Professional Documents

Culture Documents

Wealthbuilder Market Brief 5th. August 2013

Uploaded by

Christopher Michael QuigleyCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wealthbuilder Market Brief 5th. August 2013

Uploaded by

Christopher Michael QuigleyCopyright:

Available Formats

Wealthbuilder Market Brief 5th.

August 2013

Detroit and Social Credit

In 2009 I wrote an essay on Social Credit which for some reason has become one of the most popular articles I have ever penned. This, I reckon, is not because it is a particularly exceptional essay but due, in part, to timing. Interest in this economic concept has recently gone viral. However, it is ironic that Detroit has recently filed for bankruptcy. Research for the piece I wrote on Social Credit helped me discover that it was in the environs of Detroit that the American Dream was made manifest by non-other than Henry Ford. Unfortunately it would appear that the lessons that should have been learned from the perspective of Social Credit have been ignored and accordingly the American Dream is dying. This is a tragedy. But it is never too late to start anew. As the saying goes: when you lose, dont lose the lesson. To mark this seminal event in the social and economic history of Detroit I outline below the essential essence contained in that 2009 essay. Hopefully the economic truths contained therein, originally championed by Major Clifford Douglas in 1910, will continue to gain appeal and thereby motivate some future administration to take up the baton of reform and instigate credit policies that will help pass on the American Dream to new generations. What is the main objective of Social Credit? In essence it seeks to fairly compensate citizens with real purchasing power and thus end the current "trans-national/out-sourcing" industrial policy of American and European business leaders. It seeks to replace capital investment (i.e. investment in technology) with human investment. Why is purchasing power so important? It is fundamental because without money no exchange can take place. In order to understand what I am talking about let us look at the historical example set by Henry Ford in Detroit in 1920. He completely redefined "classical" economics through the policies undertaken by the Ford Motor Company. Under "normal" economic theory it was assumed that a corporation could only maximise profits by ideally becoming a monopoly which meant increasing price and limiting supply. Ford did the exact opposite. He had a more holistic view of the role of the corporation in society. He understood the synergetic relationship between money and goods. He DOUBLED the wages of his workers, DECREASED the price of the Model T and in the process remade the Ford Motor Corporation and remade America. (This policy was not inflationary because he knew he could at least double production through increased efficiencies when he doubled wages. This is the essence of the enlightened policy of Social Credit for communities rather than of monopoly credit for social elites alone). The Ford Company boomed. How did this happen? It was axiomatic. He understood the importance of money and purchasing power in society. With "high" wages Ford's workers were able to make a good living and have excess funds to save or spend. Accordingly their financial anxiety ceased and staff turnover dropped by a multiple of five in one year. This dramatically decreased management expense and increased productivity. Workers finally had peace of mind. With the increased disposable income in the Detroit area the general economy boomed. All classes of economic sectors expanded. As a result more workers, new business owners, company managers, insurance brokers, real estate brokers, bankers, salesmen, craftsmen, delivery men, builders, farmers and retailers all could afford Ford cars. Demand for the model T exploded through the increased buying power WHICH HE HAD CREATED THROUGH MONEY DISTRIBUTION. Like Major Clifford Douglas, the mind behind Social Credit, Ford understood economics and he understood the issue of PURCHASING POWER. FOR HIM PURCHASING POWER WAS NOT CREDIT

BUT CASH. HE REASLIZED THAT WITHOUT THE MONEY TO PURCHASE HIS CARS POTENTIAL DEMAND WAS IRRELEVANT. THEREFORE HE INITIALLY REDISTRIBUTED DIVIDENDS FROM THE OWNERS TO THE WORKERS. THIS INCREASED GENERAL BUSINESS ACTIVITY AND TURNOVER EXPONENTIALLY. THESE INCREASED SALE BOOSTED PROFITS TO SUCH A DEGREE THAT THE SAME OWNERS EVENTUALLY RECEIVED INCREASED SUSTAINABLE DIVIDENDS. EVERYBODY WON. THIS BRILLIANT POLICY MADE THE COMPANY. It built up the economy of Detroit and it helped define America as a country where a factory worker was respected and well paid, not exploited, as had been the case throughout the English industrial revolution. The "American Dream" was Fords vision made manifest. It was a dream brought to fruition not through political fantasy but through the hard laws of economics, accounting, finance, production, distribution and marketing. To reiterate, in my view the death of Detroit is the unmistakable sign the The American Dream is dying on its feet. Unless the policies of off-shoring American jobs and the systematic lowering of American working wages cease we are going to see many more U.S. cities going bankrupt. Social Credit as a policy may not have all the solutions to our contemporary economic crises but it has a part to play. Mainly it is helping people realise that fallacy of championing the use of technology without a concomitant policy in place to distribute money to consumers. Thus as a matter of expediency without the introduction of a National Dividend to stimulate American purchasing power contemporary modernity is going to continue to experience social disintegration. However, for some reason governments cannot seem to come to terms with the radicalness of this solution. Radical or not, the truth of the matter is you either adapt or die and unfortunately the tragedy of the Detroit bankruptcy saga proves that America is opting to die.

Technical Strength Continues For Now.

The market, though over-bought, continues to show exceptional technical strength. The strategy of going long on pullbacks and selling into highs remains in place. How long this approach continues to provide excellent returns is anyones guess but one should not fight a gift horse in the mouth. Of the Transports and the Industrials, the Trannies is the strongest Index of the two, despite rising oil prices. Case in point, observe the powerful bullish engulfing candlestick price action on the Transport Index last Friday. It would appear that the Industrials are keen to follow, we shall wait and see. One would have thought that since we are coming to the end of this earnings season there would be a serious pullback, but no, not as we speak. As reported previously this market strength is not based on fundamentals but on technicals. The FED is walking a tightrope with its QE strategy. How the FED finally gets itself out of the box it has constructed around its policy remains to be seen. Rationally one would assume that when Government debt stops being monetized interest rates will explode. The Gold bear is actually indicating that interest rates could go into double digits soon. Such an event would cripple any real estate recovery, seriously negatively alter valuations on dividend paying equities, and push debt crippled European sovereign budgets into fresh crises. However, currently the market is not interested in such logical consequences. Therefore traders and investors should soldier on and take advantage of the party while it lasts, for it cannot go on forever. Reversion to the historical price-earning-ratio-mean is inevitable. Technical analysis will

indicate to keen observers when this setup is unfolding. For the moment mean reversion is off the technical radar but as is the nature of this profession we will only believe what we see not what we hear. Dow Transports: Daily

USO: United States OIL Fund ETF: Daily

Charts: Courtesy of StockCharts.Com Ref: Robots Dont Buy Cars: Henry Ford and Social Credit 2009 Christopher M. Quigley 5h. August 2013 Christopher M. Quigley

You might also like

- Henry Ford and Social CreditDocument5 pagesHenry Ford and Social CreditChristopher Michael QuigleyNo ratings yet

- 9 Ideas To Change Your World & Other EssaysDocument37 pages9 Ideas To Change Your World & Other EssaysChristopher Michael QuigleyNo ratings yet

- A Joosr Guide to... Business Adventures by John Brooks: Twelve Classic Tales from the World of Wall StreetFrom EverandA Joosr Guide to... Business Adventures by John Brooks: Twelve Classic Tales from the World of Wall StreetNo ratings yet

- A Brief History of Doom: Two Hundred Years of Financial CrisesFrom EverandA Brief History of Doom: Two Hundred Years of Financial CrisesRating: 3.5 out of 5 stars3.5/5 (1)

- Global Market Outlook July 2011Document8 pagesGlobal Market Outlook July 2011IceCap Asset ManagementNo ratings yet

- A History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationFrom EverandA History of the United States in Five Crashes: Stock Market Meltdowns That Defined a NationRating: 4 out of 5 stars4/5 (11)

- Survival Investing: How to Prosper Amid Thieving Banks and Corrupt GovernmentsFrom EverandSurvival Investing: How to Prosper Amid Thieving Banks and Corrupt GovernmentsRating: 3.5 out of 5 stars3.5/5 (3)

- The Death of Capital Gains Investing: And What to Replace It WithFrom EverandThe Death of Capital Gains Investing: And What to Replace It WithNo ratings yet

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsFrom EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsNo ratings yet

- Why Nothing Works: The Anthropology of Daily LifeFrom EverandWhy Nothing Works: The Anthropology of Daily LifeRating: 4 out of 5 stars4/5 (30)

- Dividend Investing: The Beginner's Guide to Create Passive Income (Use the Power of Dividend Growth to Create a Winning Portfolio)From EverandDividend Investing: The Beginner's Guide to Create Passive Income (Use the Power of Dividend Growth to Create a Winning Portfolio)No ratings yet

- “Crisis Averted” 5 Things Every Organization Should Consider in Times of Business CrisisFrom Everand“Crisis Averted” 5 Things Every Organization Should Consider in Times of Business CrisisNo ratings yet

- Crisis of Character: Building Corporate Reputation in the Age of SkepticismFrom EverandCrisis of Character: Building Corporate Reputation in the Age of SkepticismNo ratings yet

- Dismantling the American Dream: How Multinational Corporations Undermine American ProsperityFrom EverandDismantling the American Dream: How Multinational Corporations Undermine American ProsperityNo ratings yet

- Selling Professional Services to the Fortune 500: How to Win in the Billion-Dollar Market of Strategy Consulting, Technology Solutions, andFrom EverandSelling Professional Services to the Fortune 500: How to Win in the Billion-Dollar Market of Strategy Consulting, Technology Solutions, andNo ratings yet

- Open: The Progressive Case for Free Trade, Immigration, and Global CapitalFrom EverandOpen: The Progressive Case for Free Trade, Immigration, and Global CapitalRating: 3.5 out of 5 stars3.5/5 (5)

- Mad About Trade: Why Main Street America Should Embrace GlobalizationFrom EverandMad About Trade: Why Main Street America Should Embrace GlobalizationNo ratings yet

- Summary: Exporting America: Review and Analysis of Lou Dobbs's BookFrom EverandSummary: Exporting America: Review and Analysis of Lou Dobbs's BookNo ratings yet

- The Economi of Success: Twelve Things Politicians Don't Want You to KnowFrom EverandThe Economi of Success: Twelve Things Politicians Don't Want You to KnowNo ratings yet

- !!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentDocument6 pages!!!engineered Stagflationary Collapse in Process To Centralize Control Under AOne World GovernmentGeneration GenerationNo ratings yet

- Building from the Ground Up: Reclaiming the American Housing BoomFrom EverandBuilding from the Ground Up: Reclaiming the American Housing BoomNo ratings yet

- Ownership: Reinventing Companies, Capitalism, and Who Owns WhatFrom EverandOwnership: Reinventing Companies, Capitalism, and Who Owns WhatNo ratings yet

- The Ten Trillion Dollar Gamble: The Coming Deficit Debacle and How to Invest Now: How Deficit Economics Will Change our Global Financial ClimateFrom EverandThe Ten Trillion Dollar Gamble: The Coming Deficit Debacle and How to Invest Now: How Deficit Economics Will Change our Global Financial ClimateRating: 4 out of 5 stars4/5 (1)

- Finance 1Document7 pagesFinance 1Samuel ChaoNo ratings yet

- Direct Public Offerings (Review and Analysis of Field's Book)From EverandDirect Public Offerings (Review and Analysis of Field's Book)No ratings yet

- MY DEBATES WITH MMTersDocument31 pagesMY DEBATES WITH MMTersxan30tosNo ratings yet

- September 22, 2010 PostsDocument543 pagesSeptember 22, 2010 PostsAlbert L. PeiaNo ratings yet

- Made in America 2.0: 10 Big Ideas for Saving the United States of America from Economic DisasterFrom EverandMade in America 2.0: 10 Big Ideas for Saving the United States of America from Economic DisasterNo ratings yet

- False Profits: Recovering from the Bubble EconomyFrom EverandFalse Profits: Recovering from the Bubble EconomyRating: 3 out of 5 stars3/5 (2)

- Playing the Long Game: How to Save the West from Short-TermismFrom EverandPlaying the Long Game: How to Save the West from Short-TermismRating: 1 out of 5 stars1/5 (1)

- The Great CrashDocument9 pagesThe Great Crashmauricio0327No ratings yet

- The Vanishing American Corporation: Navigating the Hazards of a New EconomyFrom EverandThe Vanishing American Corporation: Navigating the Hazards of a New EconomyRating: 5 out of 5 stars5/5 (1)

- Habitat For Insanity": Share ThisDocument10 pagesHabitat For Insanity": Share ThisAnonymous Feglbx5No ratings yet

- The Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.Document17 pagesThe Pessimist Complains About The Wind The Optimist Expects It To Change The Realist Adjusts The Sails.brundbakenNo ratings yet

- The Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real MoneyFrom EverandThe Invisible Hands: Top Hedge Fund Traders on Bubbles, Crashes, and Real MoneyNo ratings yet

- Investing Redefined: A Proven Investment Approach for a Changing WorldFrom EverandInvesting Redefined: A Proven Investment Approach for a Changing WorldNo ratings yet

- Summary of Business Adventures: by John Brooks | Includes AnalysisFrom EverandSummary of Business Adventures: by John Brooks | Includes AnalysisRating: 5 out of 5 stars5/5 (1)

- Wake-Up Call: Economic, Political, Social, and Psychological Factors That Can Erode Your WealthFrom EverandWake-Up Call: Economic, Political, Social, and Psychological Factors That Can Erode Your WealthNo ratings yet

- The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment PortfolioFrom EverandThe Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment PortfolioRating: 5 out of 5 stars5/5 (1)

- The Emid Report on Volatility 2019: First of a Series Designed to Help You with You Finances, #1From EverandThe Emid Report on Volatility 2019: First of a Series Designed to Help You with You Finances, #1No ratings yet

- 7 - 1st December 2007 (011207)Document4 pages7 - 1st December 2007 (011207)Chaanakya_cuimNo ratings yet

- The War on Small Business: How the Government Used the Pandemic to Crush the Backbone of AmericaFrom EverandThe War on Small Business: How the Government Used the Pandemic to Crush the Backbone of AmericaNo ratings yet

- New Anti Tech Monopoly Act Needed UrgentlyDocument2 pagesNew Anti Tech Monopoly Act Needed UrgentlyChristopher Michael QuigleyNo ratings yet

- The Meaning of MoneyDocument6 pagesThe Meaning of MoneyChristopher Michael Quigley100% (1)

- 77 Days To TauDocument14 pages77 Days To TauChristopher Michael QuigleyNo ratings yet

- "Spiritual Truth" 2024 EditionDocument56 pages"Spiritual Truth" 2024 EditionChristopher Michael Quigley100% (1)

- Wealthbuilder Stock Market Brief 2nd May 2019Document6 pagesWealthbuilder Stock Market Brief 2nd May 2019Christopher Michael QuigleyNo ratings yet

- Wealthbuilder Stock Market Brief 9th February 2018Document4 pagesWealthbuilder Stock Market Brief 9th February 2018Christopher Michael QuigleyNo ratings yet

- A Matter of Life or Debt - Final - 1 PDFDocument128 pagesA Matter of Life or Debt - Final - 1 PDFChristopher Michael Quigley100% (1)

- Wealthbuilder Stock Market Brief 20th May 2017Document9 pagesWealthbuilder Stock Market Brief 20th May 2017Christopher Michael QuigleyNo ratings yet

- A Matter of Life or Debt - Final - 1 PDFDocument128 pagesA Matter of Life or Debt - Final - 1 PDFChristopher Michael Quigley100% (1)

- Wealthbuilder Stock Market Brief 15th December 2015Document3 pagesWealthbuilder Stock Market Brief 15th December 2015Christopher Michael QuigleyNo ratings yet

- Introduction To Social Credit by DR Bryan W. Monahan Excellent Publication For The BeginnerDocument143 pagesIntroduction To Social Credit by DR Bryan W. Monahan Excellent Publication For The BeginnerChristopher Michael QuigleyNo ratings yet

- Reflections of Jose Maria ArizmendiarrietaDocument128 pagesReflections of Jose Maria ArizmendiarrietaChristopher Michael Quigley100% (2)

- Wealthbuilder Stock Market Brief 16th March 2016Document4 pagesWealthbuilder Stock Market Brief 16th March 2016Christopher Michael QuigleyNo ratings yet

- Understanding The Cantos by Ezra PoundDocument32 pagesUnderstanding The Cantos by Ezra PoundChristopher Michael QuigleyNo ratings yet

- Father Seraphim Rose ExcerptsDocument3 pagesFather Seraphim Rose ExcerptsChristopher Michael QuigleyNo ratings yet

- Manipulation Methods and How To Avoid From ManipulationDocument5 pagesManipulation Methods and How To Avoid From ManipulationEylül ErgünNo ratings yet

- Operating Instructions: Vacuum Drying Oven Pump ModuleDocument56 pagesOperating Instructions: Vacuum Drying Oven Pump ModuleSarah NeoSkyrerNo ratings yet

- Rural Marketing MergedDocument146 pagesRural Marketing MergedRishabh HemaniNo ratings yet

- UBO - Lecture 07 - Implementing and Managing Organisational ChangeDocument0 pagesUBO - Lecture 07 - Implementing and Managing Organisational ChangeShahNooraniITNo ratings yet

- DR Cast Iron Fittings CharlotteDocument124 pagesDR Cast Iron Fittings CharlotteMohamad NohayliNo ratings yet

- RKS IFC 2015 Solar CellDocument23 pagesRKS IFC 2015 Solar CellAnugrah PangeranNo ratings yet

- Programmable Logic Controllers: Basic Ladder Logic ProgrammingDocument9 pagesProgrammable Logic Controllers: Basic Ladder Logic Programminganuradha19No ratings yet

- Moodle2Word Word Template: Startup Menu: Supported Question TypesDocument6 pagesMoodle2Word Word Template: Startup Menu: Supported Question TypesinamNo ratings yet

- Intercostal Drainage and Its ManagementDocument36 pagesIntercostal Drainage and Its ManagementAnusha Verghese67% (3)

- CSMP77: en Es FRDocument38 pagesCSMP77: en Es FRGerson FelipeNo ratings yet

- Forklift Driver Card and Certificate TemplateDocument25 pagesForklift Driver Card and Certificate Templatempac99964% (14)

- System Software Mind MapDocument1 pageSystem Software Mind MapRena AllenNo ratings yet

- Berghahn Dana ResumeDocument2 pagesBerghahn Dana ResumeAnonymous fTYuIuK0pkNo ratings yet

- Psychological Well Being - 18 ItemsDocument5 pagesPsychological Well Being - 18 ItemsIqra LatifNo ratings yet

- Year 10 English Unit Plan AdvertisingDocument5 pagesYear 10 English Unit Plan Advertisingapi-333849174No ratings yet

- 1) About The Pandemic COVID-19Document2 pages1) About The Pandemic COVID-19محسين اشيكNo ratings yet

- New York LifeDocument38 pagesNew York LifeDaniel SineusNo ratings yet

- Causal Relationships WorksheetDocument2 pagesCausal Relationships Worksheetledmabaya23No ratings yet

- JamPlay 30 Minute Guitar Pratice TemplateDocument23 pagesJamPlay 30 Minute Guitar Pratice TemplateSunkilr Sönny100% (4)

- 5G, 4G, Vonr Crash Course Complete Log AnaylsisDocument11 pages5G, 4G, Vonr Crash Course Complete Log AnaylsisJavier GonzalesNo ratings yet

- Transformational and Charismatic Leadership: The Road Ahead 10th Anniversary EditionDocument32 pagesTransformational and Charismatic Leadership: The Road Ahead 10th Anniversary Editionfisaac333085No ratings yet

- Learner Cala Guide: PART A: Identification of Knowledgeable Elderly Part BDocument5 pagesLearner Cala Guide: PART A: Identification of Knowledgeable Elderly Part BPrimrose MurapeNo ratings yet

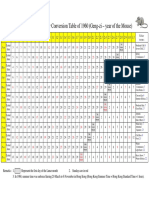

- Gregorian-Lunar Calendar Conversion Table of 1960 (Geng-Zi - Year of The Mouse)Document1 pageGregorian-Lunar Calendar Conversion Table of 1960 (Geng-Zi - Year of The Mouse)Anomali SahamNo ratings yet

- Good Data Won't Guarantee Good DecisionsDocument3 pagesGood Data Won't Guarantee Good DecisionsAditya SharmaNo ratings yet

- WB-Mech 120 Ch05 ModalDocument16 pagesWB-Mech 120 Ch05 ModalhebiyongNo ratings yet

- AMST 398 SyllabusDocument7 pagesAMST 398 SyllabusNatNo ratings yet

- A. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFDocument4 pagesA. Erfurth, P. Hoff. Mad Scenes in Early 19th-Century Opera PDFbiarrodNo ratings yet

- Salik Sa Mga Estudyante NG Hindi Wastong Pagsuot NG Uniporme NG Senior High School Sa Paaralang Ama Computer College Fairview CampusDocument1 pageSalik Sa Mga Estudyante NG Hindi Wastong Pagsuot NG Uniporme NG Senior High School Sa Paaralang Ama Computer College Fairview CampusIsrael ManansalaNo ratings yet

- Introduction To Hydraulic System in The Construction Machinery - Copy ALIDocument2 pagesIntroduction To Hydraulic System in The Construction Machinery - Copy ALImahadNo ratings yet

- Applications Description: General Purpose NPN Transistor ArrayDocument5 pagesApplications Description: General Purpose NPN Transistor ArraynudufoqiNo ratings yet