Professional Documents

Culture Documents

Impact of NPA on Profitability and Functioning of Commercial Banks

Uploaded by

jatt_tinka_3760Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Impact of NPA on Profitability and Functioning of Commercial Banks

Uploaded by

jatt_tinka_3760Copyright:

Available Formats

Adverse Effects of NPA on the Working of Commercial Banks NPA has affected the profitability, liquidity and competitive

functioning of PSBs and finally the psychology of the bankers in respect of their disposition towards credit delivery and credit expansion. Impact on Profitability Between 01.04.93 to 31.03.2001Commercial banks incurred a total amount of Rs.31251 Crores towards provisioning NPA. This has brought Net NPA to Rs.32632 Crores or 6.2% of net advances. To this extent the problem is contained, but at what cost? This costly remedy is made at the sacrifice of building healthy reserves for future capital adequacy. The enormous provisioning of NPA together with the holding cost of such non-productive assets over the years has acted as a severe drain on the profitability of the PSBs. In turn PSBs are seen as poor performers and unable to approach the market for raising additional capital. Equity issues of nationalised banks that have already tapped the market are now quoted at a discount in the secondary market. Other banks hesitate to approach the market to raise new issues. This has alternatively forced PSBs to borrow heavily from the debt market to build Tier II Capital to meet capital adequacy norms putting severe pressure on their profit margin, else they are to seek the bounty of the Central Government for repeated Recapitalisation. Considering the minimum cost of holding NPAs at 7% p.a. (reckoning average cost of funds at 6% plus 1% service charge) the net NPA of Rs.32632 Crores absorbs a recurring holding cost of Rs.2300 Crores annually. Considering the average provisions made for the last 8 years, which works out to average of Rs.3300 Crores from annum, a sizeable portion of the interest income is absorbed in servicing NPA. NPA is not merely non-remunerative. It is also cost absorbing and profit eroding. In the context of severe competition in the banking industry, the weak banks are at disadvantage for leveraging the rate of interest in the deregulated market and securing remunerative business growth. The options for these banks are lost. "The spread is the bread for the banks". This is the margin between the cost of resources employed and the return there from. In other words it is gap between the return on funds deployed(Interest earned on credit and investments) and cost of funds employed(Interest paid on deposits). When the interest rates were directed by RBI, as heretofore, there was no option for banks. But today in the deregulated market the banks decide their lending rates and borrowing rates. In the competitive money and capital Markets, inability to offer competitive market rates adds to the disadvantage of marketing and building new business. In the face of the deregulated banking industry, an ideal competitive working is reached, when the banks are able to earn adequate amount of non-interest income to cover their entire operating expenses i.e. a positive burden. In that event the spread factor i.e. the difference between the gross interest income and interest cost will constitute its operating profits. Theoretically even if the bank keeps 0% spread, it will still break even in terms of operating profit and not return an operating loss. The net profit is the amount of the operating profit minus the amount of provisions to be made including for taxation. On account of the burden of heavy NPA, many nationalised banks have little option and they are unable to lower lending rates competitively, as a wider spread is necessitated to cover cost of NPA in the face of lower income from off balance sheet business yielding non-interest income.

The following working results of Corporation bank an identified well managed nationalised banks for the last two years and for the first nine months of the current financial year, will be revealing to prove this statement-

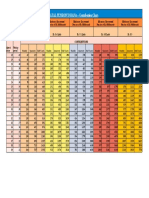

Table -6 (part-1) Performance of Corporation Bank .......(Amount in Crores)..

Performance indicator Earnings - Noninterest Operating expenses Difference Year ended Mar. 2000 270.81 303.99 -33.18 Year ended Mar. 2001 292.09 341.36 -49.27 9 months Apr.Decr.2001 285.85 280.52 5.33

Non-interest income fully absorbs the operating expenses of this bank in the current financial year for the first 9 months. In the last two financial years, though such income has substantially covered the operating expenses (between 80 to 90%) there is still a deficit left. Now what are the interest earnings and expenses of Corporation Bank during this period?

Table -6 (part-1) Corporation Bank -Interest Earnings and Expense.. (Amount in Crores)

Performance indicator Earnings - Interest Income Exp.-Interest expenses Interest spread Operating Profit Provisions Net Profit Year ended Mar. 2000 1604.39 1146.09 458.30 425.12 192.68 232.44 Year ended Mar. 2001 1804.54 1223.21 581.33 482.21 270.22 261.84 9 months Apr.Decr.2001 1458.33 981.45 476.88 532.06 219.48 262.73

The strength of Corporation Bank is identified by the following positive features: i. It's sizeable earnings under of non-interest income substantially/totally meets its non-interest expenses . ii. Its obligation for provisioning requirements is within bounds. (Net NPA/Net Advances is 1.92%)

It is worthwhile to compare the aggregate figures of the 19 Nationalised banks for the year ended March 2001, as published by RBI in its Report on trends and progress of banking in India.

Table 7- Nationalised banks operational statistics.. (Amount in Crores)

Performance indicator Earnings - Non-interest Operating expenses Difference Earnings - interest income Exp.-Interest expenses Year ended Mar. 2000 6662.42 14251.87 -7589.45 50234.01 35477.41 Year ended Mar. 2001 7159.41 17283.55 -10124.14 56967.11 38789.64

Interest spread Intt. On Recap bonds Operating Profit Provisions Net Profit

14756.60 1797.88 5405.27 4766.15 639.12

18177.47 1795.48 6257.85 5958.24 299.61

Interest on Recapitalisation Bonds is an income earned from the Government, who had issued the Recapitalisation Bonds to the weak banks to sustain their capital adequacy under a bailout package. The statistics above show the other weaknesses of the nationalised banks in addition to the heavy burden they have to bear for servicing NPA by way of provisioning and holding cost as under: i. Their operating expenses are higher due to surplus manpower employed. Wage costs to total assets is much higher to PSBs compared to new private banks or foreign banks. Their earnings from sources other than interest income are meagre. This is due to failure to develop off balance sheet business through innovative banking products. How NPA Affects the Liquidity of the Nationalised Banks? Though nationalised banks (except Indian Bank) are able to meet norms of Capital Adequacy, as per RBI guidelines, the fact that their net NPA in the average is as much as 7% is a potential threat for them. RBI has indicated the ideal position as Zero percent Net NPA. Even granting 3% net NPA within limits of tolerance the nationalised banks are holding an uncomfortable burden at 7.1% as at March 2001. They have not been able to build additional capital needed for business expansion through internal generations or by tapping the equity market, but have resorted to II-Tier capital in the debt market or looking to recapitalisation by Government of India. How NPA Affects the Outlook of Bankers towards Credit Delivery The fear of NPA permeates the psychology of bank managers in the PSBs in entertaining new projects for credit expansion. In the world of banking the concepts of business and risks are inseparable. Business is an exercise of balancing between risk and reward. Accept justifiable risks and implement de-risking steps. Without accepting risk, there can be no reward. The psychology of the banks today is to insulate themselves with zero percent risk and turn lukewarm to fresh credit. This has affected adversely credit growth compared to growth of deposits, resulting a low C/D Ratio around 50 to 54% for the industry. The fear psychosis also leads to excessive security-consciousness in the approach towards lending to the small and medium sized credit customers. There is insistence on provision of collateral security, sometimes up to 200% value of the advance, and consequently due to a feeling of assumed protection on account of holding adequate security (albeit over-confidence), a tendency towards laxity in the standards of credit appraisal comes to the fore. It is well known that the existence of collateral security at best may convert the credit extended to productive sectors into an investment against real estate, but will not prevent the account turning into NPA. Further blocked assets and real estate represent the most illiquid security and NPA in such advances has the tendency to persist for a long duration.

ii.

Nationalised banks have reached a dead-end of the tunnel and their future prosperity depends on an urgent solution of this hovering threat.

Impact of NPA on overall profitability of banks To start with, performance in terms of profitability is a benchmark for any business enterprise including the banking industry. However, increasing NPAs have a direct impact on profitability of banks as legally banks are not allowed to book income on such accounts and at the same time banks are forced to make provision on such assets as per the Reserve Bank of India (RBI) guidelines on Performing Asset means an asset or account of borrower, which has been classified by a bank or financial institution as substandard, doubtful or loss asset, in accordance with the directions or guidelines relating to asset classification issued by RBI. An amount due under any credit facility is treated as "past due" when it has not been paid within 30 days from the due date. Due to the improvement in the payment and settlement systems, recovery climate, up gradation of technology in the banking system, etc., it was decided to dispense with 'past due' concept, with effect from March 31, 2001. Subsequent guidelines issued by RBI in line with international best practices in accordance with Basel standards ,the prudential norms for income recognition ,asset classification, capital adequacy and provisioning in commercial banks has been introduced. These guidelines lay emphasis on regulatory and supervisory control of banks by RBI and enhancing the overall financial stability in the economy. It also expects the banks and financial institutions to be following capital adequacy norms, maintain capital provisioning on a risk weighted assets basis along with operating on income recognition, asset classification and liquidity management. Further, all the commercial banks are subject to regulatory and supervisory frame work by RBI in accordance with switch over to Risk Based Supervision (RBS) in 2003-04 which has concurrently ushered in CAMELS(Capital adequacy, Asset quality, Management, Earnings, Liquidity, Systems and Controls ) approach and Basel II norms. In accordance with asset classification norms brought in with effect from March 31, 2004, a non-performing asset (NPA) shell be a loan or an advance, where: 1. Interest and /or instalment of principal remain overdue for a period of more than 90 Days in respect of a Term Loan, 2. The account remains 'out of order' for a period of more than 90 days, in respect of an overdraft/ cash credit (OD/CC) 3. The bill remains overdue for a period of more than 90 days in the case of bills purchased and discounted, 4. Interest and/ or instalment of principal remains overdue for two harvest seasons but for a period not exceeding two half years in the case of an advance granted for agricultural purpose, and 5. Any amount to be received remains overdue for a period of more than 90 days in respect of other accounts. Also, with increasing deposits made by the public in the banking system, the banking industry cannot afford defaults by borrower s since NPAs affects the repayment capacity of banks.

Further, Reserve Bank of India (RBI) successfully creates excess liquidity in the system through various rate cuts and banks fail to utilize this benefit to its advantage due to the fear of burgeoning non-performing assets. After liberalization the Indian banking sector developed very appreciate. The RBI also nationalized good amount of commercial banks for proving socio economic services to the people of the nation. The Public Sector Banks have shown very good performance as far as the financial operations are concerned. If we look to the glance of the financial operations, we may find that deposits of public to the Public Sector Banks have increased from 859,461.95crore to 1,079,393.81crore in 2003, the investments of the Public Sector Banks have increased from 349,107.81crore to 545,509.00crore, and however the advances have also been increased to 549,351.16crore from 414,989.36crore in 2003. The total income of the public sector banks have also shown good performance since the last few years and currently it is 128,464.40crore. The Public Sector Banks have also shown comparatively good result. The gross profits of the Public Sector Banks currently 29,715.26crore which has been doubled to the last to last year, and the net profit of the Public Sector Banks is 12,295,47crore. However, the only problem of the Public Sector Banks these days are the increasing level of the non performing assets. The non performing assets of the Public Sector Banks have been increasing regularly year by year. If we glance on the numbers of non performing assets we may come to know that in the year 1997 the NPAs were 47,300crore and reached to 80,246crore in 2002. The only problem that hampers the possible financial performance of the Public Sector Banks is the increasing results of the non performing assets.The non performing assets impacts drastically to the working of the banks. The efficiency of a bank is not always reflected only by the size of its balance sheet but by the level of return on its assets. NPAs do not generate interest income for the banks, but at the same time banks are required to make provisions for such NPAs from their current profits. NPAs have a deleterious effect on the return on assets in several ways They erode current profits through provisioning requirements They result in reduced interest income They require higher provisioning requirements affecting profits and accretion to capital funds and capacity to increase good quality risk assets in future, and They limit recycling of funds, set in asset-liability mismatches, etc. The RBI has also tried to develop many schemes and tools to reduce the non performing assets by introducing internal checks and control scheme, relationship managers as stated by RBI who have complete knowledge of the borrowers, credit rating system, and early warning system and so on. The RBI has also tried to improve the securitization Act and SRFAESI Act and other acts related to the pattern of the borrowings. Though RBI has taken number of measures to reduce the level of the non performing assets the results is not up to the expectations. To improve NPAs each bank should be motivated to introduce their own precautionary steps. Before lending the banks must evaluate the feasible financial and operational prospective results of the borrowing companies. They must evaluate the business of borrowing companies by keeping in considerations the overall impacts of all the factors that influence the business.

You might also like

- Borrower Application 2483 RevisedDocument5 pagesBorrower Application 2483 RevisedJustin Davies33% (3)

- James Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244Document2 pagesJames Clarence Burke JR 5435 Norde Drive West APT# 32 Jacksonville FL 32244api-270182608100% (2)

- CapgeminiOfferLetter 29122011 PDFDocument23 pagesCapgeminiOfferLetter 29122011 PDFsreeharivaleti100% (1)

- Buying and SellingDocument19 pagesBuying and SellingNeri SangalangNo ratings yet

- Tata Vs HyundaiDocument49 pagesTata Vs HyundaiAnkit SethNo ratings yet

- Financial Management Introduction Lecture#1Document12 pagesFinancial Management Introduction Lecture#1Rameez Ramzan AliNo ratings yet

- CH-2 - NPAs, Its Emergence and EffectsDocument7 pagesCH-2 - NPAs, Its Emergence and EffectsNirjhar DuttaNo ratings yet

- Definition of NPADocument3 pagesDefinition of NPAsajilapkNo ratings yet

- NPA of Indian BanksDocument27 pagesNPA of Indian BanksShristi GuptaNo ratings yet

- Report On Trend and Progress of Banking in India 2019Document6 pagesReport On Trend and Progress of Banking in India 2019Jobin JohnNo ratings yet

- Indian Banking SystemsDocument16 pagesIndian Banking Systemsloveaute15No ratings yet

- Soumik Sen 12PGDM055 Section ADocument15 pagesSoumik Sen 12PGDM055 Section ASoumik SenNo ratings yet

- Causes of NPADocument7 pagesCauses of NPAsggovardhan0% (1)

- Axis Bank Aug. 2012Document13 pagesAxis Bank Aug. 2012Deepankar MitraNo ratings yet

- Npa 119610079679343 5Document46 pagesNpa 119610079679343 5Teju AshuNo ratings yet

- Banking Challenges 09AC31 PsgimDocument10 pagesBanking Challenges 09AC31 Psgimscribd09ac31No ratings yet

- Non Performing AssetsDocument12 pagesNon Performing AssetsVikram SinghNo ratings yet

- 1939IIBF Vision April 2012Document8 pages1939IIBF Vision April 2012Shambhu KumarNo ratings yet

- Commercial Banking System and Role of RBI A ST WDLDXPDocument9 pagesCommercial Banking System and Role of RBI A ST WDLDXPNageshwar SinghNo ratings yet

- Assignment of Risk Management of BankingDocument19 pagesAssignment of Risk Management of Bankingshruti_sood52No ratings yet

- Ijrim Volume 2, Issue 11 (November 2012) (ISSN 2231-4334) Management of Non Performing Assets (Npas) in Public Sector BanksDocument9 pagesIjrim Volume 2, Issue 11 (November 2012) (ISSN 2231-4334) Management of Non Performing Assets (Npas) in Public Sector BanksmithiliNo ratings yet

- Rise in Bank NPAs Due to External and Internal FactorsDocument10 pagesRise in Bank NPAs Due to External and Internal FactorsRakesh KushwahNo ratings yet

- Macro-Economics Assignment: Rising NPAsDocument9 pagesMacro-Economics Assignment: Rising NPAsAnanditaKarNo ratings yet

- Non Performing AssetsDocument24 pagesNon Performing AssetsAmarjeet DhobiNo ratings yet

- Financial Management ReportDocument11 pagesFinancial Management ReportTaghi MammadovNo ratings yet

- Accounting Fraud A Study On Sonali Bank Limited Hallmark ScamDocument42 pagesAccounting Fraud A Study On Sonali Bank Limited Hallmark ScamMostak AhmedNo ratings yet

- Banks Have Ability To Withstand Stress: Also ReadDocument22 pagesBanks Have Ability To Withstand Stress: Also Readpriya2210No ratings yet

- What Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingDocument5 pagesWhat Is NPA?: Banking Businesses Is Mainly That of Borrowing From The Public and LendingbhagatamitNo ratings yet

- Equity: Read More: Under Creative Commons LicenseDocument7 pagesEquity: Read More: Under Creative Commons Licenseyogallaly_jNo ratings yet

- India's Private or Public Sector Banks - Who Is BetterDocument9 pagesIndia's Private or Public Sector Banks - Who Is BetterSammyPeachNo ratings yet

- Interest Income: Principles and Practices of Banking ManagementDocument25 pagesInterest Income: Principles and Practices of Banking ManagementShreya MathurNo ratings yet

- NPA EvalautiaonDocument7 pagesNPA EvalautiaonmgajenNo ratings yet

- Posted: Sat Feb 03, 2007 1:58 PM Post Subject: Causes For Non-Performing Assets in Public Sector BanksDocument13 pagesPosted: Sat Feb 03, 2007 1:58 PM Post Subject: Causes For Non-Performing Assets in Public Sector BanksSimer KaurNo ratings yet

- Understanding Non-Performing Assets in BanksDocument35 pagesUnderstanding Non-Performing Assets in BanksMaridasrajanNo ratings yet

- NPAs in Indian State Co-op BanksDocument9 pagesNPAs in Indian State Co-op BankskumardattNo ratings yet

- Project Report On Financial Analysis of Banking Sector: (Icici Bank Vs HDFC Bank)Document18 pagesProject Report On Financial Analysis of Banking Sector: (Icici Bank Vs HDFC Bank)jotijiaNo ratings yet

- Private Banks Rein in NPAsDocument8 pagesPrivate Banks Rein in NPAsanayatbakshNo ratings yet

- Indian Banking SystemDocument21 pagesIndian Banking Systemankurp68No ratings yet

- Performance Evaluation of BanksDocument6 pagesPerformance Evaluation of BanksAroop Kumar MohapatraNo ratings yet

- Samba Bank LimitedDocument7 pagesSamba Bank LimitedSadia AslamNo ratings yet

- Interest Rate Risk: Get QuoteDocument5 pagesInterest Rate Risk: Get Quoterini08No ratings yet

- Impact of Non-Performing Assets On Banking Industry: The Indian PerspectiveDocument8 pagesImpact of Non-Performing Assets On Banking Industry: The Indian Perspectiveshubham kumarNo ratings yet

- Non - Performing Assets - PublicationDocument12 pagesNon - Performing Assets - PublicationChandra SekarNo ratings yet

- BANKING ISSUESDocument17 pagesBANKING ISSUESbhavyaNo ratings yet

- Sbi & HDFC MBA PROJECTDocument7 pagesSbi & HDFC MBA PROJECTKartik PahwaNo ratings yet

- A Report Presented by Kpeya Queen and Bezankeng Marvel On The Analysis of TheDocument5 pagesA Report Presented by Kpeya Queen and Bezankeng Marvel On The Analysis of TheBiboutNo ratings yet

- Impact of Banking Sector Npa'S On Indian EconomyDocument9 pagesImpact of Banking Sector Npa'S On Indian EconomyKaran Veer SinghNo ratings yet

- AssignmentDocument14 pagesAssignmentAbhiNo ratings yet

- Porter: Five Forces - Buyer Power (Low)Document7 pagesPorter: Five Forces - Buyer Power (Low)Aniruddha PatilNo ratings yet

- NPA Issues Facing Indian Banking SectorDocument8 pagesNPA Issues Facing Indian Banking Sectorbhattcomputer3015No ratings yet

- Black Book Fdocuments - in - Blackbook-Project-On-Indian-Banking-Sector-2Document119 pagesBlack Book Fdocuments - in - Blackbook-Project-On-Indian-Banking-Sector-2SamNo ratings yet

- Comparing NPAs of Canara Bank & ICICI BankDocument42 pagesComparing NPAs of Canara Bank & ICICI BankASWATHYNo ratings yet

- Final ReportDocument39 pagesFinal ReportBhupendra KushwahaNo ratings yet

- Banking Sector AnalysisDocument7 pagesBanking Sector AnalysisKarthikJattiNo ratings yet

- Non Performing NpaDocument21 pagesNon Performing NpaPriya Rakeshkumar MistryNo ratings yet

- Chapter - 6 Npa Analysis and Interpretation of Data of Kendrapara Urban Co-Operative BankDocument36 pagesChapter - 6 Npa Analysis and Interpretation of Data of Kendrapara Urban Co-Operative BankJagadish SahuNo ratings yet

- Accounting Fraud: A Study On Sonali Bank Limited (Hallmark) ScamDocument42 pagesAccounting Fraud: A Study On Sonali Bank Limited (Hallmark) Scammunatasneem94% (17)

- Chapter 3Document4 pagesChapter 3Cupid CuteNo ratings yet

- FIM Done PDFDocument244 pagesFIM Done PDFsNo ratings yet

- Shri Vaishnav Institute of Management, Indore (M.P.)Document14 pagesShri Vaishnav Institute of Management, Indore (M.P.)Vikas_2coolNo ratings yet

- Ratings reaffirmed for Nepal Bangladesh Bank LimitedDocument4 pagesRatings reaffirmed for Nepal Bangladesh Bank LimitedBhupEndra AdhikaRiNo ratings yet

- T R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)From EverandT R A N S F O R M A T I O N: THREE DECADES OF INDIA’S FINANCIAL AND BANKING SECTOR REFORMS (1991–2021)No ratings yet

- Public Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesFrom EverandPublic Financing for Small and Medium-Sized Enterprises: The Cases of the Republic of Korea and the United StatesNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- N550 - Financial Accounting N4 Memo Nov 2019Document7 pagesN550 - Financial Accounting N4 Memo Nov 2019Thembelihle SitholeNo ratings yet

- Financial Accounting International Student 7th Edition Kimmel Solutions ManualDocument25 pagesFinancial Accounting International Student 7th Edition Kimmel Solutions ManualDannyJohnsonobtk100% (58)

- Indian Taxation LawDocument22 pagesIndian Taxation LawEngineerNo ratings yet

- Handbook On Indian Insurance Statistics 2015 16Document302 pagesHandbook On Indian Insurance Statistics 2015 16grazdNo ratings yet

- ACCA F3-FFA LRP Revision Mock - Questions S15Document18 pagesACCA F3-FFA LRP Revision Mock - Questions S15Kiri chrisNo ratings yet

- Computer Software For FisheriesDocument9 pagesComputer Software For FisheriesSudar ShanNo ratings yet

- Valartis Annual-Report 2017Document152 pagesValartis Annual-Report 2017Miguel Couto RamosNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisLea AndreleiNo ratings yet

- Resume Ch.11 Consolidation TheoriesDocument3 pagesResume Ch.11 Consolidation TheoriesDwiki TegarNo ratings yet

- Comprehensive Examination 1 TaxationDocument2 pagesComprehensive Examination 1 TaxationAlysa Sandra HizonNo ratings yet

- Capital Gains Tax PDFDocument3 pagesCapital Gains Tax PDFvalsupmNo ratings yet

- EU Greece Assessment Μarch 2012 PPDocument195 pagesEU Greece Assessment Μarch 2012 PPThanasis KatsikisNo ratings yet

- IA3 Balance SheetDocument6 pagesIA3 Balance SheetJoebin Corporal LopezNo ratings yet

- Memorandum of Association of TRADE ORGANIZATIONDocument8 pagesMemorandum of Association of TRADE ORGANIZATIONSyed Zahid ImtiazNo ratings yet

- Niddf PDFDocument1 pageNiddf PDFMuhammad MudassarNo ratings yet

- Rezoning Proposal For Subdivision PlansDocument186 pagesRezoning Proposal For Subdivision PlansKarly BlatsNo ratings yet

- Scenario Analyzer Mountain Man StudentDocument6 pagesScenario Analyzer Mountain Man StudentCarlos Romani PolancoNo ratings yet

- Clarkson QuestionsDocument5 pagesClarkson QuestionssharonulyssesNo ratings yet

- Unit 1. Fundamentals of Managerial Economics (Chapter 1)Document50 pagesUnit 1. Fundamentals of Managerial Economics (Chapter 1)Felimar CalaNo ratings yet

- Mom and Pop Stores SurvivalDocument2 pagesMom and Pop Stores Survivallonely_hrt123@yahoo.comNo ratings yet

- Atal Pension Yojana contribution chart and minimum guaranteed pension amountsDocument1 pageAtal Pension Yojana contribution chart and minimum guaranteed pension amountsG Pavan Kumar100% (1)

- Economy 1 PDFDocument163 pagesEconomy 1 PDFAnil Kumar SudarsiNo ratings yet

- Please Sign PPP Origination Application - PDF BDocument12 pagesPlease Sign PPP Origination Application - PDF BpayneNo ratings yet

- Merger of e CommerceDocument9 pagesMerger of e CommerceWesley100% (1)