Professional Documents

Culture Documents

HW#3

HW#3

Uploaded by

Eduardo Vega0 ratings0% found this document useful (0 votes)

164 views2 pagesThe company expects to invest $5 million in new manufacturing facilities to produce a laser speed detector priced at $3,000 per unit. It plans to sell 5,000 units annually over five years. The facilities will be depreciated over seven years for tax purposes. At the end of five years, the expected salvage value of the facilities is $1.6 million. Over the five years, the project is expected to generate a total net income of $17.7 million after taxes.

Original Description:

Engineering Economy HW3

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe company expects to invest $5 million in new manufacturing facilities to produce a laser speed detector priced at $3,000 per unit. It plans to sell 5,000 units annually over five years. The facilities will be depreciated over seven years for tax purposes. At the end of five years, the expected salvage value of the facilities is $1.6 million. Over the five years, the project is expected to generate a total net income of $17.7 million after taxes.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

164 views2 pagesHW#3

HW#3

Uploaded by

Eduardo VegaThe company expects to invest $5 million in new manufacturing facilities to produce a laser speed detector priced at $3,000 per unit. It plans to sell 5,000 units annually over five years. The facilities will be depreciated over seven years for tax purposes. At the end of five years, the expected salvage value of the facilities is $1.6 million. Over the five years, the project is expected to generate a total net income of $17.7 million after taxes.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

.

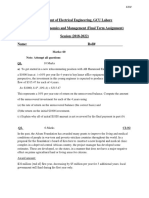

Electronic Measurement and Control Company (EMCC) has

developed a laser speed detector that emits infrared light, which

is invisible to humans and radar detectors alike. For full-scale

commercial marketing, EMCC needs to invest $5 mil- lion in

new manufacturing facilities. The system is priced at $3,000 per

unit. The company expects to sell 5,000 units annually over the

next five years. The new manufacturing facilities will be

depreciated according to a seven-year MACRS property class.

The expected salvage value of the manufacturing facilities at the

end of five years is $1.6 million. The manufacturing cost for the

detector is $1,200 per unit, excluding depreciation expenses. The

operating and maintenance costs are expected to run to $1.2

million per year. EMCC has a combined federal and state income

tax rate of 35%, and undertaking this project will not change this

cur- rent marginal tax rate.

. (a)

Determine, for the next five years, the incremental taxable

income, income taxes, and net income due to undertaking this

new product.

Year

Gross Revenue

Facilities

Maintenance

1

$9,000,000.00

($1,000,000)

($1,200,000)

2

$9,000,000.00

($1,000,000)

($1,200,000)

3

$9,000,000.00

($1,000,000)

($1,200,000)

4

$9,000,000.00

($1,000,000)

($1,200,000)

5

$9,000,000.00

($1,000,000)

($1,200,000)

Depreciation

Taxable

income

$(714,500.00) $(1,224,500.00)

$(874,500.00)

$(624,500.00)

$(446,500.00)

$6,085,500.00

$5,925,500.00

$6,175,500.00

$6,353,500.00

$5,575,500.00

Year

Income Tax

1

$2,530,075.00

2

$2,708,575.00

3

$2,586,075.00

4

$2,498,575.00

5

$2,436,275.00

Taxes (35%)

Net Income

$2,129,925.00

$3,955,575.00

$1,951,425.00

$3,624,075.00

$2,073,925.00

$3,851,575.00

$2,161,425.00

$4,014,075.00

$2,223,725.00

$4,129,775.00

. (b)

Determine the gains or losses associated with the disposal of the

manufacturing facilities at the end of five years.

(

You might also like

- Business PlanDocument3 pagesBusiness PlanJumoke Olaniyan67% (9)

- Financial Decision Making - Sample Suggested AnswersDocument14 pagesFinancial Decision Making - Sample Suggested AnswersRaymond RayNo ratings yet

- ACC110 P2 Q2 Answer - Docx 2Document13 pagesACC110 P2 Q2 Answer - Docx 2Sherwin SarzueloNo ratings yet

- Bài Tập Buổi 4 (Updated)Document4 pagesBài Tập Buổi 4 (Updated)Minh NguyenNo ratings yet

- F 9Document32 pagesF 9billyryan1100% (2)

- Capital BudgetingDocument3 pagesCapital BudgetingMikz PolzzNo ratings yet

- MANAGERIAL FINANCE AssignmentDocument2 pagesMANAGERIAL FINANCE Assignmentfahim zamanNo ratings yet

- CFD ExercisesDocument6 pagesCFD ExercisesJohn Paul CristobalNo ratings yet

- 05 Exercises On Capital BudgetingDocument4 pages05 Exercises On Capital BudgetingAnshuman AggarwalNo ratings yet

- NPV & Capital Budgeting QuestionsDocument8 pagesNPV & Capital Budgeting QuestionsAnastasiaNo ratings yet

- Assignment 1Document2 pagesAssignment 1Jabnon NonjabNo ratings yet

- HW1 NPVDocument4 pagesHW1 NPVLalit GuptaNo ratings yet

- PRQZ 2Document26 pagesPRQZ 2Hoa Long ĐởmNo ratings yet

- Supply Chain Drivers and Metrics: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanyDocument25 pagesSupply Chain Drivers and Metrics: Powerpoint Presentation To Accompany Powerpoint Presentation To AccompanysynwithgNo ratings yet

- Electronic Measurement and Control Company Emcc Has Developed A LaserDocument1 pageElectronic Measurement and Control Company Emcc Has Developed A LaserTaimur TechnologistNo ratings yet

- Tutorial Problems - Capital BudgetingDocument6 pagesTutorial Problems - Capital BudgetingMarcoBonaparte0% (1)

- Tutorial 3a-Cash Flow EstimationDocument3 pagesTutorial 3a-Cash Flow EstimationPrincessCC20No ratings yet

- NPV Practice CompleteDocument5 pagesNPV Practice CompleteShakeel AslamNo ratings yet

- Homework Financial MNGTDocument3 pagesHomework Financial MNGTArka Narayan DashguptaNo ratings yet

- Mas Test Bank QuestionDocument3 pagesMas Test Bank QuestionEricka CalaNo ratings yet

- Ie342 SS4Document8 pagesIe342 SS4slnyzclrNo ratings yet

- EM Final Paper Assingment EE GCU S18Document4 pagesEM Final Paper Assingment EE GCU S18KhanNo ratings yet

- Plates in Econ Direction: Copy and Solve The Following Problems in A Short/long/a4 Bond of Paper. Final Answer Must Be inDocument1 pagePlates in Econ Direction: Copy and Solve The Following Problems in A Short/long/a4 Bond of Paper. Final Answer Must Be inJamie MedallaNo ratings yet

- P4 TestDocument4 pagesP4 TestSameed ArifNo ratings yet

- Pteroleum Economy Exercise - DepreciationDocument31 pagesPteroleum Economy Exercise - Depreciationshaziera omarNo ratings yet

- Cash Flow Analysis - Delta Co Problems - Docx + RepcoDocument2 pagesCash Flow Analysis - Delta Co Problems - Docx + RepcoAnjali ChopraNo ratings yet

- Acca QNSDocument10 pagesAcca QNSIshmael OneyaNo ratings yet

- TH HĐNSV Buổi 5Document2 pagesTH HĐNSV Buổi 5Dỹ KhangNo ratings yet

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyNo ratings yet

- PS #5 Fall, 2022Document2 pagesPS #5 Fall, 2022Kutay SağırNo ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)Document8 pagesNanyang Business School AB1201 Financial Management Tutorial 9: Cash Flow Estimation (Common Questions)asdsadsaNo ratings yet

- DeVry ACCT 434 Final Exam 100% Correct AnswerDocument9 pagesDeVry ACCT 434 Final Exam 100% Correct AnswerDeVryHelpNo ratings yet

- Engineering Economy AssignmentDocument1 pageEngineering Economy Assignmentprateekagrawal812004No ratings yet

- Assig5 2010Document4 pagesAssig5 2010WK LamNo ratings yet

- BT Lựa Chọn Dự Án EDocument2 pagesBT Lựa Chọn Dự Án EstormspiritlcNo ratings yet

- Engg Econ QuestionsDocument7 pagesEngg Econ QuestionsSherwin Dela CruzzNo ratings yet

- Engineering Economics and Finacial Management (HUM 3051)Document5 pagesEngineering Economics and Finacial Management (HUM 3051)uday KiranNo ratings yet

- Soal-Soal Capital Budgeting # 1Document2 pagesSoal-Soal Capital Budgeting # 1Danang0% (2)

- Question 1: Company Analysis (17 Marks Total) : Assignment 2Document5 pagesQuestion 1: Company Analysis (17 Marks Total) : Assignment 2Armeen Khan0% (1)

- Economics Tutorial-Sheet-2Document3 pagesEconomics Tutorial-Sheet-2Saburo SahibNo ratings yet

- Hightec Corporation Has A Seven Year Contract With Magichip CompDocument1 pageHightec Corporation Has A Seven Year Contract With Magichip CompAmit PandeyNo ratings yet

- Practice Questions-Ch 10Document2 pagesPractice Questions-Ch 10JoeNo ratings yet

- DeVry ACCT 505 Final Exam 2Document12 pagesDeVry ACCT 505 Final Exam 2devryfinalexamscomNo ratings yet

- Capital Budgeting 2 Homework SS 22Document2 pagesCapital Budgeting 2 Homework SS 22buivunguyetminhNo ratings yet

- Work SheeetDocument2 pagesWork SheeetAwoke100% (1)

- 2nd Assignment 2021Document3 pages2nd Assignment 2021No NameNo ratings yet

- 2-4 2005 Jun QDocument10 pages2-4 2005 Jun QAjay TakiarNo ratings yet

- Chap 1Document2 pagesChap 1Mariane Jean GuerreroNo ratings yet

- Required:: Project A Would CostDocument10 pagesRequired:: Project A Would CostSad CharlieNo ratings yet

- Annual Worth IRR Capital Recovery CostDocument30 pagesAnnual Worth IRR Capital Recovery CostadvikapriyaNo ratings yet

- Financial Management Case StudyDocument1 pageFinancial Management Case StudyAin NadiaNo ratings yet

- DeVry ACCT 505 Final Exam 2 100% Correct AnswerDocument12 pagesDeVry ACCT 505 Final Exam 2 100% Correct AnswerDeVryHelpNo ratings yet

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaNo ratings yet

- HW Week 5 Fin/571Document5 pagesHW Week 5 Fin/571trelvisd0% (1)

- Test 2Document2 pagesTest 2raaasaaNo ratings yet

- 16 58Document3 pages16 58René MorelNo ratings yet

- F5 2012 Jun QPDocument7 pagesF5 2012 Jun QPRuslan LamievNo ratings yet

- Break Even TutorialDocument7 pagesBreak Even TutorialAhmed BeheryNo ratings yet

- Capital Budgeting 2Document3 pagesCapital Budgeting 2mlexarNo ratings yet

- Investment Decisions Problems 2Document5 pagesInvestment Decisions Problems 2MussaNo ratings yet

- Assignment 5Document2 pagesAssignment 5Sajid IqbalNo ratings yet

- Communication Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryFrom EverandCommunication Equipment Repair & Maintenance Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Fiber Optic Cable World Summary: Market Values & Financials by CountryFrom EverandFiber Optic Cable World Summary: Market Values & Financials by CountryNo ratings yet

- Sl. No - Case No. Applicant Vs Defendant AdvocateDocument5 pagesSl. No - Case No. Applicant Vs Defendant AdvocateLaxmikant DugeNo ratings yet

- Histori TransaksiDocument6 pagesHistori TransaksiSalwa NtsNo ratings yet

- Summary of Lecture 5 - ElasticityDocument5 pagesSummary of Lecture 5 - ElasticityGwyneth Ü ElipanioNo ratings yet

- Moving Average Convergence Divergence (MACD)Document3 pagesMoving Average Convergence Divergence (MACD)Neha RoyNo ratings yet

- XBA-SAR4 (Pulse+MDB+ICT+Parallel A3) PDFDocument1 pageXBA-SAR4 (Pulse+MDB+ICT+Parallel A3) PDFVasil StoyanovNo ratings yet

- (Agenda Pamphlet) 7th Regional Symposium On Effective Governance and Digital TransformationDocument4 pages(Agenda Pamphlet) 7th Regional Symposium On Effective Governance and Digital Transformationcool08coolNo ratings yet

- Stamp Duties Imposed by The Act of Congress of July 1, 1862Document9 pagesStamp Duties Imposed by The Act of Congress of July 1, 1862Mike SmithNo ratings yet

- Phalgun Kesharaju I Year - MHM'10, Nizam's Institute of Medical Sciences, Hyderabad, IndiaDocument23 pagesPhalgun Kesharaju I Year - MHM'10, Nizam's Institute of Medical Sciences, Hyderabad, IndiaPhalgun KesharajuNo ratings yet

- SALN 2023 BlankDocument2 pagesSALN 2023 BlankJastine Mico benedictoNo ratings yet

- Problem Set 4 - With AnswerDocument3 pagesProblem Set 4 - With AnswerAndré MpahNo ratings yet

- Quiz Cpa EsDocument4 pagesQuiz Cpa Esmusic niNo ratings yet

- HET Neoclassical School, MarshallDocument26 pagesHET Neoclassical School, MarshallDogusNo ratings yet

- 3.1 PM - Throughput and TOC - 260622Document18 pages3.1 PM - Throughput and TOC - 260622abhijit tikekarNo ratings yet

- 5479-Article Text-9982-1-10-20210515Document7 pages5479-Article Text-9982-1-10-20210515overkillNo ratings yet

- Manage Your BookingsDocument2 pagesManage Your BookingsSKY HOLIDAYNo ratings yet

- P2 PDF Cost of Goods Sold Inventory 4Document1 pageP2 PDF Cost of Goods Sold Inventory 4Marife GuintuNo ratings yet

- Unit 2 - Second Half (Globalization, Liberalization, WTO & Its Impact & Consumer Protection)Document35 pagesUnit 2 - Second Half (Globalization, Liberalization, WTO & Its Impact & Consumer Protection)Aneesh DugarNo ratings yet

- M12Document1 pageM12Kendrew SujideNo ratings yet

- Fin 460 FinalDocument32 pagesFin 460 FinalShadman ShahadNo ratings yet

- Pradhan Mantri Ujjwala Yojana UJJWALA KYC ApplicationDocument2 pagesPradhan Mantri Ujjwala Yojana UJJWALA KYC ApplicationANANYA GARAINo ratings yet

- Chapter-13 & 14-IB-The Strategy & Organization of International BusinessDocument31 pagesChapter-13 & 14-IB-The Strategy & Organization of International BusinessabdulbashirshahriarNo ratings yet

- The Public Wet Market System of Iloilo City, PhilippinesDocument29 pagesThe Public Wet Market System of Iloilo City, PhilippinesJillian GarimbaoNo ratings yet

- PGINVIT - Q3 FY24 Earnings CallDocument17 pagesPGINVIT - Q3 FY24 Earnings CallBuvanesh BalajiNo ratings yet

- The Contemporary World Week 7Document21 pagesThe Contemporary World Week 7Jared ZabalaNo ratings yet

- ISSUE OF DEBENTURES REVISION QUESTIONS - SolnDocument18 pagesISSUE OF DEBENTURES REVISION QUESTIONS - Solnlalitha sureshNo ratings yet

- 12 Cbse Accountancy Set 1 QPDocument12 pages12 Cbse Accountancy Set 1 QPAymenNo ratings yet

- Six Years of DemonetisationDocument4 pagesSix Years of DemonetisationAmit RajNo ratings yet