issue of Certificates of Deposit (CDs) in dematerialised form 13. DBOD.No.BP.BC.115/21.03.053/2001- June 15, 02 2002 14. DBOD.No.BP.BC.43/21.03.053/2002November 03 16, 2002 15. MPD.No.254/07.01.279/2004-05 16. MPD.No.263/07.01.279/2004-05 Certificates of Deposit (CDs) Mid-Term Review of Monetary and Credit Policy 2002-03: Certificates of Deposit

July 12, 2004 Guidelines for Issue of Certificates of Deposit April 28, 2005 Certificates of Deposit

17. FMD.MSRG.No.2063/02.08.003/2009- February 25, Reporting of Issuances of 10 2010 Certificates of Deposit 18. FMD.MSRG.No.2905/02.08.003/2009- June 17, 10 2010 19. IDMD.DOD.11/11.08.36/2009-10 June 30, 2010

10

Reporting of Issuances of Certificates of Deposits Online Returns Filing System Reporting of OTC trades in Certificates of Deposit (CDs) and Commercial Papers (CPs)

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5811)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Chapter 5 Risk and ReturnDocument46 pagesChapter 5 Risk and ReturnJunaid MalicNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Entrepreneurship12q2 Mod8 Computation of Gross Profit v3Document22 pagesEntrepreneurship12q2 Mod8 Computation of Gross Profit v3Marc anthony Sibbaluca80% (10)

- Elliot Wave For Advanced UsersDocument9 pagesElliot Wave For Advanced UsersRazif Bahsir67% (6)

- Cebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekDocument23 pagesCebu CPAR Center: C.C.P.A.R. Practical Accounting Problems 1 - PreweekIzzy BNo ratings yet

- Foundations of Financial Management: Block, Hirt, and Danielsen 17th EditionDocument40 pagesFoundations of Financial Management: Block, Hirt, and Danielsen 17th Editionfbm2000No ratings yet

- Python Financial Modelling PDFDocument54 pagesPython Financial Modelling PDFAmit KumarNo ratings yet

- Investment Account StatementDocument6 pagesInvestment Account StatementMorgan ThomasNo ratings yet

- Chapter 009Document33 pagesChapter 009AfnanNo ratings yet

- Case 4 1Document20 pagesCase 4 1Lamont Clinton100% (3)

- Business Strategy Influence Interfirm Financing 1-S2.0-S0148296321008572-MainDocument17 pagesBusiness Strategy Influence Interfirm Financing 1-S2.0-S0148296321008572-MainNguyễn Thị Thảo VyNo ratings yet

- Fsa - Dabur Itc PDFDocument49 pagesFsa - Dabur Itc PDFrituNo ratings yet

- 17Q June 2016Document95 pages17Q June 2016Juliana ChengNo ratings yet

- Poject SequenceDocument84 pagesPoject SequenceJuned JindaniNo ratings yet

- Annualreport 2020Document360 pagesAnnualreport 2020EvgeniyNo ratings yet

- Price DeterminationDocument10 pagesPrice DeterminationRekha BeniwalNo ratings yet

- Chapter 25 - Exchange Rates and The Open EconomyDocument36 pagesChapter 25 - Exchange Rates and The Open EconomyNoura AhmedNo ratings yet

- Capital FinancingDocument5 pagesCapital FinancingJohn Kenneth MantesNo ratings yet

- Commerce 308: Introduction To Finance: Equity ValuationDocument34 pagesCommerce 308: Introduction To Finance: Equity ValuationPamela SantosNo ratings yet

- Discussion Chapter 7Document15 pagesDiscussion Chapter 7yayangNo ratings yet

- Chapter-1 125626Document11 pagesChapter-1 125626Jelna CeladaNo ratings yet

- Nova SBE Handbook MSC Finance - 2022 - 2023Document24 pagesNova SBE Handbook MSC Finance - 2022 - 2023Vasco TamenNo ratings yet

- Fin 201 1stsolution SetDocument6 pagesFin 201 1stsolution Set123xxNo ratings yet

- Pune Growth Mini DeckDocument8 pagesPune Growth Mini Deckvenus CompanyNo ratings yet

- Risk, Return, and The Security Market Line: B. Unsystematic C. D. Unsystematic E. FDocument15 pagesRisk, Return, and The Security Market Line: B. Unsystematic C. D. Unsystematic E. FTú Anh Nguyễn ThịNo ratings yet

- Standard Setting in MalaysiaDocument14 pagesStandard Setting in MalaysiaLuqman Nul HakimNo ratings yet

- Chapter 2 - IND AS 1 Presentation of Financial StatementsDocument22 pagesChapter 2 - IND AS 1 Presentation of Financial StatementsAmbati Madhava ReddyNo ratings yet

- Analysis of D Mat AccountDocument3 pagesAnalysis of D Mat AccountYammanuri VenkyNo ratings yet

- Tutorial Letter 101/3/2018: Monetary Economics IIIDocument45 pagesTutorial Letter 101/3/2018: Monetary Economics IIIDeanNo ratings yet

- FN2409 2706 - Footnotes Levin-Coburn Report.Document975 pagesFN2409 2706 - Footnotes Levin-Coburn Report.Rick ThomaNo ratings yet

- Bon Valuation - M8Document82 pagesBon Valuation - M8AhsanulNo ratings yet