Professional Documents

Culture Documents

Holder in Due Course

Uploaded by

Sarada NagCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Holder in Due Course

Uploaded by

Sarada NagCopyright:

Available Formats

Holder in due course

Holder

According to Section 8 the "holder of a promissory note, bill of exchange, cheque means a person is entitled in his own name, to the possession thereof and to receive or recover the amount due thereon from the parties thereto. The definition given in the section 8 implies that any persona) Who is entitled in his own name to the possession of the negotiable instrument and b) Has right to receive or recover the amount from the parties thereto. Following persons are considered the holders of negotiable instrument: a) A principal whose name appears on an instrument as holder though it is executed in the name of his agent for him. b) Where the negotiable instrument is a bearer one, any person who is in possession of such instrument sis the holder. c) Where the negotiable instrument is in the name of a partner of a firm, it naturally becomes holder, as it is not a separate entity from the partner. d) The endorsee of a cheque is called a holder. e) If a holder of a negotiable instrument is dead, heirs of the deceased holder become the holders. f) A principal on whose behalf a pronote is endorsed in blank and is delivered to his agent, he is a holder of the instrument though his name does not appear on the instrument. However the following persons are not called the holders: a) A thief or a finder of an instrument is not a holder though he is in possession of an instrument. b) The word entitled used in the definition of a holder shows that the title of the person who claim to be the holder must be acquired in a lawful manner. The person obtaining the instrument under forgery is not a holder. c) When the endorsement of a bill is for collection only the endorsee cannot be a holder.

The Holder in Due Course (HDC) (Section 9) "A holder in due course means any person who for consideration, became the possessor of a promissory note, bill of exchange or cheque, if payable to bearer, or the payee or endorsee thereof, if payable to order, before the amount mentioned in it became payable, and without having sufficient cause to believe that defect existed in the title of the person from whom he derived his title"

HDC doctrine is a rule in commercial law that protects a purchaser of debt, where the purchaser is assigned the right to receive the debt payments. The doctrine insulates the purchaser of debt, or other obligation to pay, against charges that either party to the original transaction might have had against the other. Suppose A promised to pay money to B in exchange for services. B then transferred the right to payment to C. C is then insulated from any consequence arising from a conflict between A and B. Suppose A sues B for non-performance of service. C is insulated from any remedy A receives against B. A is still obligated to pay the original obligation to C. The following conditions are to be satisfied: (i) The negotiable instrument must be in the possession of the holder in due course. In case of an order instrument, he must be its payee or endorsee, i.e., his name must appear on the instrument. (ii) The negotiable instrument must be regular and complete in all respects. Alterations, if any, must be confirmed by the drawee through his signature. Holder of an incomplete document cannot be its holder in due course. The instrument must have been properly delivered to the holder in due course. The case of an order cheque, endorsement in favour of the holder is essential. A postdated cheque is not deemed to be irregular. (iii) The instrument must have been obtained for valuable consideration, i.e., by paying its full value. A person who receives a cheque as a gift will not be called its holder in due course. The consideration must be legal and adequate. For example, if a cheque is given in respect of a debt incurred in gambling, the consideration for the cheque is unlawful.

A person is not a holder in due course, if, a) b) c) d) e) He obtains the Negotiable instrument after its maturity. He obtains it by way of gift He obtains it for any unlawful consideration He obtains it by any illegal method He does not obtain it bona fide.

Rights of a Holder The holder of a negotiable instrument enjoys the following rights: (i) An endorsement in blank may be converted by him into an endorsement in full. (ii) He is entitled to cross a cheque either generally or specially and also with the words

"Not Negotiable." (iii)

. if such negotiation is not

He can negotiate a cheque to a third person, prohibited by the direction given in the cheque.

(iv) He can claim payment of the instrument and can sue in his own name on the instrument. (v) A duplicate copy of a lost cheque may be obtained by a holder.

Privileges of a Holder in Due Course Besides the aforesaid rights of a holder, a holder in due course enjoys the following privileges under various sections of the Negotiable Instruments Act: 1. He Possesses Better Title Free from Defects. This is the greatest privilege of a holder in due course. He always possesses better title than that of his transferor or any of the previous parties and can give to the subsequent parties the good title that he possesses. Section 53 states that "a holder of a negotiable instrument who derives title from a holder in due course has the right thereon of that holder in due course." The holder in due course is entitled to recover the amount of the instrument from any or all of the previous parties. The good title of the holder in due course is affected if he himself was party to the fraud or illegality which affected the instrument earlier. 2. Liability of Prior Parties to Holder in Due Course. According to Section 36 "Every prior party to a negotiable instrument, i.e., its maker or drawee, acceptor or endorser, is liable thereon to a holder in due course until the instrument is duly satisfied." It means that a holder in due course can recover the amount of the negotiable instrument from any or all of the previous parties to the instrument. 3. Right of the Holder in Due Course in Case of Inchoate Instrument. If a negotiable instrument was originally an inchoate (i.e., incomplete) instrument and a subsequent transferor completed the instrument for a sum greater than what was the intention of the maker, the right of a holder in due course to recover the money of the instrument is not at all affected (Section 20). 4. Right in Case of Fictitious Bills. If a bill of exchange is drawn on behalf of a fictitious person and is payable to his order, the acceptor is not relieved of his liability to holder in due course because of such fictitious name. But it is essential that the holder in due course proves that the document bears the endorsement with signature in the same hand as that of the drawer and purporting to be made by the

drawer (Section 42). Example: X draws a bill on Y but signs in the fictitious name of Z. It is payable to the order of Z and is duly accepted by Y. X endorses it to A who becomes its holder in due course. Y, the acceptor of the bill, cannot deny his liability on the bill to fhe holder in due course on the ground that it was drawn on behalf of a fictitious person Z. It is, however, essential that the signature of Z as drawer, and as endorser, must be in the same handwriting. 5. Right in Case the Instrument is Obtained by Unlawful Means or for Unlawful Consideration. A person liable on a negotiable instrument cannot defend himself against a holder in due course on the ground that the instrument was lost or obtained from him by means of an offence or for an unlawful consideration (Section 58). 6. Estoppel against Denying Original Validity of the Instrument. Section 120 provides that "no maker of a promissory note and no drawer of a bill of exchange or cheque and no acceptor of a bill of exchange for the honour of the drawer shall in a suit thereon by holder in due course, be permitted to deny the validity of the instrument as originally made or drawn." 7. Estoppel against Denying Capacity of Payee to Endorse. No maker of a promissory note and no acceptor of a bill of exchange payable to order shall, in a suit thereon by a holder in due course, be permitted to deny the payee's capacity at the date of note or bill, to endorse the same (Section 121). 8. Estoppel against Denying Signature or Capacity of Prior Party. No endorser of a negotiable instrument shall, in a suit thereon by a subsequent holder, be permitted to deny the signature or capacity of any prior party to the instrument (Section 122).

Limitations The rule can be considered inequitable to consumers. As a response to this, the United States Federal Trade Commission promulgated Rule 433, formally known as the "Trade Regulation Rule Concerning Preservation of Consumers' Claims and Defenses", which "effectively abolished the [holder in due course] doctrine in consumer credit transactions". In 2012, the FTC reaffirmed the regulation.

The difference between holder and holder in due course 1. Meaning: Holder means any person entitled in his own name to the possession of the negotiable instrument and to recover or receive the amount due thereon from the parties thereto. A holder in due course on the other hand, means a holder who takes the instrument in good faith for consideration before it is overdue and without any notice of defect in the title of the person who transferred it to him. 2. Consideration: A person who claims to be a holder in due course must show that he acquired the instrument for consideration. However consideration may not pass from a holder of the instrument. 3. Title: Holder of negotiable instrument does not acquire a better title than that of the person from whom he acquired the instrument. Thus a holder does not acquire a good title if the title of any of the prior parties is defective. But a holder in due course gets a good title even though there was a defect in the title of any prior parties to the instrument. 4. Liability: A holder in due course can sue all prior parties to a negotiable instrument until the instrument is duly satisfied. Whereas a holder of the instrument can enforce it against the person who has signed it and also against the transfer-or from whom he obtained it. 5. Maturity: A person will be a holder in due course only if he acquires the instrument before the amount mentioned in it become payable. But a holder may acquire the instrument even after it has become due for payment.

You might also like

- Lawfully Yours: The Realm of Business, Government and LawFrom EverandLawfully Yours: The Realm of Business, Government and LawNo ratings yet

- Negotiable Instruments Act, 1881Document33 pagesNegotiable Instruments Act, 1881Vinayak Khemani100% (1)

- The Negotiable Instrument Act, 1881Document18 pagesThe Negotiable Instrument Act, 1881GarimaNo ratings yet

- Holder Vs Holder in Due CourseDocument10 pagesHolder Vs Holder in Due CourseBappy PaulNo ratings yet

- Negotiable Instrument ActDocument9 pagesNegotiable Instrument ActHimanshu DarganNo ratings yet

- Law of EstoppelDocument26 pagesLaw of EstoppelAnurag Chaurasia83% (24)

- Registration ActDocument2 pagesRegistration Actrahulsgupta100% (1)

- Revocation of Continuing GuaranteeDocument9 pagesRevocation of Continuing GuaranteeAbhishek Raj100% (5)

- Bill of ExchangeDocument9 pagesBill of ExchangeMariyam MalsaNo ratings yet

- Once A Mortgage Is Always A Mortgage andDocument17 pagesOnce A Mortgage Is Always A Mortgage andamit dipankar50% (2)

- Negotiable Instrument ActDocument28 pagesNegotiable Instrument ActShrikant RathodNo ratings yet

- Banking LawDocument18 pagesBanking LawUdisha SinghNo ratings yet

- Negotiable Instruments NotesDocument39 pagesNegotiable Instruments NotesMehru KhanNo ratings yet

- Promissory EstoppelDocument5 pagesPromissory EstoppelVineet Gupta100% (1)

- The Maxims of EquityDocument8 pagesThe Maxims of EquityzeusapocalypseNo ratings yet

- Discharge of SuretyDocument9 pagesDischarge of SuretyMindblowing SahilNo ratings yet

- Execution of DecreesDocument8 pagesExecution of DecreesSandeep SinghNo ratings yet

- Negotiable Instruments - Dishonour and Discharge - Group VDocument56 pagesNegotiable Instruments - Dishonour and Discharge - Group VSaurabh PatelNo ratings yet

- Negotiable Instrument Act, 1881Document25 pagesNegotiable Instrument Act, 1881Viney VermaNo ratings yet

- Bonds & DebentureDocument6 pagesBonds & DebentureHemant GaikwadNo ratings yet

- Right of RescissionDocument18 pagesRight of RescissionKushagra GuptaNo ratings yet

- Holder & Holder in Due CourseDocument22 pagesHolder & Holder in Due Coursesagarsavla100% (1)

- BLL13 - Types of Negotiable InstrumentsDocument8 pagesBLL13 - Types of Negotiable Instrumentssvm kishoreNo ratings yet

- Negotiable Instrument Act, 1881Document25 pagesNegotiable Instrument Act, 1881Garima100% (1)

- Equity and Trust: Assignment TopicDocument12 pagesEquity and Trust: Assignment TopicApoorv100% (3)

- The Indian Trusts Act, 1882Document53 pagesThe Indian Trusts Act, 1882akash_shah_42No ratings yet

- Negotiable Instruments Act, 1881Document23 pagesNegotiable Instruments Act, 1881Kansal Abhishek100% (1)

- PINKYS WORLD ... SECTION-1-POWER-OF-ATTORNEY Gos From Strawman To The RealDocument3 pagesPINKYS WORLD ... SECTION-1-POWER-OF-ATTORNEY Gos From Strawman To The RealStephanie's World100% (2)

- Writ JurisdictionDocument4 pagesWrit JurisdictionIbban Javid100% (1)

- WritsDocument46 pagesWritsDeepanshu Verma100% (3)

- Bill of ExchangeDocument14 pagesBill of Exchangenakoda121100% (2)

- Types of WritsDocument19 pagesTypes of WritsGaurav TripathiNo ratings yet

- Indian Stamp Act, 1899Document9 pagesIndian Stamp Act, 1899palkinNo ratings yet

- CA Notes Bill of Exchange and Promissory Notes PDFDocument28 pagesCA Notes Bill of Exchange and Promissory Notes PDFBijay Aryan DhakalNo ratings yet

- Capacity To ContractDocument33 pagesCapacity To ContractAbhay MalikNo ratings yet

- Dishonour of Negotiable InstrumentsDocument6 pagesDishonour of Negotiable InstrumentsMukul BajajNo ratings yet

- Rights of Surety Against CreditorDocument16 pagesRights of Surety Against CreditorPrasenjit Tripathi100% (1)

- Once A Mortgage Always A MortgagesDocument6 pagesOnce A Mortgage Always A MortgagesAnonymous 2Q60K5kNo ratings yet

- Bill of ExchangeDocument5 pagesBill of ExchangeyosephworkuNo ratings yet

- In The High Court of Judicature of Andhra Pradesh at Hyderabad Writ Petition No. 201 of 2019Document3 pagesIn The High Court of Judicature of Andhra Pradesh at Hyderabad Writ Petition No. 201 of 2019Priyansh KohliNo ratings yet

- Banking Law ProjectDocument13 pagesBanking Law ProjectManasa CheekatlaNo ratings yet

- Negotiable Instrument Act-1Document56 pagesNegotiable Instrument Act-1Law LawyersNo ratings yet

- Promissory Estoppel Is Not Applied EverywhereDocument12 pagesPromissory Estoppel Is Not Applied Everywheredhaneshpatel25100% (2)

- Important Provisions of Stamp Duty and RegistrationDocument39 pagesImportant Provisions of Stamp Duty and Registrationvidya adsuleNo ratings yet

- Negotiable InstrumentsDocument11 pagesNegotiable InstrumentsMahesh ChavanNo ratings yet

- Chapter - 1: 1.1 Research MethodologyDocument8 pagesChapter - 1: 1.1 Research MethodologyKapildev Dhaka100% (14)

- Security Interest Enforcement Rules PDFDocument14 pagesSecurity Interest Enforcement Rules PDFgopalushaNo ratings yet

- Modi Law College, Kota: Case: Commissioner-Cum-Secretary, Dept. of Animal Husbandry Vs Smt. K. RinzingDocument4 pagesModi Law College, Kota: Case: Commissioner-Cum-Secretary, Dept. of Animal Husbandry Vs Smt. K. RinzingPriyanka SinghNo ratings yet

- Registration Act, 1908Document30 pagesRegistration Act, 1908Trilok AshpalNo ratings yet

- Endorsement and Types of EndorsementsDocument3 pagesEndorsement and Types of EndorsementsAkash Heda100% (1)

- Duties & Rights of Bailor BaileeDocument6 pagesDuties & Rights of Bailor BaileeBoobalan RNo ratings yet

- Equity and Legal MaximsDocument16 pagesEquity and Legal MaximsBasit AliNo ratings yet

- Negotiable Instrument Act 1881Document19 pagesNegotiable Instrument Act 1881Shaktikumar95% (19)

- Doctrine of Constructive NoticeDocument14 pagesDoctrine of Constructive NoticeAkshay Bansal100% (1)

- Dishonour of Negotiable InstrumentsDocument33 pagesDishonour of Negotiable InstrumentsNandini Tarway0% (1)

- Constructive TrustDocument22 pagesConstructive TrustLIA170033 STUDENTNo ratings yet

- Contract of BailmentDocument16 pagesContract of BailmentRachit GoelNo ratings yet

- Negotiable Instruments Act, 1881Document24 pagesNegotiable Instruments Act, 1881vikramjeet_22100% (1)

- Bills of ExchangeDocument5 pagesBills of Exchangesara24391100% (3)

- Holder and Holder in Due Course Holder:-According To Section 8 of The ActDocument28 pagesHolder and Holder in Due Course Holder:-According To Section 8 of The ActNeenu VargheseNo ratings yet

- Institutionalizing EthicsDocument19 pagesInstitutionalizing EthicsSarada NagNo ratings yet

- 16Document6 pages16teddygroupsNo ratings yet

- Indian Bonds Rise On Strong Demand From BanksDocument1 pageIndian Bonds Rise On Strong Demand From BanksSarada NagNo ratings yet

- Individual Investors: Communication ChallengesDocument12 pagesIndividual Investors: Communication ChallengesSarada NagNo ratings yet

- Topic-Government Security MarketDocument15 pagesTopic-Government Security MarketSarada NagNo ratings yet

- Book Building IPODocument2 pagesBook Building IPOSarada NagNo ratings yet

- Business Start-Up Process: CP-305 PresentationDocument18 pagesBusiness Start-Up Process: CP-305 PresentationSarada NagNo ratings yet

- Monetary PolicyDocument18 pagesMonetary PolicySarada NagNo ratings yet

- Pest Analysis of ChinaDocument7 pagesPest Analysis of ChinaSarada Nag100% (1)

- Indian Financial SystemDocument16 pagesIndian Financial SystemSarada NagNo ratings yet

- Legal Formalities and DocumentationDocument20 pagesLegal Formalities and DocumentationSarada NagNo ratings yet

- Rural Social StructureDocument3 pagesRural Social StructureSarada NagNo ratings yet

- Government InterventionDocument19 pagesGovernment InterventionLav PoddarNo ratings yet

- Rural Social StructureDocument3 pagesRural Social StructureSarada NagNo ratings yet

- Corporate Finace 1 PDFDocument4 pagesCorporate Finace 1 PDFwafflesNo ratings yet

- Press Release Q1 2019Document3 pagesPress Release Q1 2019knighthood4allNo ratings yet

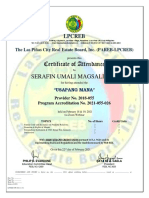

- Certificate of Attendance: Serafin Umali Magsalin JRDocument1 pageCertificate of Attendance: Serafin Umali Magsalin JRSerafin Jr. MagsalinNo ratings yet

- 8.yutivo and Sons Hardware Vs CTA, G.R. No. L-13203Document12 pages8.yutivo and Sons Hardware Vs CTA, G.R. No. L-13203Elizabeth Jade D. CalaorNo ratings yet

- The Fuller Method Learn To Grow Your Money Exponentially - V4.0 14 PDFDocument35 pagesThe Fuller Method Learn To Grow Your Money Exponentially - V4.0 14 PDFartlet100% (1)

- An Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedDocument32 pagesAn Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedNafiz FahimNo ratings yet

- Department of Labor: BC10Document1 pageDepartment of Labor: BC10USA_DepartmentOfLaborNo ratings yet

- ET 500 Companies ListDocument22 pagesET 500 Companies ListKunal SinghalNo ratings yet

- Marian Grajdan CVDocument7 pagesMarian Grajdan CVMarian GrajdanNo ratings yet

- BirlasoftDocument3 pagesBirlasoftlubna ghazalNo ratings yet

- The Need For AdjustmentDocument5 pagesThe Need For AdjustmentAnna CharlotteNo ratings yet

- Questions and AnswersDocument12 pagesQuestions and Answersaparajita rai100% (3)

- Business Combination - SubsequentDocument2 pagesBusiness Combination - SubsequentMaan CabolesNo ratings yet

- Report JSWDocument29 pagesReport JSWS nithin100% (1)

- ch07 - Intermediate Acc IFRS (Cash and Receivable)Document104 pagesch07 - Intermediate Acc IFRS (Cash and Receivable)irma cahyani kawiNo ratings yet

- Diaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)Document3 pagesDiaz vs. Secretary of Finance (G.R. No. 193007, July 19, 2011)EvangerylNo ratings yet

- Indicators XDDocument17 pagesIndicators XDAniket jaiswalNo ratings yet

- FASE 1 Financial Accounting Manual 2021Document98 pagesFASE 1 Financial Accounting Manual 2021erikatri366No ratings yet

- 14 Cession or AssignmentDocument8 pages14 Cession or AssignmentJong PerrarenNo ratings yet

- Cyber Receipt PDFDocument1 pageCyber Receipt PDFprince_rahul_159No ratings yet

- Accounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Document81 pagesAccounting, 7e (Horngren) Chapter 3: The Adjusting Process: Diff: 1 Page Ref: 126 Objective: 3-1 EOC Ref: S3-1Layla MainNo ratings yet

- Business Finance Week 5Document5 pagesBusiness Finance Week 5cjNo ratings yet

- Andrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaDocument22 pagesAndrei Leon Gill Motion To Approve Settlement Rule 2004 Examination Producing Documents SubpoenaCamdenCanaryNo ratings yet

- CS Section: Consulting ServicesDocument7 pagesCS Section: Consulting ServicesTyra Joyce RevadaviaNo ratings yet

- Sublease Contract TemplateDocument8 pagesSublease Contract TemplateAzizul KirosakiNo ratings yet

- Chapter 7Document45 pagesChapter 7Chitose HarukiNo ratings yet

- Development of A Business PlanDocument18 pagesDevelopment of A Business Plansisay2001No ratings yet

- Chapter 18Document30 pagesChapter 18Hery PrambudiNo ratings yet

- Module 5 Using Mathematical TechniquesDocument57 pagesModule 5 Using Mathematical Techniquessheryl_morales100% (5)

- Referralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrerDocument3 pagesReferralprogramtermsandconditions: Ection Xisting Ustomer Nvestor EferrermikeNo ratings yet