Professional Documents

Culture Documents

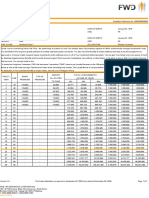

Report Finma-9th Presentor!

Uploaded by

Irish DMOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Report Finma-9th Presentor!

Uploaded by

Irish DMCopyright:

Available Formats

Operating cash flow

From Wikipedia, the free encyclopedia

In financial accounting, operating cash flow (OCF), cash flow provided by operations or cash flow from operating activities (CFO), refers to the amount of cash a company generates from the revenues it brings in, excluding costs associated with long-term investment on capital items or investment in securities.[1] The International Financial Reporting Standards defines operating cash flow as cash generated from operations less taxation and interest paid, investment income received and less dividends paid gives rise to operating cash flows.[2] To calculate cash generated from operations, one must calculate cash generated from customers and cash paid to suppliers. The difference between the two reflects cash generated from operations. Cash generated from operating customers

revenue as reported - increase (decrease) in operating trade receivables (1) - investment income (Profit on asset Sales, disclosed separately in Investment Cash Flow) - other income that is non cash and/or non sales related

Cash paid to operating suppliers

costs of sales- Stock Variation = Purchase of goods. (2) + all other expenses - increase (decrease) in operating trade payables (1) - non cash expense items such as depreciation, provisioning, impairments, bad debts, etc. - financing expenses (disclosed separately in Finance Cash Flow)

(1): operating: Variations of Assets Suppliers and Clients accounts will be disclosed in the Financial Cash Flow (2): Cost of Sales = Stock Out for sales. It is Cash Neutral. Cost of Sales - Stock Variation = Stock out - (Stock out - Stock In)= Stock In = Purchase of goods: Cash Out

Operating Cash Flow vs. Net Income, EBIT, and EBITDA [edit]

Interest is an operating flow. Since it adjusts for liabilities, receivables, and depreciation, operating cash flow is a more accurate measure of how much cash a company has generated (or used) than traditional measures of profitability such as net income or EBIT. For example, a company with numerous fixed assets on its books (e.g. factories, machinery, etc.) would likely have decreased net income due to depreciation; however, as depreciation is a non-cash expense[3] the operating cash flow would provide a more accurate picture of the company's current cash holdings than the artificially low net income.[4]

Earnings before interest, taxes, depreciation and amortization (EBITDA) is a non-GAAP metric that can be used to evaluate a company's profitability based on net working capital. The difference between EBITDA and OCF would then reflect how the entity finances its net working capital in the short term. OCF is not a measure of free cash flow and the effect of investment activities would need to be considered to arrive at the free cash flow of the entity.

Operating Cash Flow (OCF)

What Does Operating Cash Flow (OCF) Mean? The cash generated from the operations of a company; generally defined as revenues minus all operating expenses but calculated through a series of adjustments to net income. The OCF can be found on the statement of cash flows. Also known as cash flow provided by operations or cash flow from operating activities. One method of calculating OCF is shown here: Investopedia explains Operating Cash Flow (OCF) Operating cash flow is the cash that a company generates as a result of normal business operations. It is arguably a better measure of a business's profits than is earnings because a company can show positive net earnings (on the income statement) and not be able to pay its debts. It is cash flow that pays the bills: OCF also can be used to check on the quality of a company's earnings. If a firm reports record earnings but negative cash, it may be using aggressive accounting techniques.

TERMINAL CASHFLOWS

Terminal cash flow is an accounting term used when analyzing capital budgets for a business or company. While cash flow describes the income and expenses of a business, terminal cashflow describes the income and expenses of a business at the end of or termination of a specific project or period of time. The term can also describe the value of a machine after it is scrapped or salvaged, after deducting any tax or net working value the business is able to recover from the device during its ownership or possession. For example, a company wants to increase its present value figures by purchasing a new machine because the new equipment enables the company to increase its production. The cost of buying the new machine is $200,000 US Dollars (USD), the life of the machine is five years, and its scrap value after that is $25,000 USD. After the company buys the machine, theworking capital requirements to maintain and operate the machine will cost the business $10,000 USD. At the end of the lifetime of the machine, terminal cash flow value of the machine can be determined. To calculate this, the salvage value of the machine is added to the amount the business recovers in working capital by having and using the machine. In this case, theterminal cash value equals $25,000 USD plus the $10,000 USD for a total of $35,000 USD. Another way to look at this figure is to consider it as the value of an item or assets after discounting for certain considerations. For example, the cash flow is a projected or estimated number that is determined for a certain number of periods or years. When the set period ends, then the annual

projections can be calculated more accurately. Instead of calculatingcash flow for each of the individual years over the projected period, terminal cash flow is the calculation of the total value for the entire period. When an assumption is made that the rate of growth is constant, then a slightly different equation is used. In this case, the equation is that the value equals the expected cash flow of the next period, divided by the discount rate, minus the expected growth rate. The consistency of the cash flow or growth rate eventually becomes less volatile for the company or business for which the accountants are calculating terminal cash flow for a specific project or piece of equipment or machinery.

You might also like

- Financial Statement PresentationDocument33 pagesFinancial Statement Presentationcyrene jamnagueNo ratings yet

- Sum of The Charts: "Trading Places": Technical AnalysisDocument31 pagesSum of The Charts: "Trading Places": Technical AnalysisArtur SilvaNo ratings yet

- Aswath Damodaran - Applying Multiples and Market RegressionsDocument28 pagesAswath Damodaran - Applying Multiples and Market RegressionssumanNo ratings yet

- Cash Flow Statement TheoryDocument30 pagesCash Flow Statement Theorymohammedakbar88100% (5)

- ForexSignals Naked Trading CheatSheetDocument15 pagesForexSignals Naked Trading CheatSheetKennedy ObaroaraNo ratings yet

- Risk Return AnalysisDocument70 pagesRisk Return Analysisvijaykumarsmec100% (7)

- Ch-5 Cash Flow AnalysisDocument9 pagesCh-5 Cash Flow AnalysisQiqi GenshinNo ratings yet

- WK - 7 - Relative Valuation PDFDocument33 pagesWK - 7 - Relative Valuation PDFreginazhaNo ratings yet

- FM09-CH 09Document12 pagesFM09-CH 09Mukul KadyanNo ratings yet

- MARKETPLACE LIVE SIMULATION REPORT - UpDocument4 pagesMARKETPLACE LIVE SIMULATION REPORT - UpLien NguyenNo ratings yet

- ACCA F7 Combined Technical Articles D16Document92 pagesACCA F7 Combined Technical Articles D16Ivan Ivanov100% (1)

- Finance QuestionsDocument14 pagesFinance QuestionsGeetika YadavNo ratings yet

- Theun-Hinboun Hydropower Project (Loan 1329-LAO (SF) )Document62 pagesTheun-Hinboun Hydropower Project (Loan 1329-LAO (SF) )Independent Evaluation at Asian Development BankNo ratings yet

- Statement of Retained Earings and Its Components HandoutDocument12 pagesStatement of Retained Earings and Its Components HandoutRitesh LashkeryNo ratings yet

- Short CFS Handout Nov 2009Document6 pagesShort CFS Handout Nov 2009Mohamed Shaffaf Ali RasheedNo ratings yet

- Key Takeaways: DirectDocument13 pagesKey Takeaways: DirectSB CorporationNo ratings yet

- Cash Flow StatementDocument4 pagesCash Flow StatementRakin HasanNo ratings yet

- Accounting TheoryDocument5 pagesAccounting TheoryMis LailaNo ratings yet

- What Is Cash Flow AnalysisDocument13 pagesWhat Is Cash Flow AnalysisWaqar EnterprisesNo ratings yet

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Mid Term TopicsDocument10 pagesMid Term TopicsТемирлан АльпиевNo ratings yet

- Free Cash FlowDocument6 pagesFree Cash FlowAnh KietNo ratings yet

- Cash Flow StatementDocument7 pagesCash Flow Statementlianapha.dohNo ratings yet

- FIN3702 SummaryDocument26 pagesFIN3702 SummaryQuentin SchwartzNo ratings yet

- Chapter 1tgDocument32 pagesChapter 1tgThimme Gowda RGNo ratings yet

- Fabm ReviewerDocument7 pagesFabm Reviewersab lightningNo ratings yet

- Essentials of Financial Accounting - ST (SEM 3Document10 pagesEssentials of Financial Accounting - ST (SEM 3Harshit RajNo ratings yet

- Acid Test: Hariapankti@yahoo - Co.inDocument14 pagesAcid Test: Hariapankti@yahoo - Co.inAbhijeet Bhaskar100% (1)

- Cash Flow Note (19743)Document10 pagesCash Flow Note (19743)Abhimanyu Singh RaghavNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsAkash ChauhanNo ratings yet

- Cash FlowDocument4 pagesCash FlowRalph EgeNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsNaina GuptaNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementTagele gashawNo ratings yet

- Acc201 Su6Document15 pagesAcc201 Su6Gwyneth LimNo ratings yet

- Chapter 5 NotesDocument15 pagesChapter 5 NotesNavroopamNo ratings yet

- 4Document2 pages4OmkumarNo ratings yet

- Business Financial Terms - Definitions: Acid TestDocument11 pagesBusiness Financial Terms - Definitions: Acid Testaishwary rana100% (1)

- Financial Statements Examples - Amazon Case StudyDocument16 pagesFinancial Statements Examples - Amazon Case Studyjabeenbegum916No ratings yet

- Cash Flow Statement AnalysisDocument36 pagesCash Flow Statement Analysisthilaganadar100% (5)

- Chapter 4Document18 pagesChapter 4Amjad J AliNo ratings yet

- Technical Accounting Interview QuestionsDocument14 pagesTechnical Accounting Interview QuestionsRudra PatidarNo ratings yet

- Accounting DocumentsDocument6 pagesAccounting DocumentsMae AroganteNo ratings yet

- Income StatementDocument6 pagesIncome Statementkyrian chimaNo ratings yet

- Accounting QuestionsDocument12 pagesAccounting QuestionsFLORENCE DE CASTRONo ratings yet

- What Are Financial Statements?: AssetsDocument4 pagesWhat Are Financial Statements?: AssetsRoselyn Joy DizonNo ratings yet

- Balance Sheet 2. Income Statement (P&L) 3. Cash Flow StatementDocument4 pagesBalance Sheet 2. Income Statement (P&L) 3. Cash Flow StatementArjit KumarNo ratings yet

- Financial Analysis: Submitted byDocument18 pagesFinancial Analysis: Submitted bybernie john bernabeNo ratings yet

- Group Report 3Document8 pagesGroup Report 3Harish SharmaNo ratings yet

- What Is A Cash Flow StatementDocument4 pagesWhat Is A Cash Flow StatementDaniel GarciaNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelArjun KhoslaNo ratings yet

- 3 Statement & DCF ModelDocument17 pages3 Statement & DCF ModelarjunNo ratings yet

- Operating Cash FlowDocument6 pagesOperating Cash FlowMuhammad KolaNo ratings yet

- Financial StatementsDocument10 pagesFinancial StatementsFraulien Legacy MaidapNo ratings yet

- Operating Cash Flow (OCF) - : - Dividends PaidDocument4 pagesOperating Cash Flow (OCF) - : - Dividends Paidpriyank0407No ratings yet

- Acid TestDocument45 pagesAcid TestMahendar Yash100% (1)

- The Cash Flow StatementDocument6 pagesThe Cash Flow Statementacuna.alexNo ratings yet

- Cash Flow Forecasts: P.V. ViswanathDocument16 pagesCash Flow Forecasts: P.V. Viswanathferkoss78No ratings yet

- The Essentials of Cash FlowDocument5 pagesThe Essentials of Cash FlowDaniel GarciaNo ratings yet

- Chapter 4 DCFDocument107 pagesChapter 4 DCFVienne MaceNo ratings yet

- Cash Flow StatementDocument5 pagesCash Flow StatementAyaz Raza100% (1)

- Financial Management - Chapter 8Document23 pagesFinancial Management - Chapter 8rksp99999No ratings yet

- Account Accounts Payable (AP) : General LedgerDocument8 pagesAccount Accounts Payable (AP) : General LedgerAJ ShinuNo ratings yet

- FINANCE MANAGEMENT FIN 420 CHP 4Document24 pagesFINANCE MANAGEMENT FIN 420 CHP 4Yanty Ibrahim25% (4)

- Cash FlowDocument10 pagesCash Flowbharti guptaNo ratings yet

- Cash Flow StatementDocument13 pagesCash Flow StatementMuhammed IbrahimNo ratings yet

- Deferred Charge: DEFINITION of 'Regulatory Asset'Document6 pagesDeferred Charge: DEFINITION of 'Regulatory Asset'Joie CruzNo ratings yet

- Business Plan of George Street Community BookshopDocument22 pagesBusiness Plan of George Street Community BookshopSonOfJamesNo ratings yet

- Reflections and Research Paper On Backpack Simulation Solomon L 1Document5 pagesReflections and Research Paper On Backpack Simulation Solomon L 1Trisha ZarenoNo ratings yet

- Property Risk and Risk Analysis: 1 Key Questions 1 Learning Resources 2 Types of Risks 2Document14 pagesProperty Risk and Risk Analysis: 1 Key Questions 1 Learning Resources 2 Types of Risks 2rishiNo ratings yet

- Set For Life 7pay Sales IllustrationDocument7 pagesSet For Life 7pay Sales IllustrationRyanNo ratings yet

- Retained Earnings: Appropriation May Be A Result ofDocument5 pagesRetained Earnings: Appropriation May Be A Result ofLane HerreraNo ratings yet

- Portfolio Management: Dr. Himanshu Joshi FORE School of Management New DelhiDocument25 pagesPortfolio Management: Dr. Himanshu Joshi FORE School of Management New Delhiashishbansal85No ratings yet

- SPTVE Entrep 9 Q1 M10Document11 pagesSPTVE Entrep 9 Q1 M10mypersonalspace780No ratings yet

- CRB ScamDocument10 pagesCRB Scamrahulsg2005No ratings yet

- FM 02 Central Banking and Monetary PolicyDocument10 pagesFM 02 Central Banking and Monetary PolicyIvy ObligadoNo ratings yet

- Peninsula Capital Q12015Document3 pagesPeninsula Capital Q12015maxmueller15No ratings yet

- Retention Ratio ($248,000 - $160,000) /$248,000 .355Document2 pagesRetention Ratio ($248,000 - $160,000) /$248,000 .355mehdiNo ratings yet

- 1 Minute Trend Momentum Scalping StrategyDocument5 pages1 Minute Trend Momentum Scalping Strategyoyekanmi agoroNo ratings yet

- CDA MC 2015-06 Philippine Financial Reporting Framework CooperativesDocument87 pagesCDA MC 2015-06 Philippine Financial Reporting Framework CooperativesJon DonNo ratings yet

- Capital BudgetingDocument15 pagesCapital Budgetingkarthik sNo ratings yet

- Cbse Board Accountancy SyllabusDocument4 pagesCbse Board Accountancy Syllabusapi-139761950No ratings yet

- Inspection and AppraisalDocument12 pagesInspection and AppraisalChavilita VallesNo ratings yet

- Capital Budgeting Decisions: A Primer: BM63002: Corporate FinanceDocument38 pagesCapital Budgeting Decisions: A Primer: BM63002: Corporate FinanceSagaeNo ratings yet

- JP Morgan Delayed Alibaba Group Holding Limited 1Document10 pagesJP Morgan Delayed Alibaba Group Holding Limited 1Man Ho LiNo ratings yet

- Mint Mumbai 17-11-2023Document22 pagesMint Mumbai 17-11-2023Raghav RaghavendraNo ratings yet

- IDX Data Services Product Pricelist JANUARI 2022Document22 pagesIDX Data Services Product Pricelist JANUARI 2022Antonia KalisaNo ratings yet

- SNL Interactive - ArticleDocument2 pagesSNL Interactive - ArticleAmin BisharaNo ratings yet

- Simple Discount AssignmentDocument3 pagesSimple Discount AssignmentAhmed BadawiNo ratings yet