Professional Documents

Culture Documents

Financing Working Capital

Financing Working Capital

Uploaded by

sayiviswadevanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financing Working Capital

Financing Working Capital

Uploaded by

sayiviswadevanCopyright:

Available Formats

Financing working capital

Working capital management is the management of the net of current assets and current liabilities with the objective of reaching the right balance between profitability and liquidity. The aim of managing inventory (stock), trade receivables (debtors), cash, trade payables (creditors), is to obtain the right balance of all the current assets and current liabilities at any given time so that the achieve the objectives of working capital management in the form of profitability and liquidity. Working capital management is made up of so many parts, such as the management of inventory, management of trade receivables, management of cash, management of trade payables, financing of working capital. To discuss the different approaches to financing working capital, it is important to identify that ordinarily, company may use short-term sources of finance to finance its short-term activities, such as working capital activities and long-term source of finance for its capital investments in non-current assets. The choice of which source of finance a company uses to finance its working capital and other activities depend on several factors such as: availability of fund, the length of time such funds may be required for, the purpose for which the funds is required, the size of the company, the rate of interest but for the discussion of the financing of the working capital, the two main factors that needs to be considered are the risk of the finance used and the cost of finance; either by financing working capital using short or long-term source of finance. The risk and cost factors are inversely related, in that if a company goes for a low risk source of finance, it is related to a high cost source of finance and vice versa.

WARMAH.COM

-1-

Assuming a normal yield curve (the term structure of interest rate) where the interest rate curve is upward sloping, a short-term loan will be cheaper than a long-term source of finance. This means that based on cost, a company may rather choose to use short-term source of finance than a long-term source of finance. Based on risk, short-term source of finance (e.g. bank overdraft) is assumed to be more risky than a long-term source of finance (e.g. long-term bank loans). Bank overdraft can technically be withdrawn on demand, at short notice, even if a company use short-term loan, upon maturity, it may not be renewed or it may be renewed on unfavourable terms, unlike long-term loan where a company meeting its loan interest payment and the terms of the loan, will not have to worry about its withdrawal or it not being renewed as may be the case with the short-term source of finance. In summary: Source of finance Short-term Long-term Cost Low High Risk High Low

To discuss the three different working capital financing approach, it is important to make distinction between permanent current assets and fluctuating working capital. Permanent current assets are often the minimum current assets held by companies at any given time. Example of which may include minimum inventory held by a company at any given time for precautionary purpose, others may include the minimum trade receivable that are almost always outstanding, another permanent current asset could be the minimum cash balance that company always wish to hold for precautionary and speculative purpose. Even

WARMAH.COM

-2-

though these minimum current assets a still recorded as current assets, it exhibits characteristics similar to that of non-current assets. Fluctuating current assets are therefore the current assets that are used continuously by the company in its operating activities, such that before it reaches the minimum it takes action to replenish such current assets, such as inventory, cash etc. with fluctuating current assets, just as it is being used, it is always replenished by the company anytime such assets reaches re-order levels, or return points etc, to avoid such assets going out of stocks.

Three approaches to financing working capital 1. Aggressive approach to financing working capital The aggressive method is where a company predominantly finance all its fluctuating current assets and most of its permanent current assets using shortterm source of finance and it is only a small proportion of its permanent current assets that is financed using long-term source of finance. A company that uses more short-term source of finance and less long-term source of finance will incur less cost but with a corresponding high risk. This has the effect of increasing its profitability but with a potential risk of facing liquidity problem should such short-term source of finance be withdrawn or renewed on unfavourable terms.

2. Conservative approach to financing working capital The other extreme method of financing working capital is where a company decides to use mainly long-term source of finance and very little short-term source of finance to finance its working capital. This option means that the

WARMAH.COM

-3-

companys finance is going to be relatively high cost (that is sacrificing low cost finance) but low risk; this will make the companys profit to be low but does not run the risk of being faced with liquidity problem as a result of withdrawal of its source of finance. The conservative method is where a company predominantly finance all its permanent current assets and most of its fluctuation current assets using longterm source of finance and it is only a small proportion of its fluctuating current assets that is financed using short-term source of finance.

3. Moderate approach to financing working capital Between the two extreme approaches to financing working capital is the moderate (or the matching or balancing) approach. This approach makes distinction between fluctuating current assets and permanent current assets with the suggestion that to finance working capital; short-term source of finance should be used to finance fluctuating current assets, whiles long-term source of finance should be used to finance permanent current assets. This matches the source of finance with the character of the current assets. Aggressive approach More short-term source of finance, less long-term source of finance Matching approach Uses short-term source of finance for fluctuating current assets and longpermanent current assets Conservative approach More long-term source of finance, less less-term High cost, low risk leading to low profitability Low cost, high risk leading to high profitability but low liquidity Balance between cost and risk, leading to a balance between

term source of finance for profitability and liquidity

WARMAH.COM

-4-

source of finance

but high liquidity

The financing of working capital approach adopted by a company is very important since it will have an impact on its profitability and liquidity. It is also important for companys to consider other factors apart from cost and risk in making such financing decisions with regards to its working capital financing. Your comments, contributions, articles etc on the above article and any other accounting, business, finance and related issues is welcome. You can send us a mail on info@warmah.com Written by; William Armah Fellow; warmah.com

WARMAH.COM

-5-

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5814)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- BurnsDocument26 pagesBurnsShahab Ud DinNo ratings yet

- ADS PFD PDFDocument1 pageADS PFD PDFShahab Ud DinNo ratings yet

- Blood-Pressure Monitors: SelectDocument3 pagesBlood-Pressure Monitors: SelectShahab Ud DinNo ratings yet

- 2 - KMC List 2013 PDFDocument2 pages2 - KMC List 2013 PDFShahab Ud DinNo ratings yet

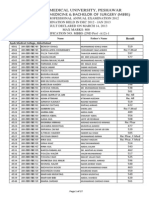

- Result: Khyber Medical University Gat Special TestDocument2 pagesResult: Khyber Medical University Gat Special TestShahab Ud DinNo ratings yet

- Msisdn Called Number Call Type Call Time Call Duration Call ChargesDocument2 pagesMsisdn Called Number Call Type Call Time Call Duration Call ChargesShahab Ud DinNo ratings yet

- 019537s082 020780s040lbl PDFDocument43 pages019537s082 020780s040lbl PDFShahab Ud DinNo ratings yet

- Signs of DeathDocument22 pagesSigns of DeathShahab Ud DinNo ratings yet

- Gazzette MBBS 2nd Prof Ann 2012Document27 pagesGazzette MBBS 2nd Prof Ann 2012Shahab Ud DinNo ratings yet

- Gazette BDS 2nd A12Document3 pagesGazette BDS 2nd A12Shahab Ud DinNo ratings yet

- MCATDocument238 pagesMCATShahab Ud DinNo ratings yet

- Huma Munir: Like ShareDocument3 pagesHuma Munir: Like ShareShahab Ud DinNo ratings yet

- Therapeutic Guidelines in Systemic Fungal Infection 3edDocument127 pagesTherapeutic Guidelines in Systemic Fungal Infection 3eddohuutri66No ratings yet

- June Inflammation, Repair and Immunity Pathology CVS, NSAIDS, Histamine, Anti Diabetic Pharmacology Virology Microbiology Toxicology ForensicDocument1 pageJune Inflammation, Repair and Immunity Pathology CVS, NSAIDS, Histamine, Anti Diabetic Pharmacology Virology Microbiology Toxicology ForensicShahab Ud DinNo ratings yet