Professional Documents

Culture Documents

Other Important Terms

Uploaded by

Saugat KarOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Other Important Terms

Uploaded by

Saugat KarCopyright:

Available Formats

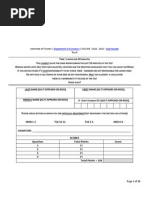

Shareholders' funds It is a measure of shareholders total interest in the company represented by the total share capital plus reserves.

It can be measured by the balance sheet value of shareholders interest in a company. For the accounts of a company with no subsidiaries, it is total assets minus total liabilities. For consolidated group accounts, the value of minority interest is excluded. It can be expressed as follows:

1)

2)

Equity Share Capital + Preference Share Capital+ Reserve and Surplus Fictitious Assets (if any) Total Assets Fictitious Assets All External Liabilities

Money against share warrants A share warrant is a document in which it is stated that the bearer of the warrant is entitled to the shares specified therein. Money against share warrants means the money that the bearer would receive for the shares. Share application money pending allotment Share Application money is that money received by a company during an initial public offering. This means that the price of the shares has been received but the shares have not yet been allotted to the investors. The company cannot use the money unless the entire allotment process is done. Tangible assets Assets that have a physical form are called tangible assets. Tangible assets include both fixed assets, such as machinery, buildings and land, and current assets, such as inventory. Intangible Assets Intangible assets are defined as identifiable non-monetary assets that cannot be seen, touched or physically measured, and are created through time and effort, and are identifiable as a separate asset. Non-physical assets, such as patents, trademarks, copyrights, goodwill and brand recognition, are all examples of intangible assets. An intangible asset can be classified as either indefinite or definite depending on the specifics of that asset. Capital Work in Progress Capital work in progress is a function of two accounting terms: capital and work in progress. Companies use capital work in progress to track and account for uncompleted building and construction. It means construction in progress or capital work in progress which is not yet completed (typically, applied to capital budget items). It is thus a work that has not been

completed but has already incurred a capital investment. A CIP item is not depreciated until the asset is placed in service. Normally, upon completion, a CIP item is reclassified, and the reclassified asset is capitalized and depreciated. Intangible assets under development Intangible assets under development relates mainly relates mainly to software development. They may also be related to location development rights, deed restrictions and similar assets. It can be explained by the following example. Say an organization has applied for patent of any product that it has invented and the approval is still pending. Hence it can be a situation of intangible assets under development. Miscellaneous expenses not written off A company spends money on various things. If money spent is sizeable and can be given a name as per materiality concept, it can be shown separately. But if money spent on petty things, they can be grouped and shown under Miscellaneous Expense. If the benefit of these expenses is receivable over a period of time, this amount can be written off in parts. The amount which is yet to be written off can be shown as Misc Expenses not written off. Contingent Liability A contingent liability is a potential liability. It depends on a future event occurring or not occurring. For example, if a parent guarantees a daughters first car loan, the parent has a contingent liability. If the daughter makes her car payments and pays off the loan, the parent will have no liability. If the daughter fails to make the payments, the parent will have a liability. These liabilities are recorded in a company's accounts and shown in the balance sheet when both probable and reasonably estimable. A footnote to the balance sheet describes the nature and extent of the contingent liabilities. Deferred Tax Liability: An account on a company's balance sheet that is a result of temporary differences between the company's accounting and tax carrying values, the anticipated and enacted income tax rate, and estimated taxes payable for the current year. This liability may or may not be realized during any given year, which makes the deferred status appropriate. Because there are differences between what a company can deduct for tax and accounting purposes, there will be a difference between a company's taxable income and income before tax. A deferred tax liability records the fact that the company will, in the future, pay more

income tax because of a transaction that took place during the current period, such as an installment sale receivable. Deferred Tax Asset: It is an asset on a company's balance sheet that may be used to reduce any subsequent period's income tax expense. Deferred tax assets can arise due to net loss carryovers, which are only recorded as assets if it is deemed more likely than not that the asset will be used in future fiscal periods. It must be determined that there is more than a 50% probability that the company will have positive accounting income in the next fiscal period before the deferred tax asset can be applied. If, for example, a company has a deferred tax asset of $25,000 on its balance sheet, and then the company earns $75,000 in before-tax accounting income, accounting tax expense will be applied to $50,000 ($75,000 - $25,000), instead of $75,000. Activity Based Costing Activity based costing is a dynamic and systematic accounting methodology for realistically calculating the actual cost of doing business, regardless of organizational structure. ABC originated from the efforts of Dr. Robert Kaplan of Harvard, who also conceptualized the Balanced Scorecard. Proponents of ABC believe that the major thrusts of a company such as continuous process improvement and simplification to boost productivity can only be attained if the real cost and time required to produce its goods and services is determined. This will prevent indiscriminate cost-cutting measures (such as miscalculated downsizing) that may actually result in worse performance and profitability. ABC entails the complex task of identifying discrete activities and identifying the measure of output for each of these activities. Each activity also needs to be classified as either 'valueadded' or 'non-value-added.' Value-added activities are activities that add value to the product or service that the customer is willing to pay for. Thus, all steps required to manufacture a product or enhance its quality or reliability are value-added activities. On the other hand, nonvalue-added activities are activities that do not contribute any value to the final product, and are other activities that the customer doesn't really want to pay for. Staging of products and unnecessary inspection are examples of non-value-added activities. Non-value added activities, in general, must be eliminated if possible. Activity-based costing consists of the following steps:

1) Analysis of activities; 2) Cost data gathering; 3) Tracing of costs to activities; 4) Establishment of output metrics; and 5) Cost analysis. A Real World Example Sam-Mart Produce Department: a) Continually dumps produce due to spoilage b) Has difficulty keeping its stock current c) Must reduce spoilage costs

You might also like

- Accounting BasicsDocument13 pagesAccounting BasicskameshpatilNo ratings yet

- Management Accounting NotesDocument9 pagesManagement Accounting NotesMd FahadNo ratings yet

- FCA Notes 01Document8 pagesFCA Notes 01US10No ratings yet

- Notes For FMDocument12 pagesNotes For FMwoldeamanuelNo ratings yet

- 02 Handout 1Document6 pages02 Handout 1Stacy Anne LucidoNo ratings yet

- SCRIPTDocument5 pagesSCRIPTJohn LucaNo ratings yet

- Task 2Document18 pagesTask 2Yashmi BhanderiNo ratings yet

- Balance SheetDocument8 pagesBalance SheetadjeponehNo ratings yet

- FINANCIAL ACCOUNTING - AsbDocument9 pagesFINANCIAL ACCOUNTING - AsbMuskaanNo ratings yet

- Finance QuestionsDocument10 pagesFinance QuestionsAkash ChauhanNo ratings yet

- A Primer On Financial StatementsDocument11 pagesA Primer On Financial StatementsPranay NarayaniNo ratings yet

- Who Are The Users of AccountingDocument20 pagesWho Are The Users of AccountingMohammad KamranNo ratings yet

- Terminology Asset: Share CapitalDocument8 pagesTerminology Asset: Share CapitalHenna HussainNo ratings yet

- Deferred Charge: DEFINITION of 'Regulatory Asset'Document6 pagesDeferred Charge: DEFINITION of 'Regulatory Asset'Joie CruzNo ratings yet

- The Profit and Loss StatementDocument5 pagesThe Profit and Loss Statementnenaddejanovic100% (1)

- Stock ResearchDocument50 pagesStock Researchvikas yadavNo ratings yet

- Account Titles and ExplanationDocument4 pagesAccount Titles and ExplanationKaye VillaflorNo ratings yet

- Account ElementsDocument8 pagesAccount ElementsMae AroganteNo ratings yet

- Corporate FininanceDocument10 pagesCorporate FininanceMohan KottuNo ratings yet

- AssetsDocument7 pagesAssetsarchie demesaNo ratings yet

- Ans.Q1) Accounting Is The Process of Recording Financial Transactions Pertaining To ADocument8 pagesAns.Q1) Accounting Is The Process of Recording Financial Transactions Pertaining To ALavina AgarwalNo ratings yet

- Assets: Elements of The Financial StatementsDocument5 pagesAssets: Elements of The Financial StatementsSiva PratapNo ratings yet

- Finance QuestionsDocument14 pagesFinance QuestionsGeetika YadavNo ratings yet

- Summary Chapter 6 Accounting For Managers - Paul M. CollierDocument4 pagesSummary Chapter 6 Accounting For Managers - Paul M. CollierMarina_1995No ratings yet

- Title /course Code Principles of AccountingDocument6 pagesTitle /course Code Principles of AccountingM Noaman AkbarNo ratings yet

- Financial Accounting and Reporting (: Assignment #1)Document4 pagesFinancial Accounting and Reporting (: Assignment #1)Mary Elouise BundaNo ratings yet

- Cash Flow Statement TheoryDocument30 pagesCash Flow Statement Theorymohammedakbar88100% (5)

- Accountng TheoryDocument25 pagesAccountng TheoryrajeeevaNo ratings yet

- Accounting Is An Information System That IdentifiesDocument5 pagesAccounting Is An Information System That Identifiesniser88No ratings yet

- Financial LiteracyDocument4 pagesFinancial LiteracyFarhan KhanNo ratings yet

- Introduction To Financial StatementsDocument21 pagesIntroduction To Financial StatementsmanjushreeNo ratings yet

- Sample of Asset-Office Land, Equiptment, Cash, MachinesDocument29 pagesSample of Asset-Office Land, Equiptment, Cash, MachinesMaria Cludet NayveNo ratings yet

- AccountingDocument12 pagesAccountingmarcus94No ratings yet

- Professional Practices Lecture 18Document40 pagesProfessional Practices Lecture 18Talha Chaudhary100% (1)

- Bunwin Residence: Is The Company Profitable??Document6 pagesBunwin Residence: Is The Company Profitable??Pum MineaNo ratings yet

- How The Balance Sheet WorksDocument5 pagesHow The Balance Sheet Worksrimpyagarwal100% (1)

- 2 Elements of AccountingDocument4 pages2 Elements of Accountingapi-299265916No ratings yet

- Understanding Financial Statements (Review and Analysis of Straub's Book)From EverandUnderstanding Financial Statements (Review and Analysis of Straub's Book)Rating: 5 out of 5 stars5/5 (5)

- Accounting IQ TestDocument12 pagesAccounting IQ TestHarichandra Patil100% (3)

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Static 1Document16 pagesStatic 1Anurag SinghNo ratings yet

- Mid Term TopicsDocument10 pagesMid Term TopicsТемирлан АльпиевNo ratings yet

- What Is Cash FlowDocument31 pagesWhat Is Cash FlowSumaira BilalNo ratings yet

- Cash Flow StatementDocument13 pagesCash Flow StatementMuhammed IbrahimNo ratings yet

- Afm Mod 2Document4 pagesAfm Mod 2Manas MohapatraNo ratings yet

- Pre-Module 1 ACC NYPLD2016 ShantanuDocument3 pagesPre-Module 1 ACC NYPLD2016 Shantanusunil kumarNo ratings yet

- Acc Financial Statement Proj InfoDocument13 pagesAcc Financial Statement Proj InfoSandhya ThaparNo ratings yet

- PDF Document 3Document37 pagesPDF Document 3Micaella JanNo ratings yet

- 2600 Legarda St. Sampaloc, Manila: Arellano University Juan Sumulong Campus Senior High School DepartmentDocument7 pages2600 Legarda St. Sampaloc, Manila: Arellano University Juan Sumulong Campus Senior High School DepartmentTrisha TorresNo ratings yet

- Easy R2R Process Interview QuestionsDocument8 pagesEasy R2R Process Interview Questionschandrakant mehtreNo ratings yet

- What Is A Chart of Accounts?: Financial Statements Balance Sheet Accounts Income Statement AccountsDocument12 pagesWhat Is A Chart of Accounts?: Financial Statements Balance Sheet Accounts Income Statement AccountsRoanNo ratings yet

- CHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Document14 pagesCHAPTER 3 The Accounting Equation and The Double-Entry System (Module)Chona MarcosNo ratings yet

- Financial Accounting: Sir Syed Adeel Ali BukhariDocument25 pagesFinancial Accounting: Sir Syed Adeel Ali Bukhariadeelali849714No ratings yet

- Name: Giovanni Oliveria. Opog 12-VenusDocument7 pagesName: Giovanni Oliveria. Opog 12-VenusbannieopogNo ratings yet

- Interview Related QuestionsDocument8 pagesInterview Related QuestionsAnshita GargNo ratings yet

- CHAPTER - 1-WPS - Office (1) (Repaired)Document27 pagesCHAPTER - 1-WPS - Office (1) (Repaired)Akash Pawaskar100% (1)

- Interview StudyDocument34 pagesInterview StudyJyotirmay SahuNo ratings yet

- Balance SheetDocument9 pagesBalance SheetMARL VINCENT L LABITADNo ratings yet

- Reading and Understanding Financial StatementsDocument14 pagesReading and Understanding Financial StatementsSyeda100% (1)

- Finance QuestionsDocument10 pagesFinance QuestionsNaina GuptaNo ratings yet

- Img 0017Document1 pageImg 0017Saugat KarNo ratings yet

- Thursday 5th Dec 2013 Class ScheduleDocument1 pageThursday 5th Dec 2013 Class ScheduleSaugat KarNo ratings yet

- পাশ্চাত্যDocument1 pageপাশ্চাত্যSaugat KarNo ratings yet

- Jared Martinez - 10 Keys To Successful Forex TradingDocument42 pagesJared Martinez - 10 Keys To Successful Forex Tradinglatnrythmz75% (4)

- Projects SS FW 13 15Document6 pagesProjects SS FW 13 15Saugat KarNo ratings yet

- Eula Microsoft Visual StudioDocument3 pagesEula Microsoft Visual StudioqwwerttyyNo ratings yet

- Eula Microsoft Visual StudioDocument3 pagesEula Microsoft Visual StudioqwwerttyyNo ratings yet

- 6.096 Problem Set 4: 1 Additional MaterialDocument5 pages6.096 Problem Set 4: 1 Additional MaterialSaugat KarNo ratings yet

- MIT6 096IAP11 Sol03Document10 pagesMIT6 096IAP11 Sol03Saugat KarNo ratings yet

- MIT6 096IAP11 Sol04Document4 pagesMIT6 096IAP11 Sol04VinayNo ratings yet

- Lab 1 Solutions: 1 "Hello, World" (10 Points)Document10 pagesLab 1 Solutions: 1 "Hello, World" (10 Points)Khaled Mohamed MagdyNo ratings yet

- MIT6 096IAP11 ProjectDocument3 pagesMIT6 096IAP11 ProjectSaugat KarNo ratings yet

- MIT6 096IAP11 Sol02Document7 pagesMIT6 096IAP11 Sol02Saugat KarNo ratings yet

- MIT6 096IAP11 Assn03Document15 pagesMIT6 096IAP11 Assn03Saugat KarNo ratings yet

- MIT6 096IAP11 Assn02Document12 pagesMIT6 096IAP11 Assn02Saugat KarNo ratings yet

- MG University Meghalaya Results 2Document1 pageMG University Meghalaya Results 2Saugat KarNo ratings yet

- MIT6 096IAP11 Assn01Document15 pagesMIT6 096IAP11 Assn01Nguyen Hoang AnhNo ratings yet

- PGP IIMM 2013 15 - 2nd - Sem PDFDocument29 pagesPGP IIMM 2013 15 - 2nd - Sem PDFSaugat KarNo ratings yet

- Lab 1 Solutions: 1 "Hello, World" (10 Points)Document10 pagesLab 1 Solutions: 1 "Hello, World" (10 Points)Khaled Mohamed MagdyNo ratings yet

- Img 0002Document1 pageImg 0002Saugat KarNo ratings yet

- MIT1 00S12 Lec 2Document12 pagesMIT1 00S12 Lec 2Cristian GaborNo ratings yet

- Mca PDFDocument15 pagesMca PDFSaugat KarNo ratings yet

- Contact Details TERM New 1Document4 pagesContact Details TERM New 1Saugat KarNo ratings yet

- PGP IIMM 2013 15 - 2nd - Sem PDFDocument29 pagesPGP IIMM 2013 15 - 2nd - Sem PDFSaugat KarNo ratings yet

- 8.starting A Venture - Legal FormsDocument77 pages8.starting A Venture - Legal FormsSaugat KarNo ratings yet

- 1000 Various VerbsDocument98 pages1000 Various VerbsSaugat KarNo ratings yet

- IIPMDocument1 pageIIPMSaugat KarNo ratings yet

- IIPMDocument1 pageIIPMSaugat KarNo ratings yet

- 1560524480pv PDFDocument18 pages1560524480pv PDFSaugat KarNo ratings yet

- Registration Form 122762 PDFDocument2 pagesRegistration Form 122762 PDFSaugat KarNo ratings yet

- Eligibility Notice: Take Action To Enroll & Use Your Financial HelpDocument12 pagesEligibility Notice: Take Action To Enroll & Use Your Financial HelpbobwocNo ratings yet

- Business Services Destinations in Central Europe 2017 PDFDocument33 pagesBusiness Services Destinations in Central Europe 2017 PDFAravind GovindanNo ratings yet

- Acl 2017Document136 pagesAcl 2017RiyasNo ratings yet

- An Analysis On The Financial Awareness and Literacy Among The Students of Cagayan State University Andrews CampusDocument30 pagesAn Analysis On The Financial Awareness and Literacy Among The Students of Cagayan State University Andrews CampusVic Annielyn CoronelNo ratings yet

- RMC No. 5-2009Document1 pageRMC No. 5-2009CROCS Acctg & Audit Dep'tNo ratings yet

- Kunci Jawaban PT Alkindi Akuntansi Dagan PDFDocument15 pagesKunci Jawaban PT Alkindi Akuntansi Dagan PDFGunawan Wahyu FaqihNo ratings yet

- Bir Form 2307Document8 pagesBir Form 2307Alex CalannoNo ratings yet

- Key Development in BanksDocument19 pagesKey Development in BanksPrem Prem KumarNo ratings yet

- Chap 9: Present ValueDocument4 pagesChap 9: Present ValueDouglas M. DougyNo ratings yet

- Chapter 8-SupplyDocument13 pagesChapter 8-SupplyBasheer KhaledNo ratings yet

- University of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainDocument20 pagesUniversity of Toronto - ECO 204 - 2011 - 2012 - : Department of Economics Ajaz HussainexamkillerNo ratings yet

- S S T P S Wyoming: NtroductionDocument4 pagesS S T P S Wyoming: NtroductionManoj GNo ratings yet

- Buletin Mutiara 1-10, Mixed VersionDocument28 pagesBuletin Mutiara 1-10, Mixed VersionChan LilianNo ratings yet

- Bookkeeping Course Syllabus - SDPDFDocument0 pagesBookkeeping Course Syllabus - SDPDFjasonmendez2010No ratings yet

- ERCA Background 1Document8 pagesERCA Background 1Abdulhafiz AbakemalNo ratings yet

- Income Taxation CHAPTER 1-NOTESDocument11 pagesIncome Taxation CHAPTER 1-NOTESMark SaysonNo ratings yet

- Solution Manual Chapter 9 Financial IssuesDocument31 pagesSolution Manual Chapter 9 Financial IssuesamnakhaiNo ratings yet

- The Business, Tax, and Financial EnvironmentsDocument38 pagesThe Business, Tax, and Financial EnvironmentsNaveed AhmadNo ratings yet

- 7 Intro To International TaxationDocument43 pages7 Intro To International TaxationGyan Prakash100% (1)

- Level 4 Code 1 Answer-1Document10 pagesLevel 4 Code 1 Answer-1biniam100% (1)

- Chapter 15 TB Hilton PDFDocument52 pagesChapter 15 TB Hilton PDFBOB MARLOWNo ratings yet

- Mena Vat 2018Document32 pagesMena Vat 2018Mukesh SharmaNo ratings yet

- YesDocument839 pagesYesAnajaliNo ratings yet

- Acknowledgement Receipt TTDDocument2 pagesAcknowledgement Receipt TTDkris_kcp100% (2)

- McGraw Hill Connect Question Bank Assignment 1Document2 pagesMcGraw Hill Connect Question Bank Assignment 1Jayann Danielle MadrazoNo ratings yet

- Interview Questions CommerceDocument1 pageInterview Questions CommerceManoj KNo ratings yet

- Gartner Newsletter Amber Road Issue 1 120518 PDFDocument16 pagesGartner Newsletter Amber Road Issue 1 120518 PDFJoseAntonioVallesNo ratings yet

- EAC Opinion On Project Specific CSR ExpenditureDocument5 pagesEAC Opinion On Project Specific CSR ExpenditureancyNo ratings yet

- 4.) Constitutional Provisions That Indirectly Affect Taxation UP TO Double TaxationDocument28 pages4.) Constitutional Provisions That Indirectly Affect Taxation UP TO Double Taxationlaw schoolNo ratings yet

- Manappuram Finance Limited: SR - NoDocument2 pagesManappuram Finance Limited: SR - NoPrayag UpadhyayNo ratings yet