Weekly Market Outlook

23 March 2013

make more, for sure.

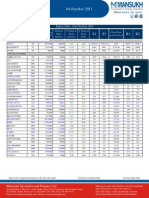

DATA MATRIX FOR THE WEEK 18th Mar 2013 - 22nd Mar 2013 Weekly Markets

Sensex Nifty Gold(US$/oz) Re/US$ Dow Nasdaq FX Res (US$ Bn) 18,736 5,651 1,611.0 54.32 14,421 3,223 292.310 -3.56% -3.78% 1.04% 0.56% -0.64% -0.80% 0.68%

SNAPSHOT

Scaling new lows for 2013, local equity markets registering five negative sessions of performance ended with cut of around four percent for the week gone by. The Indian equity markets plunged in the passing week, breaking all their nearest support levels. No respite emerged from any corner throughout the week and all the recovery attempts vanished in rampant profit booking . While, it was a crucial week and after last week's drubbing marketmen were thinking of some recovery on expectation of Reserve Bank of India easing its monetary policy stance. Though, the expected was delivered with RBI cutting its Repo rate by 25 basis points but the political turmoil weighed on the sentiments. Fear of a similar action for other loan seekers spooked the markets across globe and the local markets too were not spared. But on the domestic front political upheaval once again tormented the markets after one of the allies of the UPA government, DMK led by M Karunanidhi withdrew its support, protesting against the government's perceived dithering on a UN resolution on war crimes in neighbouring country Sri Lanka. Markets closed lower for all the five trading days with benchmarks losing around 4 percent.

3000 2500

Volume* & Volatility Index (Nifty - Mar 2013)

1524 2431 1644 2736

1331

1111

1303

1947

2472

2000 1500 1000

Net FII / DII Equity Activity (Rs Cr) Upto 22.03.13

Total Mar 2013 Total 2013

119

156

132

123

101

100

122

92

7593.0 36,324

-6976.5 -32,074

0 11-Mar 12-Mar 13-Mar 14-Mar 15-Mar 18-Mar 19-Mar 20-Mar 21-Mar 22-Mar *NSE Cash Volume (Rs bn) F & O Volume (Rs bn) Volatility Index %

Weekly Sector Movement

Sectors

Auto Bankex CD CG FMCG Healthcare IT Metal Oil & Gas PSU Realty

WEEK AHEAD

Close

10,115 12,867 6,825 9,124 5,853 7,953 6,788 8,625 8,422 6,377 1,781

%

-4.80 -5.15 -2.22 -6.79 0.07 -1.32 -1.64 -6.87 -5.24 -7.58 2013. The BSE Mid-cap index was down by 306.34 points or 4.80% to 6079.79 and the Small-cap index down by 406.60 -13.04 points or 6.58% to 5772.93. The Nifty plunged by 221.25 points or 3.77% to 5651.35. On the National Stock Exchange

(NSE), Bank Nifty down by 612.50 points or 5.18% to 11204.05, CNX IT down by 104.55 points or 1.45% to 7119.80. The Bombay Stock Exchange (BSE) Sensex tumbled 691.96 points or 3.56% to 18735.60 during the week ended March 22,

A volatile week is in the offing for the Indian stock market as movements are expected to be quite listless ahead of expiry of March series derivatives contracts. However, the week will be shortened with two trading holidays on March 27 and March 29 on account of 'Holi' and 'Good Friday'. Global factors too will have significant impact on the markets for the coming week, given that ECB has fixed Monday Deadline for Cyprus Deal. Meanwhile, the coming week could see diesel getting costlier and PSU OMCs in action again, as Oil Ministry is likely to take a call on charging higher price for diesel after the Madras High Court Hearing on March 22. Markets would also await the release of key macroeconomic indicators, viz, Current Account Deficit, Balance Of Payments and Trade data, to assess the performance of the economy. On the global front, besides Cyprus bail out deal, investors would await the release of few economic data from world's largest economy, United States, starting with Durable Goods Orders data on March 26, followed by New Home Sales data, GDP, Jobless Claims and finally the Personal Income and Outlays data on March 29. Conclusively quite a volatile week we ae expecting in the upcoming sessions with 5580-5550 could be the crucial support zone. On the flip side 5890 followed by 5960 may provide strong resistance. HAPPY HOLI TO ALL OF YOU...............

Please refer to important disclosures at the end of this report For Private circulation Only For Our Clients Only

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@[Link], Website: [Link]

SEBI [Link]: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

86

500

104

FIIs

DIIs

17 16.5 16 15.5 15 14.5 14 13.5 13

1833

�Weekly Market Outlook

make more, for sure.

SENSEX 30-TECHNICAL LEVELS FOR THE UPCOMING WEEK ENDED 29th Mar 2012

SUPPORT SCRIP

Bajaj Auto Ltd Bharat Heavy Electricals Ltd. Bharti Airtel Ltd. Cipla Ltd. Coal India Ltd. Dr Reddys Laboratories Ltd. GAIL (India) Ltd. HDFC Bank Ltd. Hero MotoCorp Ltd. Hindalco Industries Ltd. Hindustan Unilever Ltd. Housing Development Finance Corporation Ltd. ICICI Bank Ltd. Infosys Ltd. ITC Ltd. Jindal Steel & Power Ltd. Larsen & Toubro Ltd. Mahindra & Mahindra Ltd. Maruti Suzuki India Ltd. NTPC Ltd. Oil & Natural Gas Corpn. Ltd. Reliance Industries Ltd. State Bank Of India Sterlite Industries (India) Ltd. Sun Pharmaceutical Inds. Ltd. Tata Consultancy Services Ltd. Tata Motors Ltd. Tata Power Company Ltd. Tata Steel Ltd. Wipro Ltd.

3rd 1567 171 255 360 288 1666 305 559 1535 81 432 736 942 2820 299 316 1284 803 1188 129 279 763 1965 85 808 1521 246 83 300 415

2nd 1675 176 275 373 293 1720 313 586 1585 85 448 767 989 2849 302 330 1349 840 1253 134 289 790 2042 89 822 1542 261 90 316 424

1st 1715 178 287 378 296 1744 316 596 1604 87 454 782 1012 2863 304 336 1373 861 1281 136 294 802 2081 90 827 1551 268 92 322 429

CLOSE PRICE 21.03.13 1755.30 179.80 298.00 382.70 298.60 1767.85 319.25 606.80 1623.20 88.20 459.80 797.30 1035.15 2876.50 304.95 341.30 1396.60 880.70 1308.20 138.10 298.30 813.55 2120.05 91.30 832.15 1560.80 273.75 94.50 327.60 434.15

RESISTANCE 1st 1823 183 306 391 301 1798 323 623 1654 91 469 813 1058 2892 307 350 1438 898 1346 141 304 829 2159 93 841 1572 282 99 337 438 2nd 1890 186 315 399 304 1828 328 639 1685 94 478 828 1082 2907 309 359 1479 916 1384 143 309 844 2198 96 849 1583 291 103 347 441 3rd 1998 192 335 412 309 1882 335 666 1735 98 493 859 1128 2936 313 373 1544 953 1449 148 319 871 2275 99 862 1604 306 110 362 450

INCLINATION

Neutral Negative Neutral Negative Negative Negative Neutral Negative Neutral Negative Neutral Neutral Neutral Neutral Negative Neutral Neutral Neutral Negative Negative Negative Neutral Neutral Neutral Negative Neutral Negative Neutral Negative Positive

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@[Link], Website: [Link]

SEBI [Link]: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

�Weekly Market Outlook

make more, for sure.

NSE MIDCAP 50-TECHNICAL LEVELS FOR THE UPCOMING WEEK ENDED 29th March 2013

SUPPORT SCRIP

Adani Power Ltd. Aditya Birla Nuvo Ltd. Allahabad Bank Andhra Bank Apollo Tyres Ltd. Ashok Leyland Ltd. Aurobindo Pharma Ltd. Bata India Ltd. Bharat Forge Ltd. CESC Ltd. Crompton Greaves Ltd. Dish T V India Ltd. DiviS Laboratories Ltd. GMR Infrastructure Ltd. Godrej Industries Ltd. Hexaware Technologies Ltd. Hindustan Zinc Ltd. Housing Development & Infrastructure Ltd. IDBI Bank Ltd IFCI Ltd. India Cements Ltd. Indian Hotels Company Ltd. Jain Irrigation Systems Ltd. JSW Steel Ltd. Jubilant FoodWorks Ltd. Karnataka Bank Ltd. Mphasis Ltd. MRF Ltd. NHPC Ltd. Opto Circuits (India) Ltd. Oracle Financial Services Software Ltd Oriental Bank Of Commerce Petronet LNG Ltd. Piramal Enterprises Ltd. Punj Lloyd Ltd. Reliance Capital Ltd. Reliance Power Ltd Sintex Industries Ltd. Steel Authority Of India Ltd. Sun TV Network Ltd. Syndicate Bank Tata Chemicals Ltd. Tata Global Beverages Ltd Tech Mahindra Ltd. Union Bank Of India Unitech Ltd. United Phosphorus Ltd. Vijaya Bank Ltd Voltas Ltd. Welspun Corp Ltd.

3rd

33 910 110 85 76 22 128 659 188 263 87 57 854 16 271 83 109 41 75 22 76 52 59 561 1159 114 374 10850 20 39 2509 212 132 566 37 263 53 37 61 311 102 292 115 1024 199 19 111 41 68 32

2nd

38 948 118 90 80 22 138 680 200 270 90 59 905 18 282 86 112 44 79 24 79 53 61 595 1197 124 384 11315 20 44 2603 227 137 581 40 292 59 42 63 353 108 303 120 1046 208 21 114 44 72 40

1st

40 962 121 91 81 23 142 691 205 273 91 60 937 19 287 87 113 46 80 25 81 54 61 610 1211 128 389 11495 21 46 2640 232 140 589 41 303 61 44 63 369 111 307 123 1056 212 22 116 45 74 44

CLOSE PRICE 21.03.13

41.20 976.20 124.30 92.75 82.95 22.85 145.45 701.15 209.80 276.15 92.55 61.15 969.40 20.05 290.80 87.55 114.40 47.50 81.40 25.75 82.90 54.60 62.35 623.85 1225.45 132.25 393.80 11674.00 20.95 48.40 2676.35 238.30 141.65 597.35 42.20 313.30 62.70 45.55 63.90 384.20 112.85 310.40 124.60 1064.85 215.80 23.25 117.95 46.65 76.05 47.60

RESISTANCE 1st

44 1000 129 95 85 23 152 711 216 281 94 63 989 21 298 89 116 49 84 27 85 55 63 644 1249 139 398 11961 21 51 2734 247 145 604 44 331 66 49 65 411 117 317 128 1078 222 25 120 49 79 51

2nd

47 1024 135 98 87 23 158 722 223 286 96 64 1008 23 304 91 118 51 86 28 87 56 65 663 1273 145 403 12247 22 54 2792 255 149 610 46 349 70 52 66 438 121 325 131 1092 228 26 121 51 82 55

3rd

52 1061 143 102 90 24 168 743 234 294 99 66 1060 25 315 93 121 55 90 30 90 58 67 697 1312 155 412 12713 22 60 2886 270 155 625 49 378 75 56 67 481 127 335 136 1115 237 29 125 54 87 63

Market Cap (Rs Crore)

9860 11083 6215 5190 4181 6080 4236 4506 4884 3450 5937 6512 12867 7804 9747 2598 48338 1990 10406 4280 2547 4409 2836 13919 7994 2491 8274 4951 25770 1173 22499 6953 10624 10308 1401 7696 17588 1426 26394 15141 6793 7908 7705 13626 11881 6083 5221 2312 2516 1252

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@[Link], Website: [Link]

SEBI [Link]: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

�Weekly Market Outlook

make more, for sure. FORTHCOMING CORPORATE ACTIONS

Ex-Date Company Name NSE- Symbol

ONGC OMMETALS MANAPPURAM MYSOREBANK IDFC GODREJCP BFUTILITIE HEXAWARE RUCHIRA SBBJ BILENERGY SBT NATIONALUM DICIND GLAXO COLPAL SANOFI KSBPUMPS STYABS CLNINDIA HONAUT CASTROL ABBOTINDIA VESUVIUS RAINCOM SKFINDIA ESABINDIA GPPL RANBAXY

Purpose

Second Interim Dividend Rs.4 Per Share (Purpose Revised) Interim Dividend Re. 0.10 Per Share Interim Dividend Rs. 1.50 Per Share Interim Dividend Rs 11.50 Per Share (Purpose Revised) Interest Payment Annual Book Closure Annual General Meeting Annual General Meeting/Dividend Rs 1.20 Per Share Interim Dividend Dividend Face Value Split From Rs.10/- To Re. 1/Interim Dividend Interim Dividend Re.0.75 Per Share (Purpose Revised) Annual General Meeting/Dividend Rs 4 Per Share Dividend Rs. 50 Per Share Interim Dividend Annual General Meeting/Dividend Rs 29 Per Share Annual General Meeting Annual General Meeting/ Dividend Rs.4.00 Per Share Annual General Meeting/Dividend Rs 17.50 Per Share Annual General Meeting / Dividend Rs 10 Per Share Dividend Rs 3.50 Per Share Annual General Meeting And Dividend Rs.17 Per Share Annual General Meeting/ Dividend Rs. 4.50 Per Share Annual General Meeting/ Dividend Of Rs.1.10 Per Share Annual General Meeting/Dividend Rs 7.50 Per Share Annual General Meeting / Dividend Rs 7.50 Per Share Annual General Meeting Annual General Meeting

22-Mar-13 Oil & Natural Gas Corporation Limited 22-Mar-13 OM Metals Infraprojects Limited 22-Mar-13 Manappuram Finance Limited 22-Mar-13 State Bank of Mysore 25-Mar-13 IDFC Limited 25-Mar-13 Godrej Consumer Products Limited 26-Mar-13 BF Utilities Limited 26-Mar-13 Hexaware Technologies Limited 26-Mar-13 Ruchira Papers Limited 26-Mar-13 State Bank of Bikaner and Jaipur 26-Mar-13 Bil Energy Systems Limited 26-Mar-13 State Bank of Travancore 26-Mar-13 National Aluminium Company Limited 2-Apr-13 4-Apr-13 4-Apr-13 5-Apr-13 5-Apr-13 DIC India Limited GlaxoSmithKline Pharmaceuticals Limited Colgate Palmolive (India) Limited Sanofi India Limited KSB Pumps Limited

10-Apr-13 Styrolution ABS (India) Limited 12-Apr-13 Clariant Chemicals (India) Limited 12-Apr-13 Honeywell Automation India Limited 12-Apr-13 Castrol India Limited 16-Apr-13 Abbott India Limited 16-Apr-13 Vesuvius India Limited 16-Apr-13 Rain Commodities Limited 18-Apr-13 SKF India Limited 18-Apr-13 Esab India Limited 18-Apr-13 Gujarat Pipavav Port Limited 25-Apr-13 Ranbaxy Laboratories Limited

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@[Link], Website: [Link]

SEBI [Link]: BSE: INB 010985834, F&O: INF 010985834 NSE: INB 230781431, F&O: INF 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293

�Weekly Market Outlook

make more, for sure.

EQUITY CALLS PERFORMANCE FOR THE WEEK ENDED 22nd Mar 2013

Total No. of Net Calls

25

Profitable Calls

22

Positional/Hold

2

Exit/Stop Loss

1

Success Rate

95.65%

NAME

Varun Gupta Pashupati Nath Jha Vikram Singh

DESIGNATION

Head - Research Research Analyst Research Analyst

E-MAIL

varungupta@[Link] pashupatinathjha@[Link] vikram_research@[Link]

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you. Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form. The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and non-infringement. The recipients of this report should rely on their own investigations. MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be happy to provide information in response to specific client queries.

Mansukh Securities and Finance Ltd

Mansukh House, Plot No. 6, Opp. Mother Dairy Plant, Patparganj Road, Pandav Nagar, New Delhi-110002, Phone: 91-11-30211800, 47617800, Fax: 011-30117710, Email: research@[Link], Website: [Link]

SEBI Regn No. BSE: BSE: INB010985834 / NSE: INB230781431 SEBI [Link]: INB 010985834, F&O: INF 010985834

PMSINF Regn No. INP000002387 NSE: INB 230781431, F&O: 230781431, DP: IN-DP-CDSL-73-2000, IN-DP-NSDL-140-2000 MCX/TCM/CORP/0740 NCDEX/TCM/CORP/0293