Professional Documents

Culture Documents

Peer Review Report Combined: Phase 1 + Phase 2: Finland

0 ratings0% found this document useful (0 votes)

188 views100 pagesThe Global Forum on transparency and exchange of information for Tax Purposes is the multilateral framework within which work in the area of tax transparency and exchange of information is carried out. The standards provide for international exchange on request of foreseeably relevant information for the administration or enforcement of the domestic tax laws of a requesting party. All members of the Global Forum, as well as jurisdictions identified by The Global Forum as relevant to its work, are being reviewed.

Original Description:

Original Title

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Global Forum on transparency and exchange of information for Tax Purposes is the multilateral framework within which work in the area of tax transparency and exchange of information is carried out. The standards provide for international exchange on request of foreseeably relevant information for the administration or enforcement of the domestic tax laws of a requesting party. All members of the Global Forum, as well as jurisdictions identified by The Global Forum as relevant to its work, are being reviewed.

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

188 views100 pagesPeer Review Report Combined: Phase 1 + Phase 2: Finland

The Global Forum on transparency and exchange of information for Tax Purposes is the multilateral framework within which work in the area of tax transparency and exchange of information is carried out. The standards provide for international exchange on request of foreseeably relevant information for the administration or enforcement of the domestic tax laws of a requesting party. All members of the Global Forum, as well as jurisdictions identified by The Global Forum as relevant to its work, are being reviewed.

Copyright:

© All Rights Reserved

You are on page 1of 100

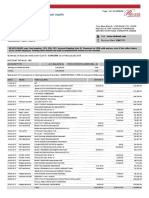

GLOBAL FORUM ON TRANSPARENCY AND EXCHANGE

OF INFORMATION FOR TAX PURPOSES

Peer Review Report

Combined: Phase 1 + Phase 2

-:HSTCQE=V^V^WV:

ISBN 978-92-64-19192-1

23 2013 07 1 P

Global Forum on Transparency and Exchange of Information

for Tax Purposes

PEER REVIEWS, COMBINED: PHASE 1 + PHASE 2

FINLAND

The Global Forum on Transparency and Exchange of Information for Tax Purposes is the

multilateral framework within which work in the area of tax transparency and exchange of

information is carried out by 120 jurisdictions, which participate in the Global Forum on an

equal footing.

The Global Forum is charged with in-depth monitoring and peer review of the implementation

of the international standards of transparency and exchange of information for tax purposes.

These standards are primarily reected in the 2002 OECD Model Agreement on Exchange

of Information on Tax Matters and its commentary, and in Article 26 of the OECD Model

Tax Convention on Income and on Capital and its commentary as updated in 2004. The

standards have also been incorporated into the UN Model Tax Convention.

The standards provide for international exchange on request of foreseeably relevant

information for the administration or enforcement of the domestic tax laws of a requesting

party. Fishing expeditions are not authorised but all foreseeably relevant information must be

provided, including bank information and information held by duciaries, regardless of the

existence of a domestic tax interest or the application of a dual criminality standard.

All members of the Global Forum, as well as jurisdictions identied by the Global Forum

as relevant to its work, are being reviewed. This process is undertaken in two phases.

Phase 1 reviews assess the quality of a jurisdictions legal and regulatory framework for

the exchange of information, while Phase 2 reviews look at the practical implementation of

that framework. Some Global Forum members are undergoing combined Phase 1 and

Phase 2 reviews. The Global Forum has also put in place a process for supplementary

reports to follow-up on recommendations, as well as for the ongoing monitoring of

jurisdictions following the conclusion of a review. The ultimate goal is to help jurisdictions

to effectively implement the international standards of transparency and exchange of

information for tax purposes.

All review reports are published once approved by the Global Forum and they thus represent

agreed Global Forum reports.

For more information on the work of the Global Forum on Transparency and Exchange of

Information for Tax Purposes, and for copies of the published review reports, please refer to

www.oecd.org/tax/transparency and www.eoi-tax.org.

FINLAND

P

e

e

r

R

e

v

i

e

w

R

e

p

o

r

t

C

o

m

b

i

n

e

d

P

h

a

s

e

1

+

P

h

a

s

e

2

F

I

N

L

A

N

D

Consult this publication on line at http://dx.doi.org/10.1787/9789264191938-en.

This work is published on the OECD iLibrary, which gathers all OECD books, periodicals and

statistical databases.

Visit www.oecd-ilibrary.org for more information.

Global Forum

on Transparency

and Exchange

of Information for Tax

Purposes Peer Reviews:

Finland

2013

COMBINED: PHASE 1 + PHASE 2

March 2013

(reflecting the legal and regulatory framework

as at December 2012)

This work is published on the responsibility of the Secretary-General of the

OECD. The opinions expressed and arguments employed herein do not

necessarily reflect the official views of the OECD or of the governments of its

member countries or those of the Global Forum on Transparency and Exchange

of Information for Tax Purposes.

This document and any map included herein are without prejudice to the status

of or sovereignty over any territory, to the delimitation of international frontiers

and boundaries and to the name of any territory, city or area.

ISBN 978-92-64-19192-1 (print)

ISBN 978-92-64-19193-8 (PDF)

Series: Global Forum on Transparency and Exchange of Information for Tax Purposes Peer Reviews

ISSN 2219-4681 (print)

ISSN 2219-469X (online)

Corrigenda to OECD publications may be found on line at: www.oecd.org/publishing/corrigenda.

OECD 2013

You can copy, download or print OECD content for your own use, and you can include excerpts from OECD

publications, databases and multimedia products in your own documents, presentations, blogs, websites and

teaching materials, provided that suitable acknowledgement of OECD as source and copyright owner is given.

All requests for public or commercial use and translation rights should be submitted to rights@oecd.org.

Requests for permission to photocopy portions of this material for public or commercial use shall be addressed

directly to the Copyright Clearance Center (CCC) at info@copyright.com or the Centre franais dexploitation du

droit de copie (CFC) at contact@cfcopies.com.

Please cite this publication as:

OECD (2013), Global Forum on Transparency and Exchange of Information for Tax Purposes Peer

Reviews: Finland 2013: Combined: Phase 1 + Phase 2, OECD Publishing.

http://dx.doi.org/10.1787/9789264191938-en

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

TABLE OF CONTENTS 3

Table of Contents

About the Global Forum. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

Executive Summary. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

Introduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

Information and methodology used for the peer review of Finland. . . . . . . . . . . . 9

Overview of Finland . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

Compliance with the Standards . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

A. Availability of Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17

A.1. Ownership and identity information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

A.2. Accounting records . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

A.3. Banking information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 44

B. Access to Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 49

B.1. Competent Authoritys ability to obtain and provide information . . . . . . . . 50

B.2. Notification requirements and rights and safeguards. . . . . . . . . . . . . . . . . . 59

C. Exchanging Information . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61

Overview . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 61

C.1. Exchange-of-information mechanisms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 63

C.2. Exchange-of-information mechanisms with all relevant partners . . . . . . . . 70

C.3. Confidentiality . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 72

C.4. Rights and safeguards of taxpayers and third parties. . . . . . . . . . . . . . . . . . 74

C.5. Timeliness of responses to requests for information . . . . . . . . . . . . . . . . . . 75

Summary of Determinations and Factors Underlying Recommendations. . . . 81

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

4 TABLE OF CONTENTS

Annex 1: Jurisdictions Response to the Review Report . . . . . . . . . . . . . . . . . . 85

Annex 2: List of All Exchange of Information Mechanisms . . . . . . . . . . . . . . . 86

Annex 3: List of All Laws, Regulations and Other Relevant Material . . . . . . . 94

Annex 4: People Interviewed During On-Site Visit . . . . . . . . . . . . . . . . . . . . . . 96

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

ABOUT THE GLOBAL FORUM 5

About the Global Forum

The Global Forum on Transparency and Exchange of Information for Tax

Purposes is the multilateral framework within which work in the area of tax

transparency and exchange of information is carried out by over 100 jurisdic-

tions, which participate in the Global Forum on an equal footing.

The Global Forum is charged with in-depth monitoring and peer review

of the implementation of the international standards of transparency and

exchange of information for tax purposes. These standards are primarily

reflected in the 2002 OECD Model Agreement on Exchange of Information

on Tax Matters and its commentary, and in Article 26 of the OECD Model

Tax Convention on Income and on Capital and its commentary as updated in

2004, which has been incorporated in the UN Model Tax Convention.

The standards provide for international exchange on request of foreseeably

relevant information for the administration or enforcement of the domestic tax

laws of a requesting party. Fishing expeditions are not authorised but all fore-

seeably relevant information must be provided, including bank information

and information held by fiduciaries, regardless of the existence of a domestic

tax interest or the application of a dual criminality standard.

All members of the Global Forum, as well as jurisdictions identified by the

Global Forum as relevant to its work, are being reviewed. This process is under-

taken in two phases. Phase 1 reviews assess the quality of a jurisdictions legal

and regulatory framework for the exchange of information, while Phase 2 reviews

look at the practical implementation of that framework. Some Global Forum

members are undergoing combined Phase 1 and Phase 2 reviews. The Global

Forum has also put in place a process for supplementary reports to follow-up on

recommendations, as well as for the ongoing monitoring of jurisdictions following

the conclusion of a review. The ultimate goal is to help jurisdictions to effectively

implement the international standards of transparency and exchange of informa-

tion for tax purposes.

All review reports are published once approved by the Global Forum and

they thus represent agreed Global Forum reports. For more information on the

work of the Global Forum on Transparency and Exchange of Information for Tax

Purposes, and for copies of the published review reports, please refer to www.

oecd.org/tax/transparency and www.eoi-tax.org.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

EXECUTIVE SUMMARY 7

Executive Summary

1. This report summarises the legal and regulatory framework for

transparency and exchange of information in Finland as well as the practi-

cal implementation of that framework. The international standard, which

is set out in the Global Forums Terms of Reference to Monitor and Review

Progress Towards Transparency and Exchange of Information, is concerned

with the availability of relevant information within a jurisdiction, the compe-

tent authoritys ability to gain timely access to that information, and whether

that information can be effectively exchanged with the jurisdictions exchange

of information partners.

2. Finland is a Nordic country situated in the Fennoscandian region of

Northern Europe with approximately 5.4 million inhabitants. Finlands econ-

omy is primarily based on the service, manufacturing and refinery sectors.

Finland has a comprehensive income tax system for natural and legal persons

and has been concluding double taxation conventions (DTCs) allowing for the

international exchange of information since the late 1960s.

3. Finlands legal and regulatory framework for the maintenance of

ownership information ensures that such information is available with respect

to relevant entities and arrangements. In practice, to reply to most requests

concerning ownership information, the Finnish competent authority can

simply access its databases, where relevant information collected from tax-

payers and third parties is stored. The quality of the framework is recognised

by Finlands peers who confirmed that Finland has an excellent track record

in delivering ownership information whenever requested. Finland prohibited

the issuance of bearer shares since 1 January 1980, and there are mechanisms

in place to identify the holder of bearer shares issued prior to that date that

might still be in circulation in Finland.

4. Relevant legal entities and arrangements are required to keep full

accounting records and underlying documentations for a period of 10 years

and 6 years, respectively.

5. In Finland, the Ministry of Finance is the designated competent authority

for DTCs and Tax Information Exchange Agreements (TIEAs), the Multilateral

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

8 EXECUTIVE SUMMARY

Convention on Mutual Administrative Assistance in Tax Matters (Multilateral

Convention) and certain EU legislation. The Ministry has delegated its competent

authority to the tax authority in most cases. The competent authority has access

to information held in its own databases as well as the databases maintained

jointly with the National Board of Patents and Registration of Finland (NBPRF).

The competent authority also has broad powers to obtain bank, ownership,

identity, and accounting information and measures are in place to compel the pro-

duction of such information. The application of rights and safeguards in Finland

does not restrict the scope of information that the tax authority can obtain. Inputs

received from Finlands peers suggest that Finland has not encountered any dif-

ficulties accessing information to respond to an EOI request.

6. Finland has a longstanding involvement in international exchange of

information in tax matters. Currently, Finland is able to exchange informa-

tion in tax matters through a broad network of EOI arrangements covering

119 jurisdictions. Out of these 119 jurisdictions, 71 of those are DTCs and

39 are TIEAs. The remaining nine jurisdictions are parties only to the

Multilateral Convention and/or the Nordic Mutual Assistance Convention on

Mutual Administrative Assistance in Tax Matters. Out of the 110 DTCs and

TIEAs, 95 are currently in force. Finland was one of the first countries to

sign and ratify the Multilateral Convention and the 2010 protocol. The 2010

protocol was ratified and is in force since 1 June 2011. A domestic tax inter-

est requirement does not exist in Finland and there are no restrictions in the

Finnish legislation as regards the competent authoritys access to information

held by banks. Finlands EOI arrangements cover all its relevant partners

including major trading partners as well as the EU and the OECD member

jurisdictions.

7. Regarding the effectiveness of exchange of information, Finlands

competent authority has more than adequate resources to exchange informa-

tion effectively. There is sufficient professional staff with clear responsibility

for processing requests and retrieving and obtaining the requested infor-

mation. The staff members also possess the required expertise and have

undergone training specific to international exchange of information. Inputs

received from Finlands peers suggest that Finlands practices in terms

of exchange of information are of a very high standard and they consider

Finland to be a reliable, efficient and cooperative exchange of information

partner. Out of 220 incoming requests on direct taxation matters received

from 2009 to 2011, Finland managed to answer 93.2% of the cases within

90 days and 4.6% of the cases within 180 days. No cases took more than one

year for Finland to furnish a reply.

8. A follow up report on the steps undertaken by Finland to answer the

recommendation made in this report should be provided to the PRG within

twelve months after the adoption of this report.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

INTRODUCTION 9

Introduction

Information and methodology used for the peer review of Finland

9. The assessment of the legal and regulatory framework of Finland and

the practical implementation and effectiveness of this framework was based

on the international standard for transparency and exchange of information as

described in the Global Forums Terms of Reference to Monitor and Review

Progress Towards Transparency and Exchange of Information, and was

prepared using the Global Forums Methodology for Peer Reviews and Non-

Member Reviews. The assessment was based on the laws, regulations, and

exchange of information mechanisms in force or effect as at December 2012,

Finlands responses to the Phase 1 and Phase 2 questionnaires, other informa-

tion, explanations and materials supplied by Finland during the on-site visit

that took place in Helsinki on 14 to 16 August 2012, and information supplied

by partner jurisdictions. During the on-site visit, the assessment team met

with officials and representatives of the relevant Finland government agen-

cies including the Ministry of Finance, the Financial Supervisory Authority,

the National Board of Patents and Registration of Finland, the Finnish Tax

Administration and the Uusimma Tax Auditing Unit (see Annex 4).

10. The Terms of Reference (ToR) breaks down the standard of trans-

parency and exchange of information into 10 essential elements and 31

enumerated aspects under three broad categories: (A) availability of infor-

mation; (B) access to information; and (C) exchange of information. This

combined review assesses Finlands legal and regulatory framework and the

implementation and effectiveness of this framework against these elements

and each of the enumerated aspects. In respect of each essential element, a

determination is made regarding Finlands legal and regulatory framework

that either: (i) the element is in place; (ii) the element is in place but certain

aspects of the legal implementation of the element need improvement; or

(iii) the element is not in place. These determinations are accompanied by

recommendations for improvement where relevant. In addition, to reflect the

Phase 2 component, recommendations are also made concerning Finlands

practical application of each of the essential elements. As outlined in the Note

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

10 INTRODUCTION

on Assessment Criteria, following a jurisdictions Phase 2 review, a Rating

will be applied to each of the essential elements to reflect the overall position

of a jurisdiction. However, this rating will only be published at such time as

a representative subset of Phase 2 reviews is completed. This report there-

fore includes recommendations in respect of Finlands legal and regulatory

framework and the actual implementation of the essential elements, as well

as a determination on the legal and regulatory framework, but it does not

include a rating of the elements.

11. The assessment was conducted by a team which consisted of

two assessors and two representatives of the Global Forum Secretariat:

Mr. Frederick Strauss, Deputy Tax Attach, Internal Revenue Service of the

United States; Mr. Bulent Citci, Senior Tax Inspector, Tax Inspection Board

of Turkey; Mr. Robin Ng and Ms. Renata Teixeira from the Global Forum

Secretariat.

Overview of Finland

12. Finland is a Nordic country situated in the Fennoscandian region of

Northern Europe with an area of 338 424 square kilometres. It has borders

with Sweden to the west, Norway to the north, the Russia Federation to the

east and Estonia to the south across the Gulf of Finland. Finland is the most

heavily forested country in Europe covering approximately 86% of the coun-

trys total area. There are also 187 888 lakes and 179 584 islands in Finland.

13. Finland has a population of approximately 5.4 million inhabitants and

an average population density of 16 inhabitants per square kilometre. Finnish

and Swedish are the official languages of Finland.

14. Finland has a highly industrialised mixed economy with a per

capita output matching those of France, Germany, United Kingdom and

Belgium. Gross Domestic Product (GDP) in 2011 was EUR 171 billion with

66% of its GDP generated by the service sector and 31% by the manufactur-

ing and refinery sectors. Finland adopted the EURO currency on 1 January

2002.

15. Finlands main trading partners are Russia, Germany, Sweden,

China, Netherlands, the United States and the United Kingdom.

1

Main inves-

tors in Finland in recent years have been Sweden, the United States, Spain the

United Kingdom and Denmark.

2

1. Statistics Finland (www.stat.fi/tup/suoluk/suoluk_kotimaankauppa_en.html#

foreigntrade).

2. Invest in Finland (www.investinfinland.fi/ ).

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

INTRODUCTION 11

16. Finland is one of the founding members of the Organisation for

Security and Co-operation in Europe (OSCE) and the World Trade Organisa-

tion (WTO), and a member of the International Monetary Fund (IMF) and

the World Bank (since 1948), the United Nations (1955), the Organisation for

Economic Co-operation and Development (1969) and the Council of Europe

(1989). Finland acceded to the European Union (EU) on 1 January 1995 and

was one of the 12 original EU countries of the euro zone. As an OECD coun-

try, Finland has been a member of the Global Forum on Transparency and

Exchange of Information for Tax Purposes since its creation.

General information on legal system and the taxation system

Legal system

17. Finland has a Nordic civil law legal system. Laws are codified as Acts

of Parliament, but customary laws are also recognised. Major sources of law

are the 1999 Constitution, Acts, Regulations, precedents, government bills

and customary law. International treaties on tax matters are brought into force

by Acts in Finland (s. 95, Constitution). In cases of inconsistencies between

domestic law and international treaties, international treaties take precedence.

Moreover, Finland is a signatory of the Vienna Convention on the Law of

Treaties.

18. Finland has a mixed presidential/parliamentary system with execu-

tive powers divided between the President and the Prime Minister. The

President directs national security and foreign affairs policies while the Prime

Minister has primary responsibility for all other areas, including European

Union (EU) issues. The President is elected for a term of six years and may

remain in office for a maximum of two consecutive terms. The supreme deci-

sion-making authority in Finland is vested with the Parliament that approves

the state budget, enacts legislation and ratifes international treaties. The 200

Members of Parliament are elected once every four years.

19. The court system for civil and criminal jurisdiction consists of District

Courts (krjoikeus), Courts of Appeal (hovioikeus), and the Supreme

Court (korkein oikeus). The administrative branch of justice consists of

Administrative Courts (hallinto-oikeus) and the Supreme Administrative

Court (korkein hallinto-oikeus). In addition to the regular courts, there are

also some special courts in certain branches of administration. For instance,

there is a High Court of Impeachment (valtakunnanoikeus) for criminal

charges against certain high-ranking officeholders and also the Market Court

(markkinaoikeus), the Labour Court (tytuomioistuin), the Insurance Court

(vakuutusoikeus) and the Prison Court (vankilaoikeus). The independence of

the judiciary is enshrined in the Constitution.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

12 INTRODUCTION

Tax system

20. Under the Finnish Constitution, the right of taxation lies with the

State (central government), the municipalities (communes) and the local com-

munities of the Evangelical-Lutheran and Orthodox Churches.

21. Income tax is levied under the Finnish Income Tax Act (TVL). Under

this Act, resident taxpayers are subject to tax on their worldwide income,

while non-residents are taxed on income originating from Finland (ss. 9 and

10, TVL). An individual is deemed to be resident in Finland if he has his main

place of abode in Finland or if he is continuously present in Finland for a

period of more than six months. A presence is deemed continuous irrespective

of temporary absence. Finnish nationals are considered a resident of Finland

for three years after the end of the year in which he left the country, unless he

shows that he has not maintained essential ties in Finland during the tax years

concerned. However, under the terms of tax treaties, the three-year rule may

be negated if the individual is deemed resident in another country.

22. An individual is taxed separately on earned income and income

from investment. Earned income is subject to national income tax, municipal

income tax and church tax. Earned income includes salaries, wages and bene-

fits in kind. Taxes on wages and salaries paid by an employer are collected via

a withholding tax mechanism. Investment income includes dividend income,

capital gains, certain interest income and income from rental activities. As

from 2006, all taxpayers (except legal persons) are within an assessment

system where they are not required to file an income tax return on their own

initiative. The tax authority sends pre-completed tax return to the taxpayer

in the month of March or April of the year following the tax year. The pre-

completed tax return contains an estimated assessment based on information

collected from various sources such as the employers, banks, pension funds,

insurance companies and the stock exchange. The individual taxpayer must

sign and return the pre-completed tax return by 8 or 15 May (as provided for

on the form) only if he has corrections or amendments. Assessment of taxable

income for a non-resident is determined under the same procedure as for resi-

dents. Individuals are subject to a progressive income rate for earned income

and a flat rate for investment income. The taxation on earned income consists

of the progressive state rate (6.5% to 29.75%), communal tax (between 15.5%

and 21.5% or average of 19.25%), social security contribution (2%) and church

tax (between 1% and 2.15%). The overall tax rate for earned income ranges

from 0% to about 55%. Tax rate for investment income is 30% and 32% for

capital gains exceeding EUR 50 000.

23. Basic tax regulations relating to corporations are contained in the

Business Income Tax Law (EVL). The net business income of all taxpayers

is determined in accordance with the Act. If the Business Income Tax Law

does not contain a relevant provision dealing with the stream of income, then

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

INTRODUCTION 13

the TVL will be applied as it can be applied to both companies and individu-

als. Companies that are treated as corporate bodies are subject to corporate

income tax at a flat rate. There is no local or municipal taxation on corporate

taxpayers. Resident private companies (Oy), public companies (Oyj), co-oper-

atives, European companies (SEs), branches and permanent establishments of

foreign companies are subject to corporate income tax. General and limited

partnerships and European economic interest groupings (EEIGs) are not rec-

ognised as separate taxpayers and their profits are taxed in the hands of the

partners (ss. 4, 9 and 16a, TVL). The tax rate for corporations is 24.5% with

effect from 1 January 2012.

24. The TVL does not contain provisions defining the meaning of resi-

dence with regard to corporate bodies but according to present practice, a

corporate body is regarded as resident in Finland only if it is registered

(incorporated) in Finland or otherwise established under Finnish Law.

Generally, foreign companies are not considered resident of Finland even

if they are effectively managed in Finland. Nevertheless, such presence

may create a permanent establishment if the conditions in the domestic law

and the relevant Double Taxation Conventions (DTCs) definitions are met.

Resident companies are subject to tax on their worldwide income. Branches

of non-resident companies are taxed on their Finnish-sourced income and on

income attributable to the branch.

25. A company must file a tax return with the tax authority within 4

months from the end of each accounting year. A non-resident or a branch

of a foreign company must also submit its tax return to the Corporate Tax

Office of Uusimaa. However, if the assessment of the non-resident is under

the purview of the Tax Office for Major Corporations, the tax return must

be submitted to it. In addition, the tax return can be submitted to any tax

office in Finland or a foreign embassy of Finland that will forward it to the

Corporate Tax Office of Uusimaa or Tax Office for Major Corporations. In

addition, assessments must be completed within 10 months from the end of

the last month of the accounting year.

International exchange of information for tax purposes

26. The negotiations of tax agreements, including any types of EOI

arrangements are under the purview of the Ministry of Finance. Finland has

an extensive network of EOI agreements. Of these agreements, 71 are DTCs

and 39 are Tax Information Exchange Agreements (TIEAs). Finland is also

a party to the multilateral Convention on Mutual Administrative Assistance

in Tax Matters (Multilateral Convention) and the Nordic Mutual Assistance

Convention on Mutual Administrative Assistance in Tax Matters (Nordic

Convention). In 2009, 2010 and 2011, Finland received 220 requests for infor-

mation on direct taxation matters from its EOI partners.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

14 INTRODUCTION

Overview of the financial sector and relevant professions

27. The financial sector in Finland has to comply with a number of EU

regulations and directives. Most of the participants in the financial sector,

such as the investors, banks, intermediaries, stock exchanges and central

securities depositories (CSDs), must provide information to Finnish national

authorities. The Financial Supervisory Authority (FIN-FSA)

3

is the supervi-

sory authority for Finlands financial and insurance sectors. The supervised

entities include banks

4

, insurance and pension companies, investment firms,

fund management companies and the Helsinki Stock Exchange. The activities

subject to supervision include trade reporting, insider trading, public offers,

investment services and banking services. The supervision of the stock

exchange and the CSDs is divided between the Ministry of Finance and FIN-

FSA. The Bank of Finland (acting as central bank) also plays a major role in

oversight of the CSD.

28. The financial sector supervisory authorities in the EU co-operate and

exchange information through three European Supervision Authorities the

European Banking Authority, the European Securities and Markets Authority

and the European Insurance and Occupational Pensions Authority.

Anti money laundering/combating financing of terrorism

legislation

29. In Finland, responsibility for the development of anti-money launder-

ing legislation is vested with the Ministry of the Interior while the FIN-FSA

and other assigned national bodies are responsible for ensuring that the pro-

cedures, risk management and internal control of supervised entities meet the

statutory requirements. The Finnish Financial Intelligence Unit (FIN-FIU)

operating in cooperation with the National Bureau of Investigation deals with

reports submitted to it on suspicious transactions.

30. The Act on Preventing and Clearing Money Laundering and Terrorist

Financing (AML Law) transposing the requirements of the EUs third Anti-

Money Laundering Directive and its complementary European Commission

Directive became effective in Finland on 1 August 2008. The Act is further

supplemented by Government Decrees 616/2008, 1204/2011, Ministry of the

Interiors decision 156/2012 and Governments decision 1022/2010. Finland

went through the FATF mutual evaluation in 2007, and the mutual evaluation

3. www.finanssivalvonta.fi/en/About_us/Pages/Default.aspx.

4. There are 14 commercial banks, 211 member banks of the OP-Pohjola Group,

36 local co-operative banks, 33 saving banks and 16 branches of foreign banks

authorised to accept deposits operating in Finland as at 31 December 2011.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

INTRODUCTION 15

report was adopted by the FATF plenary in June 2007. Since 2007, seven

follow-up reports have been submitted with the latest one in October 2012.

Recent developments

31. The Finnish authority advised that it is currently in negotiations

or planning negotiations with Albania, Botswana, Chile, Egypt, Jamaica,

Panama, Oman, the United Arab Emirates, Kuwait, Peru, Qatar, Saudi Arabia,

Tunisia, Turkmenistan, Uzbekistan and Russia for EOI agreements. They have

also initialled the EOI agreement with Malaysia in November 2011 and with

Hong Kong, China and Tajikistan in May and June 2012, respectively.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 17

Compliance with the Standards

A. Availability of Information

Overview

32. Effective exchange of information requires the availability of reliable

information. In particular, it requires information on the identity of owners

and other stakeholders as well as information on the transactions carried out

by entities and other organisational structures. Such information may be kept

for tax, regulatory, commercial or other reasons. If such information is not

kept or the information is not maintained for a reasonable period, a jurisdic-

tions competent authority

5

may not be able to obtain and provide it when

requested. This section of the report describes and assesses Finlands legal

and regulatory framework for availability of information. It also assesses the

implementation and effectiveness of this framework.

33. Finnish law provides for the formation of a wide range of legal enti-

ties and arrangements. Private limited liability company is the most common

form of legal entity in Finland. Comprehensive obligations are consistently

imposed on companies and partnerships to ensure that ownership information

is available in the hands of public authorities, the entity itself or custodians.

The issuance of bearer shares has been forbidden in Finland since 1 January

1980 and there are mechanisms in place to identify the holder of bearer

5. The term competent authority means the person or government authority des-

ignated by a jurisdiction as being competent to exchange information pursuant

to a double tax convention or tax information exchange agreement.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

18 COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION

shares issued prior to that date. The obligations to keep ownership informa-

tion under company law and tax laws are complemented by the anti-money

laundering legislation. Enforcement provisions are in place to ensure the

availability of ownership and identity information.

34. The concept of trusts that exists under common law does not exist

under Finnish law. However, there are no obstacles for a Finnish person to act

as trustee of a foreign trust. The Finnish tax authorities indicated that they

are not aware of any instances where foreign trusts have been administered

by Finnish persons. The combination of general record-keeping requirements

under the tax law and the customer due diligence requirements under the

AML Law appears to allow information on settlor(s) and beneficiaries of for-

eign trusts with a Finnish resident trustee to be made available to the Finnish

authorities.

35. As far as accounting information is concerned, the Finnish Accounting

Act requires all relevant entities and arrangements to keep accounting

records and underlying documentations for a period of 10 years and 6 years,

respectively.

36. Enforcement provisions are in place to ensure the availability of

information in accordance with the international standards.

37. With regard to banking information, the Accounting Act and the

AML Law require banks and other financial institutions to keep transaction

records and conduct customer due diligence. Consequently, information of

account holders, including all records pertaining to the account holder, bank

accounts and transactions is available.

38. The Finnish tax authority possesses a very comprehensive database

that contains extensive information on taxpayers. The database is updated

frequently through periodical tax information provided by taxpayers and

third parties (banks, employers, stock exchange etc.). Comments received

from Finlands treaty partners indicate that ownership, accounting and bank-

ing information was available when requested.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 19

A.1. Ownership and identity information

Jurisdictions should ensure that ownership and identity information for all relevant

entities and arrangements is available to their competent authorities.

Companies (ToR

6

A.1.1)

Types of companies

39. Companies in Finland are formed pursuant to the Limited Liability

Companies Act 624/2006 (LLCA). A limited liability company can be formed

by one or more persons. The liability of shareholders is limited to the sub-

scribed capital. Under Chapter 1, Section 1(1) of the LLCA, a limited liability

company may be a:

Private Company (Oy): The shares of a private company cannot be

admitted to public trading. The minimum share capital required of a

private company is EUR 2 500.

Public Company (Oyj): The minimum share capital required of a

public company is EUR 80 000. The shares of a public company can

be offered to the public and traded on stock markets.

40. Both private and public companies are subject to mandatory reg-

istration with the National Board of Patents and Registration of Finland

(NBPRF) within 3 months from the date of signing the articles of association

(Chapter 2, Section 8(1) of the LLCA).

41. In addition to the private and public company incorporated pursuant

to the LLCA, there are also European Companies (SEs). SEs are regulated

by Council Regulation (EEC) No. 2157/2001 on Statute for a European

Company which was transposed into Finnish law under the Finnish European

Companies Act, 742/2004. Pursuant to Section 10 of the Council Regulation,

the rules that apply to SEs are the same as those applicable to public limited

companies. In Finland, the requirements applicable to public companies apply

mutatis mutandis to SEs.

42. As at 30 June 2012, there are 229 048 private companies, 204 public

companies and 1 SE registered in the Trade Register in Finland.

6. Terms of Reference to Monitor and Review Progress Towards Transparency and

Exchange of Information.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

20 COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION

Information held by government authorities

Registration of companies

43. Under Chapter 2, Section 8(1) of the LLCA, both private and public

companies are required to be registered in the Trade Register maintained by

the NBPRF within 3 months from the date of signing the articles of associa-

tion. The official names of the founding shareholders must be recorded in

the articles of association and submitted to the NBPRF. While subsequent

changes to the share ownerships do not need to be reported to the NBPRF,

this information must be provided to the tax authority or be kept by the com-

pany or a custodian, as analysed below.

Information provided to the tax authority

44. Under Section 7 of the Act on Assessment Procedure 1558/1995

(AAP), all private and public companies are required to submit a tax return

to the Finnish Tax Authority. Section 10 of the AAP provides that the Tax

Authority will publish precise information detailing the information that must

be provided in the tax return by each type of taxpayers. The tax return for

companies must include among other particulars, information on the names,

business IDs or personal identity codes and the number of shares held by each

shareholder that owns at least 10% of all shares of the company (Form 6B and

Form 72). The same information is also required to be provided in relation to

every shareholder if the company has less than 10 shareholders.

45. All the information provided by the companies in the prescribed

forms is captured and stored electronically in the database maintained by

the tax authority. Information is maintained in the database for a period of

10 years. This period is counted from the year following the year of taxation

(e.g. the taxation for year 2013 is finalised on 31 October 2014 and the infor-

mation is stored in the database until 31 December 2024).

46. The transfer of securities (including shares of private companies)

is an event subject to the transfer tax (section 1, Asset Transfer Tax Act).

The transferee is required to file a prescribed form (Form 6012e) with the

tax authority. The information provided in the form includes the name, per-

sonal or business ID number of the transferor and transferee and the interest

transferred. The form must be filed and the transfer tax must be paid within

two months from the date of transfer (section 21, Asset Transfer Tax Act).

Securities that are publicly traded are generally exempt from the transfer tax

if they fulfil the conditions for exemption in section 15a of the Asset Transfer

Tax Act. Notwithstanding the above, information relating to the ownership

of publicly traded shares is kept in the central securities depository (CSD) as

indicated in the subsequent paragraphs.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 21

Information held by the companies

47. Shares of companies may be issued either in book-entry form or in

the form of share certificates.

48. There are currently 168 companies in Finland with shares issued

in book-entry form, of which 134 are publicly traded. All publicly traded

companies must maintain their shares in book-entry form. There are also

other reasons for companies to maintain shares in the book-entry system. For

instance, by having shares electronically registered in the book-entry system,

the company will have access to up-to-date shareholder information and allows

an efficient management of ownership changes and dividend distributions.

49. In Finland, shares issued in book-entry form are maintained in a

computerised shareholder register kept by the central securities depository

(CSD) (Chapter 4, Section 3 of the LLCA). Euroclear Finland is the CSD

of Finland and holds the register for shares and debt securities traded in the

Finnish financial markets. Pursuant to the LLCA, the shareholder register

maintained by the CSD must contain the name of the shareholder (or the

nominee, in case of nominee ownership), the shareholders (or nominees) per-

sonal identity code, contact details, payment address, taxation information,

the quantity of shares by share class and the account operator maintaining

the book-entry account. An account operator is defined under Chapter 1,

Section 2b of the Act on Book-Entry System to mean an organisation that

has been granted the right to make registration in the book-entry register.

In the case of a transfer of shares, the transferee is required to inform the

account operator to update the shareholder register. The LLCA does not

specify a time frame for which the transfer of shares has to be updated in the

shareholder register but under Chapter 4, Section 2(1) of the LLCA, the trans-

feree cannot exercise his shareholder rights in the company until his name is

entered into the share register.

50. Most companies in Finland issue shares in certificate form. In rela-

tion to those companies, the board of directors of the company is required

to keep a Share Register under Chapter 3, Section 15(1) of the LLCA. The

register must contain a list of the shares or the share certificates in numerical

order, their dates of issue and the names and addresses of the shareholders. If

there is a transfer of shares, the transferee of the share is required to provide

the company with evidence of the transfer as well as evidence of the payment

of the transfer tax. The company must verify the evidence of the transfer as

well as the payment of the transfer tax and update the Share Register imme-

diately (Chapter 3, Section 16(1) of the LLCA). The LLCA does not specify a

time frame for which the transferee has to inform the company of the transfer

of shares. Nevertheless, under Chapter 3, Section 2(1) of the LLCA, the trans-

feree cannot exercise his shareholder rights in the company until his name is

entered into the share register.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

22 COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION

Foreign companies

51. The Finnish Income Tax Act does not contain provisions defining

residence with regard to corporate bodies but according to present practice,

a corporate body is regarded as resident in Finland only if it is registered

(incorporated) in Finland or otherwise established under Finnish Law.

Generally, a foreign company is not considered resident of Finland even if it

is effectively managed from Finland. Nevertheless, such presence may create

a permanent establishment (e.g. a branch) if the conditions under the domes-

tic law and the relevant treaty are met. There are 1 104 branches of foreign

companies registered in the Trade Register as at 30 June 2012.

Registration of branch of a foreign company

52. A foreign company is required to submit a Start-up Notification

concerning the establishment of a branch to the Trade Register before com-

mencing business operation in Finland. If the company is from a country

outside the EEA, a permit issued by the NBPRF for the establishment of the

branch is also required. However, no ownership information of the company

is provided to the NBPRF in the Start-up Notification or in relation to

applying the permit.

Information provided to the tax authority

53. A branch is required to file a tax return and disclose ownership infor-

mation pursuant to the same rules concerning ownership information that has

to be filed for Finnish private and public company (ss. 7 and 10, AAP). More

specifically, the tax return for branches of foreign companies must include

among other particulars, information on the name, business ID or personal

identity code and the number of shares held by each shareholder that owns at

least 10% of all shares of the company. The same information is also required

for each shareholder if the company has less than 10 shareholders. The

sanctions for non-compliance for private and public companies are equally

applicable to a branch of a foreign company.

54. Similarly, all the information provided by the branches of foreign

companies in the prescribed forms is data-captured and stored electronically

in the database maintained by the tax authority.

Nominees

55. The concept of nominee ownership exists in Finland in relation to

shares in book-entry form.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 23

56. Shares issued in certificate form are deemed by the Finnish authori-

ties to be owned by the person whose name is recorded in the share register

maintained by the company. In this regard, all the benefits and consequences

of owning the shares will apply to the persons reflected as the owner of the

share in the share register. Therefore, nominee ownership is not recognised

in respect of shares in certificate form.

Information held by Nominees

57. Finnish law expressly allows shares to be held by nominees when

the shares are in book-entry form. Under Section 5a of the Act on Book-

Entry Account, shares in book-entry form owned by a foreign individual, a

corporation or a foundation can be held in a nominee account maintained by

a custodian with the CSD. When the account is a nominee account, the CSD

will record the identity information of the custodian instead of the beneficial

owner of the shares. There is also a requirement that the account explicitly

indicate that it is a nominee account. The account holder of a custodial nomi-

nee account may be a central securities depository, a central bank, an account

management organisation or a credit institution (s. 5(a), Act on the Book-

Entry Accounts). The holder of a custodian nominee account is required to

know the identity of the person he is acting for under Section 28 of the Act on

the Book-Entry System.

Conclusion and Practice

58. Ownership information for private and public company established

in Finland is kept by the company in the Share Register or by the CSD in the

shareholder register. Ownership information on shareholdings of at least 10%

in private, public and foreign companies is held by the Finnish tax authority.

The holder of a custodian nominee account under the book-entry system is

required to know the identity of the person he/she is acting on behalf.

59. In practice, the Finnish competent authority can simply access its data-

base to reply to most requests concerning ownership information. Ownership

information may be accessed directly by the tax auditors from the comput-

ers connected to the tax authoritys computer network and the access to the

information is almost instantaneous. The Finnish authorities advised that tax

authoritys databases are updated on a constant basis whenever new data or

information is made available to them.

60. With regard to ownership information of shares in book-entry form,

the CSD keeps ownership information in its database. Reports identifying

owners of shares in book-entry form can be generated within a few business

days whenever a request is made to the CSD.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

24 COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION

61. In the three-year period under review (2009-11), Finland received

requests concerning ownership information of companies. The Finnish

authorities maintain consolidated statistics concerning incoming requests

concerning information on the identity or ownership information of legal

entities (including companies, partnerships, etc.). In the period under review,

23 EOI requests concerning identity or ownership information were received.

Generally, response times were within 90 days (an average response time of

71 days). The comments provided by Finlands EOI partners confirmed that

ownership information of companies was one of the common categories of

information requested. They have also reported that there were no instances

where the requested information was not provided to them.

Bearer shares (ToR A.1.2)

62. Bearer shares cannot be issued in Finland since 1 January 1980,

resulting from the repeal of the Limited Liability Companies Act (LLCA) of

1895, and the issuance of the LLCA of 1978. The LLCA of 1978 was repealed

and replaced by the existing LLCA of 2006 that contains the same prohibi-

tion on the issuance of bearer shares. The Finnish authority advised that the

decision to prohibit the issuance of bearer shares in 1978 was based on three

reasons: (i) the use of bearer shares was not prevalent and they were mainly

used by publicly traded companies; (ii) the need for companies to know its

shareholders; and (iii) to prevent shareholders from misusing voting rights.

63. It is possible that some bearer shares issued prior to 1 January 1980

by companies that were in existence at that time are still in circulation in

Finland. Finland estimates that there are approximately 9 400 companies

that were incorporated before 1 January 1980 which are still in existence and

active today. This represents less than 5% of the total number of all compa-

nies currently in existence. These 9 400 companies could have potentially

issued bearer shares if their articles of association allowed them to do so.

There are no specific statistics on how many of the 9 400 companies could

issue bearer shares pursuant to their articles of association, if any of them

has issued bearer shares and if any bearer shares are still in circulations after

32 years of prohibition. The Finnish authorities confirmed that bearer shares

were never detected in tax audits. In its EOI practice, Finland has never faced

a case where it could not identify all shareholders of a company. As the use

of bearer shares was not prevalent and no issues have arisen in practice, the

Finnish legislator does not see the need to issue any further legislation on the

subject matter.

64. In any case, any legacy issue relating to bearer shares should not pose

a material risk as mechanisms enabling the identification of the holders of

such shares are in place. For instance, there is a requirement for companies

to include information on the names, business IDs or personal identity codes

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 25

and the number of shares held by each shareholder that owns at least 10% of

the shares of a company, in their tax return. The same information is also

required for every shareholder if the company has less than 10 shareholders

(ss. 7 and 10, AAP). Moreover, companies must keep a share register which

must contain a list of the shares or the share certificates in numerical order,

their dates of issuance and the names and addresses of the shareholders

(Chapter 3, Section 15(1) of the LLCA). The transfer of shares of a non-listed

company is also subject to a transfer tax, and the identity of the transferor

and transferee must be provided to the tax authority (s. 30, Asset Transfer Tax

Act). In addition, resident taxpayers must provide detailed information on the

dividend income they receive and must also declare assets including shares

they own in their tax return annually (s. 7.1, Act on Assessment Procedure).

Conclusion and Practice

65. Bearer shares cannot be issued in Finland since 1 January 1980.

While some bearer shares may still exist, the risk associated with the circu-

lation of these shares is not significant as the use of bearer shares was not

prevalent prior to 1980 and there are appropriate mechanisms in place to

identify the holders of such remaining shares. Namely, various reporting obli-

gations applicable to both companies and shareholders (including holder of

bearer shares) ensure that any holder of a remaining bearer share is identified.

Partnerships (ToR A.1.3)

Types of partnerships

66. Partnerships in Finland are formed pursuant to the Partnerships Act

389/1988 (PA). Under Chapter 1, Section 1 of the PA, a partnership may be

a general or limited partnership. Both general and limited partnerships are

legal persons under Chapter 1, Section 1 of the PA. A partnership is formed

by a partnership agreement and both individuals and legal persons can be a

partner of a general or limited partnership. A partnership must have at least

two partners.

General Partnership: All partners are personally, jointly and sev-

erally liable for the obligations of the partnership. Partners can

contribute to the partnership in the form of cash, assets or work

(services). Unless otherwise agreed, all partners decide together the

matters relating to the partnership.

Limited Partnership: There are two categories of partners: general

partners and limited partners. There must be at least one general

partner and one limited partner in a Finnish limited partnership.

General partners have management control whereas limited partners

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

26 COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION

have no management control but receive a return on their invest-

ment. General partners are personally, jointly and severally liable

for all the obligations of the partnership. Limited partners are only

liable on debts incurred by the firm to the extent of their registered

investment.

67. In addition to the above partnerships, there are also European

Economic Interest Groupings (EEIGs) (Council Regulation (EEC) No. 2137/85

of 25 July 1985 on the European Economic Interest Grouping). EEIG is a form

of association between companies and other legal bodies, firms or individuals

from different EU countries who operate together across national frontiers.

Finland has also transposed the Council Regulation into the Act on European

Economic Interest Grouping 1299/1994 (AEEIG).

68. As at 30 June 2012, there are 12 630 general partnerships, 35 198 lim-

ited partnerships and one EEIG registered in the Trade Register in Finland.

Information held by government authorities

Registration of partnerships

69. Chapter 1, Section 2 of the PA indicates that the partnerships entry in

the Trade Register maintained by NBPRF is governed by the Trade Register

Act 129/1979. The Trade Register Act provides that where the partner is an

individual, the name, address, identity number, date of birth and nationality

have to be provided and where the partner is a legal person, the companys

identification number has to be provided (sections 3 and 4, Trade Register

Act). As the partners are registered in the Trade Register, partnerships are

required to notify the Trade Register if there are any changes to the composi-

tion of the partners of the partnership (section 11 of the Business Information

Act).

70. An EEIG is also required to be registered in the Trade Register main-

tained by the NBPRF. The information that has to be furnished by an EEIG

is also governed by the Trade Register Act 129/1979 as spelt out in Section 2

of the AEEIG. In this regard, an EEIG has to file the same information and

details as those required by a general and limited partnership described in the

preceding paragraph.

71. All the information described in the preceding two paragraphs are

kept and maintained in the tax authoritys database.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 27

Information provided to the tax authority

72. Partnerships are not regarded as separate taxable entities in Finland.

The net income of a partnership is determined under the rules applicable to

corporate bodies but is attributed to the partners according to each partners

share in the partnerships total income and must be taxed either as earned

income or investment income in the hands of the partners. In this regard,

all partnerships and EEIGs will be required to submit a prescribed form

(Form 6A) to the tax authority for the determination of the taxable income

attributable to the partners and information identifying the partners of the

partnership/EEIG has to be provided to the tax authority if there are changes

to the composition of the partnership. The same rule applies to foreign

partnerships that are carrying on a business in Finland. Moreover, Finnish

resident partners of foreign partnerships are taxed in Finland as if they were

partners in a domestic partnership and any losses of the partnership are

deducted at the partner level.

73. All the information provided by the partnerships in the prescribed

forms are captured and stored in the database maintained by the tax authority.

Information held by the partnership or partners

74. A partnership is formed by a partnership agreement. The PA is silent

as to the information that has to be included in the partnership agreement

and whether the partnership or a partner is required to maintain information

that identifies the partners. Notwithstanding the above, as partnerships/EEIG

are also responsible for registering the transfer of partnership interests with

the Trade Registry, this would imply that they would have to maintain such

information in order to comply with their statutory obligations.

Conclusion and Practice

75. Information identifying partners of a general, limited partnership and

EEIG is filed in the Trade Register and with the tax authority and are stored

the tax authoritys database. In practice, the Finnish competent authority

can access information stored in its database to reply to most EOI requests

concerning ownership information. Such information may be accessed by

the tax auditors directly from the computers connected to the tax authoritys

network and the access to the information is almost instantaneous. The tax

authoritys tax database is updated frequently on a constant basis whenever

new information is received.

76. In the three-year period under review (2009-11), Finland received

requests relating to the identity of partners in a partnership. The Finnish

authorities maintain consolidated statistics concerning incoming requests

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

28 COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION

concerning information on the identity or ownership information of legal

entities (including companies, partnerships, etc.). In the period under review,

23 EOI requests concerning identity or ownership information were received.

In average, requests were responded in less than 90 days. Finlands EOI

partners that provided comments to this review did not refer to information

identifying partners of partnerships as one of the categories of information

they requested Finland to provide.

Trusts (ToR A.1.4)

77. The Finnish legal system does not allow for the creation of trusts and

the legal concept of trust does not exist under Finnish law. Finland has not

ratified the 1985 The Hague Convention on the Law Applicable to Trusts and

on their Recognition. There is, however, no obstacle for Finnish citizens or

legal persons to be trustees of foreign trusts.

Information held by trustees acting by way of business and other

service provider subject to AML Law

78. Under the AML Law, service providers (trust and company service

providers) referred to in Article 3(7) of the Directive 2005/60/EC of the

European Parliament and of the Council are required to comply with AML

Law and conduct CDD procedures (s. 2(23), AML Law). Article 3(7)(d) of

the Directive further define trust and company service providers means

any natural or legal person which by way of business provides any of the fol-

lowing services to third parties: (); (d) acting as or arranging for another

person to act as a trustee of an express trust or a similar legal arrangement.

Therefore, the AML requirements cover all circumstances where a trustee is

acting by way of business.

79. In this regard, if a settlor(s) approaches such a Finnish service

providers to establish a trust and/or act as trustee, the Finnish service pro-

vider would be required to conduct CDD and, as such, identify and verify

the identity of his or her customer under Section 7 of the AML Law. Such

service providers are also required to identify the beneficial owners

under Section 8 of the AML Law. The term beneficial owner is defined

under Section 5(6) of the AML Law to mean a natural person on whose

behalf a transaction is being conducted. In the case where the customer is

a legal person, it means the natural person who controls the legal person by

(i) having at least 25% voting rights; or (ii) has the power to appoint or dis-

miss the majority of member of the board of the legal person. If the measures

laid down cannot be carried out, the obligated person is obliged to decline

entering into a business relationship with the prospective customer.

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 29

80. There are currently no written guidelines in Finland detailing how

the CDD is to be carried out in the case of a trust. Notwithstanding the

absence of specific guidelines on trusts, the general guidance in respect of

CDD provided in the AML Law still applies. The Finnish Regional State

Administrative Agency (RSAA), who is the AML supervisory authority for

all trust and company service providers in Finland, advised that it consid-

ers the beneficiaries of a trust as the beneficial owners. The RSAA has

also highlighted that the situation of a Finnish resident acting as a trustee or

administrator of a foreign trust is not common in Finland. The RSAA has not

encountered any situations where obligated person under its supervision has

requested for clarification on how the CDD should be conducted in situations

where the customer is a trust (or a trustee) or where the customer purports to

create a trust and require trusteeship services from the obligated person.

81. To the extent that a trust (or the trustee) uses the service of an obligated

person that is an entity listed in Section 2 of the AML Law (e.g. opening an

account with a financial institution), the AML Law would apply to the trust (or

the trustee) as customer. The obligated persons are required to conduct CDD

and identify and verify the identity of their customers/prospective customer

under Section 7 of the AML Law. If the prospective customer is representing

another person, the obligated person is required to also identify and verify the

identity of the representative. The beneficial owner also has to be identified

and verified by the obligated person under Section 8 of the AML Law. If the

measures laid down cannot be carried out, the obligated person is obliged to

decline entering into a business relationship with the prospective customer.

Information held by the tax authority

82. Finnish tax law does not contain specific provisions on the taxation

of assets or income derived through foreign trusts with a link to Finland.

The Finnish authorities have also indicated that they are not aware of any

instances where foreign trusts have been administered by Finnish persons.

Notwithstanding the above, if information is considered necessary for

Finnish tax assessment purposes, the taxpayer has an obligation to disclose

such information to the tax authority. This may include relevant ownership

information concerning assets held in trust.

83. Finland taxes its residents on their worldwide income. The trustee

and the beneficiaries must provide all information necessary to determine the

amount of taxable income or assets to the Finnish tax authority (s. 11, AAP).

Therefore, the taxation of Finnish resident trustees in respect of income

arising from the trust assets they hold would put an onus on the trustees to

explain the origin of the income. A trustee resident in Finland is subject to

record-keeping requirements for determination of his/her income, as any

other person resident in Finland. Thus, all records that are necessary for the

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

30 COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION

determination of his/her income must be kept. This would most likely include

trusts deed and other documents related to the management of the trust,

which will allow the identification of the settlor(s) and beneficiaries.

Conclusion and Practice

84. Finnish tax law does not contain specific provisions on the taxation

of assets or income derived through foreign trusts with a link to Finland.

Notwithstanding the above, a trustee resident in Finland is subject to tax

on his worldwide income and to the record-keeping requirements for deter-

mination of his/her income. Thus, all records that are necessary for the

determination of his/her income must be kept. These records would most

likely include the trust deed and other documents related to the management

of the trust, which allow the identification of settlor(s) and beneficiaries. It

can therefore be concluded that Finland has taken reasonable measures to

ensure that ownership information is available to its competent authorities in

respect of foreign trusts with a Finnish resident trustee or administrator.

85. In addition to the tax obligations, AML CDD obligations will also

apply in a number of circumstances. Information identifying the settlor(s)

and beneficiaries of a trust is likely to be available with professional service

provider providing trustee services by way of business, as they are required

to identify their customers and the beneficial owners. The same information

may also be available if a trust (or trustee) uses the service of a service pro-

vider (e.g. financial institution) that is subject to AML Law in Finland. The

general obligations to identify beneficial owners under AML would amount

to an obligation to identify the beneficiaries who have at least 25% interest in

the trust. The supervisory authority for trust and company service providers

for AML Law purposes, advised that the situation of a Finnish resident acting

as a trustee or administrator of a foreign trust is not common in Finland.

86. From the comments provided by Finlands EOI partners, information

identifying settlor(s) and beneficiaries of foreign trusts was not one of the

categories of information Finland was specifically requested to provide in the

last 3 years. Finland confirmed that it has not received any requests concern-

ing settlor(s) and beneficiaries of foreign trusts.

Foundations (ToR A.1.5)

87. Foundations in Finland are regulated by the Foundation Act. A foun-

dation can be established by either a foundation deed or a written will, which

must state the purpose of the foundation and the property to be endowed to it.

88. A foundation must have a useful (beneficial) purpose and the pur-

pose cannot be to conduct business or to bring direct financial gains to the

PEER REVIEW REPORT COMBINED PHASE 1 AND PHASE 2 REPORT FINLAND OECD 2013

COMPLIANCE WITH THE STANDARDS: AVAILABILITY OF INFORMATION 31

founder or a functionary of the foundation. Foundations in Finland are typi-

cally established for the purpose of preserving a national heritage (e.g. for

maintaining a museum), maintaining an organisation of community interest

(e.g. sports club) or for the purpose of granting grants, scholarships, fellow-

ship and awards. Notwithstanding the general rule governing the purpose of

a foundation, the Finnish authority advised that it is possible for a foundation

to be given the authorisation to carry out auxiliary business activities. Such

foundations are however, required to be registered in the Trade Register

with the NBPRF. There are approximately 2 800 foundations registered in

the Register of Foundations maintained by NBPRF and 30 are concurrently

registered in the Trade Register maintained by NBPRF.

Information held by government authorities

Registration of foundations

89. Permission has to be granted by NBPRF to establish a foundation.

To apply for the permission, an application accompanied by (i) the original

or certified copy of the deed of the foundation or the will with a certificate