Professional Documents

Culture Documents

Assignment 4

Uploaded by

businessdoctor23Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 4

Uploaded by

businessdoctor23Copyright:

Available Formats

.Beths Society Clothiers, Inc., has collection centers across the country to speed up collections.

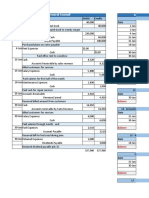

The company also makes payments from remote disbursement centers so the firms checks will take longer to clear the bank. Collection time has been reduced by two and one-half days and disbursement time increased by one and one-half days because of these policies. Excess funds are being invested in short-term instruments yielding 6 percent per annum. a.If the firm has $4 million per day in collections and $3 million per day in disbursements, how many dollars has the cash management system freed up? Freed up cash Dollar: Reduced Collection days = 2.5 x 4million = 10 million Increased disbursement day = 1day for 3 million Total freed up cash = 13million

b.How much can the firm earn in dollars per year on short-term investments made possible by the freed-up cash? 9.Route Canal Shipping Company has the following schedule for aging of accounts receivable: a.Fill in column (4) for each month. b.If the firm had $1,440,000 in credit sales over the four-month period, compute the average collection period. Average daily sales should be based on a 120-day period. c.If the firm likes to see its bills collected in 30 days, should it be satisfied with the average collection period? d.Disregarding your answer to part c and considering the aging schedule for accounts receivable, should the company be satisfied? e.What additional information does the aging schedule bring to the company that the average collection period may not show? Aging of accounts receivable 11.Fisk Corporation is trying to improve its inventory control system and has installed an online computer at its retail stores. Fisk anticipates sales of 75,000 units per year, an ordering cost of $8 per order, and carrying costs of $1.20 per unit. a.What is the economic ordering quantity? b.How many orders will be placed during the year? c.What will the average inventory be? d.What is the total cost of ordering and carrying inventory Compute the cost of not taking the following cash discounts. 2/10, net 50. 2/15, net 40.

3/10, net 45. 3/10, net 180 6. Sol Pine is going to borrow $3,000 for one year at 8 percent interest. What is the effective rate of interest if the loan is discounted

Randall Corporation plans to borrow $200,000 for one year at 12 percent from the Waco State Bank. There is a 20 percent compensating balance requirement. Randall Corporation keeps minimum transaction balances of $10,000 in the normal course of business. This idle cash counts toward meeting the compensating balance requirement. What is the effective rate of interest Question 7.1: Answers a) b)

You might also like

- Solutions Ch04 P35 Build A ModelDocument13 pagesSolutions Ch04 P35 Build A Modelbusinessdoctor23100% (4)

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Reserve Bank of IndiaDocument84 pagesReserve Bank of IndiaSunil ColacoNo ratings yet

- UNSW FINS1612 Chapter01 - TestBankDocument24 pagesUNSW FINS1612 Chapter01 - TestBankelkieNo ratings yet

- Nationalisation of BanksDocument10 pagesNationalisation of BanksKavitha prabhakaranNo ratings yet

- CSEC POA June 2014 P1 PDFDocument12 pagesCSEC POA June 2014 P1 PDFjunior subhanNo ratings yet

- FM - Working Capital MGMTDocument6 pagesFM - Working Capital MGMTSam Sasuman100% (1)

- Finance 510 Graded Final - AaronDocument14 pagesFinance 510 Graded Final - Aaronbusinessdoctor23No ratings yet

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownFrom EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNo ratings yet

- Continental CarrierDocument10 pagesContinental CarrierYetunde James100% (1)

- Assignment 6Document3 pagesAssignment 6businessdoctor23No ratings yet

- Morton Handley & CompanyDocument4 pagesMorton Handley & Companybusinessdoctor23No ratings yet

- Ch7 HW AnswersDocument31 pagesCh7 HW Answerscourtdubs78% (9)

- Multiple Choice Questions General ConceptsDocument10 pagesMultiple Choice Questions General ConceptsAzureBlazeNo ratings yet

- 404 - WCM ExerciseDocument9 pages404 - WCM ExerciseChloe Quirona Policios0% (2)

- DocxDocument32 pagesDocxDaniella Zapata Montemayor100% (1)

- Allied Food ProductsDocument5 pagesAllied Food Productsbusinessdoctor23No ratings yet

- Some ExercisesDocument3 pagesSome ExercisesMinh Tâm NguyễnNo ratings yet

- Chapter5 ExercisesDocument3 pagesChapter5 ExercisesTrần Hoài LinhNo ratings yet

- Untitled DocumentDocument4 pagesUntitled DocumentLizzy MondiaNo ratings yet

- Exercises of Cash Liquidity ManagementDocument8 pagesExercises of Cash Liquidity ManagementTâm ThuNo ratings yet

- 6 - 262728 - Short-Term Finance and PlanningDocument5 pages6 - 262728 - Short-Term Finance and PlanningPham Ngoc VanNo ratings yet

- Seminar Questions Set III A-2Document3 pagesSeminar Questions Set III A-2fanuel kijojiNo ratings yet

- QuestionsDocument71 pagesQuestionsChan Chan50% (4)

- 06 Current Assets ManagementDocument2 pages06 Current Assets ManagementQamber AbbasNo ratings yet

- ACF 103 Exam Revision Qns 20151Document5 pagesACF 103 Exam Revision Qns 20151Riri FahraniNo ratings yet

- Week 7 Home Work ProblemDocument3 pagesWeek 7 Home Work ProblemSandip AgarwalNo ratings yet

- ACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsDocument7 pagesACF 103 - Fundamentals of Finance Tutorial 6 - QuestionsRiri FahraniNo ratings yet

- Working Capital ManagementDocument5 pagesWorking Capital ManagementellaNo ratings yet

- Financial ManagementDocument2 pagesFinancial Managementbakayaro92No ratings yet

- Finals Exercise 1 - WC Management Receivables and InventoryDocument4 pagesFinals Exercise 1 - WC Management Receivables and InventoryMarielle SidayonNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisaramsivaNo ratings yet

- HO No. 3 - Working Capital ManagementDocument2 pagesHO No. 3 - Working Capital ManagementGrace Chavez ManaliliNo ratings yet

- Ratios Test PaperDocument7 pagesRatios Test Papermeesam2100% (1)

- CASH MathDocument3 pagesCASH MathNuzat Nawar TofaNo ratings yet

- Midterm Review Term 3 2011 - 2012Document4 pagesMidterm Review Term 3 2011 - 2012Milles ManginsayNo ratings yet

- MAS 3 WC Management Exercises For UploadDocument3 pagesMAS 3 WC Management Exercises For UploadJaiavave LinogonNo ratings yet

- Working Cap - MGMT QuestionsDocument2 pagesWorking Cap - MGMT Questionscmverma82No ratings yet

- Homework Set IDocument4 pagesHomework Set IjondoedoeNo ratings yet

- MGT325 M3 CashManagementDocument6 pagesMGT325 M3 CashManagementfltdeckabNo ratings yet

- Latih Soal Untuk Mhs Fin MGTDocument13 pagesLatih Soal Untuk Mhs Fin MGTnajNo ratings yet

- MBA Exam 1 Spring 2009Document12 pagesMBA Exam 1 Spring 2009Kamal AssafNo ratings yet

- Answer The Following QuestionsDocument8 pagesAnswer The Following QuestionsTaha Wael QandeelNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and ExercisesPhương Nguyễn ThuNo ratings yet

- FinmnDocument5 pagesFinmnprey kunNo ratings yet

- University of Tunis Tunis Business School: Corporate FinanceDocument3 pagesUniversity of Tunis Tunis Business School: Corporate FinanceArbi ChaimaNo ratings yet

- Part 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyDocument22 pagesPart 1: Multiple Choice 2 Points Each /140 Points 5 Points Deduction For Every 5 Items Answered IncorectlyDanna Karen MallariNo ratings yet

- HHHHHHHH PDFDocument31 pagesHHHHHHHH PDFmohamed saedNo ratings yet

- WC ExercisesDocument5 pagesWC ExercisesRaniel PamatmatNo ratings yet

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and ExercisesAnh TramNo ratings yet

- Problems-Finance Fall, 2014Document22 pagesProblems-Finance Fall, 2014jyoon2140% (1)

- Financial Management Assignment 2023Document2 pagesFinancial Management Assignment 2023mafumhekluivertNo ratings yet

- Accounting MCQDocument7 pagesAccounting MCQsamuelkishNo ratings yet

- QuestionsDocument30 pagesQuestionsArra VillanuevaNo ratings yet

- Chapter 15 Problems UHFM 7th EditionDocument13 pagesChapter 15 Problems UHFM 7th EditionJonas Mondala0% (1)

- Chapter 3 - Concept Questions and ExercisesDocument3 pagesChapter 3 - Concept Questions and Exercisesmin - radiseNo ratings yet

- STR 581 Capstone Final Examination, Part Two - Transweb E TutorsDocument10 pagesSTR 581 Capstone Final Examination, Part Two - Transweb E Tutorstranswebetutors3No ratings yet

- BF Q2 StudentsDocument4 pagesBF Q2 StudentsCarmen Dana SuarezNo ratings yet

- Tutorial 5 & 6 - SolutionDocument6 pagesTutorial 5 & 6 - SolutionHamza IftekharNo ratings yet

- Working Capital BrighamDocument9 pagesWorking Capital BrighamOkasha AliNo ratings yet

- Chapter 3 Working With Financial Statement - Student VersionDocument4 pagesChapter 3 Working With Financial Statement - Student VersionNga PhamNo ratings yet

- Before Course Exam SBSDocument17 pagesBefore Course Exam SBSGia LâmNo ratings yet

- Quiz Week 1 QnsDocument7 pagesQuiz Week 1 Qnsesraa karamNo ratings yet

- Class Activity Exercises in FinancingDocument2 pagesClass Activity Exercises in FinancingSoothing BlendNo ratings yet

- Test 2 True / False QuestionsDocument6 pagesTest 2 True / False QuestionsIslam FarhanaNo ratings yet

- You Have The Following Information For Estée Lauder CompaniesDocument4 pagesYou Have The Following Information For Estée Lauder CompaniesÂn ThiênNo ratings yet

- Problem 7Document5 pagesProblem 7businessdoctor23No ratings yet

- Chapt 8Document2 pagesChapt 8businessdoctor23No ratings yet

- Forum Topic Response Grading RubricDocument1 pageForum Topic Response Grading Rubricbusinessdoctor23No ratings yet

- FIN 510 Syllabus Part 2 - Winter 2, 2013Document14 pagesFIN 510 Syllabus Part 2 - Winter 2, 2013businessdoctor23No ratings yet

- Day # Subject System/chapter BooksDocument1 pageDay # Subject System/chapter Booksbusinessdoctor23No ratings yet

- Risk Management in Punjab National BankDocument76 pagesRisk Management in Punjab National BankAshis SahooNo ratings yet

- Week 11 - Tutorial QuestionsDocument7 pagesWeek 11 - Tutorial QuestionsVuong Bao KhanhNo ratings yet

- WWW Simandhareducation Com Blogs Mba Vs Cpa What Is Wiser To ChooseDocument5 pagesWWW Simandhareducation Com Blogs Mba Vs Cpa What Is Wiser To Choosesrinu patroNo ratings yet

- FAR610 - Test 1-Apr2018-Q PDFDocument3 pagesFAR610 - Test 1-Apr2018-Q PDFIman NadhirahNo ratings yet

- General AnnuityDocument15 pagesGeneral AnnuityJORENCE PHILIPP ENCARNACIONNo ratings yet

- Assignment 3 - AccountingDocument5 pagesAssignment 3 - AccountingGulzar JamalNo ratings yet

- No. Account Titles and Explanation Debit CreditDocument11 pagesNo. Account Titles and Explanation Debit CreditJorenz UndagNo ratings yet

- DLF Announces Annual Results For FY10: HistoryDocument7 pagesDLF Announces Annual Results For FY10: HistoryShalinee SinghNo ratings yet

- AC - OSE JUMMAI OGBONYA - APRIL, 2021 - 681964006 - FullStmtDocument5 pagesAC - OSE JUMMAI OGBONYA - APRIL, 2021 - 681964006 - FullStmtDauda jibrilNo ratings yet

- Customer Satisfaction On Housing Loan in SBI BankDocument23 pagesCustomer Satisfaction On Housing Loan in SBI BankDebjyoti Rakshit100% (2)

- Last Assignment December 2022Document77 pagesLast Assignment December 2022DavidNo ratings yet

- Part 2 FIRST Comprehensive Exam - Section A - Qs 03 Jun 2023Document30 pagesPart 2 FIRST Comprehensive Exam - Section A - Qs 03 Jun 2023rdjimenez.auNo ratings yet

- Cambridge O Level: Accounting 7707/23Document15 pagesCambridge O Level: Accounting 7707/23Prince AhmedNo ratings yet

- Consumer Client Manual CitibankDocument32 pagesConsumer Client Manual CitibankGuillermo CarranzaNo ratings yet

- Chap. 8. The Search For Entrepreneurial Ventures NewDocument39 pagesChap. 8. The Search For Entrepreneurial Ventures NewAudrey CoronadoNo ratings yet

- Acc 102 - Module 3aDocument12 pagesAcc 102 - Module 3aPatricia CarreonNo ratings yet

- Bank Name Account NumberDocument4 pagesBank Name Account Numberhemant kangriwalaNo ratings yet

- AFAR02 04 Franchise AccountingDocument4 pagesAFAR02 04 Franchise AccountingNicoleNo ratings yet

- Schroders: Schroder ISF Global SMLR Coms A Acc USDDocument2 pagesSchroders: Schroder ISF Global SMLR Coms A Acc USDSam AbdurahimNo ratings yet

- Deposit Slip 3Document11 pagesDeposit Slip 3AlfazzastoreNo ratings yet

- Tutorial Questions FinDocument16 pagesTutorial Questions FinNhu Nguyen HoangNo ratings yet

- JAIIB Syllabus 2024 and Exam Pattern, IIBF JAIIB Syllabus PDFDocument34 pagesJAIIB Syllabus 2024 and Exam Pattern, IIBF JAIIB Syllabus PDFGauthamNo ratings yet

- Importance of Life InsuranceDocument3 pagesImportance of Life InsuranceManya NagpalNo ratings yet

- Solution Accounting 2Document3 pagesSolution Accounting 2Hanzo vargasNo ratings yet

- Cycle Test Ii AnswerDocument46 pagesCycle Test Ii Answersumitha ganesanNo ratings yet