Professional Documents

Culture Documents

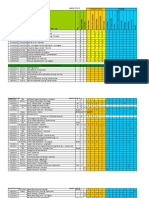

MLPs

Uploaded by

fsaldivia1Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

MLPs

Uploaded by

fsaldivia1Copyright:

Available Formats

What a Difference a Year Makes for the MLP?

In June 2008 I attended the second annual MLP conference, whilst the interest in the two day discussion was good (approximately 80 people), it was a far cry from the interest shown in last years event when aprox 300 attended. Many speakers noted the waning interest in the sector that has been greatly affected by credit crisis as compared to the hype of the previous year. Refreshingly, many of the CEOs of current E&P MLPs (there are 9 now), identify their long term strategy of the accretion in MLP share price as very dissimilar from the previous two years which has negative impacts on the industry.

Source: Steve Pruett, CEO, President Legacy Reserves LP

Speakers at the conference ranged from industry analysts, CEOs and CFOs of the larger MLPs, and Fund managers invested in MLPs who discussed topics such as Maintenance capital, the evolution of the E&P MLP sector and S&P credit ratings. I have outlined the main points from the discussions which I feel are relevant to HighMounts future interest in the MLP structure. The slides incorporated in my presentation are from the presenters who all share a favorable outlook on the MLP sector.

A Look back at the Last 12 Months

Steven Pruett CEO, President of Legacy Reserves LP, one of the initial adopters of the MLP model chaired the conference and gave a very succinct analysis of the last 12 months. Peak of irrational exuberance in July 2007 Upstream MLP shares purchased aggressively by institutions looking for growth. Hedge funds were initially, during the IPO, only allocated a small % of the allocation and were driven to buy shares from private placements at inflated prices. Available assets for this type of MLP structure were significantly larger than that of midstream and pipeline MLPs optimism of large growth potential through acquisition. Wave of upstream MLPs created as well as S1/S3 filings of potential MLPs increased interest in the sector. Institutions provided equity capital for aggressive acquisitions ($7 billion in deals over a short time frame) in the form of PIPES (Private investments in public equity) which fulfilled expectations. The Credit Crunch Underwriters and institutions experience mortgage losses and a need for capital. Small MLP trading volumes result in an illiquid investment - mismatched short term funds in a long term investment. Credit crunch drives higher cost of funds, margin calls and divestiture from the MLP space, driving down the share prices. PIPE overhang issued at a discount to market share price, the sale of this equity further drove down share prices. Integration issues experienced for some MLPs due to the large acquisitions. Loss of valuation premiums vs C-corps as shown below.

Source: Steve Pruett, CEO, President Legacy Reserves LP

Maintenance Capital the calculation of..

Defined as, the amount necessary to maintain production levels of oil and gas properties or operating capacity of other capital assets over the long term. The definition is required to manage partner expectations of operating surplus/distributable cash flow which is even further complicated by some MLPs, having subordinated units and incentive distribution rights. The phrase over the long term was emphasized because an MLP is seen as a long term yield vehicle with a high PDP ratio to total long lived reserves. To achieve sustainable growth over the long term, EVEP for example, uses 33% of Adjusted EBITDA or $1.90 per mcfe, even though replacing current production is forecasted to cost approximately $1.00 per mcfe. The reason for this is two fold: PUD drilling with high initial decline rates (40-75% first year EVEP stat) replaces lower decline rate PDP reserves.

The finite number of drilling opportunities means that at some future point the decline in production will have to be replaced by acquisitions. In summary, maintenance capital is seen as more of an art than a science which will be better developed and understood as MLP companies mature. The maintenance capital as a percentage of Adjusted EBITDA (excl Hedging FAS133) varies between companies 12-33%. Value creation should not be affected by the maintenance capital requirements; rather it is a disciplined approach to acquisitions at rates of return that exceed cost of capital that create value.

Hedging Losses distorting Net Incomes

Reduction in cash flow volatility due to commodity price by hedging is critical to an MLP, whether it be to maintain a threshold rate of return required on an acquisition or maintain quarterly distributions to partners. EVEP who presented this topic for discussion are 90% hedged on PDP production through 2012 using swaps as well as costless collars. Some concern was expressed at the conference about investors understanding of the first quarter negative EBITDA due to the booking of large FAS133 losses due the run up of commodity prices. As with EVEP and others, a cushion between hedged prices, maintenance capital and current distributions, is maintained at approximately 20%. This gives the company some coverage to compensate for increased operating costs, increasing of distributions or increasing maintenance capital. The topic was also raised about allocation of the cost of puts over the life of the hedge and adjusting EBITDA for this cost, as well as providing for this treatment in the partnership agreement. In summary, hedging will always be part of the MLP business model and as one CEO commented we hedge to ensure that prices will rise.

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

Credit Ratings of Current MLPs

Only one current E&P MLP is currently rated by Standard & Poors Atlas Energy Resources LP (B+), however Pioneer Natural Resources (BB+), Quicksilver Resources (BB-) and Encore Acquisition (BB-) are rated C-Corps that own MLP subsidiaries. Most non-major, pure E&P C-Corps are rated B (45%) or BB (33%). Positive credit trends have been the result of high commodity prices, companies increasing in size and diversity, unconventional resource plays providing growth opportunities and access to capital. Negative trends have arisen from the cyclical and capital intensive industry, rampant LOE cost increases, high first year depletion rates especially for natural gas and the leveraging of acquisitions. The corporate credit rating is comprised of two risk profiles: Business Risk Profile E&P Reserves (size/mix/quality/life), cost structure (F&D cost in particular), geographic diversity, reserve replacement & growth (drilling inventory and 3P reserves), profitability. Financial Risk Profile Financial policy/Risk tolerance (Qualitative assessment of management strategy and track record, debt reduction strategy, leveraging to acquire), cash flow adequacy, capital structure/asset protection (financial leverage ratios such as debt to proved reserves and Debt/EBITDAX), liquidity (adequate cash flows to cope with lower commodity prices). S&P are significantly conservative on their crude oil ($90 -2008, $80 2009, $60- onwards) and natural gas ($9 2008, $8 2009, $6 onwards) assumptions, but feel that they are in line with commercial bank price decks and Majors pricing assumptions when considering long lead-time projects. MLPs with tolling assets such as the pipelines and fee based gathering/processing/storage MLPs, have better risk profiles, and are rated more highly than propane/heating oil MLPs, commodity risk gathering/processing/storage MLPs and E&P MLPs. Positive considerations when analyzing Atlas are the low capital intensity ($2 F&D cost in line with peers, Marcellus shale exposure although capital intensive, does provide an organic growth opportunity), high level of hedging (margin squeeze is also considered, puts are expensive), low geological risk (operating in Appalachia and Michigan). Concerns would be that size and diversity are limited, dependant on capital markets, high financial leverage (4.25x EBITDAX/Interest, 3x Debt/EBITDAX, significant revolver borrowings) and semifixed unit holder distributions (distributions limit cash build up effecting liquidity). Distribution coverage for pipeline MLPs is 1.05 to 1.1x, but E&P MLPs are thought to require a more robust coverage of 1.3x due to the volatile industry. MLPs are valued on a yield basis and any decrease in distributions would have an adverse effect on share price.

Asset Monetization -Royalty Trust vs the MLP

A royalty trust is a statutory trust that is formed with specific oil and gas interests from a sponsor company. Whiting USA Trust I - IPO April 2008 $234m and MV Oil Trust IPO Jan 2007 $173m are the latest public offerings after 8 years on inactivity. US Royalty Trusts are passive entities, whereas Canadian Royalty Trusts operate more like E&P MLPs. Sponsors view trusts as a tax efficient way to monetize producing assets with attractive valuations. Investors view trusts as high yield instruments that have exposure to oil and gas commodity prices.

Source: Michael Ames, Managing Director, Investment Banking, Raymond James & Associates

Market capitalization for US Royalty Trusts is approximately $9.6 billion, of which institutions own 17% of total market value. Median R/P ratio is 9.8 years, weighted towards natural gas (64.6%), although the two most recent trusts are 80.5% oil.

Source: Michael Ames, Managing Director, Investment Banking, Raymond James & Associates

The table above is slightly misleading as US Royalty Trusts because most trusts operate for a fixed term, at which point the shares have no value (the rate of return therefore also represents a repayment of capital). Trusts have a high PDP ratio, low risk, low-cost development, established production history, owner controlled operations, prohibited from making acquisitions or offering additional primary units, as well as not having an actively managed hedging program. Trusts, if structured with a term (based on time or a remaining reserves balance) can be a tax deferred transaction that is marketed using a hedged volume strip price, Wall Street consensus forecast on unhedged volumes and a target internal rate of return. There are two predominant types of Royalty trust: Net Profit Interest trust receives a set percentage of net profits, shared capital and operating costs. This structure provides lower up-front costs to the sponsor. Overriding Royalty Interest trust receives a set percentage of the net proceeds from production however the sponsor bears all capital costs, operating costs and workover expenses. Enhanced marketability due to no operating or capital costs bourn by the unit holders. In summary, the trust provides a different option to the E&P MLP for the long term high yield investor. After the hedged period it is subject to commodity price movements but has a fixed term with no organic or acquisition growth as HighMount has experienced.

MLP Growth and Financing

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

The PIPE influence on the E&P MLP sector has been measurable in the last 12 months: The Bull case PIPEs increase institutional ownership and create accelerated MLP growth profiles, growth then attracts retail investors and mutual funds, rational selling from PIPE positions increases share liquidity, additional financing options available to MLPs increase growth prospects even further. The Bear case post credit crunch PIPEs had created large institutional ownership in MLPs which had to be liquidated, forced selling depresses the market unprepared for higher volumes, volatility drives away traditional (long term stable growth) buyers, PIPE registration dates become doomsday events, MLPSs struggle to raise capital and growth prospects diminish.

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

In summary the PIPE overhang is no longer present in the MLP sector, as all those who have wanted to exit have done so. MLPs are now ensuring that they attract the right investor (avoiding liquidity problems brought about by momentum buyers), with a balance between retail and institutional investors. If this type of financing were to be used in future, MLPs would look to more creative structuring of PIPEs with for example staggered lock-ups and at competitive discounts vs other forms of public issuance as well as being smaller in magnitude. Financing of acquisitions this year has been through revolvers or operating cash flows and have tended to be significantly smaller.

Outlook for the next 12 months

Robust environment for E&P MLPs due to rising oil and gas prices, low interest rates (low debt to equity ratios), solid distribution growth, strong distribution coverage (Legacy is approaching 1.3x). Build credibility, broader participation by retail investors through road shows and subsequent offerings, discipline in acquisitions, financing and distribution growth. MLP structure still fits long-lived, predictable assets that generate more cash flow than is needed to maintain production. Emergence of farm out opportunities to bring value forward Constellations coal bed methane Cherokee field, horizontal drilling is also seen as potentially changing basin economics. Possible emergence of new MLPs from the IPO backlog Never filed S-1 (Petrohawk Energy Corp, XTO Energy Inc, Plains Exploration & Production Co, Devon Energy Corp, Talisman Energy Inc), Delayed (Resolute Energy Partners, LP, Venoco Acquisition Company, LP), Pulled (EXCO Partners,LP) Berry Pertoleum. Argument still exists that upstream MLPs for a public company, monetizes lowergrowth assets at attractive valuation to fund high-impact development opportunities. The argument is similar for the private company, unlocking value from stable producing assets, to establish a vehicle to drive accelerated growth.

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

Fundamentals still strong, much of the downturn that was driven by technical factors such as PIPE overhang which has substantially cleared and acquisitions and financing will

more closely relate to entity size. Continued strong operating results and reduced sector volatility should attract long term instead of speculative investors.

Source: Richard Gross, Managing Director, Equity Research, Lehman Brothers

The two MLP companies mentioned above are showing positive gains in their share price Encore due to the announcement of a 50% distribution to partners from available cash flows, with strong commodity prices this has attracted institutional investors. Atlass share price is trading more on its net asset value vs its current yield due to exploration activities announced in the Marcellus Shale. It will be interesting to see how successful both these strategies are and if there is consolidation within the sector, but fundamentally I believe that success will be driven by a disciplined management team who understand their assets and acquisition targets, develop a good hedging strategy and manage costs of capital at less than rates of return required by partners.

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 320C10Document59 pages320C10Kara Mhisyella Assad100% (2)

- CIR Vs ST LukeDocument7 pagesCIR Vs ST LukeMark Lester Lee Aure100% (2)

- Case 6Document3 pagesCase 6Cristine Sanchez50% (4)

- Jason Spero: With Johanna WertherDocument41 pagesJason Spero: With Johanna WertherVasco MarquesNo ratings yet

- Ranchi Women's CollegeDocument5 pagesRanchi Women's Collegevarsha kumariNo ratings yet

- Project FurnitureDocument29 pagesProject FurnitureN sparklesNo ratings yet

- AG - The Contract Management Benchmark Report, Sales Contracts - 200604Document26 pagesAG - The Contract Management Benchmark Report, Sales Contracts - 200604Mounir100% (1)

- E-Directory:: 2022 Patna Branch of ICAI (CIRC) As On 01/01/2022Document345 pagesE-Directory:: 2022 Patna Branch of ICAI (CIRC) As On 01/01/2022Rekha MeghaniNo ratings yet

- 2017/eur/pdf/DEVNET 2023 PDFDocument45 pages2017/eur/pdf/DEVNET 2023 PDFSayaOtanashiNo ratings yet

- Chap 13 Inventory ManagementDocument43 pagesChap 13 Inventory ManagementAcyslz50% (2)

- NEW TRC Volunteer Application FormDocument4 pagesNEW TRC Volunteer Application FormMark J ThompsonNo ratings yet

- Project List (Updated 11 30 12) BADocument140 pagesProject List (Updated 11 30 12) BALiey BustamanteNo ratings yet

- Problemson CVPanalysisDocument11 pagesProblemson CVPanalysisMark RevarezNo ratings yet

- Classification of BanksDocument7 pagesClassification of BanksBrian PapellerasNo ratings yet

- InCompany3rdPre PDFDocument7 pagesInCompany3rdPre PDFFrances DoloresNo ratings yet

- 3PL PresenttionDocument13 pages3PL PresenttionSachin DhamijaNo ratings yet

- A Brief History of The MBADocument16 pagesA Brief History of The MBAasimaneelNo ratings yet

- Cpa Review School of The Philippines: Related Psas: Psa 700, 710, 720, 560, 570, 600 and 620Document20 pagesCpa Review School of The Philippines: Related Psas: Psa 700, 710, 720, 560, 570, 600 and 620melody btobNo ratings yet

- A3.2 Offer Curves 2018-19Document15 pagesA3.2 Offer Curves 2018-19Meeyah NajmieyahNo ratings yet

- Cisco IT Case Study B2BDocument8 pagesCisco IT Case Study B2BLaxmi PaiNo ratings yet

- Catherine Austin Fitts - Grappling With Chemtrails and General Wesley Clark Battle Plan After Nine ElevenDocument13 pagesCatherine Austin Fitts - Grappling With Chemtrails and General Wesley Clark Battle Plan After Nine ElevensisterrosettaNo ratings yet

- Primary Research AnalysisDocument5 pagesPrimary Research Analysisbhoven2nrbNo ratings yet

- Exam 1 OnlineDocument2 pagesExam 1 OnlineGreg N Michelle SuddethNo ratings yet

- Menu EngineeringDocument9 pagesMenu Engineeringfirstman31No ratings yet

- Social MediaDocument44 pagesSocial MediaAzam Ali ChhachharNo ratings yet

- Chapter 3Document62 pagesChapter 3K60 Cù Thảo LyNo ratings yet

- Accounting Information SystemDocument79 pagesAccounting Information Systemrecca123100% (3)

- Ravali Sop IBMDocument3 pagesRavali Sop IBMSadak SushrithNo ratings yet

- Totality Rule-Kinds of ActionsDocument8 pagesTotality Rule-Kinds of ActionsAisha TejadaNo ratings yet

- Final MR ProjectDocument18 pagesFinal MR ProjectAnkit JaiswalNo ratings yet