Professional Documents

Culture Documents

Income Splitting With A Prescribed Rate Loan

Uploaded by

api-233195329Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Income Splitting With A Prescribed Rate Loan

Uploaded by

api-233195329Copyright:

Available Formats

Income Splitting with a Prescribed Rate Loan

Introduction Canada and most of its provinces (except Alberta) and territories impose a progressive rate of tax on the income of an individual. This progressive tax system is an incentive for individuals to look for ways to split income with other taxpayers, particularly family members.

The prescribed rate has been 1% since April 1, 2009. On October 1, 2013, the prescribed rate will increase to 2%.

Income splitting is achieved when income otherwise taxable to one taxpayer (and at a higher rate) is shifted to and is taxed in the hands of another taxpayer who is taxed at a lower rate. When income splitting can be achieved, it provides tax savings and leaves more money that can be used for investment purposes or to pay living expenses. While income splitting sounds like a wonderful idea, Canada has attribution rules designed to thwart taxpayers attempting to income split. Generally speaking, these attribution rules operate by attributing investment income back to the higher rate taxpayer from:

money loaned, and property that is loaned or transferred to a lower rate taxpayer, where the taxpayers are related (e.g., spouses or common-law partners and minor children).

If the attribution rules apply, all investment income is attributed back to the higher rate taxpayer if the income splitting involves spouses or common-law partners. Where the income splitting involves minor children, all investment income (but not capital gains) is attributed back. One exception to the attribution rules is where the parties use a Prescribed Rate Loan (PRL) for the money loaned or property that is loaned or transferred. A PRL uses the prescribed rate of interest that is determined by a formula in the Regulations under Canadas Income Tax Act. This prescribed rate of interest is calculated quarterly and a PRL is an effective and often used strategy to successfully achieve income splitting (e.g., not have the attribution rules apply). The prescribed rate has been 1% since April 1, 2009. On October 1, 2013, the prescribed rate will increase to 2%.

Income Splitting with a Prescribed Rate Loan

To be an effective PRL, the following criteria should be met:

there is a written loan agreement at the time the loan is made, the rate of interest charged is at least equal to the lesser of:

the prescribed rate, or an arms length rate (e.g., a commercial rate), and

the loan interest (for the prior year) must be paid on or before January 30th of the following year.

If the interest payments on the PRL are not made when required, the attribution rules will apply for the current and all future years. In this case, the original PRL should be repaid and a new PRL entered into so that the attribution rules do not apply. The interest paid must be included in income and is therefore taxable to the lending party. If the PRL proceeds are used for investment purposes, the borrowing party may be able claim a tax deduction for the interest paid. It should be noted that if property is transferred to a spouse or common-law partner (spouse), there is an automatic spousal rollover rule under the Income Tax Act that applies. Under this rollover rule, no gain or loss is triggered on the transfer of property between spouses, however, all of the income or loss (and any capital gain or loss) from the transferred property will be attributed back to the transferring spouse. Accordingly, where property is transferred between spouses for income splitting purposes, the transferring spouse should elect out of the automatic rollover. This results in any accrued capital gain being taxable in the year of transfer to the transferring spouse. PRL Example Skyler Doe lends his common-law partner Tyler $100,000 at a time when the prescribed rate is 2%. Assume that Skyler is in a 40% marginal tax bracket, and Tyler is in a 25% marginal tax bracket. Skyler Lends Tyler $100,000 Earns 2% interest (from Tyler) Skylers Taxable Income Tax @ 40% After tax income Total Income (After Tax) $2,000 $2,000 $800 $1200 $5,000 $3,000 $750 $2,250 Income for Skyler Income for Tyler Tyler Invests the $100,000 Earns 5% interest from his investment Tylers taxable Income Tax @ 25% After tax income If Skyler had kept and invested his $100,000 for himself, the full $5,000 of interest income would have been taxed in his hands, yielding an after tax income of just $3,000.

$3,450

Income Splitting with a Prescribed Rate Loan

Additional Information:

The CRA announces the prescribed interest rate on a quarterly basis. This rate generally follows the interest rate on 90 day Government of Canada Treasury Bills (T-Bills) sold in the first 30 days of the previous quarter. For example, the prescribed rate for October 1 to December 31, 2013 is based upon the 90 day T-Bills that were sold in July 2013. The prescribed rate can be locked in under a PRL. For example, if the current prescribed rate is 2%, this rate can be locked in for as long as the loan is in existence, regardless of whether the prescribed rate rises. However, if the prescribed rate declines, the PRL can be renegotiated to lock in the lower prescribed rate. There is no limit on the PRL amount or the length of time the PRL is in place.

Generally speaking, a PRL agreement would: Provide the names of the borrower and lender Stipulate the amount loaned (principal) Stipulate the interest rate charged (prescribed rate or higher) Be signed, dated and witnessed, and Stipulate that interest for the year is due and payable on or before the 30th of January of the following year.

As with any tax related planning, it is important to consult with a tax professional prior to implementing this strategy. Legal advice may also be required in the drafting of the PRL Agreement.

The information contained herein has been provided by TD Wealth and is for information purposes only. The information has been drawn from sources believed to be reliable. Where such statements are based in whole or in part on information provided by third parties, they are not guaranteed to be accurate or complete. Graphs and charts are used for illustrative purposes only and do not reflect future values or future performance of any investment. The information does not provide financial, legal, tax or investment advice. Particular investment, trading or tax strategies should be evaluated relative to each individuals objectives and risk tolerance. TD Wealth, The TorontoDominion Bank and its affiliates and related entities are not liable for any errors or omissions in the information or for any loss or damage suffered. TD Wealth represents the products and services offered by TD Waterhouse Canada Inc. (Member Canadian Investor Protection Fund), TD Waterhouse Private Investment Counsel Inc., TD Wealth Private Banking (offered by The Toronto-Dominion Bank) and TD Wealth Private Trust (offered by The Canada Trust Company). / The TD logo and other trade-marks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or in other countries. Revised 06/08/2013

You might also like

- Charitable Remainder TrustDocument4 pagesCharitable Remainder Trustapi-246909910100% (1)

- TestamentaryTrusts Assante Nov 2006Document10 pagesTestamentaryTrusts Assante Nov 2006edlycos100% (1)

- How I Improved My Fatca Form in One DayvbgmjDocument4 pagesHow I Improved My Fatca Form in One Dayvbgmjshieldopera1No ratings yet

- Ten Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamDocument4 pagesTen Income and Estate Tax Planning Strategies For 2014: Ideas From PutnamPrince McGershonNo ratings yet

- Assignment of Income DoctrineDocument20 pagesAssignment of Income DoctrinewxwgmumpdNo ratings yet

- Putnam Gifting Opportunities in 2012Document4 pagesPutnam Gifting Opportunities in 2012Putnam InvestmentsNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Multiple Definitions of Effective APRDocument2 pagesMultiple Definitions of Effective APRCynea ArquisolaNo ratings yet

- Important Investment Information For AGLA361424Document18 pagesImportant Investment Information For AGLA361424Simbarashe MarisaNo ratings yet

- Unreported IncomeDocument3 pagesUnreported IncomeAziz JawaidNo ratings yet

- Estate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCDocument4 pagesEstate Tax After The Fiscal Cliff: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Strategies To Pay Less TaxDocument4 pagesStrategies To Pay Less TaxblkdwgNo ratings yet

- Year-End Investment Planning and The Fiscal Cliffhanger: Collaborative Financial Solutions, LLCDocument4 pagesYear-End Investment Planning and The Fiscal Cliffhanger: Collaborative Financial Solutions, LLCJanet BarrNo ratings yet

- Solution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by PrattDocument36 pagesSolution Manual For Corporate Partnership Estate and Gift Taxation 2013 7th Edition by Prattgalbehiphaltkll3100% (47)

- Full Solution Manual For Corporate Partnership Estate and Gift Taxation 2013 7Th Edition by Pratt PDF Docx Full Chapter ChapterDocument13 pagesFull Solution Manual For Corporate Partnership Estate and Gift Taxation 2013 7Th Edition by Pratt PDF Docx Full Chapter Chapterinsurer.dual.83l3100% (16)

- Overview of The Federal Tax System As in Effect For 2013: Prepared by The Staff of The Joint Committee On TaxationDocument20 pagesOverview of The Federal Tax System As in Effect For 2013: Prepared by The Staff of The Joint Committee On TaxationVincent Jerome LloydNo ratings yet

- A Accrual Accounting MethodDocument19 pagesA Accrual Accounting MethodVivian Montenegro GarciaNo ratings yet

- Federal Tax System 2015Document32 pagesFederal Tax System 2015Matt GillNo ratings yet

- Individual Taxation 2013 Pratt 7th Edition Solutions ManualDocument14 pagesIndividual Taxation 2013 Pratt 7th Edition Solutions ManualCharles Davis100% (35)

- Individual Taxation 2013 Pratt 7th Edition Solutions ManualDocument14 pagesIndividual Taxation 2013 Pratt 7th Edition Solutions Manualbrianbradyogztekbndm100% (42)

- Accg Tax Notes C6Document5 pagesAccg Tax Notes C6IntelaCrosoftNo ratings yet

- Preparing For EOFY June 2011Document2 pagesPreparing For EOFY June 2011nsfpNo ratings yet

- E Demandnotice 411 A 11Document10 pagesE Demandnotice 411 A 11Leonardo Zikri ArmandaNo ratings yet

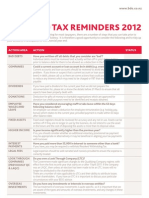

- Year-End Tax Reminders 2012: Action Area Action StatusDocument2 pagesYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783No ratings yet

- E Demandnotice 411 A 11Document10 pagesE Demandnotice 411 A 11llukelawrenceNo ratings yet

- Know Your Taxation Sec 1Document20 pagesKnow Your Taxation Sec 1Nagarajan PeriyasamyNo ratings yet

- NATP TaxPro Monthly September2013Document16 pagesNATP TaxPro Monthly September2013Concha Burciaga HurtadoNo ratings yet

- Solution Manual For Personal Finance 12th Edition by GarmanDocument7 pagesSolution Manual For Personal Finance 12th Edition by Garmana719435805No ratings yet

- What Is Imputed Interest?Document3 pagesWhat Is Imputed Interest?1abhishek1No ratings yet

- Seven Investments The Government Will Pay You To MakeDocument11 pagesSeven Investments The Government Will Pay You To Makeangelprezz84100% (1)

- Tax Accounting Study GuideDocument4 pagesTax Accounting Study Guides511939No ratings yet

- Quick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”From EverandQuick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”No ratings yet

- IDGT by GreenbergvacDocument2 pagesIDGT by GreenbergvaccurrencytradesNo ratings yet

- Rollovers: JDG Wealth Management Group, LLCDocument2 pagesRollovers: JDG Wealth Management Group, LLCJeremy A. MillerNo ratings yet

- Tax Planning DefinitionDocument7 pagesTax Planning DefinitionAlex MasonNo ratings yet

- The Trump Tax Cut: Your Personal Guide to the New Tax LawFrom EverandThe Trump Tax Cut: Your Personal Guide to the New Tax LawNo ratings yet

- Payroll MGMT Learner GuideDocument6 pagesPayroll MGMT Learner GuideEphraim PryceNo ratings yet

- October 2014: Prepare Now For A Year-End Investment ReviewDocument4 pagesOctober 2014: Prepare Now For A Year-End Investment ReviewIncome Solutions Wealth ManagementNo ratings yet

- Preliminary ProspectusDocument229 pagesPreliminary ProspectusSteve LadurantayeNo ratings yet

- Dividend Tax Cuts 2002 Bush - DamodaranDocument24 pagesDividend Tax Cuts 2002 Bush - DamodarantoddaeNo ratings yet

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- 2012 Tax LetterDocument3 pages2012 Tax LetterLinda GrangerNo ratings yet

- Chapter 3 - Investment IncomeDocument26 pagesChapter 3 - Investment IncomeRyan YangNo ratings yet

- Private Family FoundationsDocument5 pagesPrivate Family Foundationsapi-246909910100% (4)

- Instructions For Schedule P (540) : What's NewDocument8 pagesInstructions For Schedule P (540) : What's NewResearch and Development Tax Credit Magazine; David Greenberg PhD, MSA, EA, CPA; TGI; 646-705-2910No ratings yet

- Debt ManagementDocument11 pagesDebt ManagementRijah WeiweiNo ratings yet

- Tax Free Investing BasicsDocument5 pagesTax Free Investing Basicsvijaychemuturi0% (1)

- Takaful MaybankDocument4 pagesTakaful MaybankSHANo ratings yet

- Chapter 1-Solutions-Spring 2020Document18 pagesChapter 1-Solutions-Spring 2020Rashaf RazakNo ratings yet

- Build Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthFrom EverandBuild Tax-Free Wealth: How to Permanently Lower Your Taxes and Build More WealthNo ratings yet

- Find Your Freedom: Financial Planning for a Life on PurposeFrom EverandFind Your Freedom: Financial Planning for a Life on PurposeRating: 5 out of 5 stars5/5 (1)

- Pass The 66 Study SheetDocument4 pagesPass The 66 Study SheetEmmanuelDasiNo ratings yet

- Family TrustsDocument2 pagesFamily Trustsvsimas11No ratings yet

- Thesis Tax AvoidanceDocument7 pagesThesis Tax Avoidancepjrozhiig100% (2)

- Five Strategies For Tax-Efficient Investing: Meet Our TeamDocument4 pagesFive Strategies For Tax-Efficient Investing: Meet Our TeamRudi MaulanaNo ratings yet