Professional Documents

Culture Documents

Diversification

Uploaded by

Pranjit BhuyanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Diversification

Uploaded by

Pranjit BhuyanCopyright:

Available Formats

In finance, diversification means reducing risk by investing in a variety of assets.

If the asset values do not move up and down in perfect synchrony, a diversified portfolio will have less risk than the weighted average risk of its constituent assets, and often less risk than the least risky of its constituent. [1] Therefore, any risk-averse investor will diversify to at least some extent, with more risk-averse investors diversifying more completely than less riskaverse investors. Diversification is one of two general techniques for reducing investment risk. The other is hedging. Diversification relies on the lack of a tight positive relationship among the assets' returns, and works even when correlations are near zero or somewhat positive. Hedging relies on negative correlation among assets, or shorting assets with positive correlation.

portfolio diverfication Portfolio diversification is the means by which investors minimize or eliminate their exposure to company-specific risk, minimize or reduce systematic risk and moderate the short-term effects of individual asset class performance on portfolio value. In a well-conceived portfolio, this can be accomplished at a minimal cost in terms of expected return. Such a portfolio would be considered to be a well-diversified.

Although the concepts relevant to portfolio diversification are customarily explained with respect to the stock markets, the same underlying principals apply to all types of investments. For example, corporate bonds have specific risk that can be diversified away in the same manner as that of stocks.

Eliminate Specific Risk and Minimize Systematic Risk

As was explained in Investment Risk and Return, it is assumed that all investors are rational and will therefore hold portfolios that are diversified to the point where specific risk has virtually been eliminated and their only exposure to risk is to that which is inherent in the market itself. Thus, the residual risk of a portfolio should be equal to market risk, a.k.a. systematic risk, and systematic risk can be reduced by investing over a broader market, i.e., a larger universe. International diversification provides a good example of the effects of

diversifying across asset classes. A portfolio invested 50% in domestic largecap stocks and 50% in international large-cap stocks would have approximately half the residual risk of a portfolio comprised solely of domestic large-cap stocks, assuming that the investments in each market were sufficiently diversified to eliminate specific risk.

Some investors may choose to be exposed to specific risk with the expectation of realizing higher returns. But this is contrary to financial theory and such investors are therefore deemed to be irrational. Deliberate exposure to specific risk is unnecessary and is essentially gambling...unless you are trading on inside information, but we won't go there, as trading on inside information is a flagrant violation of the securities laws.

You might also like

- Chapter 7Document6 pagesChapter 7Muhammed YismawNo ratings yet

- Risk:: The Two Major Types of Risks AreDocument16 pagesRisk:: The Two Major Types of Risks AreAbhishek TyagiNo ratings yet

- MUSEDocument12 pagesMUSEmuse tamiruNo ratings yet

- The Portfoli Theory: Systematic Risk - These Are Market Risks That Cannot Be Diversified Away. InterestDocument12 pagesThe Portfoli Theory: Systematic Risk - These Are Market Risks That Cannot Be Diversified Away. Interestmuse tamiruNo ratings yet

- Reduction of Portfolio Risk Through DiversificationDocument38 pagesReduction of Portfolio Risk Through DiversificationDilshaad Shaikh100% (1)

- DiversificationDocument8 pagesDiversificationambulahbdugNo ratings yet

- Objective of Study Concepts Investment Options Data Collection Analysis Recommendation Limitations ReferencesDocument26 pagesObjective of Study Concepts Investment Options Data Collection Analysis Recommendation Limitations Referenceshtikyani_1No ratings yet

- Risk & Return Analysis - Prime BookDocument25 pagesRisk & Return Analysis - Prime Bookßïshñü PhüyãlNo ratings yet

- Answers To Concepts in Review: S R R NDocument5 pagesAnswers To Concepts in Review: S R R NJerine TanNo ratings yet

- Portfolio TheoryDocument3 pagesPortfolio TheoryZain MughalNo ratings yet

- Unit-2 Portfolio Analysis &selectionDocument64 pagesUnit-2 Portfolio Analysis &selectiontanishq8807No ratings yet

- Harry Markowitz's Modern Portfolio Theory: The Efficient FrontierDocument7 pagesHarry Markowitz's Modern Portfolio Theory: The Efficient Frontiermahbobullah rahmaniNo ratings yet

- Unit 4Document17 pagesUnit 4vivek badhanNo ratings yet

- Powerpoint Concept Smjhne Security-Analysis-and-Portfolo-Management-Unit-4-Dr-Asma-KhanDocument66 pagesPowerpoint Concept Smjhne Security-Analysis-and-Portfolo-Management-Unit-4-Dr-Asma-KhanShailjaNo ratings yet

- Understanding The Efficient FrontierDocument4 pagesUnderstanding The Efficient FrontierThanh Tu NguyenNo ratings yet

- Diversification (Finance)Document8 pagesDiversification (Finance)ElsenNo ratings yet

- Basics of FinanceDocument46 pagesBasics of Financeisrael_zamora6389No ratings yet

- Finman3 Report DiscussionDocument5 pagesFinman3 Report DiscussionFlorence CuansoNo ratings yet

- Chapter-2 Portfolio Analysis and SelectionDocument14 pagesChapter-2 Portfolio Analysis and Selection8008 Aman GuptaNo ratings yet

- Understanding Risk and ReturnDocument5 pagesUnderstanding Risk and ReturnFORCHIA MAE CUTARNo ratings yet

- 17 Investment ManagementDocument20 pages17 Investment ManagementAdebajo AbdulrazaqNo ratings yet

- Safe Investment??: (A Case Study On Risk of Diversification)Document26 pagesSafe Investment??: (A Case Study On Risk of Diversification)A Srihari KrishnaNo ratings yet

- Introduction To Portfolio ManagementDocument84 pagesIntroduction To Portfolio ManagementRadhika SivadiNo ratings yet

- Risk Return AnalysisDocument1 pageRisk Return Analysissnehachandan91No ratings yet

- Portfolio Evaluation and RevisionDocument53 pagesPortfolio Evaluation and Revisionjibumon k gNo ratings yet

- Portfolio 8Document4 pagesPortfolio 8Saloni NeelamNo ratings yet

- Portfolio Theory - Ses2Document82 pagesPortfolio Theory - Ses2Vaidyanathan Ravichandran100% (1)

- Definition of Portfolio AnalysisDocument15 pagesDefinition of Portfolio Analysissimrenchoudhary057No ratings yet

- Portfolio ConstructionDocument13 pagesPortfolio ConstructionRonak GosaliaNo ratings yet

- Risk Return Analysis-IIFLDocument131 pagesRisk Return Analysis-IIFLPrathapReddy100% (1)

- Portfolio Selection Summary FMPDocument3 pagesPortfolio Selection Summary FMPMufti AliNo ratings yet

- Earnings Per Share-ProDocument3 pagesEarnings Per Share-ProVibhorBajpaiNo ratings yet

- 3.1 Portfolio TheoryDocument15 pages3.1 Portfolio TheoryRajarshi DaharwalNo ratings yet

- Retail Banking Assignment Yashkumar Patel 17020942046: Ans. Modern Portfolio TheoryDocument5 pagesRetail Banking Assignment Yashkumar Patel 17020942046: Ans. Modern Portfolio TheoryYashkumar PatelNo ratings yet

- Basics of FinanceDocument46 pagesBasics of FinanceELgün F. QurbanovNo ratings yet

- BBA Unit 5Document4 pagesBBA Unit 5gorang GehaniNo ratings yet

- Risk Return Analysis Analysis of Banking and FMCG StocksDocument93 pagesRisk Return Analysis Analysis of Banking and FMCG StocksbhagathnagarNo ratings yet

- Topic: What Do You Understand by Efficient Frontier (With Diagram) ? IntroductionDocument2 pagesTopic: What Do You Understand by Efficient Frontier (With Diagram) ? Introductiondeepti sharmaNo ratings yet

- Investment Management FAQDocument3 pagesInvestment Management FAQRockyBalboaaNo ratings yet

- Portfolio Management - Module 2Document16 pagesPortfolio Management - Module 2satyamchoudhary2004No ratings yet

- Risk and Return For Single SecuritiesDocument10 pagesRisk and Return For Single Securitieskritigupta.may1999No ratings yet

- Investment, Security and Portfolio ManagementDocument396 pagesInvestment, Security and Portfolio ManagementSM FriendNo ratings yet

- Unit 2 PORTFOLIO RISK AND RETURNDocument19 pagesUnit 2 PORTFOLIO RISK AND RETURNmahi jainNo ratings yet

- M6 Assignment 1Document3 pagesM6 Assignment 1Lorraine CaliwanNo ratings yet

- Chapter 7Document11 pagesChapter 7Seid KassawNo ratings yet

- Markowitz ModelDocument25 pagesMarkowitz ModelVignesh PrabhuNo ratings yet

- Corporate Portfolio Analysis TechniquesDocument24 pagesCorporate Portfolio Analysis TechniquesSanjay DhageNo ratings yet

- Chapter 6 NotesDocument2 pagesChapter 6 Notesazhar80malikNo ratings yet

- Chapter - 1Document69 pagesChapter - 1111induNo ratings yet

- BAUTISTA BAFIMARX ACT181, Activity 2Document3 pagesBAUTISTA BAFIMARX ACT181, Activity 2Joshua BautistaNo ratings yet

- Investment Portfolio Diversification:: Diversify Our Company InvestmentsDocument4 pagesInvestment Portfolio Diversification:: Diversify Our Company Investmentsfiza akhterNo ratings yet

- Risk and ReturnDocument7 pagesRisk and Returnshinobu kochoNo ratings yet

- IA - Limitation in PortfolioDocument4 pagesIA - Limitation in PortfolioJustina BaharunNo ratings yet

- What Is Portfolio ManagementDocument2 pagesWhat Is Portfolio ManagementTariq MahmoodNo ratings yet

- Portfoli o Anaysi S: Financial Manageme NTDocument3 pagesPortfoli o Anaysi S: Financial Manageme NTRahul BaidNo ratings yet

- Modern Portfolio Theory (Markowitz)Document6 pagesModern Portfolio Theory (Markowitz)Millat AfridiNo ratings yet

- Dipu MedicalDocument1 pageDipu MedicalPranjit BhuyanNo ratings yet

- TZBT LRQCMG ONg DwoDocument6 pagesTZBT LRQCMG ONg DwoPranjit BhuyanNo ratings yet

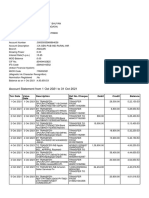

- Account Statement From 1 Nov 2021 To 30 Nov 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument4 pagesAccount Statement From 1 Nov 2021 To 30 Nov 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePranjit BhuyanNo ratings yet

- Investment ManagementDocument38 pagesInvestment ManagementPranjit BhuyanNo ratings yet

- Management Information SystemDocument98 pagesManagement Information SystemPranjit BhuyanNo ratings yet

- Indifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, IsDocument5 pagesIndifference Curve, Which Reflects That Investor's Preferences Regarding Risk and Return, Ismd mehedi hasanNo ratings yet

- Rev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeDocument6 pagesRev 1 - Prelim Examination - From Partnership Formation To Joint ArrangemeCM Lance100% (2)

- Islamic QuizDocument4 pagesIslamic QuizSharmila DeviNo ratings yet

- Fra Project FinalllDocument23 pagesFra Project Finalllshahtaj khanNo ratings yet

- Project Report FormatDocument9 pagesProject Report FormatGiri SukumarNo ratings yet

- CHPTR 4 Project Analysis and EvaluationDocument32 pagesCHPTR 4 Project Analysis and EvaluationSivaranjini KaliappanNo ratings yet

- Quantitative Investment Analysis CFA Institute Investment SeriesDocument159 pagesQuantitative Investment Analysis CFA Institute Investment SeriesMuhamad ArmawaddinNo ratings yet

- Stock Market - Black BookDocument82 pagesStock Market - Black BookHrisha Bhatt62% (52)

- The FVA - Forward Volatility AgreementDocument9 pagesThe FVA - Forward Volatility Agreementshih_kaichih100% (1)

- FAIIQuiz 1 BsolDocument3 pagesFAIIQuiz 1 BsolHuzaifa Bin SaeedNo ratings yet

- Chapter 005Document30 pagesChapter 005Yinan Lu100% (2)

- IFIC Bank Internship ReportDocument136 pagesIFIC Bank Internship ReportAppleNo ratings yet

- Accenture Strategy ZBX Zero Based Transformation POV July2019Document9 pagesAccenture Strategy ZBX Zero Based Transformation POV July2019Deepak SharmaNo ratings yet

- BIM Experiences and Expectations: The Constructors' PerspectiveDocument24 pagesBIM Experiences and Expectations: The Constructors' PerspectiveArifNo ratings yet

- CF 26051Document20 pagesCF 26051sdfdsfNo ratings yet

- Credit Management System of IFIC Bank LTDDocument73 pagesCredit Management System of IFIC Bank LTDHasib SimantoNo ratings yet

- 12.course OutlineDocument3 pages12.course OutlineMD. ANWAR UL HAQUENo ratings yet

- Revised Amlc TrancodesDocument25 pagesRevised Amlc TrancodesGuevarraWellrhoNo ratings yet

- Quick Take: Ashok Leyland LTDDocument8 pagesQuick Take: Ashok Leyland LTDshrikantmsdNo ratings yet

- Quiz 5Document5 pagesQuiz 5Lê Thanh ThủyNo ratings yet

- Loan SalesDocument17 pagesLoan SalesWILLY SETIAWANNo ratings yet

- By LawsDocument8 pagesBy LawsChrissy SabellaNo ratings yet

- Bottled Water Strategy in UKDocument19 pagesBottled Water Strategy in UKshibin21No ratings yet

- Business Standard English DelhiDocument25 pagesBusiness Standard English DelhiRajan NandolaNo ratings yet

- QWDocument23 pagesQWCarlo Angelo CastilloNo ratings yet

- LS4-7 (3) MARIANO - EditedDocument16 pagesLS4-7 (3) MARIANO - EditedarnelNo ratings yet

- The Option Value of LifeDocument21 pagesThe Option Value of LifeSusanne BurriNo ratings yet

- Business Credit Made EasyDocument68 pagesBusiness Credit Made Easylabeledagenius100% (25)

- 5 6152282107373683204Document49 pages5 6152282107373683204Musyahadah ZauqiNo ratings yet