Professional Documents

Culture Documents

Income Tax Declaration Form

Uploaded by

diwakar1978Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Tax Declaration Form

Uploaded by

diwakar1978Copyright:

Available Formats

INCOME TAX DECLARATION FORM Assessment Year 2012-2013 Financial Year 2011-2012 Dear Sir/Madam On The Basis of your

Current Salary of Rs --------------------- per month. Your Tax Liability Comes to Rs. ----------------------Monthly Deduction would be Rs. ---------------------Please fill up the attached form and submit till 31-05-11. So the deduction should be made accordingly. 1. 2. 3. 4. 5. Employee Code No. --------------------- -------- Date of Joining --------------- Date of Birth ---------------------Name ------------------------------ Fathers Name ------------------------------------------------------Designation ------------------------------ Department/Site ---------------------------------------------------Residential Address ---------------------------------------------------------------------------------------------------------Permanent Account No. (PAN)------------------------------------ Contact No. -----------------------------------------------(As per Finance Act, 2001 the employees must give their PAN No. to get Form 16 from the Company. In case someone doesnt have PAN No, he / she should apply in Form 49A to INCOME TAX DEPARTMENT) Total Premium payable on L I. P. during the year 01.04.2011 to 31.03.2012 (attach receipts) Policy No. Sum Assured Premium Payable Rs. Rs. ________________________ Rs. Rs. ________________________ Contribution to Equity linked Savings Scheme of a Mutual Fund Rs. Deposit in 10/15 year CTD (Post Office) Rs. Contribution to Public Provident Fund (PPF) Rs. Contribution to Statutory / Recognized Provident Fund (SPF/RPF) Rs._________________________ Subscription to NSC VIII th Series Rs. Contribution to Unit Linked Ins. Plan (ULIP) Rs. Interest on NSC invested earlier (give details) Rs. Repayment of Principal amount for Loan for Purchase / Const. Rs. Of House (enclose Banks Certificate) Date of completion / purchase of Property. (Attach copy of completion / possession certificate issued by Competent Authority) School fees of Children paid during the year Fees for First / One Child Rs. _______________________ Fees for Second Child Rs. _______________________ Contribution for Annuity Plan of LIC Pension Rs. _______________________ Amount deposited in a Fixed Deposit for 5 years or more with a scheduled bank in accordance with the scheme framed Rs. _______________________ Subscription to any notified bonds NABARD. Rs. _______________________

Investment in longterm infrastructure bonds notified by the Central Government upto Rs. 20,000 is allowed as deduction over and above the existing limit of Rs.1 lakh on tax savings. Rs.________________________

6.

7. a) b) c) ca) d) e) f) g)

h)

i) j) k) l)

m)

n) o) p)

q)

r)

Payment of Mediclaim insurance premium (Sec.80D) Rs. _______________________ Expenditure for medical treatment of handicapped dependent (Sec. 80DD) Rs. _______________________ Repayment of interest on Education Loan (Sec. 80E) Rs. _______________________ Repayment of interest amount paid for Loan for Purchase / Construction Rs. _______________________ Of House (enclose Banks Certificate) Date of completion / purchase of Property (Attach copy of completion / possession certificate issued by Competent Authority Monthly Rent paid to Landlord Rs._______________________ i ) Mention city/town (In which city located the house). --------------------ii ) Attach rent receipt from April 2011 or from the first month of joining during FY 2011-12 to March, 12) Confirm that I have spent at least Rs.800 per month on transport on commuting between office and residence:------yes/No)

I declare that the above information given is true and correct to the best of my knowledge. Any change in the above information will be intimated immediately. I further declare and understand that proof of investments made during the year 2011-12 will be submitted to the Accounts Department and if the same is not submitted latest by 25.02.12 TDS calculations will be made on the basis of proofs available with the Accounts Department. I agree to indemnify the Company of any Income Tax interest that the Company may become liable in view of my declaration provided being wrong. I also declare and confirm that the amount invested in respect of which I have claimed rebate / deduction under the Income tax Act, 1961 will be made out of my income chargeable to tax during the above financial year 2011-12 and as per the stipulations laid out under the Income Tax Act. Place : Date : Signature 1. 2. NOTE : SL. NO.1 TO 5 IS COMPULSORY TO FILL. NOTE: ALL NEW EMLPOYEES (JOINING DURING THE F.Y.2011-12) MUST PROVIDE FORM-16 RECEIVED FROM PREVIOUS EMPLOYER.

You might also like

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Circular / Office OrderDocument10 pagesCircular / Office OrderrockyrrNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- 2declaration FormatDocument2 pages2declaration FormatSACH KI TALASHNo ratings yet

- IT DeclarationDocument5 pagesIT Declarationkalpanagupta_purNo ratings yet

- Communication and Declarations To CustomerDocument5 pagesCommunication and Declarations To CustomerMuzaffar Ali ShaikhNo ratings yet

- Haryana Vidyut Prasaran Nigam LimitedDocument10 pagesHaryana Vidyut Prasaran Nigam Limitedaloo leoNo ratings yet

- Pensioners - IT Declaration Form - Annexure1Document3 pagesPensioners - IT Declaration Form - Annexure1Sudeep MitraNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- IT Declaration 2011-12Document2 pagesIT Declaration 2011-12Vijaya Saradhi PeddiNo ratings yet

- Financial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileDocument7 pagesFinancial Statements Questionnaire - 2011: Name Email Home: Phone Home: Email Work: Phone Work: Fax: MobileIdrees HafeezNo ratings yet

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyNo ratings yet

- Sr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidDocument7 pagesSr. No. Pan Place Name Father Name Address: Adddress Abc Company Company/Firm Name & Address Name of Owner Rahul DravidKartikey RanaNo ratings yet

- Policy Surrender Form PDFDocument2 pagesPolicy Surrender Form PDF1012804201No ratings yet

- Tax Proof Submission FY 2021-22Document10 pagesTax Proof Submission FY 2021-22cutieedivyaNo ratings yet

- Income-Tax Circular 2021-22Document1 pageIncome-Tax Circular 2021-22Aishwarya TripathiNo ratings yet

- Provident Fund Balance Through RTIDocument7 pagesProvident Fund Balance Through RTIgvkkishoreNo ratings yet

- HRA, Chapter VI A - 80CCD, 80C, 80D, Other IncomeDocument9 pagesHRA, Chapter VI A - 80CCD, 80C, 80D, Other Incomefaiyaz432No ratings yet

- IDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1Document3 pagesIDC - Investment Declaration Form For Tax Saving For Financial Year 2020-2021 - 1.1ragupathi.arumugaNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- Income Tax Declaration Form 2022-2023Document2 pagesIncome Tax Declaration Form 2022-2023ARUN CHAUHANNo ratings yet

- Request Letter For Export Bill ProcessingDocument2 pagesRequest Letter For Export Bill ProcessingS K GlassNo ratings yet

- Application Form: Loan Requested Purpose of Loan DateDocument2 pagesApplication Form: Loan Requested Purpose of Loan DateZulueta Jing MjNo ratings yet

- IncomeDocument5 pagesIncomevishalNo ratings yet

- APPLICATIONDocument19 pagesAPPLICATIONSuranjan BhattacharyyaNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionnikunjrnanavatiNo ratings yet

- Declaration For InvestmentsDocument6 pagesDeclaration For InvestmentsAnonymous EkFiHy0QoNo ratings yet

- Tax Savings Declarations GuidelinesDocument13 pagesTax Savings Declarations GuidelinesAditya DasNo ratings yet

- Letter To CustomerDocument3 pagesLetter To CustomerAgri MosaramNo ratings yet

- GTCPhase4 - Terms N ConditionDocument28 pagesGTCPhase4 - Terms N ConditionMitraNo ratings yet

- 3 - Sat0720151654 - Declaration - Field - Staff 15-16Document2 pages3 - Sat0720151654 - Declaration - Field - Staff 15-16Faiz AhmedNo ratings yet

- Declaration FormatDocument2 pagesDeclaration Formatshyam gildaNo ratings yet

- Employee Proof Submission Form - 2011-12Document5 pagesEmployee Proof Submission Form - 2011-12aby_000No ratings yet

- 194 Q DeclarationDocument1 page194 Q DeclarationAnkit KapoorNo ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- Guidelines For Income Tax DeclarationDocument9 pagesGuidelines For Income Tax Declarationapoorva1801No ratings yet

- PBC - Documents - Forms Required For Tax Proofs FY 23-24Document13 pagesPBC - Documents - Forms Required For Tax Proofs FY 23-24saika tabbasumNo ratings yet

- Subject: Grant of Ad-Hoc Bonus To The State Government Employees and Some Other Categories of Employees For The Year 2019-2020Document3 pagesSubject: Grant of Ad-Hoc Bonus To The State Government Employees and Some Other Categories of Employees For The Year 2019-2020Satyaki Prasad MaitiNo ratings yet

- TFW Application Forms NEW - 20210809102815Document5 pagesTFW Application Forms NEW - 20210809102815doney PhilipNo ratings yet

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraNo ratings yet

- Annex A-RR22-2020NOD V03Document2 pagesAnnex A-RR22-2020NOD V03Fo LetNo ratings yet

- Income Tax - Exemptions and Deductions Procedure For FY 2020-2021 FinalDocument16 pagesIncome Tax - Exemptions and Deductions Procedure For FY 2020-2021 Finalsrikanth100% (1)

- Investment Proof For Income Tax Computation (FY 2023-24)Document1 pageInvestment Proof For Income Tax Computation (FY 2023-24)Nandu kumarNo ratings yet

- Proof GuidelinesDocument26 pagesProof GuidelinesvarunstuffNo ratings yet

- Taxguru - In-Claiming HRA What To Do If Landlord Do Not Have PANDocument3 pagesTaxguru - In-Claiming HRA What To Do If Landlord Do Not Have PANmass1984No ratings yet

- Forms Required For Tax Proofs 1011Document5 pagesForms Required For Tax Proofs 1011Neeraj JosephNo ratings yet

- Agreement of MR Baharul IslamDocument2 pagesAgreement of MR Baharul Islamapi-35340561150% (2)

- BIR Form 2316 UndertakingDocument1 pageBIR Form 2316 UndertakingJan Paolo CruzNo ratings yet

- Notes To Investment Proof SubmissionDocument10 pagesNotes To Investment Proof SubmissionVinayak DhotreNo ratings yet

- Requisition Letter Salaried Individual (Noor)Document4 pagesRequisition Letter Salaried Individual (Noor)Ayat FatimaNo ratings yet

- It CirularDocument1 pageIt CirularMani VannanNo ratings yet

- Annexure-I-Undertaking Format PDFDocument2 pagesAnnexure-I-Undertaking Format PDFkrishancafegmailcomNo ratings yet

- Guidelines For EPSF FY 2012-13.Document14 pagesGuidelines For EPSF FY 2012-13.80ALLAVINo ratings yet

- Mandate Form For Auto Debit HDFC ElifeDocument2 pagesMandate Form For Auto Debit HDFC ElifeRaj Herg100% (1)

- What Is Payroll?Document12 pagesWhat Is Payroll?vishnukant mishraNo ratings yet

- Application Form For Final Payment Gazetted Officer UpdatedDocument5 pagesApplication Form For Final Payment Gazetted Officer UpdatedMuhammad AsifNo ratings yet

- Format of Customer Declaration For Inward Remittance: DateDocument1 pageFormat of Customer Declaration For Inward Remittance: Dateamrish rai100% (1)

- Declaration TDS On SalaryDocument4 pagesDeclaration TDS On SalaryCharles WeberNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Asian Epoxy Finish PaintDocument1 pageAsian Epoxy Finish Paintdiwakar1978No ratings yet

- Area Area (KM ) (SQ Mi) Rank Name Type Image LocationDocument3 pagesArea Area (KM ) (SQ Mi) Rank Name Type Image Locationdiwakar1978No ratings yet

- Is 6913 1973Document11 pagesIs 6913 1973diwakar1978No ratings yet

- Method Statement: Conbextra GP2Document5 pagesMethod Statement: Conbextra GP2diwakar1978No ratings yet

- SX150 IsDocument200 pagesSX150 Isdiwakar1978No ratings yet

- Cofferdams, Construction ProcedureDocument15 pagesCofferdams, Construction ProcedurefleaxxNo ratings yet

- Temporary StructuresDocument6 pagesTemporary Structuresdiwakar1978No ratings yet

- Print ChallanDocument1 pagePrint ChallanSameer AsifNo ratings yet

- BIR Form 2307 - May2022Document12 pagesBIR Form 2307 - May2022Mae Ann Aguila100% (1)

- Research Paper Group 3 1Document5 pagesResearch Paper Group 3 1Jp CombisNo ratings yet

- RA No. 11976 - Ease of Paying Taxes ActDocument22 pagesRA No. 11976 - Ease of Paying Taxes ActAnostasia NemusNo ratings yet

- Keuleneer Presentatie Waardebepaling NIVRADocument8 pagesKeuleneer Presentatie Waardebepaling NIVRAnalar22No ratings yet

- About Ripple: How Ripple Revolutionizes Cross-Border Payments and RemittancesDocument5 pagesAbout Ripple: How Ripple Revolutionizes Cross-Border Payments and RemittancesDaniel keith LucasNo ratings yet

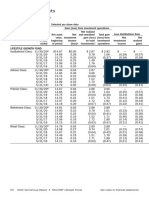

- RL Reco Fund Tracker 181214Document5 pagesRL Reco Fund Tracker 181214techkasambaNo ratings yet

- E BankingDocument18 pagesE BankingHuelien_Nguyen_1121No ratings yet

- Electrosteel Castings Result UpdatedDocument8 pagesElectrosteel Castings Result UpdatedAngel BrokingNo ratings yet

- ch#5 of CFDocument2 pagesch#5 of CFAzeem KhalidNo ratings yet

- SBI LifeDocument15 pagesSBI LifeLindsay PowellNo ratings yet

- Local Media1577402990991204520Document3 pagesLocal Media1577402990991204520KsUnlockerNo ratings yet

- LS Sar Page50Document1 pageLS Sar Page50Ljubisa MaticNo ratings yet

- No. 2010-20 July 2010: Receivables (Topic 310)Document92 pagesNo. 2010-20 July 2010: Receivables (Topic 310)LexuzDyNo ratings yet

- Mohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)Document39 pagesMohamed Ismail Mohamed Riyath - An Overview of Asset Pricing Models (2005, GRIN Verlag)EVERYTHING FOOTBALLNo ratings yet

- KX072867 Invoice/Credit: Miss Margarita Pantelidou (200073769) Pooley 21I Pooley House Westfield Way London E1 4PUDocument1 pageKX072867 Invoice/Credit: Miss Margarita Pantelidou (200073769) Pooley 21I Pooley House Westfield Way London E1 4PUMarita PantelNo ratings yet

- Human Resources 3Document104 pagesHuman Resources 3Harsh 21COM1555No ratings yet

- SB 7a PDFDocument1 pageSB 7a PDFtafseerahmedNo ratings yet

- ACCT5942 Week4 PresentationDocument13 pagesACCT5942 Week4 PresentationDuongPhamNo ratings yet

- Chapter 23Document24 pagesChapter 23Nguyên BảoNo ratings yet

- Financial Statement Analysis Chapter 13Document65 pagesFinancial Statement Analysis Chapter 13Rupesh PolNo ratings yet

- CONTENTDocument51 pagesCONTENTMuhammed Salim v0% (1)

- Sime Darby BerhadDocument16 pagesSime Darby Berhadjue -No ratings yet

- BOQ 412692eDocument126 pagesBOQ 412692erohitNo ratings yet

- BFN202 Seminar Questions SET1Document3 pagesBFN202 Seminar Questions SET1baba cacaNo ratings yet

- Mcs Fee StructureDocument2 pagesMcs Fee StructureRockyNo ratings yet

- Microfinance Management: Chapter - 1Document251 pagesMicrofinance Management: Chapter - 1sunit dasNo ratings yet

- Collateral Valuation and DocumentationDocument13 pagesCollateral Valuation and DocumentationWondmienehLgwNo ratings yet

- (Kotak) Vedanta, October 02, 2023Document9 pages(Kotak) Vedanta, October 02, 2023PrakashNo ratings yet

- Non Shopee & Lazada - Promo Mechanics (September Promo)Document5 pagesNon Shopee & Lazada - Promo Mechanics (September Promo)Ma Joyce ImperialNo ratings yet