Professional Documents

Culture Documents

New Service Tax

Uploaded by

csdineshrOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

New Service Tax

Uploaded by

csdineshrCopyright:

Available Formats

Report on New Service Tax

The Broad scheme of new taxation of Service: The key features of the new system of taxation are as follows: At the outset service has been defined in clause (44) of section 65B of the Act. Section 66B specifies the charge of service tax which is essentially that service tax shall be levied on all services provided or agreed to be provided in a taxable territory, other than services specified in the negative list. The negative list of services is contained in section 66D of the Act. Since provision of service in the taxable territory is an important ingredient of taxability, section 66C empowers the Central Government to make rules for determination of place of provision of service. Under these provisions the Place of Provision of Services Rules, 2012 have been made. To remove some ambiguities certain activities have been specifically defined by description as services and are referred as Declared Services (listed in section 66E). In addition to the services specified in the negative list, certain exemptions have been given. Most of the exemptions have been consolidated in a single mega exemption for ease of reference. Principles have been laid down in section 66F of the Act for interpretation wherever services have to be treated differentially for any reason and also for determining the taxability of bundled services. The system of valuation of services for levy of service tax and of availment and utilization of Cenvat credits essentially remains the same with only incidental changes required for the new system of taxation. What is Service? Service has been defined in clause 44 of new Section 65(B) of the Finance Act, 2012 as follows: Service means any activity carried out by a person for another for consideration, and includes a declared service, but shall not include(a) An activity which constitutes merely, (i) A transfer of title in goods or immovable property, by way of sale, gift or in any other manner; or (ii) Such transfer, delivery or supply of any goods which is deemed to be sale with the meaning of clause 29(A) of article 366 of the Constitution; or (iii) A transaction in money or actionable claim; (b) A provision of service by an employee to the employer in the course of or in relation to his employment; (c) Fees taken in any Court or tribunal established under any law for the time being in force.

Page 1 of 8

Report on New Service Tax

What does the word activity signify? Activity has not been defined in the Act. In terms of the common understanding of the word activity would include an act done, a work done, a deed done, an operation carried out, execution of an act, provision of a facility etc. It is a term with very wide connotation. Activity could be active or passive and would also include forbearance to act. Agreeing to an obligation to refrain from an act or to tolerate an act or a situation has been specifically listed as a declared service under section 66E of the Act. Consideration The phrase consideration has not been defined in the Act. What is, therefore, the meaning of consideration? As per Explanation (a) to section 67 of the Act consideration includes any amount that is payable for the taxable services provided or to be provided Since this definition is inclusive it will not be out of place to refer to the definition of consideration as given in section 2 (d) of the Indian Contract Act, 1872 as follows- When, at the desire of the promisor, the promisee or any other person has done or abstained from doing, or does or abstains from doing, or promises to do or to abstain from doing, something, such act or abstinence or promise is called a consideration for the promise In simple terms, consideration means everything received or recoverable in return for a Provision of service which includes monetary payment and any consideration of non- monetary nature or deferred consideration as well as recharges between establishments located in a non-taxable territory on one hand and taxable territory on the other hand. In the definition of service contained in clause (44) of section 65B of the Act it has also been stated that service includes a declared service. The phrase declared service is also defined in the said section as an activity carried out by a person for another for consideration and specified in section 66E of the Act. The following nine activities have been specified in section 66E: 1. Renting of immovable property; 2. construction of a complex, building, civil structure or a part thereof, including a complex or building intended for sale to a buyer, wholly or partly, except where the entire consideration is received after issuance of certificate of completion by a competent authority; 3. Temporary transfer or permitting the use or enjoyment of any intellectual property right; 4. Development, design, programming, customization, adaptation, up gradation, enhancement, implementation of information technology software; 5. Agreeing to the obligation to refrain from an act, or to tolerate an act or a situation, or to do an act; 6. Transfer of goods by way of hiring, leasing, licensing or any such manner without transfer of right to use such goods;

Page 2 of 8

Report on New Service Tax

7. Activities in relation to delivery of goods on hire purchase or any system of payment by installments; 8. Service portion in execution of a works contract; 9. Service portion in an activity wherein goods, being food or any other article of human consumption or any drink (whether or not intoxicating) is supplied in any manner as part of the activity. The above activities when carried out by a person for another for consideration would amount to provision of service ARE ALL SERVICES PROVIDED BY AN EMPLOYER TO THE EMPLOYEE OUTSIDE THE AMBIT OF SERVICES? Services that are provided by the employee to the employer in the course of employment are outside the ambit of services. Services provided outside the ambit of employment for a consideration would be a service. For example, if an employee provides his services on contract basis to an associate company of the employer, then this would be treated as provision of service.

WOULD SERVICES PROVIDED ON CONTRACT BASIS BY A PERSON TO ANOTHER BE TREATED AS SERVICES IN THE COURSE OF EMPLOYMENT? Services provided on contract basis i.e. principal-to-principal basis are not services provided in the course of employment.

TAXABILITY OF SERVICES The taxability of services or the charge of service tax has been specified in section 66B of the Act. To be a taxable a service should be provided or agreed to be provided by a person to another in the taxable territory and should not be specified in the negative list. Does the liability to pay the service tax on a taxable service arise the moment it is agreed to be provided without actual provision of service? No. The point of taxation is determined in terms of the Point of Taxation Rules, 2011. As per these Rules point of taxation is The time when the invoice for the service provided or agreed to be provided is issued; if invoice is not issued within prescribed time period( 30 days except for specified financial sector where it is 45 days) of completion of provision of service then the date of completion of service;

Page 3 of 8

Report on New Service Tax

The date of receipt of payment where payment is received before issuance of invoice or completion of service. Therefore agreements to provide taxable services will become liable to pay tax only on issuance of invoice or date of completion of service if invoice is not issued within prescribed period of completion or on receipt of payment. NEGATVE LIST OF SERVICES (a) Services by Government or a local authority excluding the following services to the extent they are not covered elsewhere: (i) Services by the Department of Posts by way of speed post, express parcel post, life insurance, and agency services provided to a person other than Government; (ii) Services in relation to an aircraft or a vessel, inside or outside the precincts of a port or an airport; (iii) Transport of goods or passengers; or (iv) Support services, other than services covered under clauses (i) to (iii) above, provided to business entities. (b) Services by the Reserve bank of India. (c) Services by a foreign diplomatic mission located in India. (d) Services relating to agriculture or agricultural produce by way of (i) Agricultural operations directly related to production of any agricultural produce including cultivation, harvesting, threshing, plant protection or seed testing; (ii) Supply of farm labor; (iii) processes carried out at an agricultural farm including tending, pruning, cutting, harvesting, drying, cleaning, trimming, sun drying, fumigating, curing, sorting, grading, Cooling or bulk packaging and such like operations which do not alter essential characteristics of agricultural produce but make it only marketable for the primary market; (iv) Renting or leasing of agro machinery or vacant land with or without a structure incidental to its use; (v) Loading, unloading, packing, storage or warehousing of agricultural produce; (vi) Agricultural extension services; (vii) Services by any Agricultural Produce Marketing Committee or Board or services provided by a commission agent for sale or purchase of agricultural produce. (e) Trading of goods. (f) Any process amounting to manufacture or production of goods. (g) Selling of space or time slots for advertisements other than advertisements broadcast by radio or television. (h) Service by way of access to a road or a bridge on payment of toll charges. (i) Betting, gambling or lottery. (j) Admission to entertainment events or access to amusement facilities. (k) Transmission or distribution of electricity by an electricity transmission or distribution Utility.

Page 4 of 8

Report on New Service Tax

(l) Services by way of 1. pre-school education and education up to higher secondary school or equivalent; 2. education as a part of a curriculum for obtaining a qualification recognized by law; 3. Education as a part of an approved vocational education course. (m) Services by way of renting of residential dwelling for use as residence; (n) Services by way of (i) Extending deposits, loans or advances in so far as the consideration is represented by way of interest or discount; (ii) inter-se sale or purchase of foreign currency amongst banks or authorized dealers of foreign exchange or amongst banks and such dealers; (o) Service of transportation of passengers, with or without accompanied belongings, by (i) a stage carriage; (ii) Railways in a class other than a) first class; or b) an air conditioned coach; (iii) Metro, monorail or tramway; (iv) Inland waterways; (v) Public transport, other than predominantly for tourism purpose, in a vessel between places located in India; and (vi) metered cabs, radio taxis or auto rickshaws; (p) Services by way of transportation of goods (i) By road except the services of a) A goods transportation agency; or b) A courier agency; (ii) By an aircraft or a vessel from a place outside India up to the customs station of clearance in India; or (iii) By inland waterways; (q) Funeral, burial, crematorium or mortuary services including transportation of the deceased. With Respect to Directors Remuneration: Is Service Tax payable on Sitting Fees/Commission paid by companies to Directors? The services performed by a director (other than Managing Director/Executive Director/Whole time Director who are employees of the Company) of a company fall within the ambit of taxable services with effect from 1st July, 2012. In respect of services provided by any non-resident director who does not have any fixed establishment in India or is not a resident in India, the companies would be statutorily required to pay the service tax in respect of any consideration which is given to such non-resident directors.

Page 5 of 8

Report on New Service Tax

Accordingly, service tax would be applicable on sitting fees and/or commission to Non-Executive Directors of the Company (NEDs). Is Service Tax payable on reimbursement of expenses of NEDs by the company? There is a Pure Agent concept in service tax. Reimbursement of expenses to Pure Agent is not liable to Service Tax. In some cases, travelling and hotel expenses incurred by NEDs to attend meetings are reimbursed by the company. This would also attract Service Tax as NEDs would not fit within the definition of Pure Agent as they do not perform any activity on behalf of the principal.

What is a Pure Agent ?

Pure agent has been defined in Explanation to sub-rule 2 of Rule (5) of the Valuation Rules as A person who enters into a contractual agreement with the recipient of service to act as his pure agent to incur expenditure or costs in the course of providing taxable service; neither intends to hold nor holds any title to the goods or services so procured or provided as pure agent of the recipient of service; does not use such goods or services so procured; and receives only the actual amount incurred to procure such goods or services. Can company bear the service tax payable by the NEDs is it a deemed Remuneration? As per the explanation to section 198 of the Companies Act, 1956 (the Act), the term remuneration includes any expenditure incurred by the company in respect of any obligation which, but for such expenditure by the company, would have been incurred by the Director. There is a view that payment of service tax is a liability or obligation of the NED. However NEDs have a right to pass it on to the service receiver i.e. the company. Since the company incurs expenditure in respect of such obligation, it may tantamount to remuneration. This may in some cases be treated as increase in remuneration compelling companies to apply to the Ministry of Corporate Affairs (MCA). For example, if a company is paying the maximum permissible sitting fee to its NEDs, the payment of service tax would tantamount to increase in the remuneration beyond the maximum permissible limit or if a company is paying maximum permissible 1% commission on net profits to its NEDs, the payment of service tax could tantamount to payment of commission over and above the maximum permissible.

Page 6 of 8

Report on New Service Tax

While considering the concept of "expenditure", it is important to dwell upon the concept of "Out of pocket". The expenditure that the company incurs in paying service tax to the director can be treated as 'input services' and can be set off by the company against its excise/service tax liability. However, depending upon the type of business, this may not be totally offset. There are varying views emerging on liability of Service Tax on directors. Whilst one view is that the Service Tax is merely collected by the NED from the company and paid to the authorities, the other view is that it is a liability of the NED which is assumed by the company attracting deemed remuneration requiring the Central Government approval. The Service Tax, being an indirect tax, it is an established fact that the service providers (NEDs in the present case) generally collect the service tax from the service receivers (company in the present case) and pay it to the Government. The company when paying the Service Tax amount to the NED, does not pay it on his behalf to a third party. The NED in turn is supposed to pay it to the Government and discharge his statutory obligation. The Board of Directors of a company, if required, can pass a suitable resolution authorizing payment of service tax on sitting fees and / or commission to NEDs but it appears that if it is treated as a deemed remuneration, it would require approval of Central Government. As many companies would bear the service tax component of sitting fees / commission / reimbursement of out of pocket expenses payable to NEDs, MCA will be flooded with multiple applications on this subject.

Procedure:

1) Obtain service tax registration number. 2) Raise invoice for sitting fees and service tax component separately for each and every meeting of Board / Committee and for commission and Service Tax as and when the commission becomes payable. 3) Issue invoice within 30 days of completion of service/receipt of payment, whichever is earlier, on a running serial number commencing from No.1 for the Financial Year. 4) Pay service tax quarterly i.e. 5th of the month following the quarter (or 6th if deposited thru internet banking) in which the service is provided. However, Service Tax for the month of March or quarter ending in March is to be paid by 31st March of the financial year. 5) Electronic filing of Return is mandatory by 25th of the month following the half year (viz. for April to Sept. by 25th Oct and Oct to March by 25th April). Nil return to be filed, even if no services have been provided. 6) Submit list of all accounts maintained at the time of filing first return.

Page 7 of 8

Report on New Service Tax

Conclusion:

Liberalized Scenario The recent amendments made to Schedule XIII to the Companies Act dealing with the Managerial Remuneration have liberalized the Managerial Remuneration to a great extent. As per the new provisos introduced, a company which is neither a listed company nor a subsidiary of the listed company need not approach Central Government for permission for managerial remuneration subject to fulfillment of certain conditions. Similarly, the listed companies and its subsidiaries have also been exempted from the Central Government approval subject to fulfillment of certain conditions as stipulated in the amended Schedule XIII. The Companies Bill, 2011 which has substantially liberalized the Managerial Remuneration does not envisage approval of Central Government in such cases. Clarifications required from MCA It would be in the interest of fairness that reimbursement of service tax should be kept outside the purview of Managerial Remuneration. It would also be in the interest of the NEDs as well as the corporate if MCA issues a circular clarifying that the payment of Service Tax by the company to the Director in respect of sitting fees and/or commission would not tantamount to remuneration / increase in remuneration of the Director. Clarifications required from MOF CBEC vide its circular No. 115/09/2009 dated 31st July 2009 had clarified that the service tax is not payable on fees and commission payable to the Non Executive Directors on the Board of a company as they do not provide taxable service. The directors have fiduciary duties towards the shareholders and remunerations paid to Directors of companies would not be liable to service tax. Even today, there is no change in the role of NEDs and the logic on which the CBEC had issued the said circular still holds good. It would be in the interest of the NEDs as well as the corporate if MOF confirms that the clarification issued by CBEC vide Circular No. 115/09/2009 dated 31st July 2009 equally applies to fees and commission payable / reimbursement of expenses to Non-Executive directors and as such is not a taxable service under the newly inserted Section 66B of the Finance Act 2012. If for some reason it is considered taxable under Section 66B, then it is requested to apply reverse charge principle under which the company on whose Board they are appointed may be made liable to pay service tax on such payments.

Page 8 of 8

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ADR Robeniol PDFDocument75 pagesADR Robeniol PDFKattels100% (3)

- 2018 - 11 - 07 GR 190800Document4 pages2018 - 11 - 07 GR 190800SabNo ratings yet

- G.R. No. 133036 Recuerdo Vs PeopleDocument4 pagesG.R. No. 133036 Recuerdo Vs PeopleKristin C. Peña-San FernandoNo ratings yet

- Paul JeremiasDocument9 pagesPaul JeremiasNCMattersNo ratings yet

- Competition Entry Form: (Please Note That ONE Form Should Be Filled in For EACH Competition You Wish To Enter.)Document2 pagesCompetition Entry Form: (Please Note That ONE Form Should Be Filled in For EACH Competition You Wish To Enter.)Juan Pablo Honorato BrugereNo ratings yet

- 3 Lorenzo Shipping Corp. vs. BJ Marthel International, Inc.Document23 pages3 Lorenzo Shipping Corp. vs. BJ Marthel International, Inc.cool_peachNo ratings yet

- Child Protection ActDocument19 pagesChild Protection ActSahil GargNo ratings yet

- Khas Lands Should Be Distributed Among The PoorDocument7 pagesKhas Lands Should Be Distributed Among The Poorআ.আ. মামুনNo ratings yet

- w2 PDFDocument6 pagesw2 PDFNEKRONo ratings yet

- What Is Victimology?: Q.1 Explain The Historical Development of Victimology?Document2 pagesWhat Is Victimology?: Q.1 Explain The Historical Development of Victimology?ankita jain100% (2)

- History of FIFADocument2 pagesHistory of FIFAankitabhat93No ratings yet

- Jimenez Vs SoronganDocument2 pagesJimenez Vs SoronganEANo ratings yet

- Department of Education: Republic of The PhilippinesDocument5 pagesDepartment of Education: Republic of The PhilippinesThering Doc-BotardoNo ratings yet

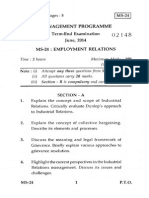

- Time: 3 Hours Maximum Marks: 100 (Weightage 70%)Document5 pagesTime: 3 Hours Maximum Marks: 100 (Weightage 70%)2912manishaNo ratings yet

- Strunk Bar Complaint Against Adam Bennett SchiffDocument9 pagesStrunk Bar Complaint Against Adam Bennett Schiffkris strunk100% (3)

- Ra 3591 An Act Establishing The Philippine Deposit Insurance Corporation, Defining Its Powers and Duties and For Other PurposesDocument16 pagesRa 3591 An Act Establishing The Philippine Deposit Insurance Corporation, Defining Its Powers and Duties and For Other PurposesCatherine Joy MoralesNo ratings yet

- Black's Police Monitor ComplaintDocument14 pagesBlack's Police Monitor ComplaintBlack2019100% (1)

- Exclusive Patent License Agreement Between Alliance For Sustainable Energy, LLC andDocument19 pagesExclusive Patent License Agreement Between Alliance For Sustainable Energy, LLC andPOOJA AGARWALNo ratings yet

- 151.CIR Vs Asalus CorpDocument7 pages151.CIR Vs Asalus CorpClyde KitongNo ratings yet

- ProTools Subscription Invoice - March 2020Document1 pageProTools Subscription Invoice - March 2020thathy78No ratings yet

- Statcon CasesDocument22 pagesStatcon CasesJoahnna Paula CorpuzNo ratings yet

- 1 CIR Vs Air LiquideDocument10 pages1 CIR Vs Air LiquideIrene Mae GomosNo ratings yet

- 1099 Ing PDFDocument3 pages1099 Ing PDFAnonymous wznsTFAMKMNo ratings yet

- Jesse U. Lucas - Versus - Jesus S. Lucas G.R. No. 190710. June 6, 2011 Nachura, J.: FactsDocument5 pagesJesse U. Lucas - Versus - Jesus S. Lucas G.R. No. 190710. June 6, 2011 Nachura, J.: FactsElah ViktoriaNo ratings yet

- PCGG Milestone ReportDocument30 pagesPCGG Milestone ReportPeggy SalazarNo ratings yet

- Reillo Vs Heirs of Quiterio San Jose - VosotrosDocument2 pagesReillo Vs Heirs of Quiterio San Jose - VosotrosJules Vosotros100% (2)

- BU 12 Tentative MOU Legislative Transmittal PackageDocument7 pagesBU 12 Tentative MOU Legislative Transmittal PackageJon OrtizNo ratings yet

- Johor Coastal Development SDN BHD V Constrajaya SDN BHDDocument17 pagesJohor Coastal Development SDN BHD V Constrajaya SDN BHDYumiko HoNo ratings yet

- Tax1-Helvering Vs BruunDocument6 pagesTax1-Helvering Vs BruunSuiNo ratings yet

- RA 9267 Securitization Act of 2004Document11 pagesRA 9267 Securitization Act of 2004acolumnofsmokeNo ratings yet